If You Have A Change In Circumstances

You must tell HMRC within 30 days if you have a change of circumstances that could affect your Child Tax Credit. For example:

- losing or getting a job

- having a baby

- a partner moving in or out.

This might mean youll have to make a new claim for Universal Credit. HMRC will tell you what you need to do.

Call the Tax Credit Helpline on to let them know about any changes to your circumstances.

Find out about extra sources of income and support available to help you manage your household bills and save money in our guide What benefits you can claim and other ways to increase your income

What Is A Tax Credit

A tax credit is an allowance given to a taxpayer by the IRS that reduces their tax bill on a dollar-for-dollar basis. It’s like having store credit at a retailer when you apply the credit to your bill, it reduces what you owe.

Some tax credits are refundable, meaning that if your bill drops to $0, you can get the remaining money as a refund after filing your tax return.

The child tax credit for tax year 2020 is only partially refundable. The American Rescue Plan makes the credit for 2021 fully refundable. It also transforms part of it from a lump-sum payment into monthly cash payments from July through December 2021.

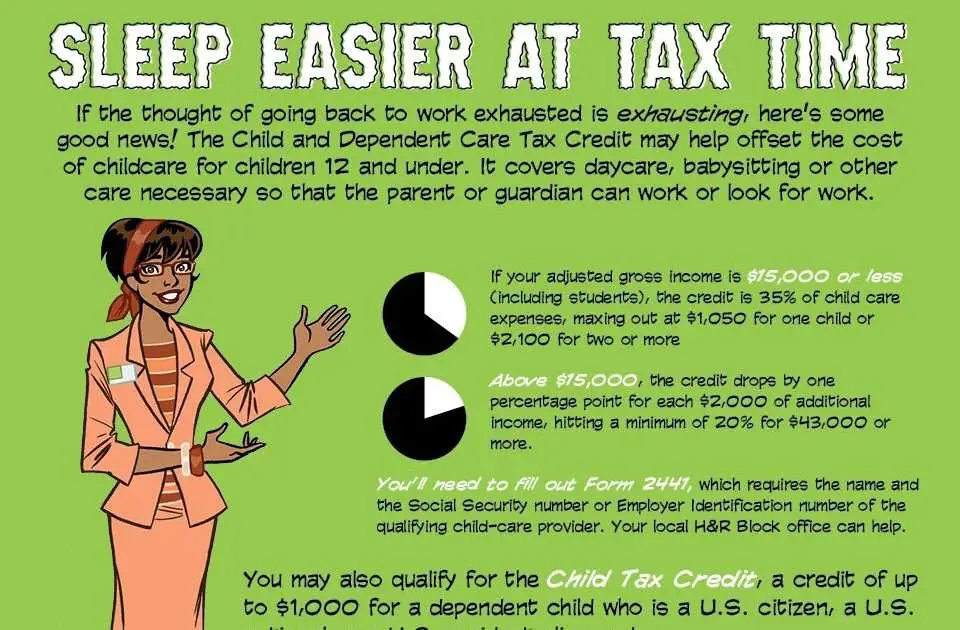

Child And Dependent Care Tax Credit

You can claim this credit if you have earned income and if youre paying someone else to care for a dependent. Unlike the CTC, which you can only claim if youre the parent or guardian of minor children, you can claim the CDCTC for aging parents and other disabled relatives. Qualifying dependents for the CDCTC include the following:

- Children who are 12 or younger at the end of the tax year

- Dependent adult family members or spouses who are not able to care for themselves due to mental or physical impairments, unless they had gross income of $4,150 or more

With the CDCTC, you can claim a credit for up to 35% of qualified care expenses. The exact percentage that you are eligible to deduct depends on your income level. The maximum amount of care expenses to which you can apply the credit is $3,000 if you have one dependent and $6,000 if you have more than one dependent. That means the largest possible credit is $1,050 with one dependent and $2,100 with multiple. The CDCTC is non-refundable. According to the IRS, expenses that qualify for the CDCTC include money that you paid for household services and care of the qualifying person while you worked or looked for work. Child support payments do not qualify. To claim the CDCTC, you need to fill out Form 2441.

Read Also: Do I Have To File Taxes If I Receive Unemployment

Have There Been Payment Glitches With The Ctc

Some parents have reported glitches in receiving their monthly checks, which has caused some stress for families counting on the money. In September, dozens of parents reached out to CBS MoneyWatch to report that they hadn’t received their checks on the 15th of that month, when the money was supposed to be deposited.

The IRS said the delay may have been caused by parents changing information in the IRS Child Tax Credit Update Portal, but that the families would receive their money.

And in August, some families with immigrant spouses didn’t receive their checks an error that the IRS later corrected.

The bottom line: While the IRS says it will deposit the checks on the 15th, it is always possible that some families may see a delay due to glitches or other issues that arise.

A Step Away From Discrimination

The expanded child tax credit will benefit almost all families, and it will work the way benefits currently work for the wealthy.

About 93% of all families with children, from those at the very bottom to , will receive the same cash benefits, delivered monthly beginning in July 2021, to support their children.

Married couples with kids who are earning over $150,000 but less than $400,000 will still benefit but get a smaller tax credit. Only families making more than $400,000 will receive nothing.

Because the government will be treating everyone eligible in the same wayas families who need and deserve supportI see it as an important step away from a discriminatory system in which, all too often, poor people are shamed and rich people are supported.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Don’t Miss: Can I Pay Quarterly Taxes Online

How Will The Child Tax Credit Give Me More Help This Year

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families.

- It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6.

- For each child ages 6 to 16, its increased from $2,000 to $3,000.

- It also now makes 17-year-olds eligible for the $3,000 credit.

- Previously, low-income families did not get the same amount or any of the Child Tax Credit. Under the American Rescue Plan, all families in need will get the full amount.

- To get money to families sooner, the IRS began sending monthly payments this year, starting in July.

- It will be broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

- Youll get the remainder of the credit when you file your taxes next year.

New In 2018 Credit For Dependents

A $500 non-refundable credit is available for families with qualifying relatives. This includes children over 17 and children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives who are considered a dependent for tax purposes , can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

Recommended Reading: Do You Need To Report Unemployment On Your Taxes

Who Counts As A Couple For Working Tax Credits

If youre in a couple, youll need to make a joint claim with your partner. Youre counted as a couple if youre married or in a civil partnership, or if you live together.

If youre temporarily separated, but still legally married, youll need to make a joint claim. HMRC treats you as a couple unless youre either:

- divorced

- legally separated under a court order

- permanently separated – ie you don’t plan to get back together

How much youll get is based on you and your partners combined income. If you’re 18 or over, you can use the Turn2us benefits calculator to work this out.

What Is The Child Tax Credit

The child tax credit is a tax benefit granted to American taxpayers for each qualifying dependent child. Designed to help taxpayers support their families, this credit has been greatly expanded by the American Rescue Plan Act of 2021. It is estimated that the new rules will reduce by 45% the number of American children living in poverty.

The child tax credit decreases taxpayers tax liability on a dollar-for-dollar basis. The recent legislation increased the maximum annual credit from $2,000 per child in 2020 to $3,000 per child or $3,600 for 2021. While the 2020 credit was partially refundable, the 2021 credit is fully refundable. In addition, the 2021 child tax credit will be distributed to eligible taxpayers in advance payments on a monthly basis, from July 15, 2021 and parents don’t have to owe taxes to receive it.

Don’t Miss: How Much Can You Get Back In Taxes

Current Child Tax Credit Amount

The current child tax credit is 2,000 dollars per child under the age of 17. The credit is gradually reduced by five percent of adjusted gross income over for joint filers with an adjusted gross income of 400,000 dollars or more and for other taxpayers with an AGI of 200,000 dollars or more.

If the credit exceeds taxes owed, taxpayers can receive up to 1,400 dollars of the balance as a refund, known as the additional child tax credit or refundable CTC. The ACTC is limited to 15 percent of earnings above 2,500 dollars. The amount of the credit families with children under 17 can receive as a refund will increase annually with inflation until it becomes equal to the full value of the credit . In 2020, the refundable portion of the credit remains at 1,400 dollars.

Starting in 2018, a 500 dollar credit was made available to dependents who were not eligible for the 2,000 dollar CTC for children under 17. Before 2018, these individuals would not have qualified for a tax credit but would have qualified for a dependent exemption, which was eliminated by the 2017 Tax Cuts and Jobs Act . Dependents eligible for this credit include children ages 17-18 or those 19-24 and in school full time in at least five months of the year. Also included are older dependents-representing about six percent of dependents eligible for the CTC.

How Do We Calculate Your Benefit

For the payment period of July 2021 to June 2022, we calculate your benefit based on all the following information:

- the number of eligible children you have and their ages

- your adjusted family net income for the base year 2020

- the child’s eligibility for the disability tax credit

To continue getting the CCB, you and your spouse or common-law partner each have to file tax returns every year, even if you have not received income in the year.

Base year and payment period

The base year is the year of the tax return from which information is taken to calculate the CCB amount for the payment period. The base year is the calendar year just before the start of the payment period.

The payment period is the 12-month period during which the CCB payments are paid. The payment period runs from July 1 of the year following the base year to June 30 of the next year. For example, CCB payments calculated based on the 2020 tax return will start being issued in July 2021, which is the beginning of the payment period. For more information, see When do we pay your benefit?.

The chart below illustrates the link between the base year and the payment period.

Base Year and Payment Period

| Base year |

|---|

Example

Child and family benefits online calculator

You can use our online calculator to get an estimate of your child benefits, by going to Child and family benefits calculator.

Canada child benefit

We calculate the CCB as follows.

Child disability benefit

Note

Don’t Miss: How Is Capital Gains Tax Calculated On Sale Of Property

Alberta Child And Family Benefit

This benefit is a non-taxable amount paid to families that have children under 18 years of age. The quarterly amounts are issued in August 2021, November 2021, February 2022, and May 2022.

The benefit includes both a base component and a working component, with combined benefits to a maximum of $5,120.

The maximum base component ranges from $1,330 to $3,325 depending on the number of children. You may be entitled to:

- $1,330 for the first qualified dependant

- $665 for the second qualified dependant

- $665 for the third qualified dependant

- $665 for the fourth qualified dependant

The base component of the benefit is reduced if your adjusted family net income is more than $24,467.

Families may be eligible for the working component once their family employment income exceeds $2,760. The maximum working component will range from $681 to $1,795 depending on the number of children. You may be entitled to:

- $681 for the first qualified dependant

- $620 for the second qualified dependant

- $371 for the third qualified dependant

- $123 for the fourth qualified dependant

The working component of the benefit is reduced once your adjusted family net income is more than $41,000.

This program is fully funded by the Alberta provincial government.

Tax Credits Are No Substitute For Child Care Reform

Tax credits such as the Child Tax Credit and the Child and Dependent Care Tax Credit do not address some of the systemic problems in child care, including low wages for people who work in child care, limited supply of quality options, and flexibility for parents who need child care in the evenings or on weekends. This is because tax credits help some parents with just a small fraction of their child care costs and arrive only during tax season, rather than giving them the support they need to pay for child care throughout the year and to select a high-quality provider of their choice.

Tax credits such as the CTC and CDCTC are potentially powerful mechanisms for lifting families out of poverty and supporting young children during a critical time in their development. However, Trumps claim that he is supporting hardworking families through an increased CTCeven though his overall tax overhaul demonstrably deserts themis just putting a bandage on a bullet wound.

Read Also: How To Make Tax Payments

The Ticket To Work And Work Incentives Improvement Act Of 1999 Rel=nofollow> pl 106

The Ticket to Work and Work Incentives Improvement Act of 1999 ” rel=”nofollow”> P.L. 106-170) extended the provision in P.L. 105-277 which allowed the nonrefundable personal credit to fully offset regular tax liability for one additional year, through the end of 1999. In addition, for tax years 2000 and 2001, the act included a provision which allowed taxpayers to use their personal nonrefundable credits to not only offset their regular tax liability in full, but also their AMT. Finally, the act also extended for tax years 1999 through 2001 the prior-law repeal of the provision that reduced the refundable portion of the child tax credit by the AMT.

The Working Families Tax Relief Act Of 2004 Rel=nofollow> pl 108

In September 2004, Congress passed the Working Families Tax Relief Act of 2004 ” rel=”nofollow”> P.L. 108-311), which further accelerated the implementation of key provisions of EGTRRA. This act extended the maximum amount of the credit established under JGTRRA, $1,000 per child, through 2009. For 2010, the EGTRRA provisions would apply and the maximum amount of the credit would remain $1,000 per child. In addition, WFTRA increased the refundability rate to 15% for 2004. Under EGTRRA, the refundability rate would remain at 15% from 2005 through 2010.

Read Also: Do I Need W2 To File Taxes

Trumps Plan For The Child Tax Credit Does Not Meet Working Families Needs

President Donald Trump and House Speaker Paul Ryan have vowed to overhaul the nations tax system, introducing a plan on September 27, 2017, that will cut taxes for the wealthy at the expense of working families. The presidents daughter, Ivanka Trump, has teamed up with Sen. Marco Rubio to advocate for an expanded Child Tax Credit as part of that plan. Recently, Ivanka Trump spoke at a town hall in Bucks County, Pennsylvania, and claimed that the CTC would help families pay for child care and position the United States to catch up to other countries on early childhood investments.

Not surprisingly, the Trump tax plan is specific on tax cuts for higher earners but provides no details on the amount of increase to the CTC. But even a significant increase to the CTC would not be enough to offset the significant losses many working families would experience under Trumps overall tax plan. And it would be nowhere near what is needed for Trump to make good on another unfulfilled campaign promiseto make child care affordable for families.

Offset For Back Taxes Or Child Support Arrears

Question: Will monthly payments be reduced for taxpayers who owe back taxes or child support?

Answer: No. The IRS cannot take the payments to offset past-due federal taxes, state income taxes, or other federal or state debts. The same goes for people who are behind on child support payments. However, there are no protections against garnishment by private creditors or debt collectors.

Although the advance monthly payments can’t be offset, the same rules don’t apply to a tax refund applicable to the child tax credit taken when you file your return next year. For example, if your actual 2021 child credits exceed the monthly payments you received, the difference may be refundable but can also be offset by back taxes, past-due child support, etc.

Also Check: When Do I Have To Do Taxes

Meager Welfare For Low

Conservative critics of the safety net often argue that Temporary Assistance to Needy Families, the income support program for families with children that many Americans simply call welfare, is large-scale and generous. But this program, known as TANF, does not begin to meet the needs of the nations poor families.

The cash it makes available varies by state. In Tennessee, where I live, a family of three receives $277.16 per month. Nationally, monthly benefits vary significantly, from a low of $170 per month for a family of three in Mississippi to a high of $1,086 for the same family in New Hampshire.

Even in New Hampshire, TANF does not lift families out of poverty. There, as in every state, people getting these benefits remain well below the poverty line. Whats more, American families cant get these benefits for more than a total of five years.

In addition, the application process is often seen as deeply degrading, and once families do receive TANF benefits, they can easily lose them. If, for example, a parent misses one work-related appointment, if their child misses school, or if they did not submit paperwork the state needs to seek child support, the state can cut off these benefits.

As a result, the majority of families who qualify do not receive TANF payments. In 2019, only 23 of every 100 eligible families got them.

Video: What to know about the Child Tax Credit payments beginning today