When An Employee Leaves

When an employee stops working for you, we suggest you calculate the employees earnings for the year to date and give the employee a T4 slip. Include the information from that T4 slip in your T4 return when you file it on or before the last day of February of the following year.

You must also issue a Record of Employment to each former employee. Generally, if you are issuing an ROE electronically, you have five calendar days after the end of the pay period in which an employees interruption of earnings occurs to issue it. If you are issuing a paper ROE, you have to issue it within five calendar days of the employees interruption of earnings or the date you become aware of the interruption of earnings. However, special rules may apply.

For more information, or to get the publication called How to Complete the Record of Employment Form, go to Service Canada at The Record of Employment on the Web . You can also call their Employer Contact Centre at 1-800-367-5693 .

If you do not have any employees for a period of time

Inform us by using the Provide a nil remittance service through My Business Account, or through Represent a Client, by calling our TeleReply service, or by sending us your completed remittance form and indicating when you expect to make deductions next. To find out how to use our TeleReply service, see How to use TeleReply.

Residential Energy Efficient Property Credit

Taxpayers may be able to claim this tax credit for the cost of installing and using certain types of renewable energy for their home. Eligible energy costs include those for solar electric, solar water heating, fuel cells, wind energy, and geothermal heat pumps. Fill out and attach Form 5695 and Schedule 3 of Form 1040 to claim the credit.

What Are The Best Small Business Tax Deductions

Since there is no standard deduction for businesses, all businesses have to keep meticulous records of their expenses and deduct them individually when its time to pay their taxes. The exception to this would be the QBI Deduction that the TCJA introduced in 2017.

But just because you have to do more work to claim your deductions doesnt mean that there arent some great small business tax deductions out there. Some of the most common deductions for businesses are:

Vehicle Expenses

If you drive a lot for work, you can deduct a good chunk of those expenses on your taxes. Youll need to keep records to prove that the use of your vehicle was for your business, and not personal use.

Common vehicle expenses you can claim as deductions are things like gas, parking, oil changes, maintenance, parking, and tolls.

When it comes time to file your taxes, you can either deduct the actual expenses of your vehicle, or you can use the IRS standard mileage rate. Which for the tax year 2019, is 58 cents per business mile driven.

If you drive the same vehicle for business and for personal use, make sure to keep meticulous records of how many miles you drove, as well as your expenses if you want to claim the deduction that way.

Office or Home Office

Regardless if youre renting an office for a team, or a coworking space for a freelancer, you can deduct the rental cost from your tax return. You simply have to prove that youre using the space for only business activities.

Supplies

You May Like: How Do I Get My Pin For My Taxes

Who Should Complete This Form

Individuals who:

- have a new employer or payer

- want to change amounts from previous claimed

- want to claim the deduction for living in a prescribed zone

- want to increase the amount of tax deducted at source

have to complete the federal TD1 and, if more than the basic personal amount is claimed, the provincial or territorial TD1.

Individuals do not have to complete a new TD1 every year unless there is a change to their federal, provincial or territorial personal tax credit amounts. If a change happens, they must complete a new form no later than seven days after the change.

How To Calculate The Home Office Deduction

You have two choices for calculating your home office deduction: the standard method or the simplified option, and you dont have to use the same method every year. The standard method requires you to calculate your actual home office expenses and keep detailed records in the event of an audit.

The simplified option lets you multiply an IRS-determined rate by your home office square footage. To use the simplified option, your home office must not be larger than 300 square feet and you cannot deduct depreciation or home-related itemized deductions.

The simplified option is a clear choice if youre pressed for time or cant pull together good records of your deductible home office expenses. However, because the simplified option is calculated as $5 per square foot, with a maximum of 300 square feet, the most youll be able to deduct is $1,500.

If you want to make sure youre claiming the largest home office deduction youre entitled to, youll want to calculate the deduction using both the regular and simplified methods. If you choose the standard method, calculate the deduction using IRS form 8829, Expenses for Business Use of Your Home.

Don’t Miss: How To Get Tax Preparer License

Employment Benefits And Payments From Which You Do Not Deduct Cpp Contributions

Employment

Do not deduct CPP contributions from payments for the following types of employment:

- Employment in agriculture, or an agricultural enterprise, horticulture, fishing, hunting, trapping, forestry, logging, or lumbering, when you meet one of the following conditions:

- pay your employee less than $250 in cash remuneration in a calendar year

- employ your employee for a period of less than 25 working days in the same year on terms providing for cash remunerationthe working days do not have to be consecutive.

NotesIn a calendar year, if your employee reaches both minimums$250 or more in cash remuneration and works 25 days or morethe employment is pensionable starting from the first day of work. Deduct CPP contributions if your employees pensionable earnings are more than the CPP basic exemption for the same period.

For more information on when these types of employment are pensionable, go to Agriculture and horticulture.

NotesIf your employee works seven days or more, the employment is pensionable from the first day of work. Deduct CPP contributions if your employees pensionable earnings are more than the CPP basic exemption for the same period.

For more information on when these types of employment are pensionable, go to Circus and fair.

- Employment by a government body as an election worker if the worker meets both of the following conditions:

- is not a regular employee of the government body

- works for less than 35 hours in a calendar year

Benefits and payments

Chapter 2 Canada Pension Plan Contributions

For Canada Pension Plan , contributions are not calculated from the first dollar of pensionable earnings. Instead, they are calculated using the amount of pensionable earnings minus an exempt amount that is based on the period of employment.

As of 2019, the Canada Pension Plan is being enhanced over a 7-year phase-in. For more information, go to Canada Pension Plan enhancement.

Read Also: Where’s My Tax Refund Ga

How Much Can You Deduct

The amount of money that you can deduct on your taxes may not be equal to the total amount of your donations.

-

If you donate non-cash items, you can claim the fair market value of the items on your taxes.

-

If you donated a vehicle, your deduction depends on if the organization keeps the car or sells it at an auction. A Donors Guide to Vehicle Donation explains how your deduction is determined.

-

If you received a gift or ticket to an event, you can only deduct the amount that exceeds the value of the gift or ticket.

Note: Limits on cash and non-cash charitable donations have increased or been suspended. Learn more about charitable deductions in 2020.

Get Your Share Of More Than $1 Trillion In Tax Deductions

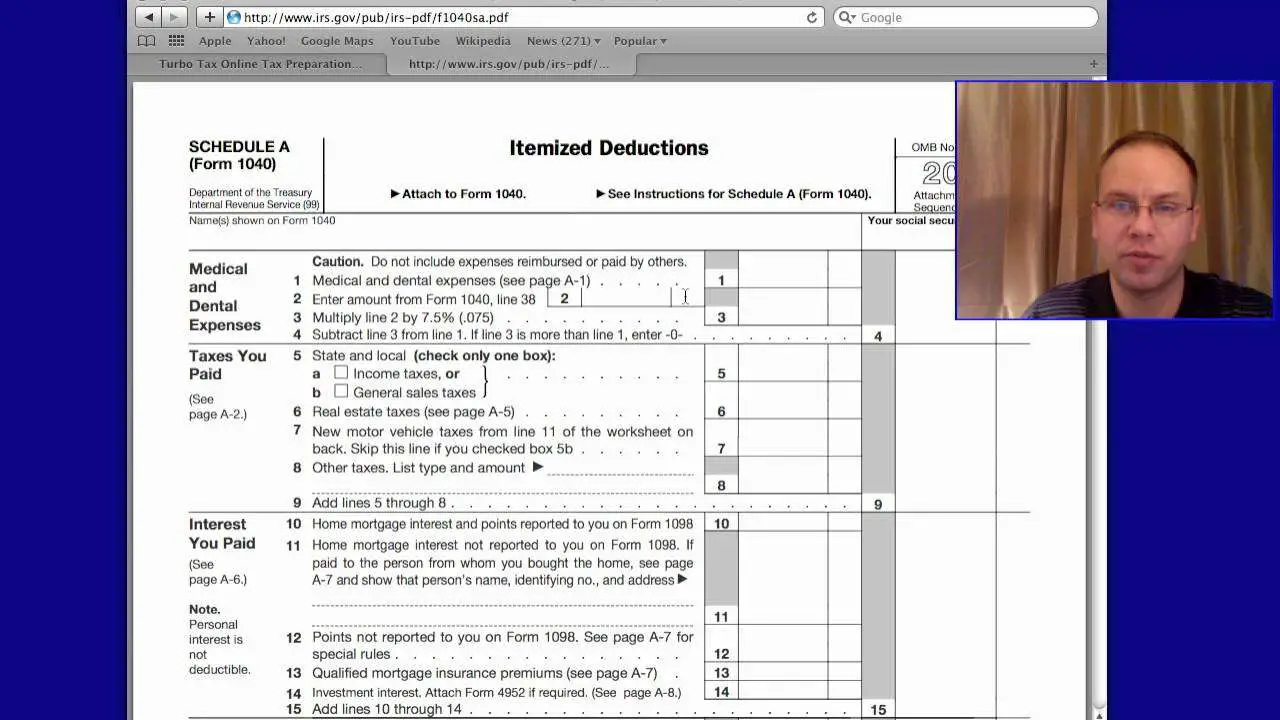

The most recent numbers show that more than 45 million of us itemized deductions on our 1040sclaiming $1.2 trillion dollars worth of tax deductions. Thats right: $1,200,000,000,000! That same year, taxpayers who claimed the standard deduction accounted for $747 billion. Some of those who took the easy way out probably shortchanged themselves.

Here are our 10 most overlooked tax deductions. Claim them if you deserve them, and keep more money in your pocket.

Don’t Miss: Www.1040paytax.com Official Site

How To Donate Crypto

Start by identifying the charities you’d like to donate to and ensure that they’re tax-exempt organizations. The IRS provides a simple search tool that you can use to verify the status. In addition, you should ensure that the organization provides a receipt showing their name, address, date of the donation, and the donation amount at a minimum.

The next step is determining what crypto assets to donate. In most cases, you’ll want to donate your most appreciated assets to avoid the most capital gains tax. You must donate the actual crypto asset to avoid triggering capital gains taxes. If you liquidate the crypto asset to cash or exchange it for another coin, it will trigger a taxable event.

Most crypto donations are made via a wallet-to-wallet exchange or using tools, such as Coinbase Commerce, that work like merchant accounts. When making a donation, you should double-check to ensure that youâre sending cryptocurrency to the correct address since blockchain transactions are generally irreversible.

The last step is reporting donations on Form 1040 Schedule A under Itemized Deductions. If the donations amount to more than $500, you also need to register the total on Form 8283 Section A under Noncash Charitable Contributions. If they’re more than $5,000, you need to complete Form 8283 Section B and obtain a qualified appraisal.

Tips For Tax Planning

- While a tax professional or tax software can help you file your annual taxes, a financial advisor can help you tax-optimize your entire financial plan. Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Just want to estimate how much youll pay in taxes? Check out our tax calculators to see how federal and state taxes will impact you.

You May Like: How Much Does H& r Block Charge For Doing Taxes

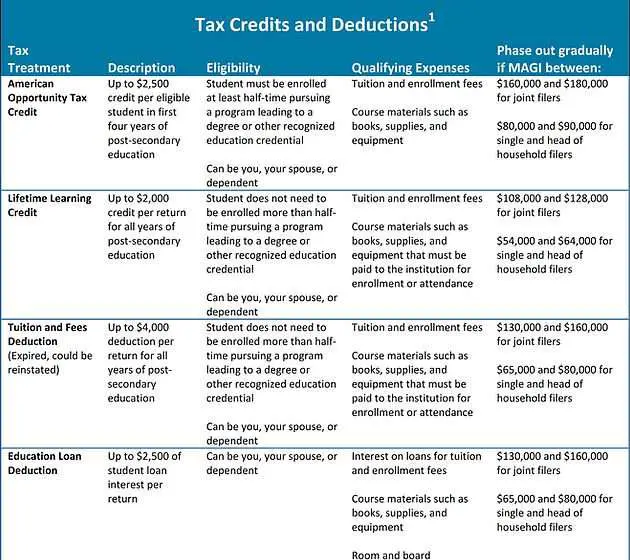

What Is The Difference Between Tax Deductions And Tax Credits

Tax credits can also lower the amount of tax you owe, but tax credits are different from tax deductions in that tax credits are applied to your return after your tax is calculated. Unlike tax deductions, which reduce the amount of your taxable income, tax credits reduce the amount of your actual tax, which works out better financially.

When youre in the 24% tax bracket, for example, a $1,000 deduction will reduce your tax by $240. A $1,000 tax credit, on the other hand, will reduce your tax by $1,000, regardless of your tax bracket. Common tax credits include the earned income credit, the child tax credit and the premium tax credit associated with the Affordable Care Act.

There are two types of tax credits: refundable and nonrefundable. A nonrefundable tax credit will only reduce the amount of tax you owe to zero any excess credit you have earned will be lost. A refundable tax credit will actually pay out a refund to you if it exceeds the amount of tax you owe. For example, imagine you owe $600 in taxes, but you qualify for a $1,000 tax credit. If the credit is nonrefundable, youll be able to use $600 of that credit, offsetting your net tax to zero. If the credit is refundable, youll be able to use the entire $1,000. The first $600 of the credit will zero out your tax liability, and the remaining $400 will be paid out to you as a tax refund.

What Is A Tax Deduction

10 Minute Read | September 17, 2021

There are two words every taxpayer needs to get familiar with as Tax Day draws near. These two words will help you shave hundreds, maybe even thousands, of dollars off your tax bill.

Are you ready? Here they are: tax deductions.

Youve probably heard phrases like you can write that off your taxes or those are deductible expenses and wondered if you really understand how this whole tax deduction thing works. Youre not the only one!

A lot of folks dont know which tax deductions are available or how to claim them on their tax returns. But you dont want to be that guy or gal, because it could mean youre leaving a good chunk of money in the hands of the IRS without even knowing it!

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Special Or Extra Duty Pay For Police Officers

Police forces regularly allow their police officers to provide security and other special or extra duty services to third parties for events.

We consider a third party that pays special or extra duty pay to police officers to be their employer. The third party has to do all of the following:

- withhold CPP contributions, EI premiums, and income tax from SEDPwhen the payment is made to a police officer

- remit these deductions to us

- report the SEDP and deductions on a T4 slip

However, we administratively allow the individual police forces, who are the regular employers of the police officers in question, the option to assume these responsibilities instead.

Note

If the police force does not assume the responsibility for withholding remitting, and reporting, it is the third partys responsibility to do this. In such a situation, the third party may have to put the police officer on payroll as a part-time employee.

Under the administrative option, the police force can take into account the CPP contributions and EI premiums previously deducted from the police officers regular salary and SEDP when determining the maximum CPP pensionable and EI insurable earnings for the year.

To determine how much income tax to deduct, the police force should use the method described under Bonuses, retroactive pay increases, or irregular amounts.

For more information, go to Police forces and extra duty.

Internet And Phone Bills

Regardless of whether you claim the home office deduction, you can deduct the business portion of your phone, fax, and internet expenses. The key is to deduct only the expenses directly related to your business. For example, you could deduct the internet-related costs of running a website for your business.

If you have just one phone line, you shouldn’t deduct your entire monthly bill, which includes both personal and business use. According to the IRS website, “You cant deduct the cost of basic local telephone service for the first telephone line you have in your home, even if you have an office in your home.” However, you can deduct 100% of the additional cost of long-distance business calls or the cost of a second phone line dedicated solely to your business.

Recommended Reading: How Much Does H & R Block Charge To Do Taxes

What Are Examples Of Incorrect Payroll Deductions

Incorrect payroll deductions are often the result of employers charging their employees for benefits and services that they should be paying themselves. This includes:

- Federal unemployment tax

- Personal protective equipment required by OSHA

- Tools necessary to perform work

There may be additional restrictions at the state level on withholding income to cover uniforms, cash register shortages and job-related expenses.

Items You May Be Able To Deduct From Your Taxes

You could save a bundle this year if you carefully consider your business expenses for possible deductions for taxes.

Entrepreneur

Benjamin Franklin said it best when he coined the phrase, “A penny saved is a penny earned.”

Many business owners take years to understand that taxes are one of their biggest costs, and it really doesnt take a lot of effort to make sure you arent missing something on your taxes.

Before setting forth my list of the top 75 deductions/strategies, allow me to make an important point: You are the captain of your own ship. You dont have to be an accountant to manage your accountant. Make sure you have a regular conversation with your tax preparer and discuss these items.

Your accountant should be suggesting these to you and they should be trying to find ways to write-off expenses — not just telling you no and talking down to you. Use this list as a discussion point and make sure you have the right person helping you with your taxes.

Consider this list of 75 possible tax deductions for business owners. It’s just a start and not every one of these items is always a viable deduction, but certainly worth a discussion.

Also Check: How Can I Make Payments For My Taxes

Understanding The Tax Deductions On Your Pay Stub

- Income tax

- Employee contributions to Employment Insurance

- Employee contributions to the Canada Pension Plan

These deductions mean that the amount on your paycheque will be less than the total you earned. Your employer must withhold and remit these amounts directly to the Canada Revenue Agency . However, you do get credit for having paid these amounts, which are reported on your T4, when you file your annual tax return.

Depending on how you get paid, your pay stub will either be attached to your cheque or to a direct deposit statement. This sample pay stub illustrates the following common terms: