Guide To Reporting Your Doordash 1099 Income

I get it filing your tax return sounds complicated. If your heart is pounding out of your chest right now, don’t worry, Keeper Tax has your back. We will make this process as easy to understand as possible. You will become excellent at reporting your taxable income in no time. Without further ado, let’s dive into the first step of your journey, discovering which taxes you have to file as a self employed individual.

Tax Information To Gather Ahead Of Time

Before we start looking at the different companies and how to get your tax documents from each of them, there are a few things to consider.

First, make sure you are keeping track of your mileage. For 2020 the mileage reimbursement amount is $0.57. This means for every mile you drive, you pay $0.57 less in taxes. That may not seem like much, but in a typical day can save you $28 $57 or more depending on how much you drive.

Thats why it is so crucial that you keep track of your miles, not just the ones your courier says you drive, but what you actually drive. My favorite way to do this is to use Gridwise. You start tracking when you start driving and turn it off at the end. It even automatically gets your earnings from whoever you drive with.

Find our full list of the top recommended mileage tracking apps for drivers, and take a look at our video below for our list of the best mileage trackers: 5 Best Apps to Track Mileage in 2021

Another thing to track are expenses directly related to your delivery driving. Things like insulation bags, music services, beverage holders, phones, phone plans, and accounting costs can all be deducted. You can find a full list of common driver expenses here.

Im Only Paying 900 In Taxes On My Doordash Earnings After Making 26k Last Year

How much do you pay in taxes doordash reddit. Customers can also order from hundreds of restaurants in their area on the DoorDash platform via Pickup with zero fees. DoorDash does not provide Dashers in Canada with a form to fill out their 2020 taxes. This means you will be responsible for paying your estimated taxes on your own quarterly.

You will have to keep a mileage log but DoorDash recommends a discounted service to do that for you. Therefore there are a number of things that you should pay attention to regarding paying taxes as food delivery. If your total yearly income from all sources is 10k though you are not going to pay 30 in taxes.

Your taxes are based on profits not on what you are paid by gig companies Youll pay income tax on your profits these can vary a lot. For the physical copy you can expect to receive the form in 7-14 business days. Deliveries that require Dashers to travel a longer distance that are expected to take more time and that are less popular with Dashers will have a higher base pay.

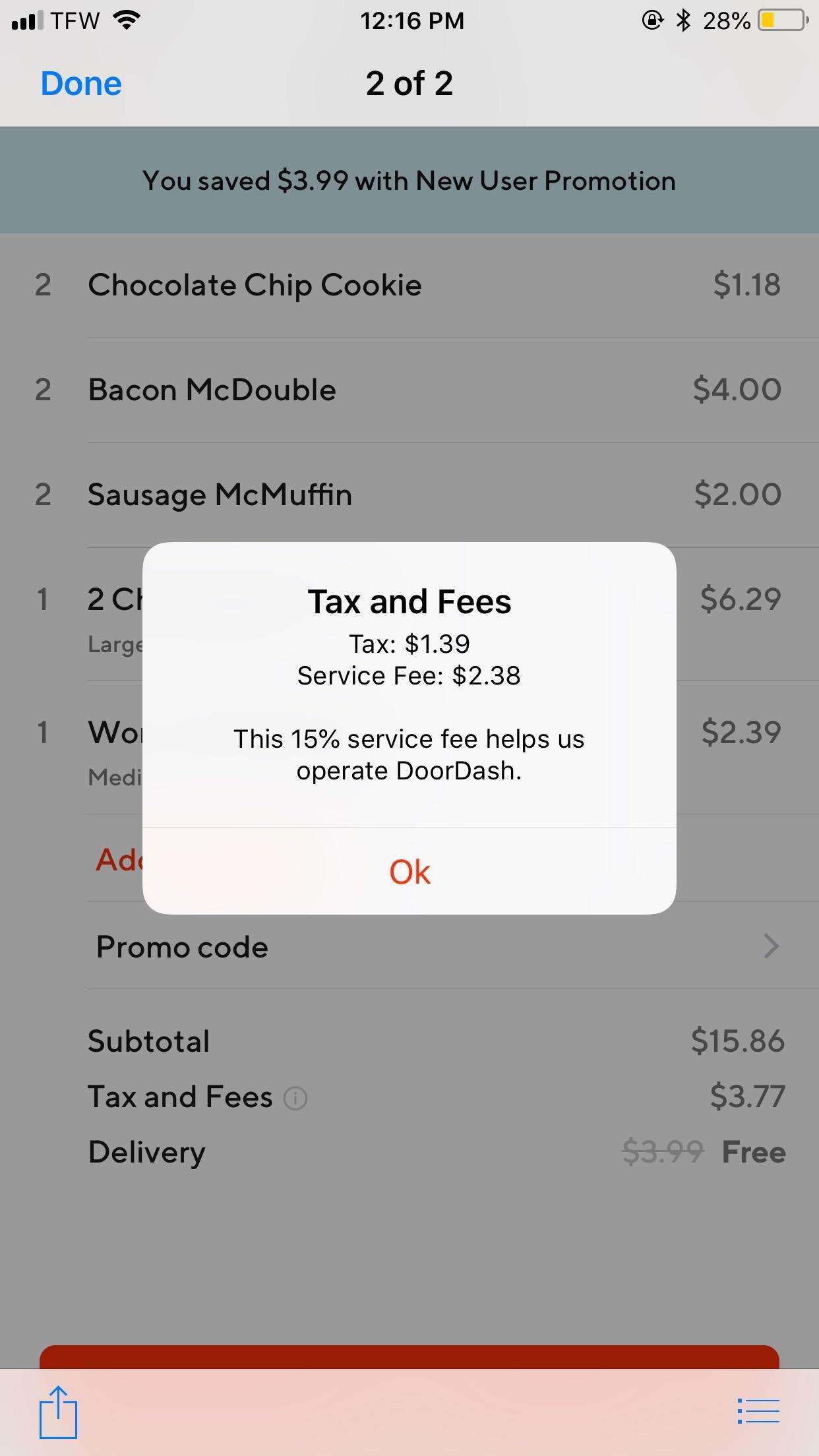

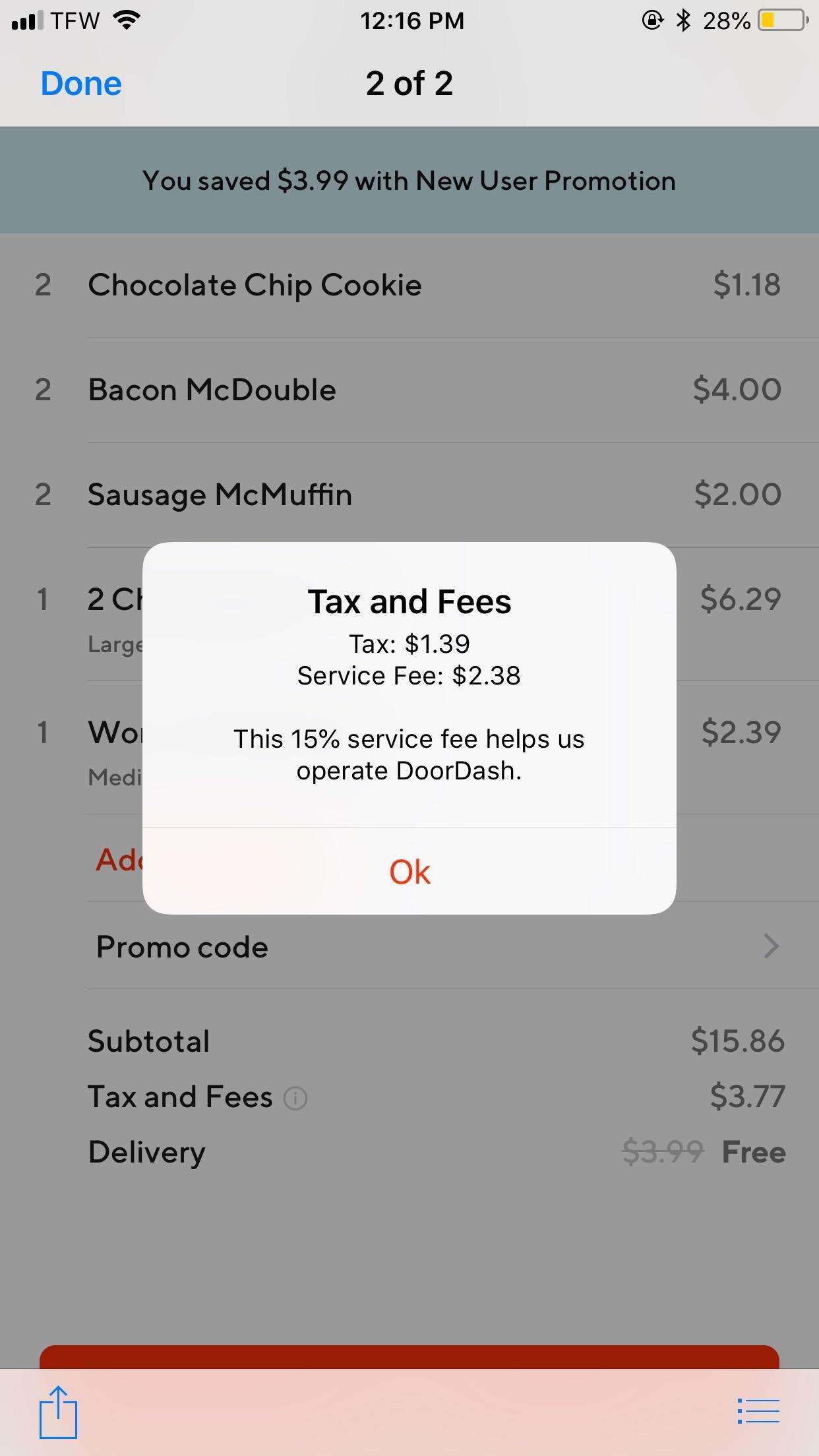

The 299 fee goes to Door Dash for the cost of you to use there app to get your food and to offer it to a Driver to deliver the food. For more information on how to complete your required tax form T2125 visit the CRA website. From there youll input your total business profit on the Schedule SE which will determine how much in taxes youll pay on your independent income.

How Much Did I Earn On Doordash Entrecourier

Best Paycheck I Ve Had Doordash

Don’t Miss: How To Report Tax Evasion

Breakdown Of The Actual Expense Method

The actual expense method requires contractors to keep detailed records of their receipts for business-related expenses.

This method will allow you to deduct expenses like gasoline, car repairs, insurance, tire replacements, licenses and registration fees, etc.

Typically, tracking your receipts will result in a higher tax break. Calculate your tax deduction for both methods for yourself to see which one you give you the bigger write-off.

Understanding Taxes With Doordash

Doordash has some services in process of delivering food to consumers, one of them is delivery to the public space. Doordash has innovation in which consumers who order food while in public spaces will be delivered directly to these consumers.

That means Doordash not only does food delivery to homes or offices but also accepts delivery to public spaces.

Additionally, Doordash has a charity program linked to the Feeding America charity donation program. This company also has taxes with Doordash policy for its employees.

However, food delivery in Doordash has a different tax payment policy with employees. Under the policy, those who work as food deliverymen will receive a 1099-K form.

The form is used to report their finances earned not from their main salary. It can come from payment card transactions where you have to pay each year.

Therefore, there are a number of things that you should pay attention to regarding paying taxes as food delivery.

Recommended Reading: How To Pay Federal And State Taxes

Keeping Track Of Your Expenses

Keep an accurate and detailed paper trail of your expenses to help you fill out Schedule A or Schedule C at tax time. Receipts and logs are your best friends and come in handy if you should be audited.

- If you have an expense that is both personal and business, then you need to allocate it between the two.

- If an expense is only business related, then no allocation is required.

For example, suppose you use your phone 30% for delivery food and 70% for personal use.

- You would multiply your phone bill by 30% to determine how much might be a deduction from your earnings or as an unreimbursed employee expense for itemizing your deductions.

If you are using your vehicle for delivering items, you might be able to deduct the costs of its use. There are two ways to deduct vehicle costsusing the mileage method or actual expenses method. Either way you need to track your personal miles and your business miles.

Your Tax Impact Is Based On Your Profits Not Overall Earnings From Delivery Fees Service Fees Incentives Tips Etc

This is good news.

Technically, we are small business owners. The income we earn because of the Doordash app is treated like business income. The Internal Revenue Service looks at us like business owners. In the business world, our profit is our income.

It’s not how much you were paid as a Doordash driver. That part is known as your gross income. This is not figured from your 1099’s from them or from other gigs like Uber Eats, Grubhub, Instacart, Lyft or any other independent contractor gigs.

It’s what’s left over of that money after you take out your business expenses. This is known as your net profit.

For most of us delivery drivers with third party delivery services, a big part of that is all those miles we put on our cars. For the 2021 tax year that means 56 cents per mile gets taken off our earnings.

And then you remove other expenses such as your cell phone, hot bags, cell phone holders, or any other expenses that are necessary and ordinary for the operation of your business.

All of that will be figured out using a Schedule C on your tax forms. The Profit and Loss from Business form is used to add up all your income, and then add up all your expenses. The amount that’s left over is what will make a difference in your tax bill.

Read Also: When Is The Deadline To File Your Income Tax

You Owe Taxes Working For Doordash Heres How Taxes Work With Doordash Plus What Tax Deductions You Can Get If You Drive For Doordash

OK, guys. I finally did it. I picked up a side-hustle.

You guessed it, I landed a job with the best of the best side-hustles DoorDash. Like many of you, DoorDash has served me the chance to make extra cash when I need it. My basking in the thrill of the gig-economy could only be darkened by one thing: Taxes.

And wouldnt you know it, that dark and stormy rain cloud rolled into my inbox yesterday evening. It was an email from DoorDash kindly writing to remind me that as an independent contractor, it is mine not their duty to withhold taxes.

Wait a second. Is this true? Do I owe taxes working for DoorDash?

Yes, I owe taxes if I earned more than $600 working for DoorDash.

My head is spinning. Taxes are confusing. No teacher taught me about taxes. Ask me about the mitochondria. Ill tell you its the powerhouse of the cell. Just dont ask me anything about taxes.

I spent the afternoon searching high and low for every ounce of information I could find on the subject. Get ready. Im going to share with you everything I know about how taxes with DoorDash work.

Social Security And Medicare For Dashers

A lot of it is very much the same, and a lot is different.

Here’s where it’s the same for us as it is for employees:

Social Security and Medicare are taxed on every dollar you earn. If you’ve ever had a small paycheck as an employee, you may have noticed that no federal income tax was withheld, but Social Security and Medicare taxes still came out of your check.

This is true as an independent contractor. All those tax deductions ? They don’t reduce your Social Security or Medicare taxes. You owe on the first dollar of taxes.

But here’s where things are very different:

One reason we don’t think about Social Security and Medicare as employees is, we never have to file any tax forms. They just take it out. You get paid, and Uncle Sam just gets 7.65% of every dollar you earn. No deductions, no forms. It just comes out.

We’re not employees. So there’s no employer taking that out and sending it in. We actually have to calculate our income, then fill out a form to figure out our Social Security and Medicare. Then we pay that when we pay our income tax.

But here’s the biggest difference: As independent contractors, we pay double.

It’s not that Uncle Sam gets any more money. They get 15.3% of our income whether we’re employees or we are self-employed.

The difference is that an employer pays half of that FICA. 7.65% comes out of your check and your boss has to match that. When you’re self-employed, you pay both the employer’s portion and the employee portion.

You May Like: How To Get Tax Exempt Status

Doordash Tax Write Offs

DoorDash drivers, also called Dashers, do not work for DoorDash. If youre not already a gig worker or independent contractor, then it may surprise you to learn that companies like DoorDash dont have employees running the ground level operations . Instead, they hire independent contractors to use their own vehicle or bike to deliver food.

This type of delivery app is typical of the gig economy, where a rideshare driver can open up an app and find work that fits into their schedule.

A DoorDash delivery driver who is ready to work can just log onto the food delivery app to take an order placed by one of many DoorDash customers. Unlike the traditional food delivery model, DoorDash drivers do not work for any one particular restaurant. Instead, the app connects the driver with available orders placed at one of the apps partner restaurants listed within the DoorDash app.

The pay model of DoorDash is, therefore, unlike the typical employer-employee pay model. The delivery company charges a delivery fee for the foodsome of which is passed on to the driver, along with the customer tip. Doordash does not pay its gig workers an hourly wage, nor does it lock them into a schedule. Its a freelance business model, which will have different tax implications to consider.

Why Does This Doordash Tax Calculator Measure Tax Impact

The bottom line is, your tax situation is unique. It’s probably different than it was last year.

I’ll give you my own example. My wife and I each brought five kids into our marriage. EACH. Insane, right? At the time, nine were still living with us . They’ve all grown up now, but you can imagine what we were thinking when the new $3,000 child tax credit was passed. That sure would have come in handy back in the day.

But that’s the thing. Claiming that many kids is a lot different than not claiming any. Being single is a lot different than married with kids. Delivering for Doordash, Grubhub, Uber Eats and others as a full time business is a lot different than doing this as a side hustle on top of a full time job.

There are so many factors that it’s really not possible to try to measure all of those things without overcomplicating things. Many of those factors are related to personal deductions and tax credits.

Instead of getting into the weeds of all those credits, deductions, and adjustments, I decided to create something that asks a very simple question:

How will my Doordash earnings impact my tax liability?

Also Check: Do You Pay Taxes On Life Insurance Payment

Track Your Tax Deductions

While driving and delivering with DoorDash you can choose to work part time or full time, It is a popular side hustle that allows you to set your own workhours and work when is more convenient to you. However, in all cases, you will use your own vehicle and spendmoney for gas, maintenance In addition you will use your phone for the Dasher app and other resources necessary to do your job.

First of all, driving with DoorDash delivery you can make smart money reducing your expenses to as low as possible. You can for example save on gas expenses, use a gascashback app and adopte techniques to savefuel and money

Whether you are in the US or in Canada , these expenses can be deducted in the portion related to your business.You can reduce your tax liability by chasing deductions and tweaking your filing strategy. The question is whatexpenses can I deduct as a 1099 contractor and in particular as a DoorDash driver?

Keep in mind that whether you work as a Doordash or as an employee, if you want to write off your car expenses,such as amounts you paid for tolls, you must keep a written record of those expenses. To make sure that youreclaiming all the deductions youre eligible to claim, we made a review of the most common self-employed taxes andespecially Doordash tax deductions.

How Do Taxes With Doordash Work

DoorDash is an independent contractor and doesnt automatically withhold federal or state income taxes. You will calculate your taxes owed and pay the IRS yourself. But there are a number of ways you can do this.

After you know how much you made, you will need to do some calculations. You will next want to determine if you were eligible for any tax deductions. You dont need a perfect number at this point. This stage is helping you decide your next move, because you have options.

Read Also: How To File Taxes Doordash

When Are Verbal Agreements Not Enforceable

There are some types of contracts which must be in writing.

The Statute of Frauds is a legal statute which states that certain kinds of contracts must be executed in writing and signed by the parties involved. The Statute of Frauds has been adopted in almost all U.S states, and requires a written contract for the following purposes:

- The sale of real estate or vehicles

- Real estate leases lasting longer than one year.

- Property transfer following the death of the owner.

- The case of a party agreeing to pay debt for someone else.

- Any contract that requires more than a year to fulfil.

- A contract involving and exceeding a specified amount of money .

Typically, a court of law won’t enforce an oral agreement in any of these circumstances under the statute. Instead, a written document is required to make the contract enforceable.

Contract law is generally doesn’t favor contracts agreed upon verbally. A verbal agreement is difficult to prove, and can be used by those intent on committing fraud. For that reason, it’s always best to put any agreements in writing and ensure all parties have fully understood and consented to signing.

Can You Use Your Doordash Red Card For Gas

Ive seen this question come up a lot when people ask if DoorDash pays for your gas, and the confusion makes sense.

Your DoorDash Red Card is the credit card DoorDash sends you in your activation. You use your Red Card to pay for certain food delivery orders.

You cant use your DoorDash Red Card to pay for gas.

According to DoorDash: you can only use the Red Card to pay for a DoorDash order at the correct time and at the correct restaurant. The card will only charge the correct amount of money due to the restaurant.

Furthermore, DoorDash states your Dasher app prompts you when its time to pay with your Red Card, so you know the scenarios when youre supposed to use it

Don’t Miss: Can I File Taxes If I Only Worked 1 Month

Let’s Break Down How Doordash And Independent Contractors Work In Plain English

Here it is in a nutshell:

When ever you make money, Uncle Sam wants a piece of it.

How Uncle Sam decides how much to collect, and how it’s collected, that’s where there’s a bit more detail.

Here’s why I’m writing this the way I am. I see a lot of articles out there that try to explain taxes. Everything I find is just an overview with just general information.

Okay, this is an overview too. Guilty as charged.

That’s because it’s important to start with a basic understanding. But once you understand how it works, it’s hard to find the details.

That’s where I want to offer a bit more. Let’s talk about how it works here. Once you understand how it works, the details become less intimidating. So from here, I want to give you more details.

I’ve put together several FAQ pages on how your taxes work. I have a tax guide that covers a lot of the same questions but in a more explanatory manner. All of this so you can get the overview, then drill down into the details. You’ll find links to articles with more detail on a topic as we go along.

Here’s what we’ll talk about in this overview.

- No taxes are taken out of your Doordash paycheck.

- You will file your own taxes on Doordash income as a business owner.

- You’re taxed based on profit, not on the money you get from Doordash.

- Understanding the different taxes you pay

- Understanding how the tax return process works and how your Doordash income fits into it

- The best ways to use this knowledge and prepare for taxes.