How To Calculate Sales Tax Percentage From Total

To calculate the sales tax that is included in receipts from items subject to sales tax, divide the receipts by 1 + the sales tax rate. For example, if the sales tax rate is 6%, divide the total amount of receipts by 1.06. $255 divided by 1.06 = 240.57 (rounded up 14.43 = tax amount to report.

What is the formula for sales tax?

- To calculate sales tax of an item, simply multiply the cost of the item by the tax rate.

How Do You Find Out The Percentage

1. How to calculate percentage of a number. Use the percentage formula: P% * X = Y

How To Calculate Reverse Sales Tax

Let’s be honest – sometimes the best reverse sales tax calculator is the one that is easy to use and doesn’t require us to even know what the reverse sales tax formula is in the first place! But if you want to know the exact formula for calculating reverse sales tax then please check out the “Formula” box above.

Read Also: How Does Doordash Do Taxes

Sales Tax Calculator And De

This calculator requires the use of Javascript enabled and capable browsers. There are two scripts in this calculator. The first script calculates the sales tax of an item or group of items, then displays the tax in raw and rounded forms and the total sales price, including tax. You may change the default values if you desire. Enter the total amount that you wish to have calculated in order to determine tax on the sale. Enter the sales tax percentage. For instance, in Palm Springs, California, the total sales tax percentage, including state, county and local taxes, is 7 and 3/4 percent. That entry would be .0775 for the percentage. The second script is the reverse of the first. If you know the total sales price, and the sales tax percentage, it will calculate the base price before taxes and the amount of sales tax that was in the total price. This is particularly useful if you sell merchandise on a “tax included” basis, and then must determine how much tax was involved in order to pay your sales tax, this is the ideal tool. Several state tax agencies actually suggest our calculator to merchants that could use it in that manner.If you need to calculate the sales tax percentage and you know the sales amount and the tax amount, use our Sales Tax Percentage Calculator. CALCULATE SALES TAX

How Do I Work Out My Tax

You can work out your tax by following these four stages:

1. Work out whether your income is taxable or notSome income is taxable and some is tax free. You start by adding up all amounts of income on which you are charged to income tax for the tax year.You can then take certain deductions from this figure, such as trade losses.

2. Work out the allowances you can deduct from your taxable income There are several different tax allowances to which you might be entitled. However, at this stage of the tax calculation there are only two which are relevant: the personal allowance and the blind persons allowance.Every man, woman and child resident in the UK has a personal allowance. For most people, the personal allowance for the tax year starting on 6 April 2021 and finishing on 5 April 2022 is £12,570.Despite its name, you do not have to be completely without sight to claim the blind persons allowance. So if you have very poor eyesight, check if you are entitled.You can find out more information on these allowances on What tax allowances am I entitled to?. Note, however, that some so-called allowances are in fact nil rates of tax that are applied at step 3 below, and some are given as a tax credit or tax reduction at step 4 below.

Similarly, if you live in Wales and are a Welsh taxpayer, there are Welsh rates of income tax set by the Welsh Assembly that apply to your non-savings and non-dividend income. The UK rates apply to your savings and dividend income.

Read Also: Doordash Independent Contractor Taxes

Do I Really Need To Register For Vat

Well, that depends on your particular circumstances. If your turnover in a 12-month period reaches the current £85,000 threshold, then registration is compulsory â and if you donât do it, youâll receive a fine as a penalty. If you donât hit this figure, then registration isnât obligatory read more..

How Do You Calculate New Price After Increase

Divide the larger number by the original number.

Don’t Miss: Ein Look Up Number

Is 7 Cents A Dollar Tax

Base retail sales tax is set at a certain number of cents per every dollar spent in a retail transaction, and the rates vary widely. Some states have no base retail sales tax at all. These states are Alaska, Delaware, Montana, Hew Hampshire and Oregon. Only California as a base sales tax above 8 cents per dollar.

Use The Sales Tax Formula To Find The Sales Tax Amount And The Final Sales Amount The Customer Owes

Origin-based states are Arizona, Illinois, Mississippi, Missouri, New Mexico, Ohio, Pennsylvania, Tennessee, Texas, Utah, and Virginia. California is considered a mixed-sourcing state since the state, city, and county taxes are origin-based, but the district sales taxes are destination-based. To try to make sales taxes affect everyone more equally, laws often exempt particular goods and services from these taxes. That means that you dont have to pay sales taxes when you buy certain things usually items that are considered necessities of life.Exemptions vary among states and local areas. In many states, food, medical expenses, and educational expenses are exempt from sales tax. For example, a boutique that buys shirts from a wholesaler will be exempt from sales tax on that purchase.

Online retailers are responsible for collecting sales tax on sales only in states where they have nexus. This can be a lot of work if they sell in many places automated services can help keep everything straight. For example, some point-of-sale platforms track tax liabilities. Sourcing rules indicate the location at which the state believes sales should be taxed. Some states tax the sale at the sellers location, while others tax the sale at the buyers location.

Recommended Reading: Irs Gov Cp63

Example Of The Sales Tax Calculation

As an example, assume that all of the items in a vending machine are subject to a sales tax of 7%. In the most recent month the vending machine receipts were $481.50. Hence, $481.50 includes the amounts received for the sales of products and the sales tax on these products. The use of algebra allows us to calculate how much of the $481.50 is the true sales amount and how much is the sales tax on those products:

Let S = the true sales of products , and let 0.07S = the sales tax on the true sales. Since the true sales + the sales tax = $481.50, we can state this as S + 0.07S = 1.07S = $481.50. We solve for S by dividing $481.50 by 1.07. The result is that the true product sales amounted to $450. The 7% of sales tax on the true sales is $31.50 . Now let’s make sure this adds up: $450 of sales of product + $31.50 of sales tax = $481.50, which was the total amount of the vending machine receipts.

How Do U Calculate Tax

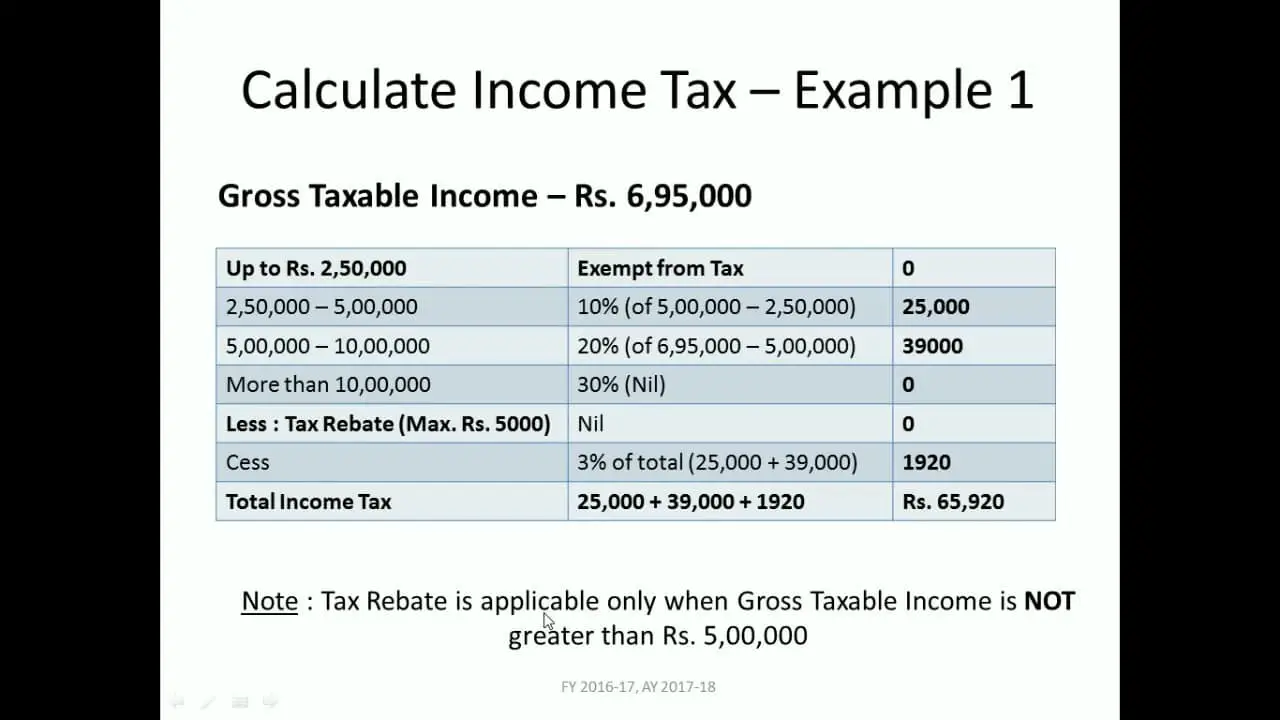

Now, one pays tax on his/her net taxable income.

You May Like: Irs Business Look Up

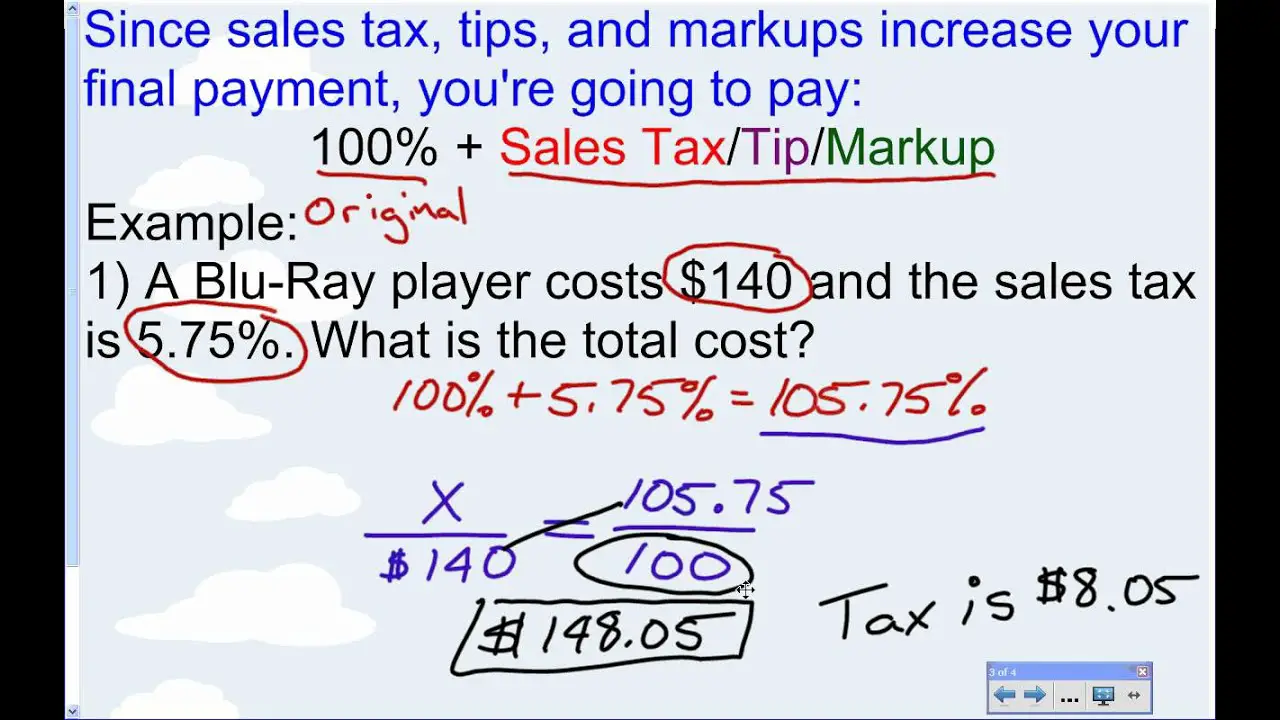

Add 100 Percent To The Tax Rate

Add 100 percent to the sales tax rate. The 100 percent represents the whole, entire pre-tax price of the item in question when you add it to the tax rate, you get a total percentage that represents the pre-tax price plus the tax. So if the sales tax in your area is 8 percent, you have:

100 + 8 = 108 percent

How To Add Sales Tax On A Calculator

Therefore 7% is the total amount of tax rate you have paid on purchasing the two items. If you run a retail business with computerized cash registers, theyll be able to break out the total sales tax for you. Otherwise, youll have to go over your books or handwritten receipts and identify which transactions involved sales tax. Instead of using a sales-tax calculator, you use whats jokingly called a sales tax decalculator. Its a bit more complicated when your sales receipts include sales tax. To figure out the gross amount less the sales tax, divide the receipts by 1 plus the sales tax rate.

- This method assumes you know the total amount paid and the amount of tax paid, and you need to figure out the percentage tax rate that was assessed.

- Currently, we have around 200 calculators to help you do the math quickly in areas such as finance, fitness, health, math, and others, and we are still developing more.

- In the Auto mode, SpreadsheetConverter automatically unlocks cells that are referenced in formulas, and cells that contain a Text widget.

- In other words, sales tax is gradually but noticeably making a considerable impact on various purchase items, compelling the buyers to understand and analyze it at the time of purchase.

- Upon entering the two values, the calculator will automatically generate the Tax Amount.

- It is common for states to offer these holidays for school supplies, disaster preparedness gear, clothing, computers, and eco-friendly appliances.

You May Like: How Does Doordash Do Taxes

How To Calculate Sales Tax Backward From Total

Most of the state and local governments would collect a sales tax on the products sold in stores. For some people, they need to know how much they had paid for, especially when they need to fill out accurate tax returns or receive monetary credits for any sales tax which theyve overpaid. Knowing this information is very beneficial, especially if you have to make a list of any purchases youve made outside of your state and find out how much taxes youve paid on them.

You dont pay for a reverse sales tax instead, you calculate it. The simplest way to do so is to use this reverse tax calculator. For instance, youve made some purchases on a business trip. As you go through the receipts, you may want to find out how much is the sales tax and how much is your actual income. Rather than calculating the sales tax from the purchase amount, its easier to calculate the sales tax in reverse then separate this amount from the total amount.

The computations remain the same whether youre performing a reverse sales tax calculation using a receipt that you have, or youre trying to figure out the price of an item before the taxes. Lets take a look at some steps for you to calculate the sales tax backward from the total. Before you start, you should know the total amount youve paid for as well as the amount of tax paid. Then follow these steps:

- Subtract the tax paid from the total amount

$26.75 $1.75 = $25

- Divide the tax paid by the price of the item before tax

$1.75 ÷ $25 = .07

How Do You Find The Original Price Before Tax

How to find original price before tax?

Don’t Miss: Philadelphia Pa Sales Tax

How Do I Calculate Tax From A Total

To calculate the sales tax that is included in a companys receipts, divide the total amount received by 1 + the sales tax rate. In other words, if the sales tax rate is 6%, divide the sales taxable receipts by 1.06.

In the same way How do I add 5.5 tax?

Subsequently, What is $1200 after taxes? $1,200 after tax is $1,200 NET salary based on 2021 tax year calculation. $1,200 after tax breaks down into $100.00 monthly, $23.00 weekly, $4.60 daily, $0.58 hourly NET salary if youre working 40 hours per week.

How do you calculate NJ sales tax?

NJ Taxation

As a seller, you have the option of calculating Sales Tax due using either the tax bracket or . If you are not using the tax bracket, you must: Calculate the tax to the third decimal point.

How To Calculate Tax Percentage

To calculate tax percentage, you need to subtract the tax paid from the total, divide the tax paid by the pre-tax price, and finally convert the tax rate to a percentage. Please follow these steps:

- Deduct tax paid from the total amount

You can withdraw the amount of tax you have paid from the total amount, which will be the goods post-tax price. This will take you to the items price before the tax allocation therefore, you will get the items pre-tax price. For example, if you have paid $26.75 for two things and $1.75 was the amount of tax applied as mentioned in the receipt, then the items cost before the tax was $25. This amount has been derived after dividing the total cost for two things and the tax amount.

- Divide the paid tax amount by the pre-tax number

You can also determine the sales tax by dividing the total amount of tax you have paid as a buyer by the items price before the tax. The resulting amount will be the percentage tax rate which will be highlighted in a decimal form. For example dollar, 1.75÷25 dollars is equal to .07. Therefore you have paid .07% of the tax amount.

- Conversion of the tax rate to percentage form

How to find the price before sales tax? To find the price before sales tax, you need to do the reverse tax calculation described below:

Read Also: H& r Block Form 5498

How Do You Calculate Net Income In Canada

Every deduction you can make is subtracted from your total income each year to arrive at your net income. determines your provincial and local non refundable credits as well as other social credits you receive, such as the GST/HST equivalable credits, or any social benefits you receive like the GST/HST credit or the Canada child benefit.

How To Do The Reverse Tax Calculation

How to calculate sales tax percentage from the total?To calculate the sales tax backward from the total, divide the total amount you received for the items subject to sales tax by 1 + the sales tax rate. For example, if the sales tax rate is 5%, divide the taxable receipts by 1.05.

You can calculate the tax paid by knowing the total post-tax price for the purchased item and the measured tax rate. In addition, this method can calculate the tax paid by determining it backward to analyze monetary compensation paid as sales tax.

You May Like: Is Plasma Donation Money Taxable

Quebec Sales Taxes On Used Motor Vehicle Sales

In Quebec, sales taxes are charged differently on used motor vehicle sales depending on who sells it to you. If you buy a used car from a dealer, you will have to pay both the 5% GST and 9.975% QST on the agreed sales price. If you buy a used car from another person, however, you will only need to pay QST on the greater of the sales price or the estimated value of the vehicle. You do not pay the QST amount to the person or dealer that sold you the vehicle. You will pay it directly to theSociété de l’assurance automobile du Québec at the time of registration.

Dealing With An Onshore Bond Tax Credit

Tax law for taxing insurance bond gains is contained in Part 4, Chapter 9 of the Income Tax Act 2005. Although, where the policyholder is a company, then the loan relationship rules apply instead as discussed here.

Chapter 9 comprises Sections 461 to 546 and from outset, S461 makes it clear that gains are charged to income tax. Only in certain specific circumstances will a charge to capital gains tax arise.

Chargeable event gains on UK bonds are not liable to basic rate tax. The individual who is liable for tax under the chargeable event regime is treated as having paid tax at the basic rate on the amount of the gain. This reflects the fact that the funds underlying a UK policy are subject to UK life fund taxation.

It is a longstanding principle that the notional tax is not repayable ITTOIA 2005

HMRC manuals therefore state that basic rate tax is still treated as paid even if some or all of the gain is subject to the 0% starting rate for savings.

Finance Act 2008 created a new 10% starting rate for savings. A consequence of this was that S530 was repealed. That particular subsection had been in place to ensure that gains taxed under the previous 10% starting rate band would be taxed at 20% rather than 10%. With S530 being omitted, this consequence was that gains with a notional 20% credit became chargeable at 10% leaving a balance of tax credit.

Example of bond gain partially taxable at 0% savings rate –

Recommended Reading: Who Has The Power To Levy And Collect Taxes