How To Register For Alabama Sales Tax

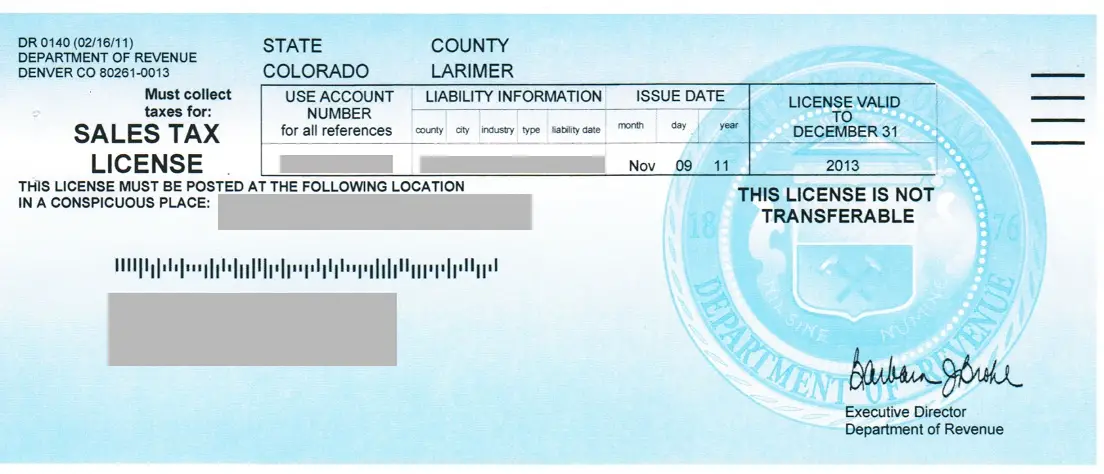

If you determined that you need to charge sales tax on some or all of the goods and services your business sells, your next step is to register for a seller’s permit. This allows your business to collect sales tax on behalf of your local and state governments.

In order to register, you will need the following information:

- Personal identification info

- Business identification info

- Business entity type

- Shipping In-State

- Out-of-State Sales

Recommended: Use our Sales Tax Calculator to look up the sales tax rate for any Zip Code in the US.

How To Collect Sales Tax In Alabama

Now itâs time to tackle the intricate stuff! Tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations.

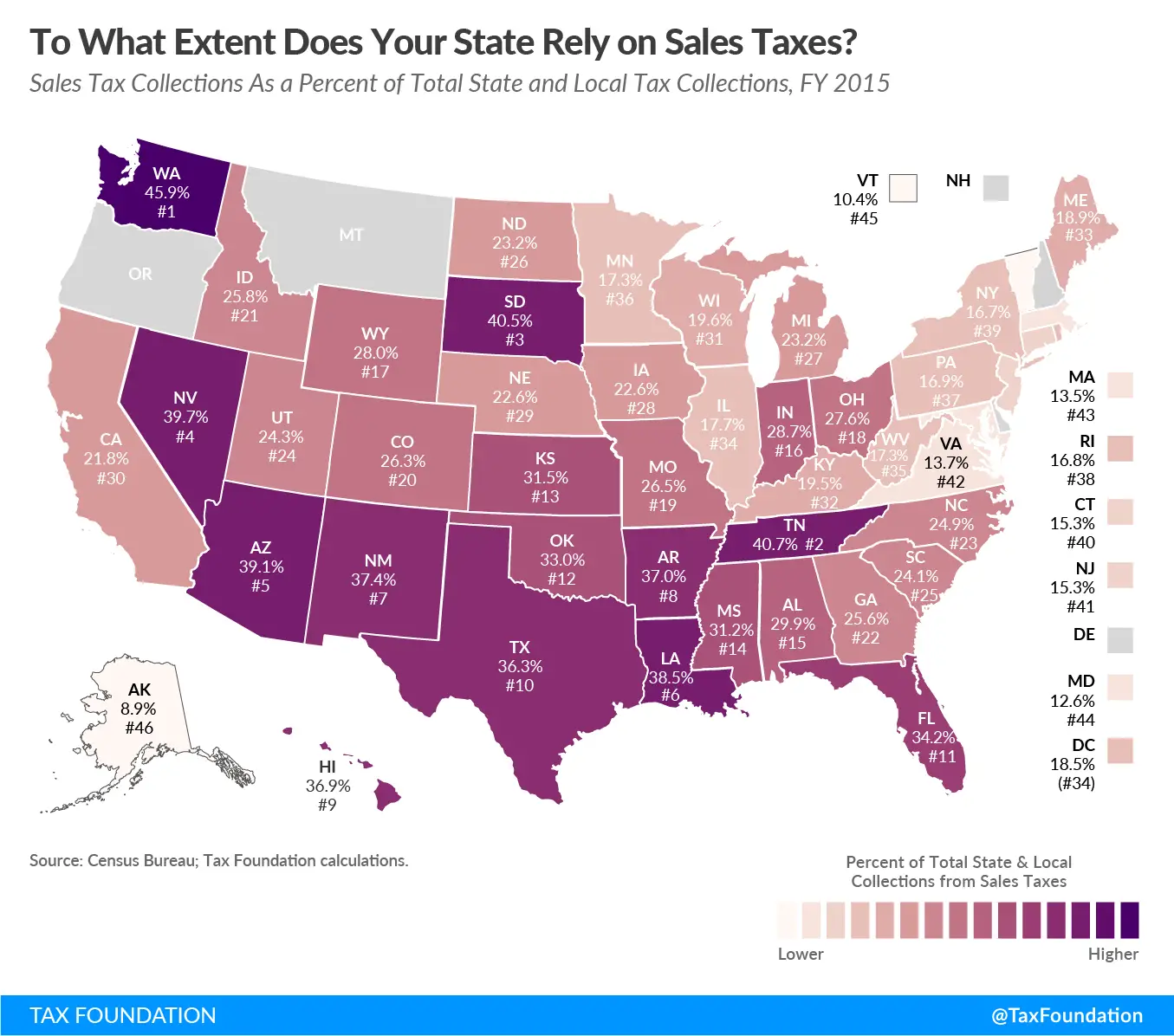

The state-wide sales tax in Alabama is 4%.

There are additional levels of sales tax at local jurisdictions, too.

Alabama has a destination-based sales tax system, * so you have to pay attention to the varying tax rates across the state. Charge the tax rate of the buyerâs address, as thatâs the destination of your product or service.

* Important to note for remote sellers: While this is generally true for Alabama, some state have peculiar rules about tax rates for remote sellers. Contact the stateâs Department of Revenue to be sure.

How Much Is Tax And Title In Alabama

Alabama has a much more straightforward fee structure, with yearly registration and title fees of $23 and $15, respectively. If you add $600 in taxes based on a $15,000-vehicle purchase at 4 percent, your total tax, title and registration costs are $638.

Recommended Reading: How Do Small Business Owners File Taxes

Alabama Nursing Facilities Privilege Tax Rates &

- Annual rate of $1,200.00 for each bed in the facility

- Annual rate of $1,899.96 for each bed in the facility

- Annual rate of $2,963.04 for each bed in the facility

- Annual rate of $3,503.04 for each bed in the facility

- Annual rate of $4,028.04 for each bed in the facility

- Annual rate of $4,429.32 for each bed in the facility

- Annual rate of $4,756.80 for each bed in the facility

Mobile Alabama Sales Tax Rate

mobile Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Mobile, Alabama?

The minimum combined 2022 sales tax rate for Mobile, Alabama is. This is the total of state, county and city sales tax rates. The Alabama sales tax rate is currently %. The County sales tax rate is %. The Mobile sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Alabama?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Alabama, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Mobile?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Mobile. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Alabama and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Recommended Reading: What Can You Claim On Your Taxes

Sales And Use Tax Rates

Sales and use tax rates vary across municipalities and counties, in addition to what is taxed by the state.

Per 40-2A-15, taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality, may call ALTIST Certified Auditors’ Complaint Hotline: 1-334-844-4706 ~ Toll Free: 1-855-638-7092. For tax information and assistance, contact the Department of Revenue.

Per 40-2B-2, a self administered county or municipality may elect to opt out of the Alabama Tax Tribunal. Click below for a list of counties and municipalities that have opted-out of the Alabama Tax Tribunal. Counties and Municipalities Opt Out List

Act 98-192, known as the Local Tax Simplification Act of 1998, required each county and municipality to submit to the Department a list of any sales, use, rental, lodgings, tobacco, or gasoline taxes it levied or administered and the current rates thereof. Act 2018-150 requires all counties and municipalities to notify the Department in writing of a new tax levy or amendment to an existing tax levy at least 60 days prior to the effective date of the new tax or amendment. Act 2018-150 also provides that the effective date of the new tax levy or amendment of an existing tax levy shall be the first day of the third month following the Departments receipt of proper notification as required by law.

CODE EXPLANATIONS Please click here for City/County Code Explanations

Dry Cleaning Environmental Response Trust Fund Registration Fee

| Type of Business | Fee |

|---|---|

| Owner/Operator of an Existing Dry Cleaning Facility Electing to be Covered ) | 2% of the gross receipts earned in Alabama during the prior calendar year, not to exceed $25,000 per year. |

| New Owner/Operator Acquiring an Existing Dry Cleaning Facility after May 24, 2000 Electing to be Covered ) | 2% of the gross receipts earned in Alabama by the prior owner/operator during the prior calendar year less the amount paid by prior owner/operator, not to exceed $25,000. |

| New Owner/Operator Establishing a New Dry Cleaning Facility after May 24, 2000 Electing to be Covered ) | One-time registration fee of $5,000 for the first year of operation for the second year of operation, the greater of $5,000 or 2% of the gross receipts earned for prior calendar year, not to exceed $25,000. For each year thereafter, see Owner/Operator of an Existing Dry Cleaning Facility above. |

| Wholesale Distributors of Dry Cleaning Agents ) | $5,000 per year |

| Owner of Abandoned Dry Cleaning Facility or Impacted Third Party ) | $5,000 per year, per site |

Read Also: How To Get Maximum Tax Deductions

Alabama Sales Tax Faq

Once you have a license to collect and remit sales taxes in Alabama, you will probably be asking yourself two questions:

- When do I charge a sales tax in Alabama?

- What goods and services are subject to sales taxes in Alabama?

We are going to go over some common questions that our clients have asked. We believe these questions will help you appreciate the nuances of taxable goods so you can be confident in fulfilling your tax obligations.

Lets start with the first question

Birmingham Alabama Sales Tax Rate

birmingham Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Birmingham, Alabama?

The minimum combined 2022 sales tax rate for Birmingham, Alabama is . This is the total of state, county and city sales tax rates. The Alabama sales tax rate is currently %. The County sales tax rate is %. The Birmingham sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Alabama?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Alabama, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Birmingham?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Birmingham. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Also Check: How To Pay My State Taxes Online

Are Services Subject To Sales Tax In Alabama

The state of Alabama does not usually collect sales taxes on the vast majority of services performed. An example of taxed services would be one which manufactures or creates a product.This means that a freelance accountant would not be required to collect sales tax, while a someone working in the creation of clothing may be required to collect sales tax.

You can find a table describing the taxability of common types of services later on this page.

Alabama Sales Tax Software

Alabama is one state where keeping track of and filing sales tax returns poses particular challenges, especially to sellers shipping to customers throughout the state, because of the independent sales tax jurisdictions not administered by the state government. Assuming youre trying to service the entire state, there will be a lot of independent registrations to fill out and returns to file, as well as multiple combined sales tax rates to keep track of.

Fortunately, you can take advantage of tax calculator software like TaxTools to manage these webs of regulations. TaxTools integrates smoothly with all eCommerce platforms, so the only thing that will change about your business is the ease with which you manage your sales tax collections and file returns. TaxTools also keeps up on changes to the local tax rates and the classification of items that are taxed, so you can be sure youre charging the right rate on the right purchases on every sale you make. Your returns will be filed online in an efficient and timely manner, and you will have immediate access to clear reports detailing your taxable sales along with location information and other pertinent data.

So if youre ready to see how TaxTools can streamline your sales tax tracking and filing processes, to learn more or to today.

Solutions

Also Check: How Do I Claim My Stimulus Check On My Taxes

Who Do I Contact To Obtain An Abatement

Abatements are authorized to be granted by the governing body of a: municipality for private use industrial property located within the corporate limits of the municipality or within the police jurisdiction of the municipality county for private use industrial property located in the county and not within a municipality or its police jurisdiction, unless consented to by resolution of the governing body of the municipality or a public industrial authority for private use industrial property located within the jurisdiction of the public industrial authority.

What Are The Alabama Sales Tax Filing Interval Thresholds

The thresholds for filing intervals are based on the expected or actual tax liability owed:

*anticipated if new business, actual if existing company

Not sure how to determine your tax filing frequency?

You can review your eCommerce or Point-of-Sale Software to see the volume of sales you have generated.

Don’t worry though! The state will let you know when your due dates change. 🙂

Keep an eye out for notices in your mail from the State of Alabama so that you don’t miss any shift in deadlines.

Read Also: How Much Can You Get Back In Taxes

What Are The Current Alabama Sales Tax Rates

Alabama is a state with many different tax rates based on the type of transaction. The state-wide sales tax rate for general sales is 4% at the time of this articles writing, with local surtaxes potentially bringing that amount up to 11%. Since sales tax rates may change, we advise you to check out the Alabama Department of Revenue Tax Rate page which has the current rate. Any change will be reflected on that page.

It always helps to be accurate and up to date with this type of information! 🙂

Local Sellers Use Tax

The local sellers use tax is due monthly, with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Beginning with the calendar year 1999, a taxpayer may elect to file and pay state-administered local use tax quarterly when the total state sales tax for which the taxpayer is liable averages less than $200 per month during the preceding calendar year and the total state use tax for which the taxpayer is liable averages less than $200 per month during the preceding calendar year. The election to file and pay quarterly shall be made in writing to the ADOR no later than February 20 of each year. Also, if a taxpayers total state sales tax liability during the preceding calendar year is $10 or less, the taxpayer may file local use tax on a calendar year basis.

Recommended Reading: How To Find My Tax Id Number Online

What Is Exempt From Sales Taxes In Alabama

Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales tax altogether. Here’s how Alabama taxes five types of commonly-exempted goods:

Clothing

OTC Drugs

For more details on what types of goods are specifically exempt from the Alabama sales tax see Alabama sales tax exemptions. To learn more about what types of transactions are subject to the sales tax to begin with, see what purchases are taxable in Alabama? Taxation of vehicle purchases in particular are discussed in the page about Alabama’s sales tax on cars.

How Much Is Tax In Alabama

The Alabama state sales tax rate is currently 4%. Depending on local municipalities, the total tax rate can be as high as 11%.

Does Alabama have income tax?

- Alabama has the second lowest average effective property tax rate in the country, and its income tax rates range from just 2% to 5%, lower than most other states that have an income tax. However, rates could be higher depending on where in Alabama you live or work, as local governments can also collect income taxes ranging from 0% to 2%.

Recommended Reading: How Much To Do Tax Return

Does Alabama Have Sales Tax On Clothes

Clothes, school supplies and even some electronics are exempt from the states four percent sales or use tax. However, there are some rules. First, clothes have to be $100 or less per item to qualify. Some items that are free of state sales tax include belts, boots, jackets, and jeans.

Do I Pay Tax On Wholesale Sales

Why is there no sales tax on wholesale sales? Wholesalers are not required to charge sales tax to retailers because when a wholesaler sells to a retailer, that retailer is not the products end user. Therefore, the wholesaler does not have to collect sales tax on the transaction when selling to a retailer.

Don’t Miss: How To Fill Out State Taxes

Which Agencies In Alabama Do I Need To Additionally Register With

You may need to check with some of the following agencies or resources:

You are now prepared to register for your Alabama sales tax permit in Alabama.

Lets summarize what we have covered:

- Have all the required information easily accessible before registering online.

- Acquire a tax ID or EIN before registering for an Alabama sales tax permit.

- Register online at the My Alabama Taxes site.

- Look into what other agencies you may have to additionally register with.

Registering for your Alabama sales tax permit will be stress free as long as you are prepared. We recommend organizing all the essential information in a folder, preferably using a system like Box.com or Dropbox .

What Should I Do If My Customer Is Exempt From Sales Tax In Alabama

Purchasers who are tax exempt must have completed resale certificate and must present their completed exemption certificate at the time of purchase. It is then incumbent upon the seller to hold on to this exemption certificate. Failure to do so may leave you unable to justify tax exempt sales. In order to verify the authenticity of an exemption certificate, you can visit the My Alabama Taxes site and click Verify an Exemption Certificate on the right .

Remember, you always want to collect and file a copy of the exempt certificate. Such certificates must be produced upon request in the event of an audit to justify tax-exempt sales.

Don’t Miss: How To Buy Tax Liens In Florida

Sales And Use Tax In Alabama

There are two key tax types businesses selling goods and services in Alabama should be well-versed in: sales tax and use tax. Businesses should be well versed in both to be sure to stay compliant with Alabama state and local tax laws. This guide aims to assist by summarizing key tax topics in an easy to read format.

Business Guide To Sales Tax In Alabama

Phone:

So, you need to know about sales tax in The Heart of Dixie. Look no further!

Whether youâve fully set up shop in Alabama, or simply ship there once in a while, itâs important you know whether your business is liable to their sales taxes. This guide will tell you everything you need to know, plus direct you to the right places for handling any sales tax responsibility you may have.

Recommended Reading: How To File State Taxes By Mail

Collecting Sales Tax In Alabama

Lets review some common questions our clients have asked regarding their Alabama Sales Tax obligations.

- How do I collect Alabama Sales Tax?

- Who is eligible for Alabama Sales Tax exemptions?

- What should I do if my customer is exempt from sales tax in Alabama?

- What happens if I lose an Alabama tax exemption certificate?

After reading this, you will be better equipped to determine when –and when not– to collect sales tax in Alabama.