How Do I File Back Tax Returns

You can use TaxSlayer to file a return for up to three years after it is due. So for example, in 2022, you can file back taxes for years 2018, 2019, and 2020.

Simply log into your account or create a new account to begin. Then click on the Prior Years tab in the middle of the My Account page. Select the year you wish to create and click Start a New Tax Return. From there, youll enter the income and expense information for the year you are filing.

Once your return is complete, you will need to print out and mail in the paper copies of your forms. This is because the IRS does not support filing prior year returns electronically. The mailing address for the IRS can be found here based on the state where you live.

When you file back taxes with TaxSlayer, you get all the correct forms and instructions for the specific year you are completing.

Heres How To Get Prior

IRS Tax Tip 2018-43, March 21, 2018

As people are filing their taxes, the IRS reminds taxpayers to hang onto their tax records. Generally, the IRS recommends keeping copies of tax returns and supporting documents at least three years. Taxpayers should keep some documents such as those related to real estate sales for three years after filing the return on which they reported the transaction.

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

Also Check: Tsc-ind Ct

How Bench Can Help

One of the main reasons small business owners fall behind on filing and paying their taxes is because their bookkeeping isnât up to date. If thatâs you, then bookkeeping is also the first place you should start in getting back on track with the IRS.

Thatâs where Bench comes in. Our team of bookkeeping specialists helps you get caught up on your accounting and generate the financial statements you need to file back tax returns. If you need help filing, our tax team can also provide tax preparation and filing from start to finish.

Plus, as a Bench client, you get access to a network of partners who can help you set up a payment plan or negotiate your balance with the IRS.

How Can I File And Pay My Back Taxes

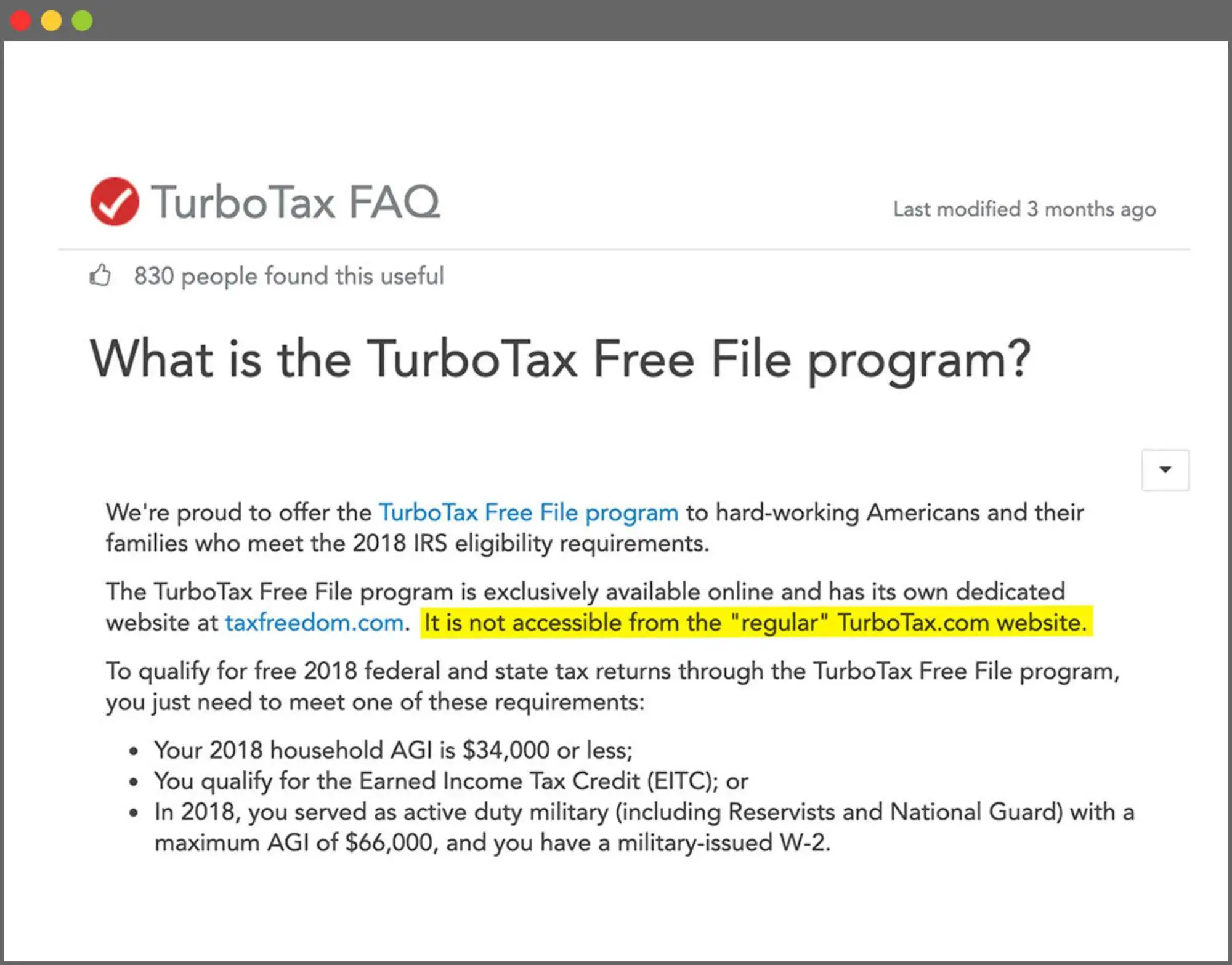

Its best to use reliable and easy-to-use software if you’re going to prepare your tax returns yourself. Plan on spending a few hours on each tax return you have to file. There are tax software programs that can help you for free.

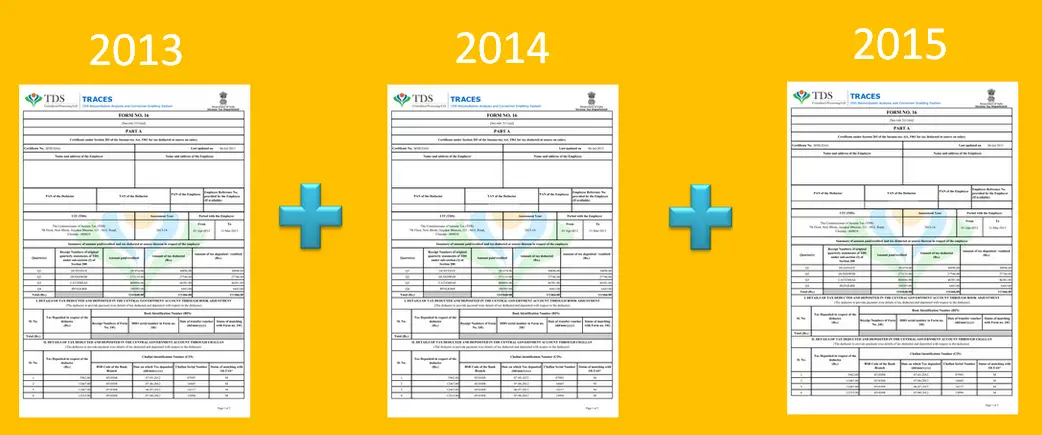

Again, make sure youre using software and forms for the appropriate tax year. Regulations vary from year to year, and the software settings can be critical for compliance as well as your liabilities or refund.

You might get a better result by hiring an experienced tax professional because they can help you with more complicated tax compliance and know how to deal with the IRS, if necessary.

Look for someone with significant experience in preparing back taxes if you decide to use the services of a professional. This would be the way to go if you need advice on handling incomplete tax documentation, or an advocate who will negotiate with the IRS on your behalf.

Youll need to print out the back tax returns and mail them in to the IRS to officially file them. You cant do it online.

You May Like: Www Aztaxes Net

Penalties That Otherwise Apply

Without the program, a plan sponsor faces many potential late filing penalties, including:

- $250 per day, up to $150,000 for each late Form 5500 or 5500-EZ, plus interest ) as amended by section 403 of the Setting Every Community Up for Retirement Enhancement Act of 2019 .

- $1,000 for each late actuarial report

Complete And File Your Tax Return

Once you have all the forms you need, be sure to use the tax forms from the year you’re filing. For instance, you must use 2018 tax return forms to file a 2018 tax return. You can find these documents on the IRS website. Patience is key when filling out a tax return by hand. And thankfully, you can also file tax returns from previous years using TurboTax.

- Select the year you want to file a return for to get started.

- Then, input your tax information and TurboTax will properly fill out the tax forms.

- You will have to print out and mail in your tax return for previous years as e-filing prior year returns is not an option through TurboTax.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Also Check: Doordash Tax Write Offs

Filing Your Own Return

You can use commercial software to complete your income tax return and file it online using the integrated NetFile Québec feature.

When you file your income tax return online, do not send us any paper copies of the return.

When can I file my income tax return using NetFile Québec?

2020 income tax return

- You can file your 2020 income tax return as of February 22, 2021.

Returns from previous years

- You can file your original 2017, 2018 and 2019 income tax returns in the four-year period following the taxation year covered by the return .

- If you did not file an income tax return for 2017, 2018 or 2019 taxation year, and we sent you a notice of assessment for the year covered by the return, you cannot file an original return using authorized software. You have to mail the return to us.

Amended income tax returns

- You can file an amended 2017, 2018 or 2019 income tax return as of February 22, 2021.

End of note

How Far Back Can You Go To File Taxes In Canada

According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Whether you are late by one year, five years, or even ten years, it is crucial that you file immediately. You may think that since you dont have the money to pay your taxes, its best to not file, but this isnt the right move.

The CRA does not forget about you over time. Every day that goes can cost you more money in late-filing penalties, interest, and other potential fees when you delay filing your taxes.

Recommended Reading: How To Find A Companys Ein

Make Sure It Has An Auto

Unless youre the kind that simply cant live without hours of manual data entry, look for a provider with an auto-fill option. Most will offer the auto-fill ability, which, once youre signed in, will automatically fill in the parts of your return that the CRA has access to, like your T4 reported income for instance. This greatly simplifies the process, so make sure the software you choose offers it.

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.7 million electronically filed returns in 2019. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

You May Like: Filing Taxes For Doordash

Gather Your Tax Documents

Before you get started, gather all relevant documents and records for the tax year in question. This may include:

-

Copies of your last filed tax return

-

Your Employer Identification Number or Social Security number

-

Financial statements

If you donât have financial statements because your bookkeeping isnât up to date, Bench can help you get caught up. We can record and categorize all transactions from your receipts, invoices, bank statements, and credit cards reconcile your bank accounts and produce financial statements.

If youâre missing information, such as W-2s, 1099s, and other tax forms, you can request a wage and income transcript from the IRS. This transcript shows all of the information reported to the IRS on your behalf for that tax year.

Help Filing Your Past Due Return

For filing help, call 1-800-829-1040 or 1-800-829-4059 for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 1-800-Tax-Form or 1-800-829-4059 for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

You May Like: Does Doordash Tax You

Individual Income Tax Filing

Filing electronically, and requesting direct deposit if youre expecting a refund, is the fastest, safest, and easiest way to file your return.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

How Late Can You File

The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return’s original due date. By not filing within three years of the due date, you might end up owing even more taxes because you can no longer claim the lucrative tax credits you might have otherwise qualified for.

Also Check: Is Doordash Money Taxed

Reasonable Cause For Late Filing

As an alternative to submitting late returns under this delinquent filer program, you may instead request relief by attaching a statement to your delinquent return, signed by a person in authority, stating your reasonable cause for the untimely return. However, if the request is denied, you will receive a penalty notice and the return will no longer be eligible for this delinquent filer program.

Can I Still Get My Tax Refund If Im Filing Back Taxes

Yes, if you file the return within three years of the original due date. This time limit also applies to claiming tax credits like the Earned Income Tax Credit . Tax credits and deductions can significantly reduce your tax liability, so its in your best interest to file within this three-year window to get the tax breaks and the refund you deserve. If you have a prior year return that you still need to file, you can get started for free today with TaxSlayer.

The information in this article is current through tax year 2021 .

Recommended Reading: How Do You Do Taxes For Doordash

Pay Social Security Taxes To Qualify For Benefits

Self-employed individuals have to pay Social Security taxes through their estimated tax payments and individual income tax returns. By filing a return and paying the associated taxes, you report your income so that you may qualify for Social Security retirement and disability benefits when you need them.

Taxes Prepared In Person

Volunteer Tax Assistance

Free tax help is provided to taxpayers that meet certain income and/or other requirements. For more information, please go to our Volunteer Assistance page.

If you would like to get your taxes prepared in person, you also can use an authorized e-file Provider. Note: The authorized e-file providers charge a fee to prepare and electronically file your Alabama and/or federal returns.

Below are some additional resources to help you to choose a tax return preparer.

IRS links

Also Check: Doordash Taces

Starting The Statute Of Limitations

The IRS generally has three years from the date you file your return to audit your return and assess additional taxes. However, that statute of limitations doesnât start until you file your return.

Filing your tax return starts the clock, so you donât have to worry about the IRS asking questions about your return five, 10, or 15 years down the line.

Investigate The Type And The Quality Of The Support You Can Expect

Support might be more important to some taxpayers. Freelancers or those with more complicated tax situation, like those with multiple sources or income like rental or investment income, may feel that they require a bit more hand holding. Some free tax filing services offer phone support for an additional fee. While most free or pay what you like services do not offer human telephone support, they may offer email or chat support. There will likely be striking differences between the quality of both telephone and email support of the various companies. Before choosing, find a software that hires staff thats well versed on Canadian taxes and able to communicate with you in your native tongue, whether its English, French, or Chinese during tax season, some tax preparation software companies staff up with seasonal helpers thousands of miles from Canada, who, no fault of theirs, arent exactly the ideal correspondents when youre white knuckling through your return. So check their website or reach out to any prospective service and get the lowdown on their support. Keep in mind some totally free tiers will offer limited support and you may have to pay additional fees for additional support.

While wait times may be long , the CRA provides a toll free number for individual tax enquiries: .

You May Like: Doordash How Much Should I Set Aside For Taxes

Self Assessment Tax Return Software

Do yourself a favour this tax season give GoSimpleTax a try, and save hours of valuable time with our easy-to-use tax return software.

GoSimpleTax is loaded with handy features that make submitting your tax return on time a breeze, including:

GoSimpleTax makes use of one-click shortcuts for ease of use, so you can swiftly access just the parts of the tax return relevant to your situation, and complete it without complications.

Our software automatically calculates your income and expenditure to work out exactly what you owe, and notify you of any tax reductions that you may be eligible for.

GoSimpleTax offers easy to read reports to help you understand your tax and how your business is performing. Reports like the SA302 show your Income Tax calculation for the year, helping you understand your income, expenses and tax calculation

It is easy to make a costly mistake on your tax return or miss out on opportunities to lower your overall bill. GoSimpleTax does much of the leg work for you and will notify you immediately when theres a possibility of a mistake

WHATS ALL THE FUSS ABOUT?

Being Out Of Time Impact On Claims And Elections

There are many tax claims and elections and all have time limits. They cover such issues as claiming Blind Persons Allowance a higher amount of tax free pay to making loss relief claims. In general, the default time limit for such claims is four years from the end of the tax year but some claims and elections, in particular, some loss relief claims, are on a shorter time scale. This means that being in arrears with your tax returns could mean that you potentially miss making a valuable claim or election.

There is technical guidance on claims and election time limits on the HMRC website at

You May Like: Pastyeartax Reviews

Watch Out For The Upsell

The CRA divides its certified software categories into free products and products with pay what you want model, and paid products and products with free offerings. The second category is largely made up of companies that have a bare bones filing platform that is free, but once on their site, they may do everything they can to upsell you on paid products, and perhaps push you into thinking you need them when you might not. Youve been warned!

Paid products, like audit protection plans, an insurance that assures that should the CRA audit you, their company will serve as an intermediary, are more controversial. Full tax audits are exceedingly rare And as Toronto tax attorney David Rotfleisch told Global News, should you be audited, you might be better off hiring a bone fide accountant or tax attorney to help you rather than relying on someone with unspecified qualifications. Rotfleisch said:

The unknown is the level of expertise of the people providing the representation services,

He went on to point out if the representatives do not have the proper expertise, the taxpayers situation may very well be prejudiced.