The Complexity Of Sales Tax

Sales taxes are, frankly, a mess. There are many taxing localities involved, each with its own tax rate and list of taxable products and services. If you have a tax presence in different states, you may have to collect different taxes on different items. And if you sell online, trying to figure out if you have to collect sales tax from customers in many states becomes almost impossible to manage.

To help you sort this out, this article contains the steps and decisions you will need to go through in order to collect, report, and pay sales taxes on the products or services you sell. Here are the main steps in the process of preparing to collect, report, and pay sales taxes.

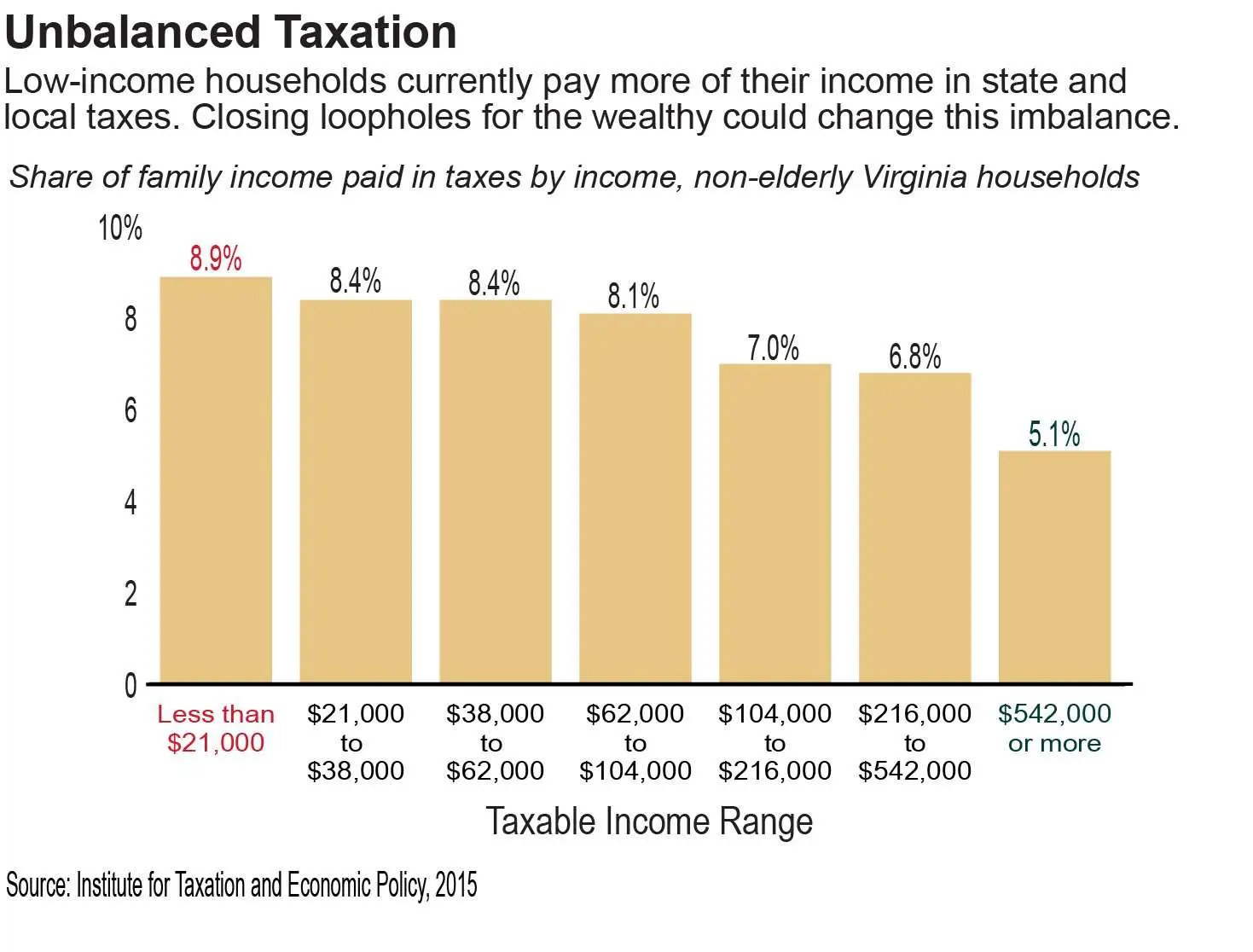

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

You May Like: Is Nursing Home Care Tax Deductible

What Are Quarterly Taxes

Quarterly taxes, also referred to as estimated taxes, are a type of taxation you must pay in advance of the annual tax return. They work on a pay-as-you-go basis, meaning you pay them throughout the year. During each quarter, applicable taxpayers pay a portion of their expected annual income tax. As a result, these payments are estimations.

These regular tax payments are meant to cover Medicare, Social Security and your income tax. So, you should familiarize yourself with how those taxes break down: the income tax and the self-employment tax. Income tax follows the same income tax rates as salaried workers pay. Then, the self-employment tax clocks in at 15.3%. This covers both the Social Security and Medicare costs .

Collecting Sales Taxes For Online Sales

If you have an online business, including an online auction business , you may be wondering if you must collect sales tax for online transactions. The simple answer comes in two parts:

- You must charge sales tax if you sell online to customers who are located in your state. This hasn’t changed.

- Your state may also require you to charge sales tax to customers outside your state .

A recent Supreme Court ruling puts the individual states in charge of online sales to customers located outside the state. The decision, called S. Dakota v. Wayfair, increased the ability of states to require internet sellers who sold a “significant quantity” of business within the state to charge sales tax and pay those taxes to the state.

Many of the states currently taxing online sales have an exemption for small sellers. This exemption typically doesn’t requiring sales taxes for businesses that have less than $100,000 in annual sales or fewer than 200 transactions a year.

The Sales Tax Institute has several guides showing which states charge sales tax on internet transactions. One guide shows states with economic nexus and the other guide shows remote seller nexus. Some states are included on both charts. The guides are updated periodically.

You May Like: Who Must File An Income Tax Return

How And Where Do Am I Pay My State Taxes

The IRS will let you pay off your federal tax debt in monthly payments through an installment agreement.

If you haven’t filed yet, step through the File section of TurboTax until you reach the screen How do you want to pay your federal taxes? Select the installment payment plan option, click Continue, and follow the onscreen instructions.

If you already filed, or you’re unable to find this option in TurboTax, you can apply for a payment plan at the IRS Payment Plans and Installment Agreements web page .

State Payment Plans

Most states offer some kind of installment payment plan as well, although the procedure varies from state to state.

The easiest way to obtain the info you need is to simply search the internet using the phrase < state> tax payment plan. You can also try contacting your state Department of Revenue for details.

Filing Multiple State Returns Gets Expensive Quickly How Can I Save Money While Staying On Top Of My State Taxes

Try a $25 flat rate for a change 1040.coms one price includes everything you need to file, including multiple state tax returns.

Most other self-prep platforms charge around that amount for each state return, so you could save $50+ just by filing with us.

Even better, we autofill as much info as we can pull from your federal tax return, so you wont get stuck plugging in the same information over and over for each state.

Feel-good tax filing is on its way. Create an account today, and well let you know when we open in January.

Recommended Reading: How To Take Taxes Out Of Check

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Collect Sales Taxes From Customers

After you have received your sales tax permit, you can begin collecting sales tax from customers. You must show the tax amount separately, so the customer can see the amount of the tax this typically isn’t a problem, since most sales receipts are programmed to show the amounts. If you are selling online, your “shopping cart” page will show the sales tax calculation. You will need to program the computer for the applicable sales tax amount or amounts or start using the services of an online sales tax service.

Recommended Reading: When Is The Irs Sending Out Tax Returns

I Work Remotely For A Company In A Different Statedo I Owe That State Income Taxes

Heres Big Rule #1: Any state that can claim you as a resident gets to tax your income.

Naturally, your home state is a given. Since you live there and consider it home, youll pay taxes to that state. That said, your employer state may be able to claim you as a resident too. Well look into that in a moment.

Big Rule #2: Any state that uses the Convenience of Employer rule can tax your income, even if you arent considered a resident of that state.

Only a few states have this rule, but well come back to Convenience of Employer in a moment. For now, lets look at how a state you dont live in could see you as a resident.

Pay It Individual Tax Payments

Below you will find links for methods to pay your Maryland tax liability. If you are unable to pay the full amount due, you should still file a return and consider making payment arrangements. We will process your return and then send you an income tax notice for the remaining balance due for nonpayment of taxes.

If you file and pay electronically by April 15, you have until April 30 to make the electronic payment, using direct debit or a credit card. Electronic payment options eliminate postage costs, the potential for lost mail and possible penalties for late payments.

Don’t Miss: How Can I Find My Tax Return

Withholding State Income Taxes From Employee Paychecks

After you have gathered the information about state income taxes, you will need to include these taxes in your company’s payroll process.

The process begins with your calculation of gross pay for each employee.

From that amount, you will need to calculate the specific amount to be withheld for that employee for state income taxes. Remember that each withholding amount is calculated against the gross pay amount.

After all taxes and other withholding, you will end up with a net pay amount.

Then, the withholding amounts for each employee and the total for each kind of withholding must be placed in a separate liability account, to be paid as required by your state.

When To Charge Another State’s Tax

You would typically collect sales tax for another state only if you have a physical presence in that state. In legal terms, this is known as having a “sales tax nexus” there.

Your physical presence might be a retail store, a warehouse, or a corporate office, even if the facility is not open to the public. Entering into an affiliate agreement with a resident of the state may also establish a physical presence or nexus there, in some states.

If you do business at your customer’s locations, check with your tax advisor as to whether traveling to a state and conducting business there would create nexus. This might cause that state’s sales tax rules to go into effect.

Don’t Miss: How Long Should I Keep Tax Records

How To Collect Report And Pay State Sales Taxes

If your business sells a product or provides a service that is taxable, and if you are in a sales tax state, you will need to set up a process to collect and pay sales taxes and file sales tax returns periodically.

If your business is selling in Alaska, Delaware, Montana, New Hampshire, or Oregon, no sales tax is charged, so you don’t have to worry about this process. Lucky you.

How To Pay Quarterly Taxes

So, if you discover youre required to pay quarterly taxes, you must first use Schedule C of Form 1040 to determine how much you owe. However, if your net earnings equate to less than $5,000, you may be able to file a Schedule C-EZ instead. Both forms will help you determine your net earnings or loss.

Then, you will use this number on your Form 1040 to calculate the total amount of self-employment tax you must pay during the year. If you file a joint return, you and the other self-employed person must calculate income separately. Therefore, its wise to consult with a tax professional who can help you ensure youre calculating the right amounts and abiding by IRS guidelines.

Filing quarterly taxes requires that you use Form 1040-ES, Estimated Tax for Individuals. Your annual tax return from the previous year is necessary to complete this form. Once filled out, the forms worksheet will indicate whether you must file quarterly estimated tax.

To make quarterly payments you can:

- Submit the payment electronically with the Electronic Federal Tax Payment System

- Mail-in vouchers that are on the Form 1040 SE

You May Like: How Much Is The Penalty For Filing Taxes Late

Why The Government Requires Quarterly Estimated Tax Payments

Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed individuals with quarterly tax payments. If you work for yourself as an independent contractor or freelancer, your taxes typically are not automatically taken from your paychecks. Therefore, the IRS collects income taxes with quarterly tax payments.

To determine if a taxpayer must make quarterly tax payments, they follow several guidelines.

- You anticipate owing more than $1,000 when filing your return for 2022

- You anticipate the withholding and tax credits will be less than 90% of your estimated tax liability for 2022 or 100% of your 2021 year tax liability .

If your adjusted gross income exceeds $150,000 $75,000 if youre married and file separately the requirement is 110%. Farmers and fishermen are an exception to this requirement. If youre in either of these professions and earn at least 66.6% of your income from the trades, you only need to pay a corresponding amount of the tax liability.

While paying your quarterly tax estimates seems like a pain, it can help you avoid a big tax bill during tax time. In addition, paying quarterly taxes makes your tax payment more manageable throughout the year.

What To Do With The Taxes You Collect

You must send the sales taxes that you charge to the appropriate state, which is why it is important to keep detailed records of your transactions. Many states, such as Michigan, require that you submit monthly sales tax returns when you make a payment.

In this case, you are collecting the tax directly from the consumer and segregating it in its separate business bank account, so you wouldn’t consider it to be part of your income.

Failing to pay the correct amount in full and on time is a serious offense, and it could lead to losing the right to do business within the state, as well as hefty fines.

Recommended Reading: How To Check Property Tax Online

Determine The Sales Tax Rate To Collect

The sales tax process is complex because there are many localities who have sales taxes, each has its own sales tax rate, and different ways of determining tax – origin-based or destination-based. Some states are origin-based and other states are destination-based . Some states, like California, have both origin-based and destination-based sales tax localities.

The rate changes, depending on your location. If you are selling in multiple locations, you must include the correct sales tax for each location. For example, if you are selling products in several cities or counties within your state, the correct amount must be collected from each locality. This gets complex if you have many places where your products are being sold. If you are selling in several states, you must also program the correct amount for each location within each state.

If this makes your head spin, join the club. If you do business in several locations, within and between states, or you sell online, you might want to use an online sales tax service like TaxJar or Avalara.

Pay Sales Taxes To Your State

Check with your state to see when you must pay the sales taxes you’ve collected. The frequency of payment depends on the volume of your sales. In most states, you must pay monthly if you have a high volume of sales, but at least quarterly in almost every state. Be sure you pay on time to avoid fines and penalties for late payment.

Some states give a discount for prepayment of sales taxes. This is definitely something to look into if possible.

For more information, see this article with answers to common questions about sales taxes.

Recommended Reading: How To Correct State Tax Return

What Is The Difference Between Federal And State Income Taxes

Federal income taxes are collected by the federal government, while state income taxes are collected by the individual state where a taxpayer lives and earns income. There are seven federal tax brackets, ranging from 10% to 37%, depending on your income and filing status. At the state level, some states use a flat-rate tax, while others impose a progressive system or have no state income tax at all.

Do Federal Income Taxes Differ By State

Federal income tax rates are based on your income and filing statusnot by where you live. Therefore, the same federal tax rates apply to everyone, no matter which state they live in. However, state taxes vary, so a taxpayer’s total tax liability will differ depending on where they live and earn income.

Also Check: What’s The Last Day To File Taxes 2021

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.