How Do I Get Help Filing My Taxes Online

If at any point you have a question about your taxes or the software, you can browse answers on our online help forum 24/7, or post a question for our online community of users and experts. While youre filing you may realize that youre looking for more guidance or help with your taxes. In that case you can upgrade to a different TurboTax Online product at any time without losing any of the data youre already entered.

Need more help? TurboTax Live Assist & Review gives you unlimited tax advice from one of our tax experts as you do your taxes, plus a final review before you file to make sure you didnt miss anything. Or if you want to hand off your taxes to one of our experts, TurboTax Live Full Service allows you to simply upload your documents and our experts will complete and file your return for you.

A Step By Step Guide On How To E

Calculate your income tax liability as per the provisions of the income tax laws. Use your Form 26AS to summarise your TDS payment for all the 4 quarters of the assessment year. On the basis of the definition provided by the Income Tax Department for each ITR form, determine the category that you fall under and choose an ITR form accordingly.

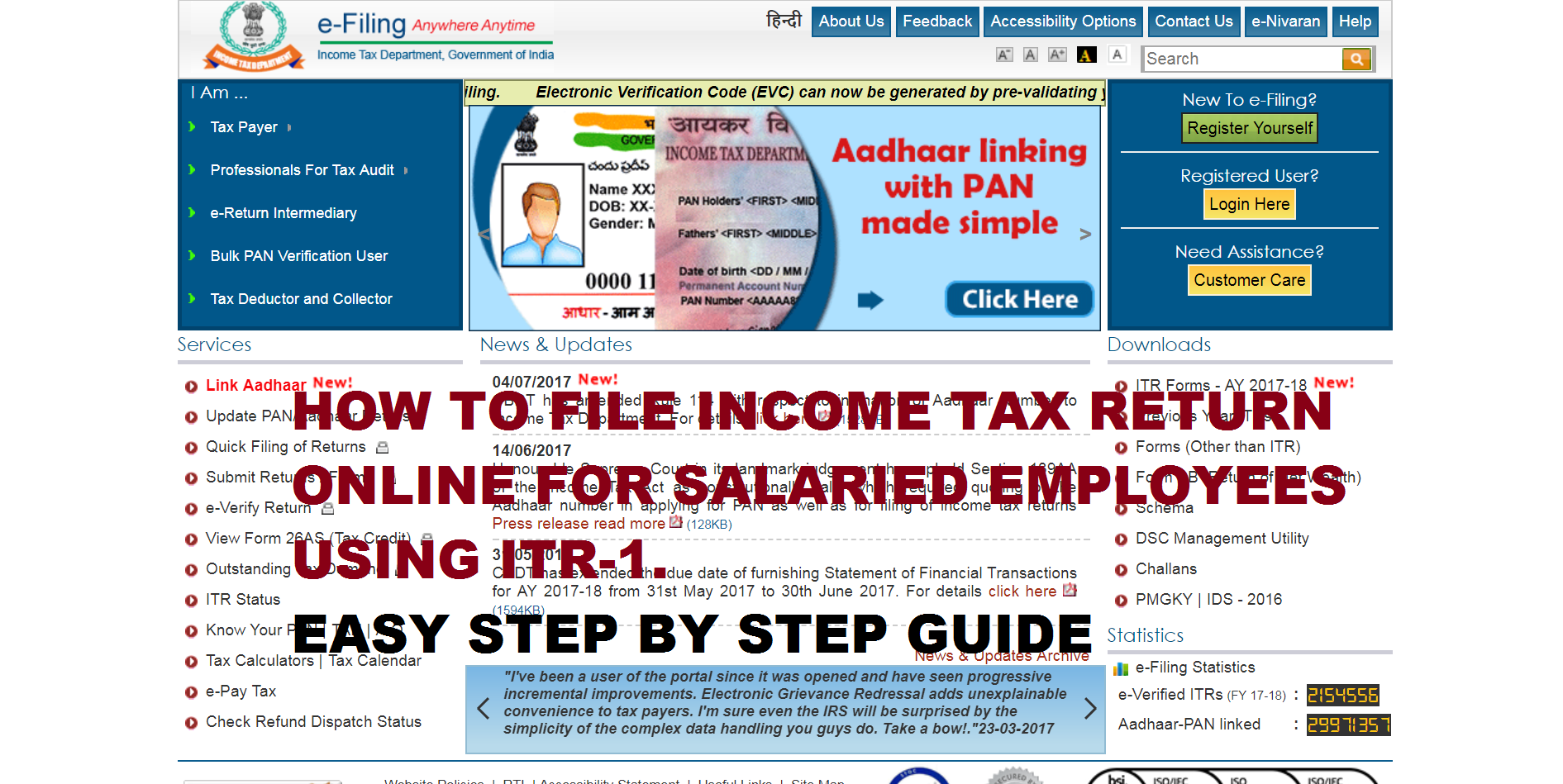

Follow the steps mentioned below to e-file your income tax returns using the Income tax e filing portal:

Step 1: Visit the official Income Tax e-filing website and Click on the Login button.

Step 2: Next, Enter Username then Click continue and After enter your Password.

Step 3: Once you have logged into the portal, click on the tab e-file and then click on File Income Tax Return.

Step 4: Select the Assessment year for which you wish to file your income tax returns and click on Continue.

Step 5: You will then be asked whether you wish to file your returns online or offline. In this case you need to choose the former which is also the recommended mode of tax filing.

Step 6: Choose whether you wish to file your income tax returns as an individual, Hindu Undivided Family , or others. Choose the option individual.

Step 7: Choose the income tax returns you wish to file. For example, ITR 2 can be filed by individuals and HUFs who dont have income from business or profession. Similarly, in case of an individual, they can choose the option ITR1 or ITR4. Here you will have to click Proceed with ITR1.

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Recommended Reading: Is Plasma Donation Money Taxable

What Is Income Tax Return

An income tax return is an income tax form which you need to fill and submit it electroncially to the Income tax Department. In this form you need to give details of your income and taxes . The income tax return forms are in various formats viz ITR-1, ITR-2 etc. Each form depicts a separate category of Income tax payers. You need not worry of your category as myITreturn handles it for you automatically.

Remember, Income tax is a Direct tax and you need to only report Direct Income and taxes paid on that Income. The tax return formats are predefined formats by the Central Board of Direct Taxes .

The tax returns must be filed every year and must be filed by a specific date. If the return shows excess tax has been paid during a given year, you are eligible for a income tax refund, subject to the departments interpretations and calculations.

All Turbotax Products Include

- 100% accuracy guaranteed

Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

- Maximum refund guaranteed

We search over 350 deductions & credits to find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- Get the green light to file

CompleteCheck will run a comprehensive review of your return before you file so nothing gets missed.

Read Also: Www..1040paytax.com

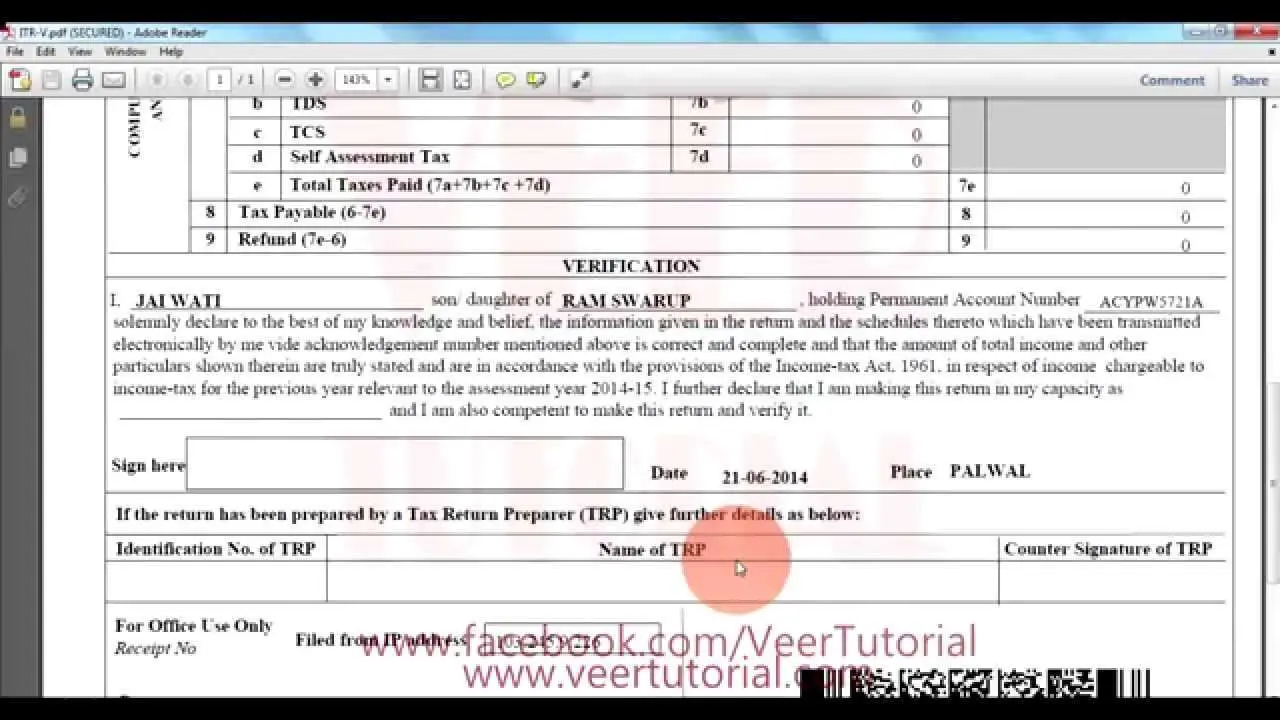

After Filling The Itr The Income Tax Verification Form Is Generated By The Tax Department So That Taxpayers Can Verify The Validity And Legitimacy Of E

| 23 Dec 2021 12:11 PM GMT

New Delhi: The last date of filling Income Tax return is December 31st and reports indicate that government is unlikely to extend the date anymore.

However, whether the government will extend the date or not that the remains with the government. But one should know the process of filling income Tax returns.

So, let’s dive into the topic and have a look at the procedure which one needs to follow while filing ITR.

Faqs On How To File Itr

1. What is the offline method to file ITR?

A taxpayer can file ITR offline with the help of upload XML method.

2. What is the manually procedure to file ITR offline?

The taxpayer wants to Choose and Download the right Income Tax Form. Fill in all necessary details and convert the file to XML Format. Upload XML file in IT portal and Choose one of the available verification modes Aadhaar OTP, EVC or sending a manually signed copy of ITR V to CPC.

3. What are the different forms that are available as per the Income Tax Law?

The different forms that are available as per the Income Tax Law are ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, ITR7 and ITR-V.

4. Should I attach any documents when I file the Income Tax Returns?

No, you need not submit any documents when you file the Income Tax Returns. However, the relevant documents must be retained and must be provided to tax authorities if requested.

5. Does the Income Tax Department provide the e-filing utility?

Yes, the e-filing utility has been provided by the Income Tax Department. The e-filed returns can be generated, and then be furnished electronically.

6. What is the difference between e-payment and e-filing?

The process of electronically furnishing the returns is e-filing. E-payment is the payment of tax online by using State Bank of Indias debit/credit card or by net banking.

6. Will I face any criminal prosecution in case the tax returns for my taxable income is not filed?

Recommended Reading: Wheres My Refund Ga.state

Pay Nothing Out Of Pocket Use Your Federal Refund To Pay For Turbotax Learn More

TurboTax CD/download also available

- Earned Income Tax Credit

- Child tax credits

- Student Loan Interest deduction

Security Of Personal Information

We accept responsibility for the security of information once we receive it. We take precautions to ensure that there is no unauthorized access to your data, and ensure the confidentiality of data you send using NETFILE. We use sophisticated security and encryption to protect this website and your personal information.

We are also responsible for making sure personal and financial information is sent in an encrypted format between your computer and our servers. This ensures that computer hackers and other Internet users cant view or alter the data you send to us.

Tax software companies whose products are certified for NETFILE are not representatives of the CRA. You are not obliged to send personal information directly to the tax software company when you ask for software assistance. Email is not a secure method of communication. Sending personal information by email is a big concern and increases the risk of identity theft.

Don’t Miss: Pastyeartax.com Review

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2020 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income. The Arizona Department of Revenue will begin processing electronic individual income tax returns beginning mid-February.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS starting mid-February. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

What Is Income Tax

There are two types of taxes in India direct tax and indirect tax. Direct tax is a tax that is calculated and paid directly on your Income e.g. tax on salary etc. Income tax is a direct tax. Indirect tax is a tax that is indirectly charged to you on purchase of goods or use of service e.g. Buying a mobile phone or eating in a fast food joint. The seller of the mobile phone or the fast food service provider charges you tax and then deposits the same to the Government account. Most indirect taxes are now covered under Goods and Services Tax .

Everyone who earns income above a certain amount is subject to income tax. Your income could be from salary, interest income from savings, income from mutual funds, sale of property or business or professional income. Income tax rates are pre-decided at the start of the year in the Union Budget . The tax paid or deducted on these incomes is called the income tax.

Also Check: Www.1040paytax.com.

About Free File Fillable Forms

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to:

- Choose the income tax form you need

- Enter your tax information online

- Electronically sign and file your return

- Print your return for recordkeeping

If you choose Free File Fillable Forms as your Free File option, you should be comfortable doing your own taxes. Limitations with Free File Fillable Forms include:

- It won’t give you guidance about which forms to use or help with your tax situation

- It only performs basic calculations and doesn’t provide extensive error checking

- It will only file your federal return for the current tax year

- No state tax return option is available

- You can’t make changes once your return is accepted

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose 2021 income is greater than $73,000. Taxpayers whose income is $73,000 or less qualify for IRS Free File partner offers, which can guide you through the preparation and filing of your tax return, and may include state tax filing.

Eligibility For Income Tax E

Under the conditions given below, it is mandatory for individuals to file ITR:

- Any firm or company must file ITR even if they make a profit or undergo a loss.

- In case individuals wish to apply for a loan or a visa.

- In case individuals invest in foreign assets or earn from foreign assets.

- In case individuals wish to claim a refund from the Income Tax Department.

- In case individuals earn an income from house property, etc.

- If the gross annual income of the individual exceeds the details mentioned in the table below:

| Age of the individuals |

|---|

In case individuals wish to claim deductions, the below-mentioned documents are required:

- Proof of income such as capital gains income and house property income.

- Any details about investments that are liable for deductions.

- Details of home loans and insurance

- Deposit account and savings account interest certificates.

You May Like: Louisiana Payroll Calculator

How To File Income Tax Returns Electronically In Canada

The Canada Revenue Agency processes more than 25 million tax returns each year and almost two-thirds of these returns are filed electronically.

That number is poised to grow as telephone filing for simple returns is no longer an option. The CRA also has encouraged taxpayers the move away from using paper forms.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Also Check: Plasma Donation Taxable Income

What Is Form 16

Form 16 is a TDS certificate that an employer issues to you when TDS is deducted by the employer. An employer is required to deduct tax at source when the employer pays salary to the employee . The employer deducts this tax on behalf of the Government and after deducting deposits the tax to the Government. The employer is then required to give a certificate to the employee giving the details of tax deducted. This certificate is called the Form 16.

In case no TDS has been deducted by the employer they may not issue you a Form 16.

You will require your Form 16 from your employer to file your tax return. You can directly upload your Form 16 and file your income tax return quickly.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Recommended Reading: Harris County Property Tax Protest Services

Income Tax E Filing Faqs

You can log on to https://www.incometax.gov.in/iec/foportal if you want to file ITR electronically. It is an independent portal launched by the income tax department

It will be refunded to the bank account or a cheque will be sent once the refund gets processed. you can also check your income tax refund status through efiling portal.

In such a case, you can contact the centralised processing centre between 8 am and 8 pm on a weekday.

It is a form issued by the employer under section 203 of the Income Tax Act for tax deducted at source from income under salary.

The TDS reconciliation Analysis and Correction Enabling System also known as TRACES can be contacted in such a case.

How To File And Pay Itr Using The Efps

Here are the simple e-filing and e-payment steps using the eFPS service:

Venus Zoleta is an experienced writer and editor for over 10 years, covering topics on personal finance, travel, government services, and digital marketing. Her background is in journalism and corporate communications. In her early 20s, she started investing and purchased a home. Now, she advocates financial literacy for Filipinos and shares her knowledge online. When she’s not working, Venus bonds with her pet cats and binges on Korean dramas and Pinoy rom-coms.

Recommended Reading: Appeal Property Tax Cook County

How Do I File My Taxes Online

Filing your taxes with TurboTax Free is quick and easy. First youll be asked to set up a profile and follow a simple process to find all the credits and deductions youre entitled to. With the CRAs Auto-fill my return, you can also import your tax info directly from the CRA. This service pulls info from your income slips , government benefit slips, RRSP receipts, and unused tuition credits. All the relevant info will be populated from these forms into your tax return saving you time and effort.

If you decide not to use CRAs Auto-fill my return service, or if you have additional info to enter that isnt captured through the import, you can find all the forms you need quickly and easily through TurboTaxs search feature.

You can also easily look for all the credits and deductions that apply to you using the search bar in TurboTax Free. If youre not sure where to start, heres a list of common credits, deductions, and expenses you may be eligible for:

Once youve entered all your info for the year and youre ready to file, our software will guide you through the steps to NETFILE your return online or print and mail your return. Well also give you step-by-step instructions on how to pay the CRA if you owe taxes.