The Complete Guide On Collecting Gst/hst For Self

If you are a recently self-employed Canadian or you are thinking about starting your own business/adding extra income with a side gig, you may be curious about what the tax requirements and implications would be. Aside from the extra info youll include on your tax return, you might also be required to register for a GST/HST account and become a GST/HST Registrant. This means youll be required to collect and remit the sales tax to the Canada Revenue Agency on a quarterly or annual basis.

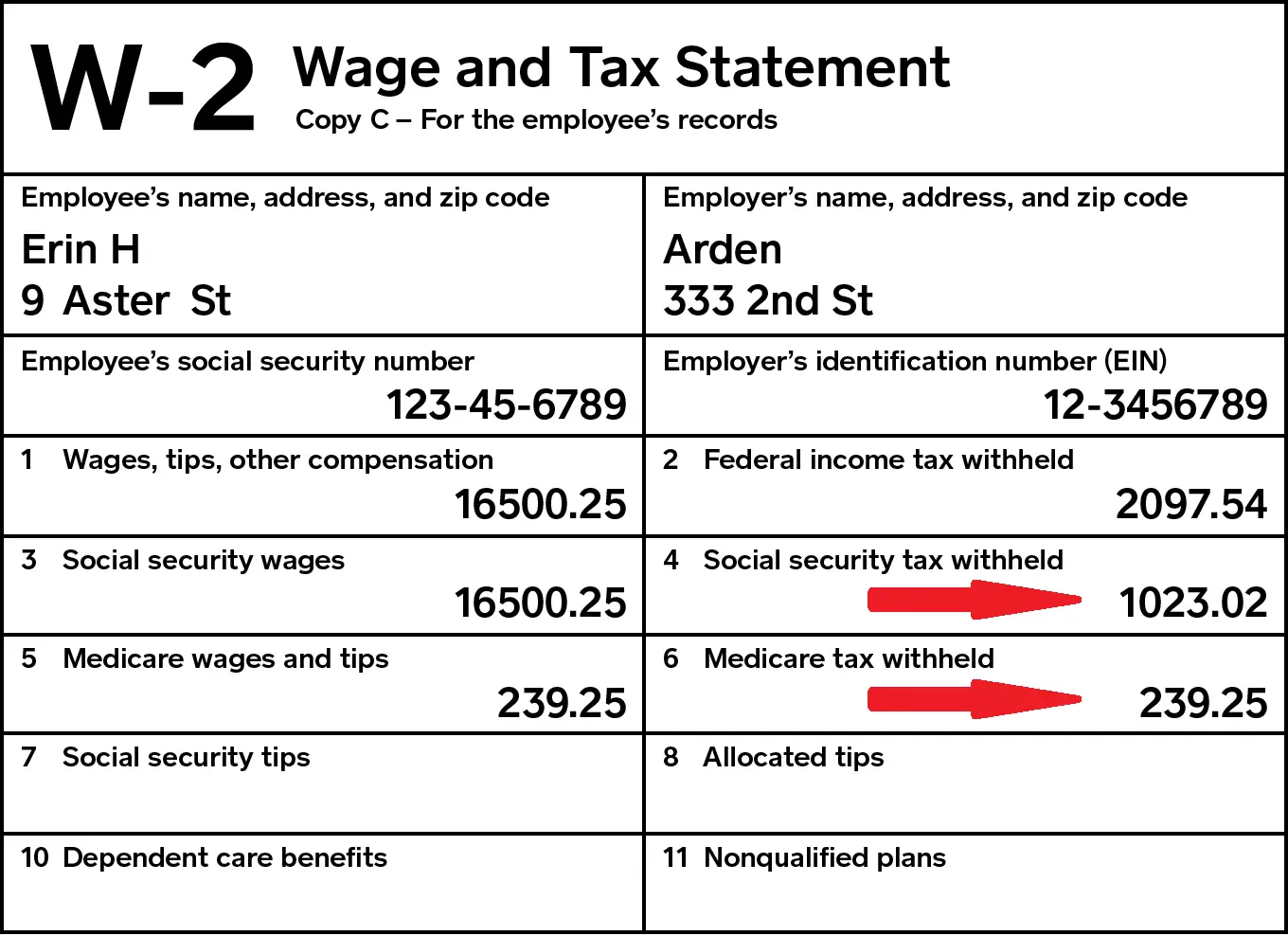

What Is My Tax Id Number For My Business

Your personal tax ID number is your Social Security number . Your business can have a unique employer identification number as well, but you must apply for the number. If you dont have any employees and your state doesnt require a separate number, you can use your SSN for your self-employment income. If you have employees or are otherwise required to, you must complete an online Form SS-4 with the IRS to get an EIN.

Pay Nothing Out Of Pocket Use Your Federal Refund To Pay For Turbotax Learn More

TurboTax CD/download also available

- Earned Income Tax Credit

- Child tax credits

- Student Loan Interest deduction

Don’t Miss: How Do You Pay Taxes For Doordash

Gst/hst When You Buy A Business

For GST/HST purposes, if you buy a business or part of a business and acquire all or substantially all of the property that can reasonably be regarded as necessary to carry on the business, you and the vendor may be able to jointly elect to have no GST/HST payable on the sale by completing Form GST44, Election Concerning the Acquisition of a Business or Part of a Business. You cannot use this election if the seller is a registrant and you are not a registrant. In addition, you must buy all or substantially all of the property, not only individual assets.

For the election to apply to the sale, you have to be able to continue to operate the business with the property acquired under the sale agreement. You have to file Form GST44 on or before the day you have to file the GST/HST return for the first reporting period in which you would have otherwise had to pay GST/HST on the purchase.

Even when you use the election, GST/HST will still apply to a taxable supply of a service made by the seller a taxable supply of property made by way of lease, licence, or similar arrangement and, if the buyer is not a GST/HST registrant, a taxable sale of real property.

Received A Payment And Other Reporting Situations

If, as part of your trade or business, you received any of the following types of payments, use the link to be directed to information on filing the appropriate information return.

- Payment of mortgage interest or reimbursements of overpaid interest from individuals

- Sale or exchange of real estate, for example the person responsible for closing the transaction

- You are a broker and you sold a covered security belonging to your customer

- You are an issuer of a security taking a specified corporate action that affects the cost basis of the securities held by others

- You released someone from paying a debt secured by property or someone abandoned property that was subject to the debt or otherwise forgave their debt to you

- You made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment

Also Check: Www Aztaxes Net

Q: Is There Any Way That I Can Avoid Self

A: Yes:

- You can get a job working for somebody else.

- You can earn less than the minimum amount at which you are required to pay taxes. In 2020, for a single person under retirement age, that amount was $12,400.

- If you are a member of a religious order or are paid for performing religious duties, you can apply for an exemption. Speak with a tax attorney knowledgeable about tax laws for religious organizations.

The Moral Of The Story

At the end of the day, trying to make sure that you do everything right to file your taxes correctly and honestly can be scary.

But it doesnt have to be.

Make sure that you are preparing throughout the entire year, keeping a record of all your payments, income, and expenses. Keep track of your estimated quarterly taxes, as well as when they are due.

And of course, dont be afraid to ask for help. You arent expected to just suddenly know how to file 1099 taxes. That is why there are professionals out there, and they are willing to help you.

Tax season is growing nearer, so get a hold of someone today and start preparing.

Recommended Reading: Are Home Improvements Tax Deductible

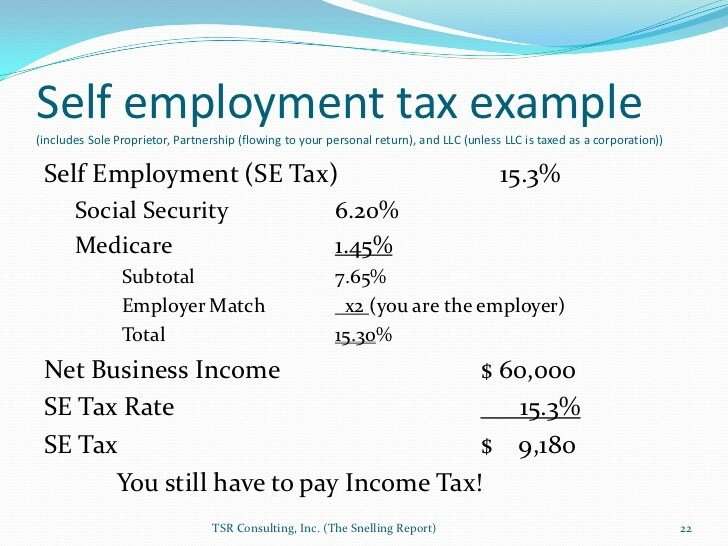

What Taxes Do I Pay If Im Self

One of the benefits of working for a company is that both you and your employer pay Social Security and Medicare taxes. When youre self-employed, however, these taxes are your responsibility alone.

The current self-employment tax rate is 12.4% for Social Security, which is your old-age, survivors and disability insurance, and 2.9% for Medicare, which is your hospital insurance. These taxes are separate from your income tax. As a self-employed worker, you can take some special deductions that will reduce your tax burden.

Read: How To Avoid Paying Taxes Legally and the 11 Craziest Ways People Have Done It

More Expenses Are Allowed If You Are Self

As a rule, a self-employed individual can claim more expenses than an employee. For example, employees cannot claim expenses related to homeownership, such as mortgage interest and depreciation, but self-employed individuals can claim them. Computer accessories and furniture are other expenses that employees cannot claim.

There are also differences between salaried and commission employees. For example, a commission employee can claim home insurance and property taxes, but a salaried employee cannot.

Below is a handy table that compares the expenses you can claim as an employee or a self-employed individual.

| Expense |

| Yes |

* For self-employed individuals, these expenses would be claimed under depreciation.

If you are looking for a professional Tax Accountant who can lead you through the process of claiming business expenses on your tax return, then feel free to reach out to Filing Taxes at 416-479-8532. Schedule your tax preparation appointment with us and take the first step towards proper management of your finances. Our professional personal tax accountants will make sure to get you the maximum tax refund on your personal tax return.

Don’t Miss: Do You Get Taxed For Donating Plasma

Are You A Sole Proprietor

As soon as you start trading goods or services for money without an employer paying you for it, the federal government considers you a sole proprietor.

At that point, youâre expected to report all income you receive as a sole proprietor to the Canada Revenue Agency . Itâs reported as part of your personal income on your personal tax return.

Tax Deductions And Tax Credits

When you’re looking for ways to save on your taxes, you might automatically jump to tax deductions and tax credits. But do you know the difference between the two? According to H& R Block, tax credits directly decrease the amount of taxes you owe, while tax deductions lower the overall amount of your taxable income.

Since deductions lower your taxable income, they also lower the amount of taxes you owe by decreasing your tax bracket, not by lowering your actual taxes. There are standard deductions and itemized deductions:

- Almost everyone qualifies for the standard tax deduction the deduction amount varies based on your filing status , but everyone with the same filing status receives the same standard deduction amount.

- There are many possible itemized deductions, and the deduction amounts vary by individual. These are some of the most common itemized deductions:

- Certain medical and dental expenses above 7.5% of your adjusted gross income

- State income taxes

- State sales and local tax

- Property taxes

- Mortgage interest

- Student loan interest

There is a catch when it comes to itemized deductions, however. Each taxpayer is only permitted to take either their standard or itemized deductions, whichever is higher, but not both.

When it comes to tax credits, there are two types refundable or non-refundable:

Which is better? If you had to choose, you’d probably prefer to receive a tax credit. Here is a list of possible tax credits:

- Earned income credit

Also Check: Do You Claim Plasma Donation On Taxes

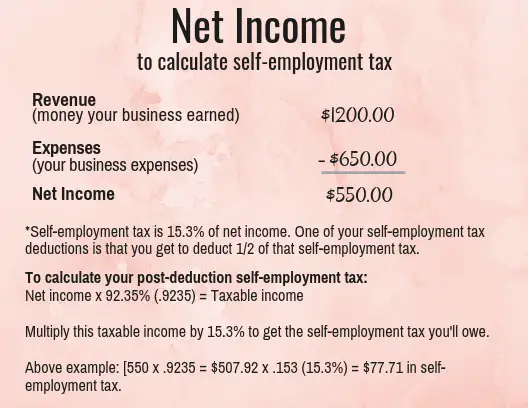

Are Se Earnings Also Subject To Income Tax

Yes, though the amount of taxable income is figured slightly differently than for employees, because of the much greater range of allowed deductions. One of the deductions is for half of your self-employment tax. So even though you have to pay the entire self-employment tax, you get half of it back when you prepare your return.

Know Where You Can Save Money And Grow Your Profits

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Over the years, legislators have written numerous lines into the tax code to soften the blow of the extra costs that self-employed taxpayers must shoulder as they do business. The Tax Cuts and Jobs Act , effective as of the 2018 tax year, made several changes to self-employed tax deductions. Many of these changes are temporary and set to expire in 2025, but others are permanent.

The law affects small businesses in many ways, particularly via a qualified business income deduction for pass-through businessesthose that pay taxes as an individual taxpayer rather than through a corporation. For owners of sole proprietorships, partnerships, S corporations, and certain trusts, estates, and limited liability companies , this deduction provides a great benefit. Eligible taxpayers can deduct up to 20% of their QBI. A pass-throughs QBI is the net amount of qualified items of income, gain, deduction, and loss from a qualified trade or business.

Recommended Reading: Is Plasma Money Taxable

Employment And Fica Tax

Your employment income and FICA tax paid is determined first. Your employer withholds Social Security and Medicare tax from your paychecks as an employee. The Social Security tax is capped at a maximum each year at a specific income level. When your income for the year exceeds that level, you stop paying the Social Security tax. The Medicare tax is not capped.

How To Calculate Your Cpp Contributions

Personally, I just use this tax calculator to ensure Im saving enough for income taxes and my Canada Pension Plan contributions, but if youre curious how the math works, here goes!

For your CPP premiums, you are required to pay these if you are 18 or older and earn more than $3,500/year. Its also interesting to note that if you are an employee, you only pay half of your CPP premiums and your employer pays the other half. When youre self-employed, you arent so lucky and have to pay the full 10.9%. You are required to pay 10.9% on your gross income , minus the $3,500 basic exemption amount. Heres an example:

You earned $100,000 in business revenue

You spent $30,000 on business expenses and operating costs

Youre left with $70,000 in business earnings after expenses

Subtract the $3,500 basic exemption amount to equal $66,500

Multiply $66,500 by 10.9% to equal $7,248.50

$100,000 $30,000 = $70,000 $3,500 = $66,500 x 10.9% = $7,248.50

But thats not all! There is actually a ceiling for CPP premiums. The maximum amount a self-employed individual can contribute to CPP is $6,332.90/year as of 2021. Which means instead of paying $7,248.50 in CPP, you would actually only owe the maximum contribution amount which is $6,332.90.

Since CPP contribution amounts change every year, to keep up to date check out this CPP contribution rates, maximums and exemptions page on the governments website.

Read Also: Reverse Ein Search

Canadian Pension Plan Contributions

The rate of CPP contributions on your income is 9.9%. Employees have half that amount withheld from their paycheck, while their employer pays the other half.

If youâre self-employed, youâre your own boss. So, you need to pay the full 9.9%.

This 9.9% only applies to part of your incomeâa range of $3,500 – $55,300.

If you make under $3,500, you canât contribute to CPP. And anything you earn over $55,300 wonât have CPP taken from it.

How To File A Tax Return With Self

When you file your annual income tax return, you may need to complete some extra tax forms because of your self-employment income. Here are the basic forms youâll need:

-

Form 1040: Standard income tax form that everyone uses

-

Schedule C: Necessary to determine your net profit

-

Schedule SE: To calculate your self-employment tax and your self-employment tax deduction

-

Schedule 1: To list your net profit from Schedule C and your self-employment tax deduction

-

Schedule 2: To list the value of your self-employment tax

If you use one of this year’s best tax-filing services, it will handle all calculations for you, but you can see the general process of filing SE tax below. For help with the rest of your tax return, try our guide to Form 1040.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

What Kinds Of Jobs Are Exempt From Paying The Self

Any job that pays less than $400 a year is exempt. That is true regardless of the type of work done. A major exception applies to clergy who are employed by a congregation. Their entire income is exempt from self-employment tax. If a clergy member is paid by a church organization and not directly by the congregation, that exemption might not apply.

The Basic Steps For Filing

At its most basic, here is how to file self employment taxes step by step.

- Calculate your income and expenses. That is a list of the money you’ve made, less the amount you’ve spent. While you may have a 1099 form for some payments you’ve received as a contractor — a 1099 is like a W-2 — you may have to gather invoices for the rest.

- Determine if you have a net profit or loss.

- Fill out an information return. This is only required for certain types of payments or businesses. Visit the IRS website on information returns to see if it applies to you.

- Fill out a 1040, and other self employment tax forms. These will include a Schedule C or Schedule C-EZ to report your income or loss. It will also include your Schedule SE , Self Employment Tax.

Since the paperwork can be lengthy and complicated, it might be helpful to have an accountant review your documents before submission.

Read Also: Pastyeartax Reviews

Eligibility To Claim Home Office Expenses

To claim your working from home expenses you must:

- be working from home to fulfill your employment duties, not just carrying out minimal tasks, such as occasionally checking emails or taking calls

- incur additional expenses because of working from home.

You can claim a deduction for the additional running expenses you incur because of working from home.

Running expenses are expenses that relate to the use of facilities within your home and include:

- electricity expenses for heating or cooling and lighting

- the decline in value of office furniture and furnishings as well other items used for work for example, a laptop

- internet expenses

- phone expenses.

If youre a sole trader or business owner and your home is your principal place of business.

All Turbotax Products Include

- 100% accuracy guaranteed

Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

- Maximum refund guaranteed

We search over 350 deductions & credits to find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- Get the green light to file

CompleteCheck will run a comprehensive review of your return before you file so nothing gets missed.

Read Also: Aztaxes Gov Refund