How To Make Futa Tax Payments

Any time your unemployment tax act FUTA tax is $500 or more, you must deposit by EFT . If your deposit is less than $500, you can carry it over to the next quarter or whenever the total amount is $500 or more.

When you apply for an EIN to register your business, the IRS automatically pre-enrolls you in their Electronic Federal Tax Payment System. If you dont have an account, you can contact the IRS at EFTPS.gov.

How Unemployment Taxes Work

In brief, the unemployment tax system works as follows:

- Employers pay into the system, based on a percentage of total employee wages.

- You don’t deduct unemployment taxes from employee wages.

- Most employers pay both federal and state unemployment taxes.

- Employers must pay federal unemployment taxes and file an annual report.

- The tax paid goes into a fund that pays unemployment benefits to employees who have been laid off.

What Goes Where On Form 940

Hereâs a breakdown of the key parts of Form 940:

a. In Section 1a, if you only pay state unemployment tax in one state, enter you stateâs abbreviation here.

b. If you have employees in more than one state, this is where you report the fact. Once you check off the box, youâll need to fill out Form 940, Schedule A, where you report which states you have employees in, and how much in taxable wages you paid in each state.

c. If you have employees in a state that is subject to a credit reduction, you need to check this box and fill out Form 940, Schedule A. Currently, only the Virgin Islands apply.

d. Part 2 is where you do the math, reporting how much you paid your employees in wages, the tax owed on those wages , and payments that are exempt from being taxed.

e. In Part 3, you modify the FUTA rate of 6.0% by applying your state credit reduction.

f. Hereâs where you report how much FUTA youâve already paid over the course of the year, and how much you still have left to pay. Once youâve done the math, if it turns out that youâve paid more tax than you owe, you can report the fact here.

g. This is a breakdown of how much FUTA tax you owed each quarter of the year.

h. If thereâs an employee, tax preparer or other person privy to information on your Form 940, you can put their contact info here. This lets them speak about the contents of the form in case the IRS has any questions.

i. Sign here to certify that everything on the form is, to your knowledge, true.

Recommended Reading: Louisiana Paycheck Tax Calculator

Paying And Reporting Futa

Even though there is an annual reporting for FUTA , the tax must be deposited at least quarterly if it is more than $500 per quarter. More specifically, if FUTA tax liability is more than $500 for the calendar year, you must deposit at least one quarterly payment. If FUTA tax liability is $500 or less in a quarter, carry it forward to the next quarter and continue to do so until your cumulative FUTA tax liability is more than $500. At that point, you must deposit your FUTA tax for the quarter.

Deposits are made through the Electronic Federal Tax Payment System . If you don’t exceed the $500 threshold, you can pay the tax when you file your annual FUTA tax return.

The tax is reported on Form 940, Employer’s Annual Federal Unemployment Tax Return. The return must be filed if:

- You paid wages of $1,500 or more to employees in any calendar quarter during the current or previous year.

- You have one or more employees for at least some part of a day in any 20 or more different weeks in the current or previous year.

Special rules apply to employers of agricultural workers. They are in the Instructions to Form 943.

Form 940 must be filed by January 31 of the year following the year to which it relates .

Returns can be mailed or e-filed . If you arent sure how to calculate, file, or meet your FUTA obligations, a tax professional can help.

How To Apply For A Suta Account

To start paying SUTA tax, you need to set up an unemployment insurance tax account through your state. Take the following steps to apply for a SUTA account, though the process may vary by state.

Tip: You can find the specific steps to apply for your SUTA account on your state’s department of labor or employment website.

Recommended Reading: Is Freetaxusa Legitimate

What Are The Effects Of Inflation On The Futa Rate

Inflation occurs when prices rise, which means that the federal government must increase Federal Unemployment Tax Act rates along with the prices of goods and services.

With this, inflation can affect federal unemployment tax rates. There are three reasons for this:

This means that if inflation rises, so does the federal unemployment tax liability for employers.

This means that the federal poverty level increases with inflation and this affects federal unemployment tax rates as well.

These tax rate adjustments can affect federal unemployment tax liabilities for both employees and employers.

To keep up with inflation, employers are taxed more by Federal Unemployment Tax Act every year.

If the tax rates remain flat or decrease, it is because the federal government has not increased the tax rates to compensate for inflation, or they have adjusted the tax credits which reduce the tax liability.

How Much Is Futa Tax

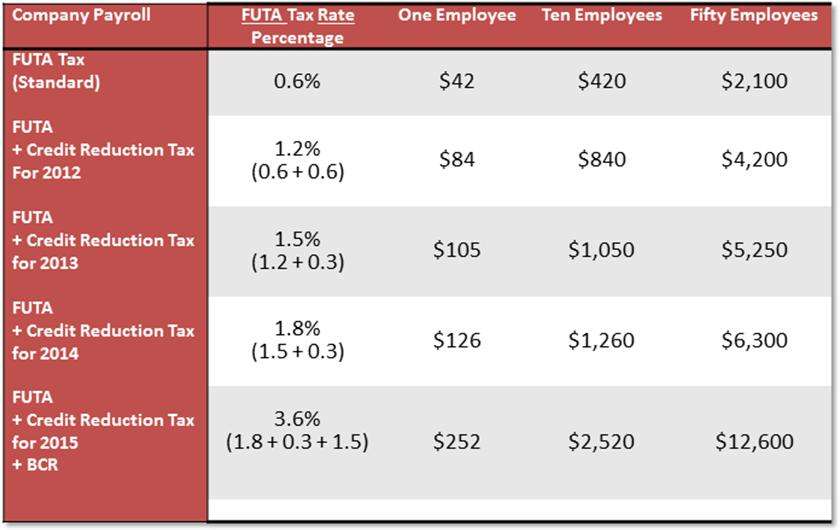

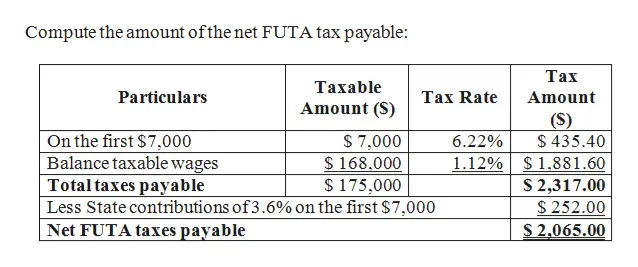

The FUTA tax rate is 6%. Federal unemployment tax only applies to the first $7,000 you pay to each employee in a calendar year. This $7,000 threshold is called the wage base. Stop paying FUTA taxes on an employees wages once you pay the employee more than $7,000 in a year.

The largest FUTA tax amount you will pay per employee is $420 .

Calculate FUTA tax every time you run payroll. This way, you will know when to stop paying FUTA tax on an employees wages.

Recommended Reading: Protest Property Taxes Harris County

The Importance Of Understanding How This Will Affect You When Filing Taxes

Not only Federal Unemployment Tax Act rates increase, but this also affects Federal Income Tax and Federal Withholding tax.

With these taxes increasing, it is important to understand what the effects of this may be when filing income taxes in order to ensure that you are filing federal unemployment tax returns correctly.

This will change how much Federal Income tax and Federal Withholding that you owe or your refund will be.

Are Nonprofits Exempt From Futa

Certain nonprofits are exempt from FUTA, while others are required to pay the unemployment tax. Nonprofits that qualify as 501 organizations are exempt from paying FUTA. These are usually public charities that give away funds directly to a cause like humanities, education, health services, religion, and more. An organization must apply for 501 status and be granted the status legally through the IRS to be exempt from FUTA. All other nonprofit organizations must pay the FUTA tax.

You May Like: Doordash Tax Deductions

Filing Form 940 With The Irs

IRS Form 940 is due on January 31 of the year after the year of the report information. For example, the 940 for 2020 is due January 31, 2021. The best way to file by IRS E-file.

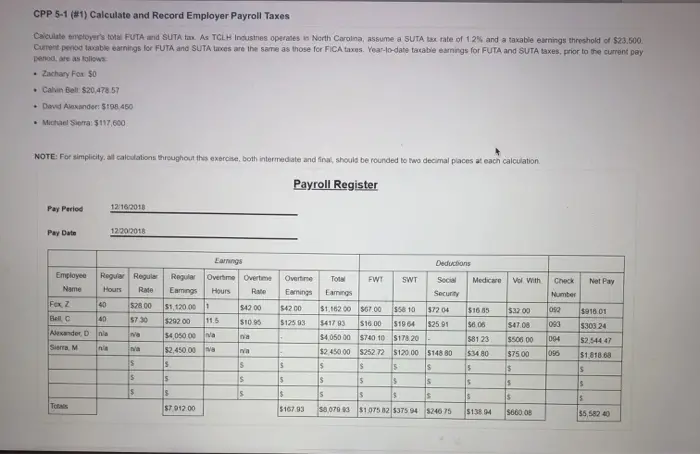

The calculations for FUTA tax are complicated. A payroll processing service can help you figure out how much to pay and when.

When And How Must You Deposit Your Futa Tax

Although Form 940 covers a calendar year, you may have to deposit your FUTA tax before you file your return. If your FUTA tax liability is more than $500 for the calendar year, you must deposit at least one quarterly payment. If your FUTA tax liability is $500 or less in a quarter, carry it forward to the next quarter. Continue carrying your tax liability forward until your cumulative FUTA tax liability is more than $500. At that point, you must deposit your FUTA tax for the quarter. Deposit your FUTA tax by the last day of the month after the end of the quarter. If your FUTA tax liability for the next quarter is $500 or less, you’re not required to deposit your tax again until the cumulative amount is more than $500. If your total FUTA tax liability for the year is $500 or less, you can either deposit the amount or pay the tax with your Form 940 by January 31. If you’re required to make a deposit on a day that’s not a business day, the deposit is considered timely if you make it by the close of the next business day. A business day is any day other than a Saturday, Sunday, or legal holiday. For example, if you’re required to make a deposit on a Friday and Friday is a legal holiday, the deposit will be considered timely if you make it by the following Monday .

Don’t Miss: How To Protest Property Tax Harris County

Futa Information For Wages Employers Paid In 2021

California employers fund regular Unemployment Insurance benefits through contributions to the states UI Trust Fund on behalf of each employee. They also pay separate FUTA taxes to the federal government to help pay for the administration of the UI program, UI loans to insolvent states, and federal extension benefits.

About The Authortrue Tamplin Bsc Cepf

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance , contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website, view his author profile on , his interview on CBS, or check out his speaker profile on the CFA Institute website.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Accounting For The Futa Tax

If employees are not involved in the production of goods, the employer should charge FUTA to expense in the period incurred. If employees are involved in the production of goods, it is possible to add this cost to products via on overhead cost pool by doing so, the employer recognizes the expense slightly later in the year, when the company sells the products and charges the related expense to the cost of goods sold. However, this is also a slightly more complex entry, and does not yield a significant difference in reported results over the long term.

Who Is Eligible For Unemployment Insurance

Now that you know what is FUTA, it is crucial to understand who is eligible for FUTA tax liability.

Unemployment insurance is available to individuals who lost a job through a layoff, business closeouts or are unemployed through no fault of their own. Its possible to receive this temporary financial assistance when you meet your states eligibility requirements.

The Federal law establishes guidelines relating to benefit amounts and how long a person can receive unemployment insurance payments. Namely, to receive unemployment compensation, claimants must have worked for an established time.

According to the U.S. Department of Labor, most states consider that period as the first four of the last five completed calendar quarters before the claim.

Each state may impose other eligibility requirements, and most states pay benefits for a maximum of 26 weeks. However, claimants must meet the states continued eligibility requirements.

Also Check: Roth Ira Reduce Taxable Income

Calculate Totals Before Adjustments

In order to determine the total amount subject to the FUTA tax, simply subtract the subtotal from the total amount of payments made to your employees. In the example above, this would result in a total taxable amount of $18,500 . Multiply this total by the standard rate of 0.006 and enter the result on line eight of Form 940, labeled “FUTA tax before adjustments”.

What Is Futa A Tax To Help Unemployed Individuals

The FUTA tax definition is, in short:

FUTA taxes are an employer tax that you may owe based on the IRS guidelines noted above. If you do owe the tax, all you need to do is make deposits on time, file the annual 940 forms, and pay any additional money due.

Now that you know what is FUTA tax, you should keep learning about business finances and management.

At Camino Financial, we provide small business loans, information, and resources so business owners can concentrate on growth rather than get bogged down by problems. We encourage you to become a part of our community by subscribing to the Camino Financial Newsletter.

ADD_THIS_TEXT

Our newsletter is filled to the brim with resources and tools thatll help you grow your business. Its another way we fulfill our motto, No Business Left Behind.

You May Like: When Do You Do Tax Returns

Discrepancies Between Futa And Fica

FUTA, which is for unemployment benefits for employees, should be distinguished from FICA, which is a paid by both employers and employees to provide Social Security and Medicare benefits. The FICA tax is 6.2 percent on taxable compensation up to a fixed amount annually for the Social Security portion and 1.45 percent of taxable compensation for the Medicare portion . The same amount is paid by the employer and the employee. For example, if an employee earns $50,000, the employer’s FICA tax is $3,825 . The employee pays the same $3,825, which is withheld from their wages.

What Are The Different Rates For Fica And Futa

Under FICA, you must withhold 6.2% from your employees wages for social security, up to a wage cap of $128,400, and your matching amount. You must also withhold 1.45% from your employees wages for Medicare, and your matching amount.

FUTAs rates are a bit different. Currently, the FUTA tax rate is 6% on the first $7,000 of an employees wages in a single year. However, this rate can also be reduced via contributions to state unemployment programs, making the current minimum FUTA rate 0.6%.

Read Also: How To Appeal Cook County Property Taxes

Add Any Adjustments To The Tax

Determine if you need to make any adjustments to your tax liability. If you were not required to pay any state unemployment taxes on wages you paid throughout the quarter, there is no money credited to you within your state system, therefore you are required to pay an additional amount of FUTA tax. Calculate the additional amount by multiplying 0.054 by the total taxable wages. In our example this would result in an adjustment of $999 . Input this figure on line nine.

Additional adjustments may come into play if only some of your FUTA wages were excluded from state unemployment tax or you paid any of your state unemployment taxes late . You must calculate your adjustment using a special worksheet included in the instructions for Form 940.

What Is Futa Basics And Example Of Futa In 2021

Typically, when you lose your job, you can file for unemployment benefits. These benefits act as a temporary income to support you while you search for a new job. But where does this money come from? All federal unemployment insurance is funded by a payroll tax called the Federal Unemployment Tax Act .

In this article, well go over the FUTA definition, why its important, and how to calculate it. Well even give you some tips on how to effectively manage FUTA taxes as a small business owner. So, read on to learn all about FUTA or skip to any section using the links below.

Read Also: Www 1040paytax

Who Needs To File A 940 Form

Per the IRS, the majority of employers must pay federal and state unemployment taxes. Yet some businesses are exempt from FUTA . You can determine whether youre required to pay FUTA tax using three tests the general test, the household employee test, and the farmworkers test.

If you want to learn more about the household employees and farmworkers tests, check out Chapter 14 of the IRS Employers Tax Guide. Below are some highlights pertaining to the general FUTA test.

General Test

You must file a Form 940 and pay FUTA tax if your business satisfies any of the following criteria:

- You paid $1,500 or more in wages to employees in the last two calendar years, OR

- You had at least one employee for any 20+ weeks in the last two calendar years. Note:

- The 20 weeks dont have to be consecutive.

- Employees who worked any part of a day count.

- Temporary, part-time, and full-time employees count.

- Self-employed individuals arent typically subject to FUTA.

- Partners dont count if your business is a legal partnership that files IRS Form 1065.

- Shareholders and corporate officers in S corporations, aka businesses that file IRS Form 2553, may be subject to FUTA.