Use An Swp To Get The Lowest Tax On Your Investment Income

The lowest tax rate on investment income is on deferred capital gains at almost any income level.

Capital gains are taxed at preferred rates. With tax-efficient equity investments, you can defer the gain and pay capital gains tax years from now, instead of this year.

To get cash flow from deferred capital gains, just sell some of your stocks, mutual funds or ETFs each month. This is called a systematic withdrawal plan . You are taxed on the gain that has built up in the investments so far.

If you just bought your investments, then the SWP is tax-free. You are just taking back some of your own money. If you owned these investments for years and they are up hugely, you could be receiving mostly capital gains.

For illustration purposes in the chart, I assumed your investments have doubled since you bought them, so half of your SWP is a capital gain and half is tax-free because it is your original investment.

The chart below shows the marginal tax brackets, including the clawbacks, on different types of investment income. Note that deferred capital gains are always in green low brackets.

Capital Gains Tax Allowance

Capital gains is the profit you make from selling certain investments, including second homes, art, antiques and shares.

Capital gains of up to £12,300 are tax-free in 2021-22. Married couples and civil partners who own assets jointly can claim a double allowance of £24,600.

Remember, if you don’t use the allowance within the tax year, it’s lost forever. You can’t add your tax-free allowances together for different years.

This chart explains the rate of capital gains tax you will pay as a basic-rate and higher-rate taxpayer. For more details, see our guide on capital gains tax allowances and rates.

Retirement & Estate Planning

22. Make super contributions

Concessional super contributions are taxed at 15 per cent when they enter a super fund, as opposed to being taxed at the marginal rate .

The types of concessional contributions individuals can make include salary sacrificing and personal deductible contributions. Salary sacrificing involves entering into an agreement with your employer to have some of your pre-tax salary paid directly to your super fund. There is no income tax on amounts that are salary sacrificed.

If you are self-employed, substantially self- employed or an unsupported person, you can make contributions to your super and claim a full tax deduction.

23. Franking Credits

Franking credits are a kind of tax credit that allows Australian companies to pass on the tax paid at company level to shareholders.

Franking credits can reduce the income tax paid on dividends or potentially be received as a tax refund.

Where a company distributes fully franked dividends the taxpayer can claim a credit against their taxable income for the tax that has already been paid by the company from which the dividend was paid.

24. The retirement exemption

Small business owners who own assets with signi cant capital gains outside of their super account should time the sale of the assets to reduce the amount of CGT.

The 50 per cent CGT discount also applies if the asset was owned for more than 12 months.

25. The bring forward rule

26. Make a Binding Death Benefit Nomination

27. Plan to avoid the death tax

You May Like: Doordash How Much To Save For Taxes

# 2 Cash Balance Plans

If being able to contribute $19,500 to $64,500 into a tax-deferred 401 is good, how would you feel about contributing another $10,000-200,000 into another tax-deferred account? Pretty attractive, right? Enter the cash balance plan, which is basically another defined contribution plan masquerading as a defined benefit plan. You can have a personal one as an independent contractor, your partnership can put one in place, or you can talk your employer into offering one as a benefit.

# 6 Take Distributions

Another tax break the rich take advantage of is to split their income into salary and distributions. By forming an LLC or a corporation and making an S election, the business is taxed as an S Corp. The portion of the income of the business that is determined to be distribution is not subject to payroll taxes like Social Security and Medicare.

Is this tax break available only to the rich? No. In fact, lower earners using this tactic may be able to save a much higher percentage of their income. A higher earner will only save the 2.9% Medicare tax but a lower earner may save 12.4% in Social Security tax AND 2.9% in Medicare tax.

Also Check: How To Get Pin To File Taxes

# 7 The Home Office Deduction

If there is an area of your home that you use regularly and exclusively for a business, you can deduct it. Since calculating and using the deduction can be complicated, the IRS has made a simplified version available- $5 per square foot of up to 300 square feet and no recapture of the deduction when the home is sold. That $1500 deduction may be worth $500 or more off your taxes. Beats a kick in the teeth.

Join A Medical Aid Scheme

If you contribute to a Medical Aid this tax year you will receive a fixed monthly tax credit of R319 for you as the primary member, a further R319 for your first dependent and R215 for each of your additional dependents. SARS calls this rebate the Medical Schemes Fees Tax Credit – it is a flat rate per month and is direct reduction of your tax liability. For example:If John pays for medical aid for himself, his wife and his 3 children, his tax credit for the 2021 tax year will be calculated as follows:R319 for John+ for his 3 children= R1,283 tax credit per monthJohn’s tax liability is therefore decreased by R1,283 per month .If your medical tax credit is greater than your actual tax liability, then your tax liability will be nil and you will not receive a tax refund. This means that in the example above, if Johns actual tax liability for the year was R13,000, it will be reduced by the tax credit of R15,396 to arrive at a nil amount due to SARS. He will NOT receive the difference of R2,396 as a tax refund.

Also Check: Doordash Filing Taxes

Make The Most Of Your Isa Allowance

Everyone can take advantage of their annual tax-free Isa allowance. For the 2021-22 tax year, you can deposit up to £20,000 into Isa accounts. This is unchanged from 2020-21.

This can all be put in a cash Isa, a stocks and shares Isa, or split between both cash and stocks and shares. We explain how this works in our guide to tax on savings and investments.

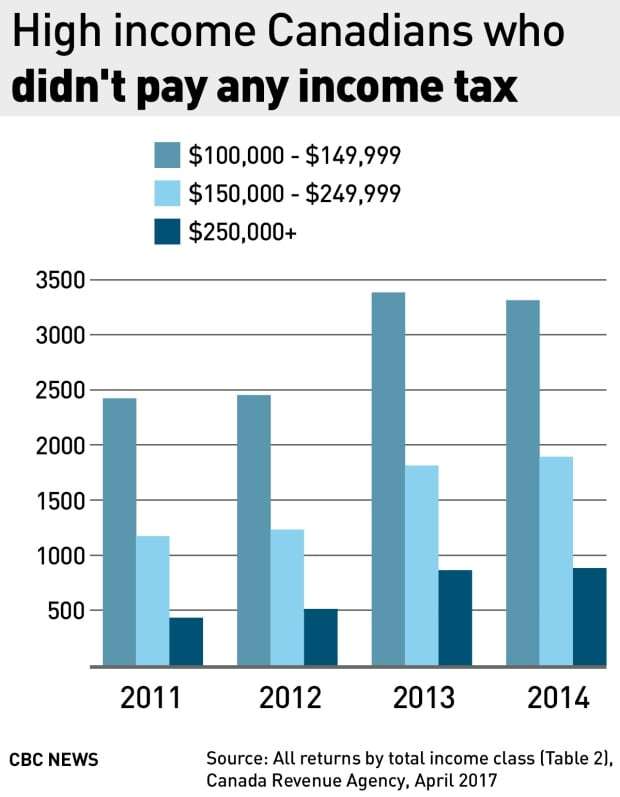

How To Pay Less Taxes In Canada: 12 Tips

There are a number of ways to pay less tax in Canada. But relatively fewer people take advantage of all the credits and deductions that CRA permits, and that can lower your tax bill significantly. Its mostly because a lot of people dont even know where they can save on taxes.

But if you are determined to learn how to pay less tax in Canada, this article will hopefully identify at least some of the ways which apply to your particular situation.

Also Check: Efstatus Taxact 2016

Above The Line Deductions For 2022

Above the line deductions reduce a taxpayer’s adjusted gross income and are allowed regardless of whether you itemize or take the standard deduction. Above the line deductions are important because reducing your AGI may help you qualify for additional deductions or credits on your return. High-income earners may consider the following above the line deductions:

Health savings account contributions. HSAs are triple tax-advantaged accounts: Contributions are tax-deductible, the money grows tax-free, and withdrawals are tax-free for qualified medical expenses for those under age 65, and for any purpose if you are age 65 or over. The contribution limits for 2022 are $3,650 for individuals and $7,300 for families. If you are age 55 or over, you can contribute an extra $1,000.

Deductible Traditional IRA contributions. Contributions to Traditional IRAs are deductible with different income thresholds based on if you have access to a group retirement plan or not. If you and your spouse do not have access to a group plan then there is no income limit for taking the deduction. The MAGI limit to deduct contributions for a married couple with just one spouse having access to a group retirement plan is $204,000 – $214,000. If both spouses have access to a group plan then the MAGI limit for the deduction is $109,000 – $129,000. For a single filer who has access to a group retirement plan, the MAGI limit is $68,000 – $78,000.

Ways To Legally Lower Your Tax Bill

Taxes are part of life and many good things are done with tax dollars. But as Judge Learned Hand said, Any one may so arrange his affairs that his taxes shall be as low as possible he is not bound to choose that pattern which will best pay the Treasury there is not even a patriotic duty to increase one’s taxes. I pay every dime I owe in taxes, but I’m not going to leave a tip. If you feel the same way, check out these tips to lower your tax bill.

Also Check: Do You Have To Pay Taxes On Plasma Donations

# 17 Send Your Kids To College

There are lots of college-related deductions, but don’t expect to come out ahead after sending your kid to college! Earnings in college savings accounts like 529s and Coverdell ESAs are tax-free when used for college. Your state may offer a state tax deduction or credit for contributing too. The American Opportunity Tax Credit and the Lifetime Learning Credit are also nice, but most doctor families are phased out of these credits. If you can get your AGI under $180,000 and have a kid in college, take a look at them as the tax savings are probably more than using a 529 account.

Recommended

Which Method Is Better For My Business Vehicle: Standard Mileage Or Actual Expense

It depends on the vehicle-related expenses that you have incurred during the year. If youve spent significant money on maintenance , car inspections, and registration, then it may be more beneficial for you to use the actual expense method. On the other hand, if youve paid minimal expenses in the year or driven many miles for business, then the 56 cents per mile in 2021 may provide a larger expense deduction. Its also simpler because you dont need to keep detailed records of all your expenses. If you have kept all of your expense records, it is always beneficial to check your total expense deduction under both methods.

Don’t Miss: 1040paytax Irs

Read More Sun Stories

The personal allowance is the amount you can earn tax-free each year.

In the current tax year running from April 6, 2022, to April 5, 2023, the standard amount is £12,570.

A rate it’s staying at until April 2026.

That means for basic rate taxpayers, the threshold will be held at £12,570 for the next few years, meanwhile higher rate taxpayers will be capped at £50,270.

Basic rate tax payers pay 20% on earnings over the lower threshold, while higher rate payers are charged 40% above the top threshold.

But what it means for your finances is that if you earn £12,570 or less, you currently pay no income tax.

Meanwhile, Brits who earn over £125,140 a year don’t get any personal allowance and will pay income tax on everything they earn.

You can calculate what your take home pay is depending on your salary by using MoneySavingExpert’s free online calculator.

Organize Your Investment Accounts

Another error many Canadians face when it comes to taxes is structuring their investment accounts the wrong way.

The most favorable form of taxable income is a capital gain. Following a capital gain would be a dividend paid by a Canadian corporation. And finally, the worst type of investment income would be interest income, as it is subject to full taxation.

With a capital gain, only 50% of the gain is taxable. With a dividend paid by a Canadian corporation, the dividend tax credit can reduce your tax burden significantly.

With that being said, I have always chosen to structure my investment accounts to tax shelter my dividends and place my stocks that do not pay a dividend in my taxable account. Why do I do this? deferral, of course.

When you receive a dividend, it is taxable in the year you receive it. But for a capital gain, it is not realized until you sell. You could potentially defer capital gains for as long as you really want. And, there is no way to reduce your overall dividend tax burden. With a capital gain, once realized, it can be offset with capital losses if you have them.

If you are holding fixed income securities, placing them in the right account is critical as well. There is no tax benefits to coupon payments made by fixed-income investments. They are simply taxed at 100% of your nominal Canadian income tax rate.

You May Like: Do I File Taxes For Doordash

Watch Your Flexible Spending Accounts

Flexible spending accounts, also called flex plans, are fringe benefits which many companies offer that let employees steer part of their pay into a special account which can then be tapped to pay child care or medical bills.

The advantage is that money that goes into the account avoids both income and Social Security taxes. The catch is the notorious “use it or lose it” rule. You have to decide at the beginning of the year how much to contribute to the plan and, if you don’t use it all by the end of the year, you forfeit the excess.

With year-end approaching, check to see if your employer has adopted a grace period permitted by the IRS, allowing employees to spend 2021 set-aside money as late as March 15, 2022. If not, you can do what employees have always done and make a last-minute trip to the drug store, dentist or optometrist to use up the funds in your account.

The Consolidated Appropriations Act was signed into law on December 27, 2020 as a stimulus measure to provide relief to those affected by the pandemic. The CAA allows employers to extend healthcare FSA and dependent care FSA grace periods for up to 12 months into the following plan year for plan years ending in 2020 and 2021.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

# 15 Buy A House With A Mortgage

Like giving to charity, spending money on a mortgage, property taxes, and Private Mortgage Insurance won’t leave you with more money afterward, but if you’re going to buy the house anyway, you might as well claim the deduction for it on Schedule A. Remember for new mortgages that only the interest on the first $750,000 in debt is deductible. This is still a massive deduction for some of my readers. Remember that property taxes are combined with income taxes and limited to $10,000 total as a Schedule A deduction.

Also Check: Do Doordash Drivers Pay Taxes

Defer Converting Your Rrsp To Do The 8

You can get up to $10,500/year of Guaranteed Income Supplement tax-free from age 65 to 72, if you have no taxable income other than OAS. You can still receive non-taxable income, such as from your TFSA or investments.

This is a cool strategy if you have enough in your TFSA or non-registered investments to give you income for these 8 years. You could plan for this by cashing in some RRSP before you turn 65 to maximize your TFSA or build up non-registered investments.

You could also get income by withdrawing from a secured credit line on your home during these 8 years.

To qualify, you could delay converting your RRSP to an RRIF until the end of the year you turn 71. You can also delay starting your CPP until age 70.

You could also make a large RRSP contribution before age 65 and defer the deduction until you need it during these 8 years to give you the maximum GIS.

At age 72, you have to start withdrawing from your RRIF, but you will still receive GIS for one more year since it is based on the prior years income. You will likely lose some or all of your GIS after that.

Deferring CPP to age 70 means you get 42% more CPP for the rest of your life. Delaying converting your RRSP gives it an extra 8 years to grow, during which time it could nearly double.

The 8-Year GIS Strategy can mean you have a much more comfortable retirement after age 71.

Are There Legal Ways To Low Your Taxable Income

You have to pay income tax on all of the income you make in a tax year.

However, there are some ways to decrease the amount of your income that is taxable. These are called tax deductibles. These deductions are there to incentivize good civil behaviour, like paying for healthcare, donating to charity, and saving for retirement.

If you are self-employed, then your business deductions also reduce your taxable income. Your business is taxed on its profit, not its gross income.

Do not try to reduce your taxable income by making up deductions or expenses. This is tax fraud and is illegal. If you are unsure, contact a tax specialist and get sound financial advice.

You May Like: Taxes On Doordash

# 14 Hire Someone To Care For Your Children

In a two-earner family with kids? I bet you’re paying someone to care for your children at least occasionally. That qualifies you for a tax credit The credit is up to 35% of $3,000 or $6,000 spent on childcare. That includes summer day camps too. Unlike the child tax credit, there’s no phaseout on this one.