How Do Non Residents File Dc Taxes

If you are not a resident of DC you must file a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.

Does DC tax income from other states?

DC does not allow a deduction for state and local income taxes. You can deduct your entire state and local real estate taxes.

Where To Send Your District Of Columbia Tax Return

| Income Tax Returns Office of Tax and RevenuePO Box 209 |

You can save time and money by electronically filing your District of Columbia income tax directly with the . Benefits of e-Filing your District of Columbia tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

Washington, DC does not provide any specific free programs for eFiling your tax return, but supports a list of paid providers and preparation services that can eFile on your behalf. The District of Columbia does offer faster refunds to taxpayers who take advantage of the eFile system.

To e-file your District of Columbia and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

The two most popular tax software packages are H& R Block At Home, sold by the H& R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. Both companies produce multiple editions for simple to very complex tax returns, so be sure to carefully compare the features offered by each package.

Washington Dc Alcohol Tax

Alcohol sales in Washington, D.C. face two separate types of taxes. The first are excise taxes that are charged to the wholesaler. These vary by the type of alcohol. Beer is taxed at a rate of 9 cents per gallon. Wine with less than 14% alcohol by volume is taxed at rate of 30 cents per gallon, while wine with more than 14% alcohol by volume is taxed at a rate of 40 cents per gallon. Liquor is taxed at a rate of $1.50 per gallon.

The second type of tax is the alcohol-specific sales tax. The rate for that tax is 10.25% of the purchase price, which is charged by the vendor to the consumer.

Also Check: Is Freetaxusa A Legitimate Site

How Federal Law Creates Nowhere Income

For states to levy taxes on a company, there must be a sufficient connectiontermed nexusbetween the state and the companys economic activities. Although this primer is not chiefly concerned with the complex subject of when and how a company has nexus for tax purposes, it is important to understand that nexus is defined and limited in three ways: by state statute, federal statute, and the U.S. Constitution. States have significant leeway to determine what sort of contacts are sufficient for a company to establish nexus therefactors like a commercial domicile, employees located in the state, deriving income from the state, or marketing into the state. If policymakers wish, states can take a narrower view of nexus than federal lawbut where they take a broader one, federal law and the constitution prevail.

Companies stand to benefit if they can avoid any economic activity other than the remote solicitation of sales into a state. This is a decision made at the margin many other factors enter into the decision of where to locate facilities and employees, with many larger businesses resigned to the fact that they will have nexus almost everywhere and many business models structurally unsuited to avoiding the establishment of nexus in states where they have sales.

District Of Columbia Income Tax Rate 2020

District of Columbia state income tax rate table for the 2020 – 2021 filing season has six income tax brackets with DCtax rates of 4%, 6%, 6.5%, 8.5%, 8.75% and 8.95% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses. The District of Columbia tax rate and tax brackets are unchanged from last year.

District of Columbia income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2020 through December 31, 2020. Outlook for the 2021 District of Columbia income tax rate is to remain unchanged.

| 8.95% |

Please reference the District of Columbia tax forms and instructions booklet published by the District of Columbia Office of Tax and Revenue to determine if you owe state income tax or are due a state income tax refund. District of Columbia income tax forms are generally published at the end of each calendar year, which will include any last minute 2020 – 2021 legislative changes to the DC tax rate or tax brackets. The District of Columbia income tax rate tables and tax brackets shown on this web page are for illustration purposes only.

You May Like: How Much Money Should I Save For Taxes Doordash

Washington Dc Estate Tax

Washington, D.C. has an estate tax that applies to estates of over $4 million. For estates above that threshold, rates are applied based on the total gross estate. That includes bank accounts, real estate, automobiles, investments and other valuable property held by the decedent. Tax rates are applied to the taxable estate based on brackets. Rates start at 11.2%, but the top rate of 16% applies to the portion of any estate beyond $10 million.

- About 30% of the population of Washington, D.C. is employed by the government.

- Construction on the Washington Monument was halted for 23 years, from 1854 to 1877, because of a lack of funding, discord in the Washington National Monument Society and the Civil War.

- Washington, D.C. has nineteen separate universities and colleges.

Study: Dc Is Among The Places With The Highest Taxes

The rise of remote work has led many people to reconsider where they live. While lifestyle and housing costs are typically the most important factors to weigh when deciding where to live, understanding the tax burden and other costs of living are important to evaluating a budget.

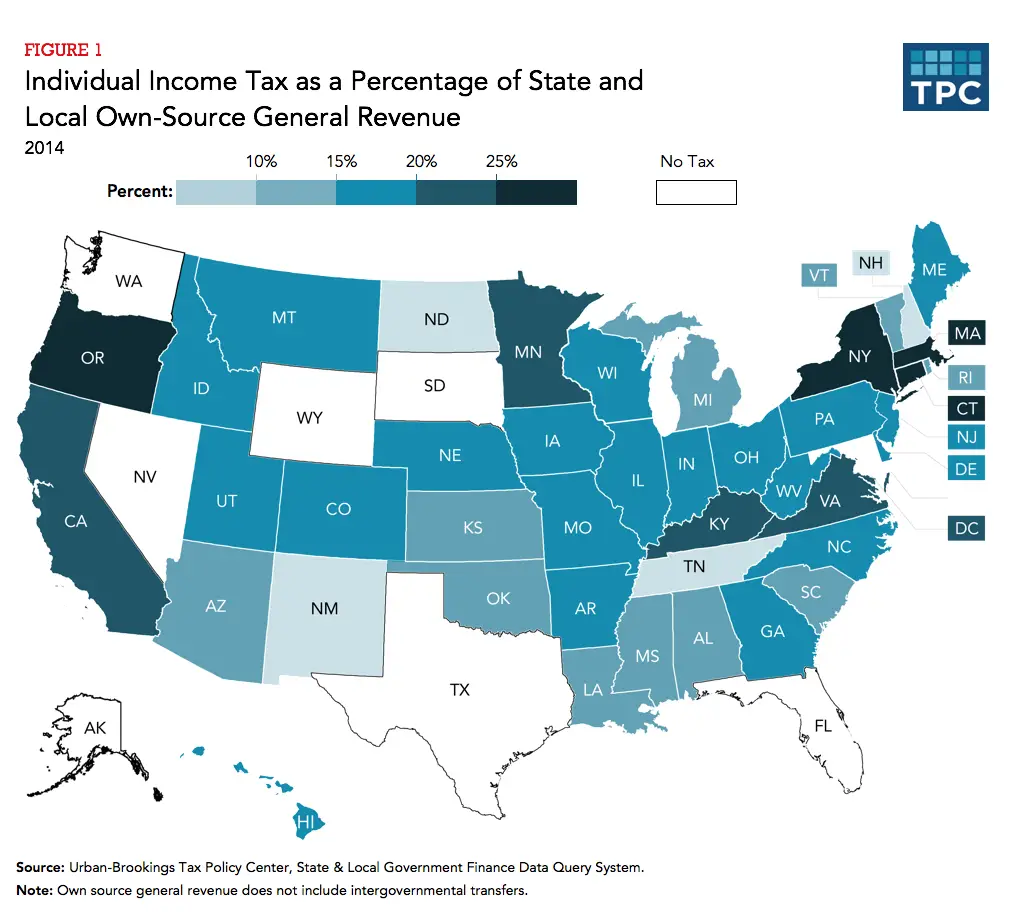

A recent analysis of state and local property, income and sales taxes in all 50 states and D.C. found D.C. residents pay the third highest in taxes as a percentage of their income.

The analysis, by HireAHelper, a site that provides reviews and booking services for local moving companies nationwide, was based on data from the Census Bureau and the Bureau of Economic Analysis. It found D.C. residents pay 11.63 percent of their income, or an average of $9,435, in combined taxes each year.

Tax burdens range from a low of 5.04 percent in Alaska to a high of 12.8 percent in New York. The second highest tax burden falls on Hawaii residents, who pay 12.23 percent of their income on taxes.

Nationally, consumers pay an average of 8.88 percent of their income in state and local taxes. Broken down by category, 3.43 percent of those taxes are sales taxes, 3.07 percent are property taxes, and 2.39 percent state income taxes.

In D.C., property taxes average 4.6 percent of income, while income taxes are 3.63 percent and sales taxes average 3.4 percent.

You May Like: Protest Property Taxes In Harris County

What To Consider Before Moving To A State With No Income Tax

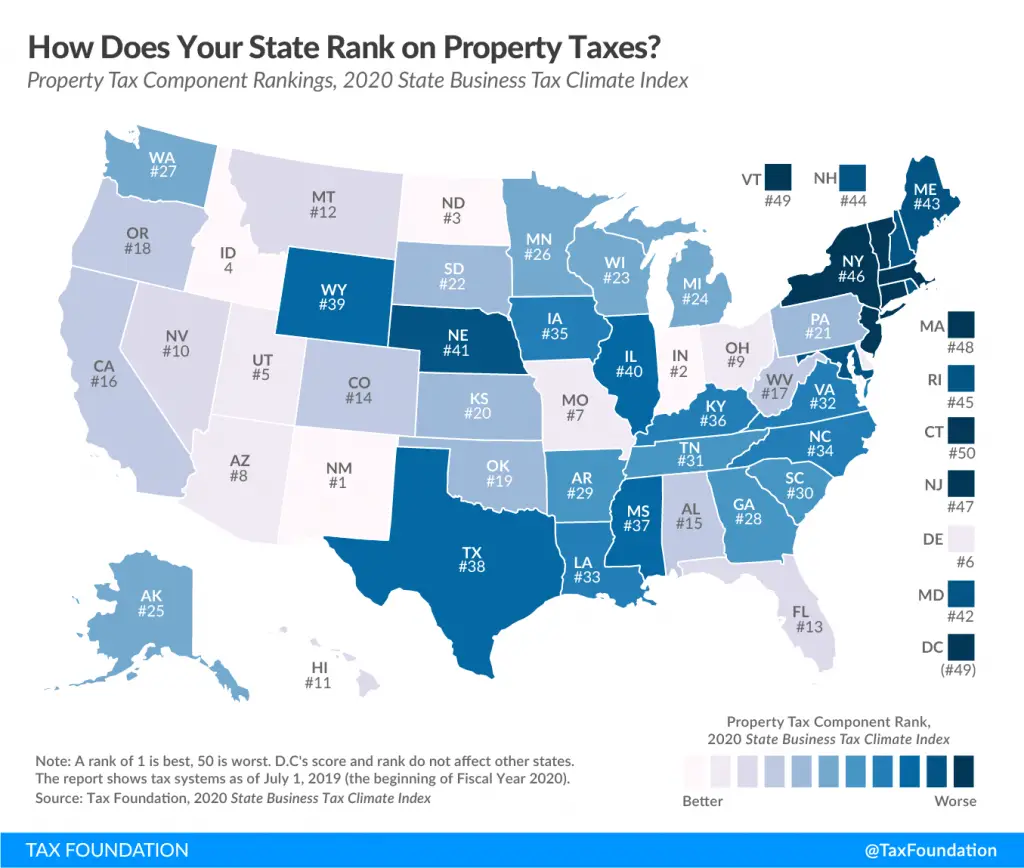

While moving to a state with no income tax may sound appealing, it comes with trade offs. States with no income tax often make up for the loss of revenue to the state by charging residents a higher sales, property or excise tax .

For instance, Tennessee has the highest combined sales tax rate in the nation at 9.53%, according to the Tax Foundation, a D.C.-based think tank. Washington state has one of the highest tax rates on gasoline in the nation, at 49.4 cents per gallon. Of all states, New Hampshire and Alaska rely the most on property taxes, with tax collections accounting for 67.6% and 51.8%, respectively, of their revenue.

Taxes are also a big source of income that the state uses to finance public services such as infrastructure, healthcare and education. Lower taxpayer dollars likely translates into lower funding for these initiatives.

South Dakota, for example, spends the lowest on education of all states in the Midwest, at $10,073 per pupil per year. Nationwide, the average school spending per pupil is $12,612, and Florida, Nevada, Tennessee, Texas all spend less than the average.

To weigh another state’s affordability, consider these above factors as well as the overall cost of living and job opportunities in your field. Leaving a big city, for example, you may have to accept certain trade-offs, such as a lower paying job for more affordable real estate.

Economic Consequences Of Throwback And Throwout Rules

Although throwback and throwout rules are designed to avoid the perceived under-taxation of corporate income, they can lead to double taxation in some circumstances and frequently impose high tax burdens in specific stateshigh enough to make the state unattractive for businesses.

Imagine a hypothetical firm with $100 million in sales into its home state and nine other states. For simplicitys sake, let us suppose that these are evenly distributed at $10 million in sales per state, and that the company has a taxable presence in three states , is immune from taxation in six others due to the workings of P.L. 86-272, and has no liability in the tenth because that state does not impose a corporate income or similar business tax. Imagine, moreover, that 70 percent of the companys salesagain evenly distributedare tangible personal property, while 30 percent are services or other intangible property.

Hypothetical Throwback Scenario| $70 million | $30 million |

In calculating the sales factor for corporate income tax purposes in the domiciliary state, the denominator is initially set at the total of all sales made anywhere, in this case $100 million. The home state begins by including all sales made in the state, in this case $10 million, in the numerator. These sales, and all others, are already in the denominator.

Don’t Miss: Calculate Doordash Taxes

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

You May Like: Www.efstatus.taxact.com

What If Im Married

How does marriage impact the equation? Lets say Bobby got married and had a kid during 2018. Using the Standard Deduction and Exemptions table , it becomes apparent that even though Washington DC has no exemptions or child credits, its $24,000 standard deduction is enough to keep Bobbys familys taxable income lower than it would be in Virginia or Maryland . Maryland on the other hand has a sizable exemption at $3,200 per person . However, Marylands extra local income tax rates are the reason that its income taxes are not lower than Virginias at any of the levels of income that we analyze.

If you really cant decide which jurisdiction to live in, remember that Virginia has the lowest alcohol tax, meaning you can splurge on an extra nice bottle of champagne to celebrate your new job and new home!

Thank you very much Klausner & Company for finally providing people with an easy to understand breakdown of taxation in the DMV. For those of you in need of CPA services for yourself or your business, I am a loyal, happy client and I cant recommend them enough. They provide specialize in tax services for individuals and small business and have over 40 years of experience in the Greater Washington area.

Below are some additional details and comparison tables outlining the tax rates in each jurisdiction.

Dcs Income Tax Is Not Progressive Enough To Offset The Impacts Of Sales And Property Taxes On Residents With Low Or Moderate Incomes

The richest in DC pay a lower share of their income in taxes than others because two of our main revenue sourcessales and property taxesfall hardest on low- and moderate-income residents. Sales and excise taxes especially affect lower-income families, since most live paycheck to paycheck and must spend most of their earnings to get by. Meanwhile, higher-income families can afford to save and therefore spend a relatively small share or their income on taxable goods and services. As a result, sales taxeswhich cover things like utilities, clothing and phone billsamount to a higher share of income for a cashier than a law firm attorney.

Property taxes affect lower-income residents, even if they rent their homes, since landlords pass on the costs of property taxes to their renters as part of monthly rent payments. ITEP finds that DCs lowest-income residents pay a larger share of their income in property taxes than higher-income families. This is true in part because DCs rising rents mean that property taxes paid by renters have risen substantially. For homeowners, however, DCs property tax includes provisions to limit taxes in ways that widen tax inequities, including a 10 percent cap on annual increases in a homes taxable assessment. This provision limits taxes the most for homeowners most in areas where home values are rising fastest.

Recommended Reading: What Tax Form Does Doordash Use

What Do You Do If Your State Doesn’t Have Tax Reciprocity

If your state doesn’t have a reciprocal tax agreement with the state where you work, you will have taxes withheld in your work state. At tax time, you will have to file taxes in both states to sort out how much you owe or how much you’ll be refunded from either state. When it’s all settled, you still won’t be taxed twice on your income.

District Of Columbia Tax Rate Changes Effective October 1 2021

The District of Columbia Office of Tax and Revenue reminds taxpayers, tax professionals, software providers, businesses and others about tax changes that were enacted in the Fiscal Year 2022 Budget Support Emergency Amendment Act of 2021.

These tax changes will take effect October 1, 2021, unless otherwise noted, for the following tax types:

Individual Income, Corporation Franchise and Unincorporated Business Taxes:

The following sources of income will be excluded from the computation of District gross income:

- Unemployment insurance benefits provided by the District or any other state

- Grants awarded by the Mayor under the COVID-19 Hotel Recovery Grant Program Act of 2021

- The following grants awarded by Deputy Mayor for Planning and Economic Development:

Individual Income Tax Rates:

Beginning on January 1, 2022, the individual income tax rates will be determined in accordance with the following table:

| Not over $10,000 | 4% of the taxable income |

| Over $10,000 but not over $40,000 | $400, plus 6% of the excess over $10,000 |

| Over $40,000 but not over $60,000 | $2,200, plus 6.5% of the excess over $40,000 |

| Over $60,000 but not over $250,000 | $3,500, plus 8.5% of the excess over $60,000 |

| Over $250,000 but not over $500,000 | $19,650, plus 9.25% of the excess over $250,000 |

| Over $500,000 but not over $1,000,000 | $42,775, plus 9.75% of the excess over $500,000 |

| Over $1,000,000 | $91,525, plus 10.75% of the excess over $1,000,000 |

Cigarettes and Other Tobacco Tax:

Motor Fuel Tax:

Read Also: Plasma Donation Earnings

Have New Employees Complete Withholding Tax Forms

All new employees for your business must complete a federal Form W-4. They also should complete the related District of Columbia Form D-4, DC Withholding Allowance Certificate. If an employee does not provide a Form D-4, the employer is required to withhold DC income tax as if the employee had not claimed any withholding allowances. You can download blank Form D-4s from the Withholding Tax Forms and Publications section of the OTR website. You should keep the completed forms on file at your business and update them as necessary.

Individual Income Tax Service Center

This center is a gateway for the services and information that personal income taxpayers will need to comply with the District’s tax laws.

DC Online Filing is a secure site that provides full calculation of District tax and credits and currently allows District residents to file the D-40 and D-40EZ individual forms for free. This site is available 24 hours a day, seven days a week. The Federal/State E-File program allows taxpayers to file their federal and DC returns electronically at the same time. .

Recommended Reading: Doordash Tax Percentage