Who Must File Taxes 2021

The very basic and general answer is this: as a filing single or married filing separate person, if your 2021 income did not not equal or exceed the standard deduction limit of $12,550 and you do not owe any special taxes or have any special tax situations that require you to file, you do not need to file.

Does Irs Forgive Tax Debt After 10 Years

In general, the Internal Revenue Service has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations. … Therefore, many taxpayers with unpaid tax bills are unaware this statute of limitations exists.

How Much Do You Have To Make To File Taxes

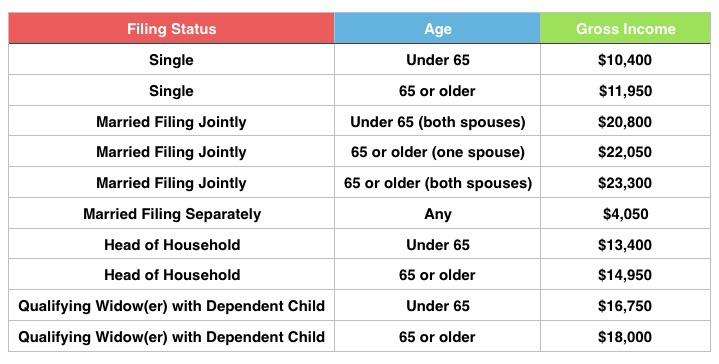

Income-based tax requirements will be dependent on how you plan on filing a tax return. Inevitably whether you’ll need to file a tax return who have to do with whether you’re income can even make it past the first tax bracket and how much more if so, but those tax brackets vary depending on how you file.

Recommended Reading: How Do I File Taxes With Doordash

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

When It Pays To File

For those few who dont legally have to file, it pays sometimes to send in a return anyway.

This is the case for individuals who dont earn much but might be eligible for the earned income tax credit. This benefit is available to qualified individuals even if they owe no tax, meaning they would get money back from the federal government. Many people think the credit is available only to parents while that is not true, the credit amount is greater for eligible low-wage taxpayers with children.

The IRS also says that most individual taxpayers are due a tax refund. But those taxpayers must send in a Form 1040, Form 1040A or Form 1040EZ to get that cash.

You can check out the filing requirements section of IRS Publication 17 for more details.

Once youve determined that you need to file taxes, your next question is likely to be when do I have to file taxes? This year, the deadline for filing your 2021 tax return is Friday, April 15, 2022. If youre still not sure whether you must file a tax return, ask a tax professional, call the IRS at 829-1040 or make an appointment at your nearest IRS Taxpayer Assistance Center.

Also Check: Efstatus Taxact Com 2016

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts that you’re eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you don’t have a type of income that requires you to file a return for other reasons, like self-employment income, generally you don’t need to file a return as long as your income is less than your standard deduction.

For example, in 2021, you don’t need to file a tax return if all of the following are true for you:

- Under age 65

- Don’t have any special circumstances that require you to file

- Earn less than $12,550

How Much Do You Have To Make If You’re A Dependent

You may still have to file a tax return even if you’re being claimed as a dependent, depending on a number of factors. There’s the earned income you make, the unearned income you make and your gross income, and the minimums for all of these will be determined by either your age or whether or not you are blind.

If you are a single dependent under the age of 65 and not blind, you will have to file a tax return if:

Read Also: Doordash Write Offs

The Child And Dependent Care Credit

This credit covers some of the costs associated with caring for a child or dependent with disabilities, including after-school programs, babysitters or daycare, if that care enabled you to work.

The American Rescue Plan made this credit fully refundable in 2021 only. The maximum eligible expense for this credit is $8,000 for one qualifying person and $16,000 for two or more.

The exact credit amount you might qualify for depends on a few factors, including income. To find out what you might be owed, use this IRS tool. The claim for this credit is made using Form 2441.

Can I Still File My 2020 Taxes Electronically In 2021

There’s no law or rule that says you have to file your 2020 return before you can do your 2021 return. However, it’s best to prepare your 2020 return first, if possible. This gives you several advantages: You’ll be able transfer your 2020 data to your 2021 return, which saves time and prevents data entry errors.

Recommended Reading: Are Doordash Tips Taxed

What Happens If You Choose Not To File Taxes

If you fail to file a tax return or contact the IRS, you are subject to the following: … You’ll have to pay the IRS interest of .5% of the tax owed for each month, or part of a month, that the tax remains unpaid from the due date, until the tax is paid in full or the 25% maximum penalty is reached.

Who Is Required To File An Income Tax Return

If you are new to Canada or if you are just entering the workforce, you may be wondering if filing a Canadian Income Tax return is a necessity, and if so, when do you have to file your first tax return?

The Canada Revenue Agency does require annual filing for most citizens but there are exceptions, so lets have a look at who is required to file a Canadian T1 General tax return and when.

Don’t Miss: Protest Property Taxes In Harris County

Other Situations In Which You’ll Need To File A Tax Return

According to the IRS, you must also file a tax return if, for example:

- You are self-employed and had net earnings of at least $400 in 2020

- You owe any special taxes

- You earned $108.28 or more from a “church or a qualified church-controlled organization that is exempt from employer social security and Medicare taxes”.

What Happens If I Skip Filing Taxes One Year

Individuals who owe federal taxes will incur interest and penalties if they don’t file and pay on time. The penalty for not filing your taxes on time is 5% of your unpaid taxes for each month that the return is late, maxing out at 25%. For every month you fail to pay, the IRS will charge you 0.5%, up to 25%.

Don’t Miss: Freetaxusa Legit

Should I File Taxes Even If I Dont Have To

People with income under a certain amount arent required to file a tax return because they wont owe any tax. Its very common to feel like you shouldnt need to file a return if you dont owe any tax. However, owing to tax and having filing requirements are two separate situations in the CRAs eyes.

Even if the amount of income from your childs job doesnt require a tax return, if a refund is coming, a return should be filed. A child should file a tax return for many reasons:

If your child had any income tax deducted at the source, chances are theyll receive those deductions back as a refund.

Filing a return sets up your childs information with CRA for future years. Many first returns still need to be mailed in, as opposed to NetFiling. Once the first return is processed, your childs info will be filed, enabling them to file electronically in the future. Trust me, sending in a paper return for a high schooler is generally much easier than waiting until they have tuition credits or medical expenses to claim.

RRSP contribution room begins as soon as earned income is reported. Even if your child doesnt purchase RRSPs , their contribution room will begin to accumulate as soon as they report their earned income on their tax return.

How To File A Free Return

If you arent sure if you need to file then you probably should. And being able to file for free with TurboTax makes it a no brainer. Youre able to file a return using the Free Edition if you have simple tax situations. According to TurboTax, simple tax situations can include:

- W-2 income

- Limited interest and dividend income

- A standard deduction

- Earned Income Tax Credit

- Child tax credits

Youre not eligible to use the free edition in situations like itemizing your deductions, business, or 1099-MISC income, rental property income or when taking a student loan interest deduction.

Before you start, get all of your paperwork gathered. If you have them, youll need things like your W-2, 1099-INT, 1099-DIV, or social security information. To determine if you need to file a return using TurboTax, begin by answer a few questions.

After that, youll be prompted to create a TurboTax account with Intuit. If you already have an Intuit account for Quickbooks or Mint, you can use the same login to have one account for all of their services.

Once your account is set up, next, youll add more details on your personal information to help personalize questions they ask you to complete your return.

Up next, theyll ask other questions like your marital status, mailing address, and if anyone else can claim you as a dependant. TurboTax asked questions based on your response to previous questions. So the steps you experience will be unique to your current situation.

- Wages and salaries

Recommended Reading: Doordash File Taxes

Is There A Minimum Income To File Taxes In California

For many California residents, filing taxes is a requirement, but there can be some exceptions based on income and other factors. Individuals or families who do not earn a significant gross income may not have to file a federal income tax return, but there can still be advantages to doing so. OC Free Tax Prep can help offset the costs of filing for low-income households and ensure families are maximizing their return potential.

California residents are gearing up for tax season. Though the deadline to file is May 17, 2021, it is not too early to start gathering necessary documents. A big question on some peoples minds, however, is whether they even need to file taxes if they did not have significant income.

When Social Security Benefits May Be Taxable

When determining whether you need to file a return and you receive Social Security benefits, you need to consider tax-exempt income because it can cause your benefits to be taxable even if you don’t have any other taxable income.

Here’s an example of where you may need to file, even with tax-exempt income:

- You are under age 65 and receive $30,000 in Social Security benefits, but also receive another $31,000 in tax-exempt interest. $14,700 of your Social Security benefits will be considered taxable income.

- This is greater than your standard deduction and you would need to file a tax return.

To figure out if your Social Security benefits are taxable:

- Add one-half of the Social Security income to all other income, including tax-exempt interest.

- Then compare that amount to the base amount for your filing status.

- If the total is more than the base amount, some of your benefits may be taxable.

TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

Read Also: How To Do Taxes Doordash

Penalties For Not Paying Your Taxes

Even if you file an extension to submit your tax return, you must pay any estimated tax you owe by April 15, 2022. If you do not pay your taxes, you will be charged a penalty and owe interest on any unpaid balance.

The penalty for failing to pay your taxes by the due date is 0.5 percent of your unpaid tax for each month or part of a month that your return is late. This penalty is capped at 25 percent of late unpaid taxes. If you file your return on time and request to pay by an installment agreement, the penalty drops to 0.25 percent for each month or part of a month of the installment agreement.

Youre also charged interest on the unpaid balance, which compounds daily. The rate is set each quarter and is based on the federal short-term rate, plus an additional 3 percent.

If you owe taxes and dont file your return on time, youll be charged a penalty for failing to file. This is usually 5 percent of the tax owed for each month or part of a month your return is late. This penalty is also capped at 25 percent.

Affordable Care Act Premium Credit Claim

If you have health care coverage as required by the Affordable Care Act, also known as ACA or Obamacare, you might need to file a return.Specifically, this will be the case if you qualified for federal help in buying your health care coverage through the health insurance marketplace or exchange. If advance payments of the ACA premium tax credit were made for you, your spouse or a dependent who obtained such marketplace medical coverage, that amount must be reported by filing a Form 1040 tax return and Form 8962, Premium Tax Credit.

This will ensure that you got the appropriate tax credit in advance. If you received too much premium help, youll have to repay it when you file your return. If you did not get enough, you can collect the extra when you file.

Read Also: Donating Plasma Taxes

The Irs Interactive Tax Assistant

There are a series of questions you should answer to help you determine the minimum income amount that applies to you. Lets start with the IRS questionnaire found on their do you need to file page. This questionnaire is provided through the IRS interactive tax assistant , which is a remarkably easy-to-use program found on the IRS website.

The questions are designed to help you determine whether you need to file a federal tax return and if you need to adjust your Form W-4 to eliminate tax withholding.

The IRS has stated that they want to help eliminate wasted time and money from returns that are filed when they dont need to be. I recommend that you take them up on that offer and work through the questions.

According to the IRS website, answering these questions should take you no longer than 10-15 minutes. This is certainly worth your time, especially if it saves the time it would take you to file or if it saves you from having money withheld unnecessarily.

Who Must File Alabama Income Tax Return

Who must file an Alabama individual income tax return? Full year residents whose filing status is Single must file if gross income for the year is at least $4,000. Full year residents whose filing status is Married Filing Separate Return must file if gross income for the year is at least $5,250.

Recommended Reading: Do They Take Taxes Out Of Doordash

Depending On Their Earnings Us Taxpayers May Not Have To Submit A Tax Return Here’s A Breakdown Of The Income Requirements For Filing Taxes

Taxpayers in the United States have until 15 April 2021 to submit their federal income tax return for 2020 – but people whose earnings didn’t reach a certain level do not have to file.

Here’s an overview of how much you need to have earned in 2020 to be required to complete a US tax return this year.

Individuals Required To File A North Carolina Individual Income Tax Return

The following individuals are required to file a 2020 North Carolina individual income tax return:

- Every resident of North Carolina whose gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020 for the individual’s filing status.

- Every part-year resident who received income while a resident of North Carolina or who received income while a nonresident that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020.

- Every nonresident who received income for the taxable year from North Carolina sources that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income from all sources both inside and outside of North Carolina for the taxble year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020. For nonresident business and employees engaged in disaster relief work at the request of a critical infrastructure company, refer to the Personal Tax Division Bulletins.

Don’t Miss: Efstatus Taxactcom