Qualifying Charitable Organization Contributions

Donating to a qualifying charitable organization can help lower your state tax bill in Arizona. Qualifying charitable organizations are those that provide immediate basic needs for residents of Arizona who are low-income, disabled or receive temporary assistance for needy families .

The maximum credit is $800 for married couples filing jointly and $400 for single filers, heads of household and married filing separately filers.

How Much Does State Of Arizona Pay

For Workforce Managers, the average income in the state of Arizona is roughly $36,000 per year, whereas for Epidemiologists, the average compensation is $51,072 per year. Custodians earn roughly $12.80 per hour on average, while Groundskeepers earn approximately $14.00 per hour on average in the State of Arizona.

Arizona Individual Income Tax Refund Inquiry

Refund status can be also obtained by using the automated phone system. Taxpayers can call 255-3381, and, after making the language selection, select Option 2 for refund status. Taxpayers should have their tax information ready before calling. Be prepared to provide the social security number, zip code, and filing status reported on the returns when inquiring on the refunds.

Representatives are also available to assist taxpayers Monday – Friday, 8 a.m. to 5 p.m. .

- 255-3381 or

- 1-800-352-4090

Also Check: Doordash Tax Calculator

What Are The Conditions Of The Arizona Tax Payment Plan

The main condition to be aware of is that you will be expected to make full payments on time. ADOR reserves the right to automatically cancel your arrangement for returned payments or insufficient funds. A $50 Return Payment Penalty will be added to your account. A tax lien targeting your wages, bank accounts, and additional assets could be filed if youre delinquent on a state of Arizona tax payment plan. Your payment plan can also be canceled if you accrue new tax debt or fail to file a tax return on time. An Arizona state tax payment plan cannot be extended once its in place. You will not be permitted to add future tax balances to an existing agreement.

Individual Income Tax Information

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2021 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS once electronic filing season opens. Tax software companies may produce tax filings before the IRS’ launch date, but taxpayers will not receive an acceptance notice until electronic tax season opens.

Please refer to the E-File Service page for details on the e-filing process.

Sign Up for Emails and Texts

to receive email or text alerts for topics including due dates, news and announcements, new features and tax reminders. Be among the first to receive updates without having to return to the website and check for changes.

Read Also: Federal Tax Return Irs

Do I Have To Pay Arizona State Income Tax

Generally, you have to file an Arizona state income tax return if youre a resident, part-year resident or nonresident and you have gross income above these amounts:

|

Filing status |

|

|---|---|

|

Head of household |

$18,800. |

Arizona gross income equals your federal gross income minus interest from government bonds, Social Security retirement benefits, Railroad Retirement Act benefits, active duty military pay and pay for service in the National Guard.

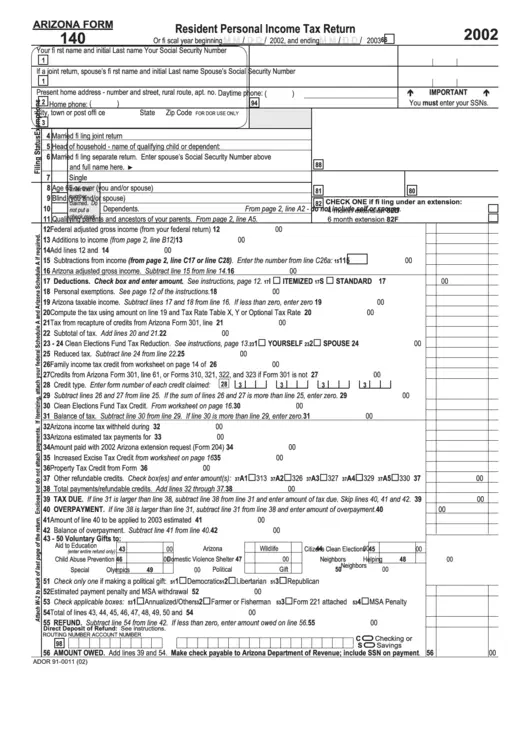

Common Arizona Income Tax Forms & Instructions

The most common Arizona income tax form is the Arizona form 140. This form is used by residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

Here are links to common Arizona tax forms for individual filers, along with instructions:

| Individual |

A full list of Arizona forms can be found here: .

Don’t Miss: Appeal Property Tax Cook County

Overview Of Arizona Taxes

Arizona has a progressive tax system, with varying rates depending on your income level. There are four tax brackets that range from 2.59% and 4.50%. There are no local income taxes. Of course, youll have federal taxes deducted from each paycheck along with your state taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

General Information On Taxability Of Asrs Benefits

ASRS pension benefits are considered taxable income by the Internal Revenue Service. Generally, pension benefit payments are considered taxable income for contributions to the ASRS after July 1, 1986, excluding any purchased service prior to retirement made with after-tax money. The amount of money in a member’s account that is not subject to taxation during retirement is derived from contributions received prior to July 1, 1986.

Tax laws can be complicated, and the ASRS strongly recommends that members seek professional advice on tax-related questions and concerns.

About Federal Income Taxes

When a member retires and starts receiving a monthly retirement pension, this pension is considered revenue and becomes reportable as taxable income. Members fall under one of three groups:

- RETIRED BEFORE JULY 1, 1986 were given up to three years to recover their taxed contributions before reporting their retirement pension as taxable income. All retired members in this group should be reporting their entire pension benefit as taxable income.

- RETIRED ON OR AFTER JULY 1, 1986 but made contributions before July 1, 1986 are required to report a portion of their pension benefit as taxable income.

- BEGAN CONTRIBUTING TO THE ASRS ON OR AFTER JULY 1, 1986 are required to report their entire pension benefit as taxable income upon retirement.

IRS Form 1099-R, an end-of-year statement similar to a W-2 statement for workers, reports the following information:

About State Income Taxes

Read Also: Do You Have To File Taxes For Doordash

Arizona State Income Tax: Rates And Who Pays In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Arizona state income tax rates are 2.59%, 3.34%, 4.17% and 4.5%. Arizona state income tax brackets and income tax rates depend on taxable income, tax-filing status and residency status.

For the 2021 tax year, the standard deduction for state income taxes in Arizona is $12,550 , $25,100 and $18,800 .

Can You Pay Arizona State Taxes In Installments

The Arizona Department of Revenues tax payment plan works very similarly to theIRS Installment Agreement plan that many people know about. No payment plan will be granted to someone owing $100 or less. You must pay your debt in full if you owe $100 or less. Here is the payment schedule for all other debt amounts:

- $101 to $1,000: 6 months

- $1,001 to $2,500: 9 months

- $2,501 to $4,999: 12 months

- $5,000 or more: 24 months

Its possible that youll need to negotiate with the Arizona Department of Revenue if you owe more than $5,000. Youre generally given 24 months to pay off larger debts under an Arizona state income tax payment plan. However, you may be able to set up an extended individualized payment plan with the help of a tax professional.

Also Check: Calculate Doordash Taxes

Arizona Department Of Revenue Selects Point & Pay To Offer Electronic Payment Solutions

Taxpayers can now pay Arizona state tax online through new electronic payment systems created by Point & Pay in partnership with the Arizona Department of Revenue. Eligible tax types include Individual Income Tax, Transaction Privilege Tax, Use Tax, Corporate Income Tax and Withholding Tax, which can be paid with American Express®, Discover®, MasterCard® or VISA® credit cards, VISA® debit cards, or e-checks.

Point & Pay was selected by the Arizona Department of Revenue over a field of competitors to provide this payment option for Arizona residents. Said Arizona Department of Revenue Director David Briant, “Our mission of ‘Serving Taxpayers!’ focuses on funding Arizonas future through excellence in innovation, customer service and continuous improvement. We look forward to working with Point & Pay to achieve these goals.”

“Point & Pay has long served Arizona county and municipal taxpayers, including those in Apache, Cochise, Graham, Mohave, Pinal, Santa Cruz, Yavapai and Yuma counties and 15 municipalities around the state,” said Kevin C. Connell, President, Point & Pay. “Now, we are honored to showcase our next-generation payment systems and top-quality customer service on the state level, and we look forward to other states joining Arizona as Point & Pay customers.”

To pay Arizona state tax online, visit .

About Point & Pay

About North American Bancard

What Is The Process For Arranging A Tax Payment Plan In Arizona

You can apply for a payment plan by filling out an Individual Income Tax Installment Agreement Request form . ADOR may ask you to complete a Collection Information Statement if you request a state installment agreement. ADOR typically assesses a taxpayers monthly income and expenses. In addition, your assets will be looked at to determine your ability to pay in full or obtain a loan.

If you are applying as a business owner, it will be necessary to fill out the designated Collection Information Statement for Businesses. This is a comprehensive document that requests details regarding business operations and financials. Its recommended that you complete this document with the help of a tax professional. The terms of business installment agreements are similar to individual agreements. However, the length of an agreement is based on the amount owed.

Don’t Miss: 1099 Nec Doordash

Update For Businesses Required To File Withholding Returns

All withholding returns are required to be filed electronically starting with returns for periods beginning in 2020 or when the Department has an electronic system available, whichever is later.

The Department currently has three different methods of filing Arizona Form A1-QRT, Form A1-R, and Form A1-APR electronically:

Arizona State Income Tax Rates And Tax Brackets

Note that an additional 3.5% tax surcharge applies to those with a taxable income over $250,000 and over $500,000 .

|

Tax rate |

|

|---|---|

|

3.34% of taxable income over $27,808, plus $720. |

|

|

4.17% |

4.17% of taxable income over $55,615, plus $1,649. |

|

4.5% |

4.5% of taxable income over $166,843, plus $6,287. |

|

1% of taxable income over $250,000, plus $10,029. Plus, an additional 3.5% surcharge of taxable income over $250,000. |

|

Tax rate |

|

|---|---|

|

3.34% of taxable income over $55,615, plus $1,440. |

|

|

4.17% |

4.17% of taxable income over $111,229, plus $3,298. |

|

4.5% |

4.5% of taxable income over $333,684, plus $12,574. |

|

1% of taxable income over $500,000, plus $20,059. Plus an additional 3.5% surcharge of taxable income over $500,000. |

Recommended Reading: Doordash Paying Taxes

Types Of Residency Statuses In Arizona

|

If your Arizona residency type is… |

Arizona taxes this part of your income. |

|---|---|

|

Resident |

All income from all sources inside and outside Arizona. |

|

Part-year resident |

All income received while a resident, plus income from Arizona sources while a nonresident. |

|

Nonresident |

» Find a local tax preparer in Arizona for free:See who’s available in your area.

How Do I Know If I Owe State Taxes

You can determine whether or not you owe state taxes by utilizing one of numerous free resources.

Recommended Reading: Doordash And Taxes

Tax Season For Individual Income In Arizona Now Open

ADOR Recommends Filing Electronically for Quicker Processing

The State of Arizonas individual income tax filing season has launched and is now accepting electronically filed 2021 income tax returns. Before filing, ensure you have all documentation as some tax statements are not required to be sent until January 31, such as W-2s, 1099s, and annual tax summaries.

How To Withhold Arizona And/or Federal Income Taxes

There are two ways members can withhold Arizona and/or federal income taxes:

- Members may file quarterly estimate forms and not have any federal or state tax withheld from their monthly pension, or

- Members may elect to claim a number of allowances and have an additional amount withheld from each pension check. Log in to your myASRS account to make changes at any time, and they will become effective in the next payroll.

New retirees should declare tax elections as part of the online retirement application. Persons who fail to complete a withholding form will automatically have federal taxes withheld with a married with three allowances status. This rule is mandated by the Internal Revenue Service. State withholding will default to zero.

Don’t Miss: Does Doordash Take Taxes

Why Arent Arizona State Taxes Withheld From My Paycheck

Arizona does not allow withholding to be deducted or retained from wages paid for domestic service in a private home. This does not mean that AZ income taxes are not due on these wages, it simply means the employer is unable to withhold and remit them for their household employees.

If my employer cannot withhold my Arizona state income tax, then how do I pay it?

Arizona provides individual estimated tax payment forms to be filed quarterly. They also provide instructions on how to fill out the Arizona Form 140ES to ensure youre filing correctly to avoid any penalties and late fees.

How do I know how much to pay? I want to make sure I set aside enough each pay period.

The Withholding Calculator helps you identify your tax withholding to make sure you the correct amount of tax withheld from your paycheck.

The Calculator helps you determine whether you need to give your employer a new Form A-4 Arizona Withholding Percentage Election. You can use your results from the calculator to help you complete the form and adjust your income tax withholding.

HWS is Here to Help You!

Take Advantage Of Free Tax Preparation And Assistance

Phoenix, AZThe Arizona Department of Revenue presents a variety of free filing services for taxpayers this tax filing season. Taxpayers are strongly encouraged to e-file and direct deposit their refund for a more accurate and secure return which delivers refunds six times faster.

Also Check: How Do I Get A Pin To File My Taxes

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Registration In Other States

If you will be doing business in states other than Arizona, you may need to register your LLC in some or all of those states. Whether you’re required to register will depend on the specific states involved: each state has its own rules for what constitutes doing business and whether registration is necessary. Often activities such as having a physical presence in a state, hiring employees in a state, or soliciting business in a state will be considered doing business for registration purposes. Registration usually involves obtaining a certificate of authority or similar document.

For more information on the requirements for forming and operating an LLC in Arizona, see Nolo’s article, 50-State Guide to Forming an LLC, and other articles on LLCs in the LLC section of the Nolo website.

Read Also: Do They Take Taxes Out Of Doordash

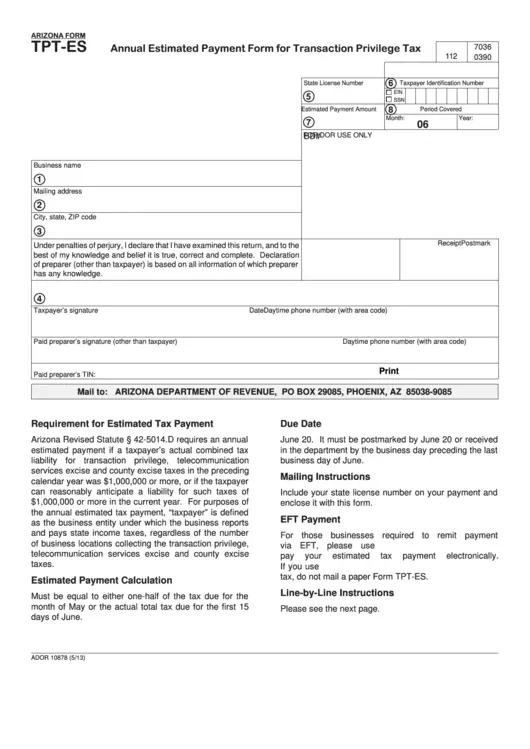

Taxable And Exempt Shipping Charges

For taxable sales:

- Delivery charges included in the sales prices are taxed with the sale

- Handling charges and combined shipping and handling charges are always taxable

For exempt sales:

- Delivery charges are exempt, regardless of whether theyre separately stated or included

There are exceptions to almost every rule with TPT, and the same is true for shipping and handling charges. Specific questions on shipping in Arizona and TPT should be taken directly to a tax professional familiar with Arizona tax laws.

For additional information, see Ruling LR13-003.

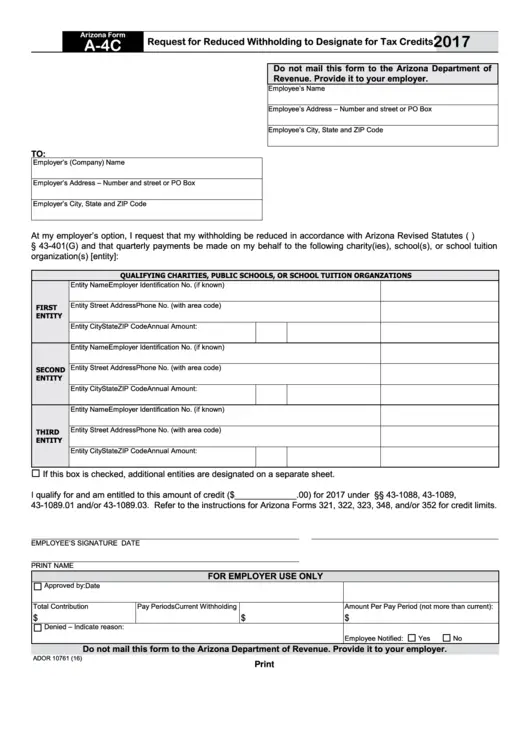

Information For Employers Employees And Individuals

Electing an Arizona Withholding Percentage Completing Arizona Form A4

All new employees subject to Arizona income tax withholding must complete Arizona Form A-4 within five days of employment. If the new employee fails to complete Arizona Form A-4 within 5 days of hire, the employer must withhold Arizona income tax at the rate of 2.7% until the employee elects a different withholding rate.

To elect an Arizona withholding percentage, an employee must complete Arizona Form A-4, Arizona Withholding Percentage Election, and submit it to his/her employer. Employees may request to have an additional amount withheld by their employer.

Existing employees may change their withholding amount by completing Arizona Form A-4 to change their previous withholding amount or percentage. Complete Arizona Form A-4 and provide it to your employer. Keep a copy for your records.

Employees who expect no Arizona income tax liability for the calendar year may claim an exemption from Arizona withholding. Employees claiming to be exempt from Arizona income tax withholding, complete Arizona Form A-4 to elect to have an Arizona withholding percentage of zero. Complete Arizona Form A-4 and provide it to your employer. Keep a copy for your records. This exemption must be renewed annually.

Arizona Residents Employed Outside of Arizona

Also Check: Appeal Cook County Taxes