An Individual Taxpayer Identification Number Helps Make Life Easier In The United States Whether Youre Here Temporarily Or Permanently

An individual taxpayer identification number is a tax processing number issued by the Internal Revenue Service to individuals who are not eligible to obtain an SSN but have taxes withheld and report income on their U.S. tax return.

Its used to file taxes and claim certain tax credits, such as the Earned Income Tax Credit . An ITIN can be obtained by filing Form W-7 with the IRS. Once you have an ITIN, you can start using it right away for things like paying your taxes or applying for benefits like medical insurance through healthcare.gov

What Are The Other Exceptions To Apply For An Itin

Here are some of the most common reasons for an ITIN other than filing a U.S. non-resident tax return and the additional information you will need to provide:

| Persons who are eligible to claim Exception | Documentation you must submit if you are eligible to claim Exception | |

| Third Party Withholding on Passive Income | Individuals who are receiving distributions during the current tax year of income such as pensions, annuities, rental income, royalties, dividends, etc., and are required to provide an ITIN to the withholding agent for the purposes of tax withholding and/or reporting requirements. | A signed letter or document from the withholding agent, on official letterhead, showing your name and verifying that an ITIN is required to make distributions to you during the current tax year that are subject to IRS information reporting or federal tax withholding. |

| Third Party WithholdingDisposition by a Foreign Person of U.S. Real Property Interest | A withholding obligation generally is imposed on a buyer or other transferee when the buyer acquires a U.S. real property interest from a foreign person. In some instances, the foreign person may apply for a withholding certificate to reduce or eliminate withholding on the disposition of real property. |

Note:For the seller of the property, copies of Forms 8288 and 8288-A submitted by the buyer should be attached to Form W-7 |

Will My Fellowship Be Put On Hold If I Do Not Have An Individual Taxpayer Identification Number

To comply with IRS tax rules, you must submit complete GLACIER tax records to the Payroll Office and a complete ITIN application to the Berkeley International Office. Berkeley International Office will notify the Payroll Office that you have applied for an ITIN. The Payroll Office will then release the funds. The UCB Payroll Office is allowed to issue the payment before the ITIN is issued by the IRS.

Don’t Miss: How To Pay Taxes Doordash

How Do You Get An Itin

You must properly complete Form W-7 and attach a valid U.S. federal income tax return, unless you qualify for an exception. You must also attach documentation to establish your identity and your connection to a foreign country. The one standalone document that satisfies both identity and foreign status is a current Foreign country passport. If you do not have a current Foreign country passport, one of the other documents from the list must be provided to prove foreign status and an additional document must be provided to prove identity.

About Form 1041 Us Income Tax Return For Estates And Trusts

The fiduciary of a domestic decedent’s estate, trust, or bankruptcy estate files Form 1041 to report:

- The income, deductions, gains, losses, etc. of the estate or trust.

- The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

- Any income tax liability of the estate or trust.

- Employment taxes on wages paid to household employees.

Read Also: Is A Raffle Ticket Tax Deductible

American Opportunity Tax Credit

This credit is worth up to $2,500 and can help reduce educational expenses to attend college. The credit is only available for the first four years of a students postsecondary education. Eligible students must be pursuing a degree or another recognized credential.

This non-refundable credit is worth up to $2,000 per household. It can be used to help reduce any post-secondary educational expenses and isnt limited to people attending college.

Note: You CANNOT claim the Earned Income Tax Credit with an ITIN.

Who Uses An Itin

Taxpayers who file their tax return with an ITIN include undocumented immigrants and their dependents as well as some people who are lawfully present in the U.S., such as certain survivors of domestic violence, Cuban and Haitian entrants, student visaholders, and certain spouses and children of individuals with employment visas. As of August 2012, the IRS had assigned 21 million ITINs to taxpayers and their dependents.

Once a person who has been issued an ITIN is eligible to apply for an SSN, the person may no longer use the ITIN.

Read Also: How To Calculate Doordash Taxes

What The Irs Decided To Do

Its come out with the Individual Tax Identification Number, the ITIN to help them do so. Take it a step further there was also a demand for people who were in this country.

And who did not have Social Security Numbers but were trying to open up bank accounts, trying to apply for credit cards, trying to do a lot of other things so the ITIN also became the alternative social security number for those purposes as well.

Then take it internationally, there was a significant amount of non-residents living abroad who also would need the ITIN for their tax reporting purposes as well too.

Whether they were earning specific types of income like royalties or dividends or rental income, pensions, annuities for many US companies, or they had US registered businesses that they were operating from abroad, and they had tax reporting requirements.

What Identification Documentation Do I Need To Provide

- The IRS used to give out the ITIN with only notarized copies of identification documents. In recent years the IRS has made changes to this and now requires certified copies or originals to be submitted.

- We recommend a certified copy of your passport. To get a certified copy of your passport, you must drop your passport at the Canada passport office, they will hold the passport for approximately 10 business days, and then you will receive your passport and certified copy. We also recommend getting two copies just in case.

Below is the list of identification documentation:

| *Can be used to establish foreign status only if they are foreign documents |

You May Like: Is Door Dash 1099

Understanding The Tax Identification Number

A tax identification number is a unique set of numbers that identifies individuals, corporations, and other entities such as nonprofit organizations . Each person or entity must apply for a TIN. Once approved, the assigning agency assigns the applicant a special number.

The TIN, which is also called a taxpayer identification number, is mandatory for anyone filing annual tax returns with the IRS, which the agency uses to track taxpayers. Filers must include the number of tax-related documents and when claiming benefits or services from the government.

TINs are also required for other purposes:

- For credit: Banks and other lenders require Social Security numbers on applications for credit. This information is then relayed to the to ensure the right person is filling out the application. The also use TINsnotably SSNsto report and track an individual’s .

- For employment: Employers require an SSN from anyone applying for employment. This is to ensure that the individual is authorized to work in the United States. Employers verify the numbers with the issuing agency.

- For state agencies: Businesses also require state identification numbers for tax purposes in order to file with their state tax agencies. State taxing authorities issue the I.D. number directly to the filer.

An Itin Makes It Easier To Buy A Home Or Rent An Apartment

If you live in the U.S., chances are youre going to need an ITIN at some point or another. Whether its to rent an apartment, buy a house, or even get a business licenseyou can use your ITIN for all of these purposes.

If you want to purchase something like a car but dont have the financial means to buy one outright yet, sometimes banks will allow people with good credit scores to finance their cars through them instead of having them pay cash upfront.

However, since most banks require proof of identification before they give out any money under any circumstance , obtaining an ITIN is usually necessary if someone doesnt have a social security number or other official documentation that proves their identity and residence within the United States.

Read Also: Internal Revenue Service Tax Returns

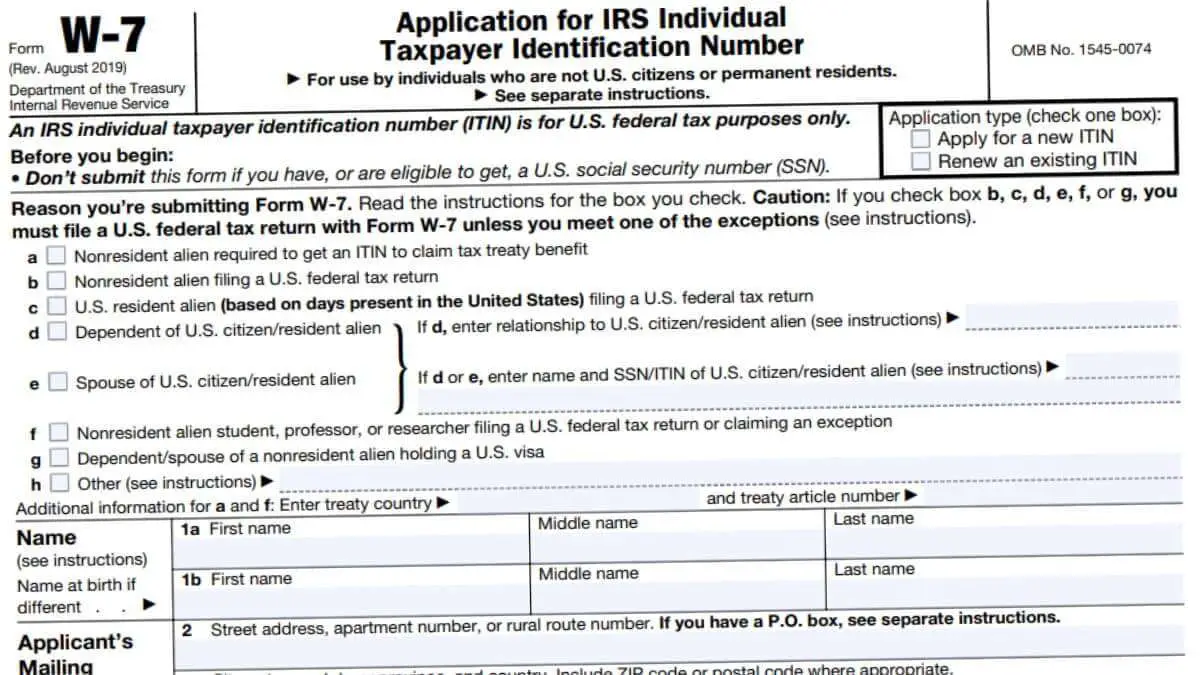

How Do I Apply For An Itin

If you want to file a tax return but cannot obtain a valid SSN, you must complete IRS Form W-7, Application for IRS Individual Taxpayer Identification Number. Form W-7 must be submitted to the IRS with a completed tax return and documents verifying identity and foreign status. You will need original documents or certified copies from the issuing agencies. The instructions for Form W-7 describe which documents are acceptable.

Parents or guardians may complete and sign a Form W-7 for a dependent under age 18 if the dependent is unable to do so, and must check the parent or guardians box in the signature area of the application. Dependents age 18 and older and spouses must complete and sign their own Forms W-7.

There are three ways you can complete the ITIN application:

What If I Dont Have An Immigration Status That Authorizes Me To Live In The Us

Many people who are not authorized to live in the United States worry that filing taxes increases their exposure to the government, fearing this could ultimately result in deportation. If you already have an ITIN, then the IRS has your information, unless you moved recently. You are not increasing your exposure by renewing an ITIN or filing taxes with an ITIN.

Current law generally prohibits the IRS from sharing tax return information with other agencies, with a few important exceptions. For instance, tax return information may in certain cases be shared with state agencies responsible for tax administration or with law enforcement agencies for investigation and prosecution of non-tax criminal laws. The protections against the disclosure of information are set in law so they cannot be rescinded by a presidential executive order or other administrative action unless Congress changes the law.

Knowing the potential risks and benefits involved, only proceed with an ITIN application or tax filing if you feel comfortable. This information does not constitute legal advice. Consult with an immigration attorney if you have any concerns.

You May Like: Do You Pay Taxes With Doordash

An Itin Gives You Instant Access To Tax Credits And Deductions

An ITIN will give you instant access to tax credits and deductions that you would otherwise miss out on, as well as the ability to file a tax return. The IRS issues ITINs for individuals who are not eligible for a Social Security number. For example, if youre a nonresident alien or resident alien but dont have an SSN, the IRS will issue an ITIN in place of your SSN.

If your employer has already filed taxes on your behalf and used an incorrect Social Security number instead of an Individual Taxpayer Identification Number , they must amend their mistakes before April 15th so that they do not get charged with penalties by the IRS.

Itin Holders Pay Taxes

- ITINs let more people pay into the system, which builds the tax base. According to the IRS, in 2015, 4.4 million ITIN filers paid over $5.5 billion in payroll and Medicare taxes and $23.6 billion in total taxes.

- ITIN holders are not eligible for all of the tax benefits and public benefits that U.S. citizens and other taxpayers can receive. For example, an ITIN holder is not eligible for Social Security benefits or the Earned Income Tax Credit . However, if that person becomes eligible for Social Security in the future , the earnings reported with an ITIN may be counted toward the amount he or she is eligible to receive.

- Some ITIN holders are eligible for the Child Tax Credit . According to federal legislation passed in March 2021, the CTC may be worth up to $3,600 for each child under 6 and up to $3,000 for each child age 6 to 17, depending upon the applicants income. Because ITIN holders are eligible for the CTC, the IRS estimated in 2014 that up to 4 million U.S.-citizen children of ITIN holders benefit from the tax credit. If a child does not have a SSN, he or she is not eligible for the tax credit.

Don’t Miss: What Home Improvement Expenses Are Tax Deductible

What Must I Do To Get An Itin

- First is that you must have a reason to need or apply for an ITIN that meets the application requirements. The most common reason is to file a U.S. non-resident tax return and the application is submitted with your return.

- There are of course many other reasons to apply for an ITIN and other options have additional documentation that must be submitted if the ITIN application is not being sent in with a tax return. Please see the common exception information further below.

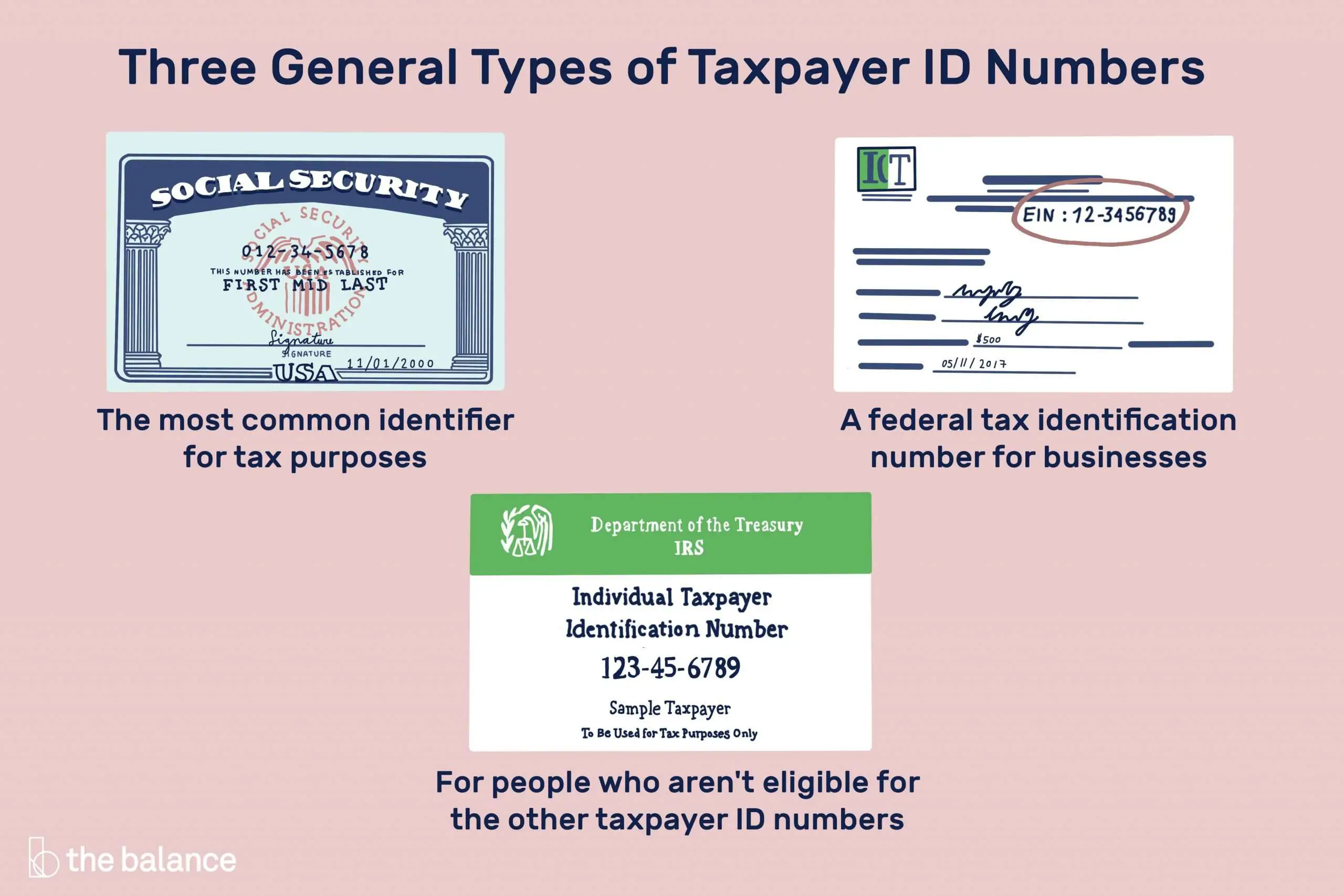

What Is A Tax Id Number

A tax identification number, or TIN, is a unique nine-digit number that identifies you to the IRS. It’s required on your tax return and requested in other IRS interactions. Social Security numbers are the most popular tax ID numbers, but four other kinds are popular too: the ITIN, EIN, ATIN and PTIN.

You May Like: How To Get A 1099 From Doordash

How Long Does It Take To Receive An Itin From The Irs

It takes approximately 8-12 weeks for the IRS to process and issue an ITIN, which will be sent to the student by mail. Any inquiry regarding an ITIN application status should be directed to the IRS hotline at 1-800-829-1040. If an ITIN rejection or request for additional information is received, please bring the notice along with the materials used to apply for the ITIN to Berkeley International Office. If the ITIN application is approved, log in to GLACIER and enter the number into the record.

How Long Does It Take To Receive An Itin

Outside of peak processing times , it should take up to six weeks for an applicant to receive their ITIN. However, because most ITIN applications must be filed with tax returns, they are typically filed during peak processing times. As a result, it can take 8 to 10 weeks to receive an ITIN. Any original documents or certified copies submitted in support of an ITIN application will be returned within 65 days. People who do not receive their original and certified documents within 65 days of mailing them to the IRS may call 1-800-908-9982 to check on their documents whereabouts.

After the ITIN application has been approved, the IRS will process the tax return within 6 to 8 weeks.

Recommended Reading: Do You Have To Pay Back Taxes For Doordash

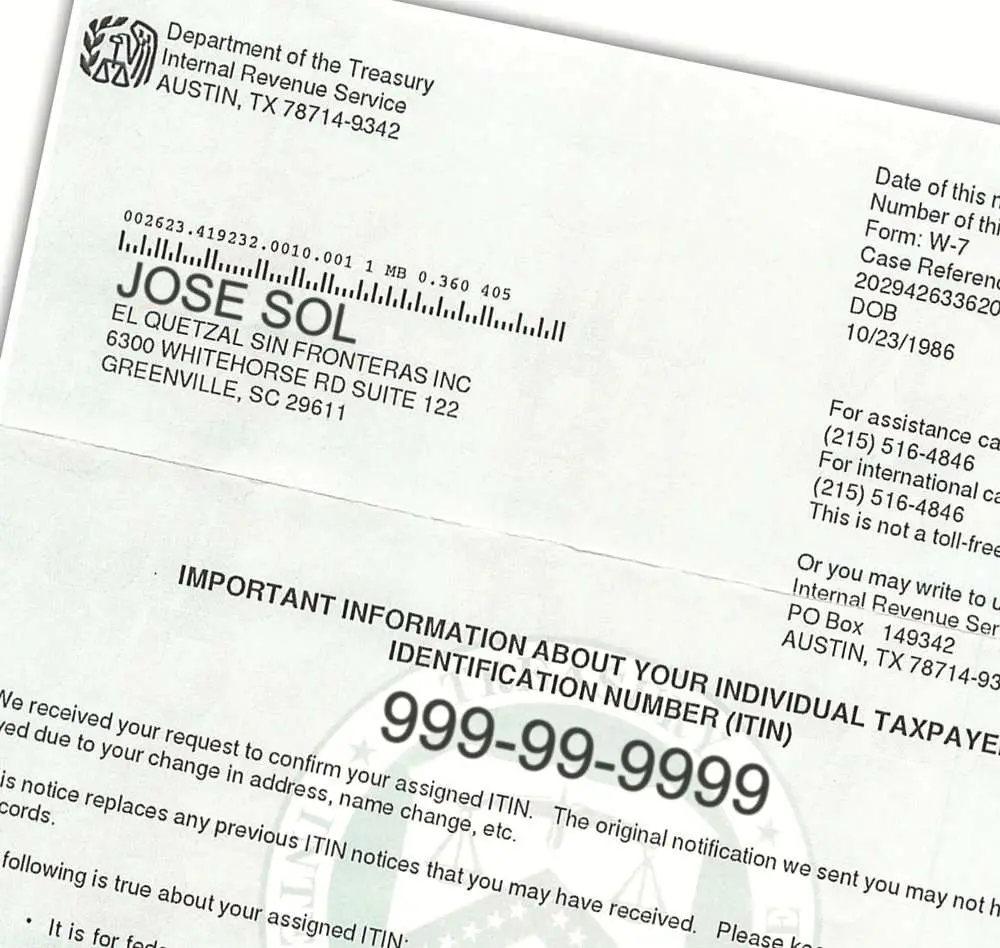

Individual Tax Identification Number

An individual taxpayer identification number is a tax processing number, issued by the Internal Revenue Service, for resident and non-resident aliens, their spouses and their dependents, if they are not eligible for a Social Security number. The ITIN is a nine digit number beginning with the number 9, has a range of numbers from 50 to 65, 70 to 88, 90 to 92 and 94 to 99 for the fourth and fifth digits, and is formatted like a Social Security number . Only individuals who have a valid tax filing requirement or are filing a U.S. federal income tax return to claim a refund of over withheld tax are eligible to receive an ITIN. ITINs are used for tax purposes only and are not intended to serve any other purpose. The ITIN does not authorize you to work in the U.S. or to receive Social Security benefits, is not valid for identification outside the tax system, and does not change your immigration status.

How Can I Get A Tin

You can get a tax identification number by applying directly to the correct agency. For instance, you can get a Social Security number through the Social Security Administration. If you need an Individual Taxpayer Identification number or one for a business, you may be able to obtain one directly from the Internal Revenue Service.

Recommended Reading: Is Doordash Taxed

Credit For Other Dependents

A $500 non-refundable credit is available for families with qualifying relatives. This includes children over 17 and children with an ITIN who otherwise qualify for the CTC. Additionally, qualifying relatives who are considered a dependent for tax purposes , can be claimed for this credit. Since this credit is non-refundable, it can only help reduce taxes owed. If you are eligible for both this credit and the CTC, this will be applied first to lower your taxable income.

The Application Process Is Straightforward And Free Of Charge

An ITIN is easy to obtain, and the application process doesnt cost you anything.

You can apply for an ITIN by mail or online if you choose to do so by mail, simply complete Form W-7 with all requested information and mail it to the address specified on the form. If you prefer to apply electronically, submit your completed W-7 Form electronically.

Recommended Reading: Is Doordash Money Taxed