Withdrawal Taxes: How To Minimize Them

You wont be able to get out of paying taxes on the funds you withdraw from your 401. However, there are a couple of tips and tricks that might help you lower the total tax you pay. Be sure to check with a tax expert or financial advisor if you want to be sure of the best course of action for your specific situation.

If you happen to hold stock of your company within your 401 account, you could potentially treat the appreciation of that stock as a capital gain rather than ordinary income. The long-term capital gain tax rate is 0%, 15% or 20%, depending on your tax bracket. For many investors, this means a lower tax rate than their ordinary income tax rate. To actually pull this off, youll need to transfer the stock into a taxable brokerage account. Dont be afraid to consult with an expert if you want to take advantage of this strategy.

The other factor to consider is your tax bracket. If your 401 distributions will put you in the lower end of one tax bracket, see if you can start distributions earlier, spreading things out and potentially dropping you into a lower bracket. As long as you start after age 59.5, you could save on your total tax bill with this method.

If I Place A Request For An Ira Withdrawal After December 15 Will My Withdrawal Be Processed For The Current Or Next Year For Whatyear Will This Withdrawal Be Reportable

The IRS refers to the date a withdrawal is processed to determine the year to which it is applicable. The amount oftime it takes for an IRA withdrawal request to be processed varies by the withdrawal method selected .

If your IRA withdrawal affects your taxes or is intended to satisfy your minimum required distribution for the current year, make sure that:

- You allow adequate processing time. Submit your online request by December 15thof the current year

- Your brokerage IRA Core account has sufficient funds to cover the withdrawal

- You are not requesting a second brokerage IRA withdrawal on the sameday, or if an earlier request is still pending

- You are not requesting a second IRA withdrawal from the same mutual fund ina mutual fund IRA when there is another request pending for the same mutual fund

If you are requesting a distribution after December 15, please call a Fidelity representative at 800-544-6666 to determine the best wayto process your IRA distribution to satisfy any applicable deadlines.

What If I Withdraw Money From My Ira

Generally, early withdrawal from an Individual Retirement Account prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. There are exceptions to the 10 percent penalty, such as using IRA funds to pay your medical insurance premium after a job loss. For more information, see Hardships, Early Withdrawals and Loans.

You May Like: 1040paytax.com Safe

Who Can Take Advantage Of This Tax Break

The QCD provision was intended to help older individuals who were no longer working and required some of their IRA assets in order to pay for living expenses.

However, planners have been able to take advantage of the rule by setting up a donor-advised fund at their local community foundation, which can be established by anyone over the age of 70 1/2.

Why Would Someone Want To Do This

The QCD provision was designed with older individuals who had limited financial resources in mind, but it can also be used by anyone who wants to lower his or her adjusted gross income.

For instance, someone who is retired and has no dependents but also has limited resources might want to use this provision in order to avoid paying income taxes on their IRA distributions.

However, in todayâs low-interest-rate environment, qualified charitable distributions can be an attractive option for individuals who are looking to generate an additional return on their investments.

Also Check: How Can I Make Payments For My Taxes

How Can I Avoid Paying Taxes On My 401k Early Withdrawal

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Withdrawal Taxes And Early Distributions

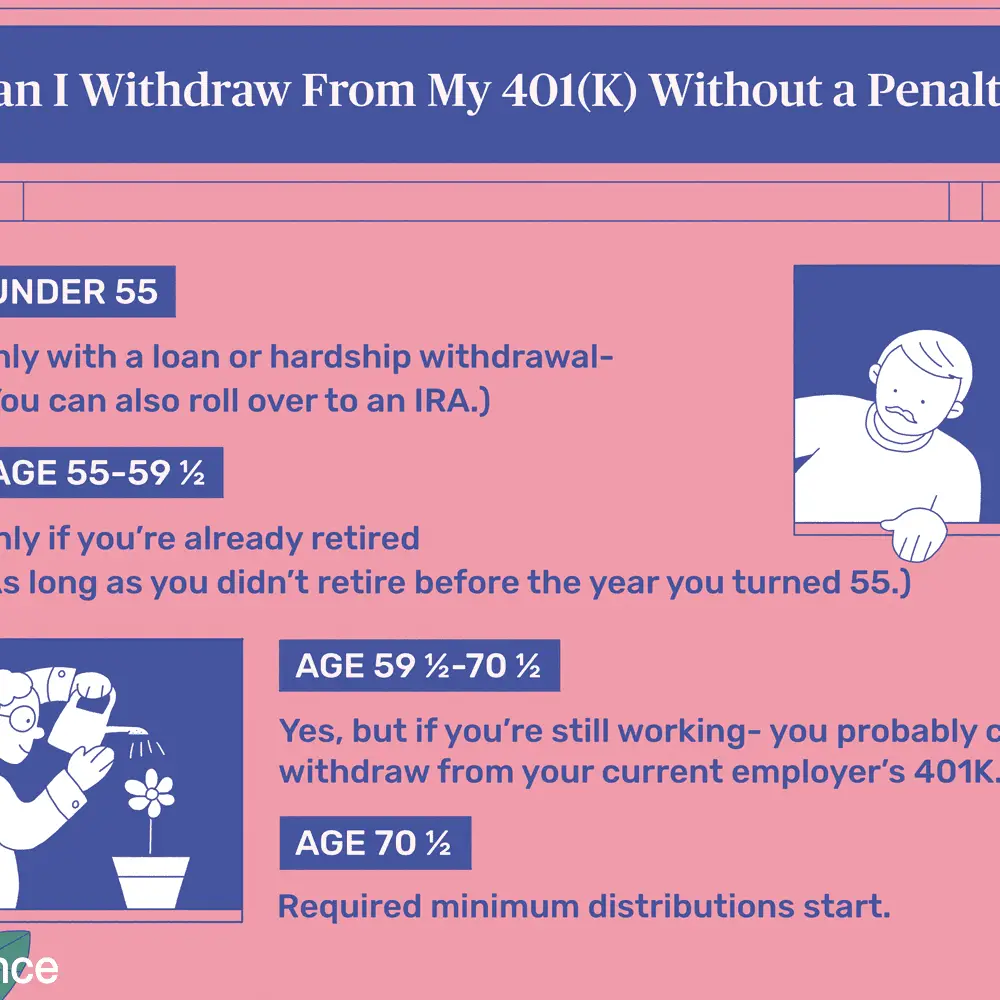

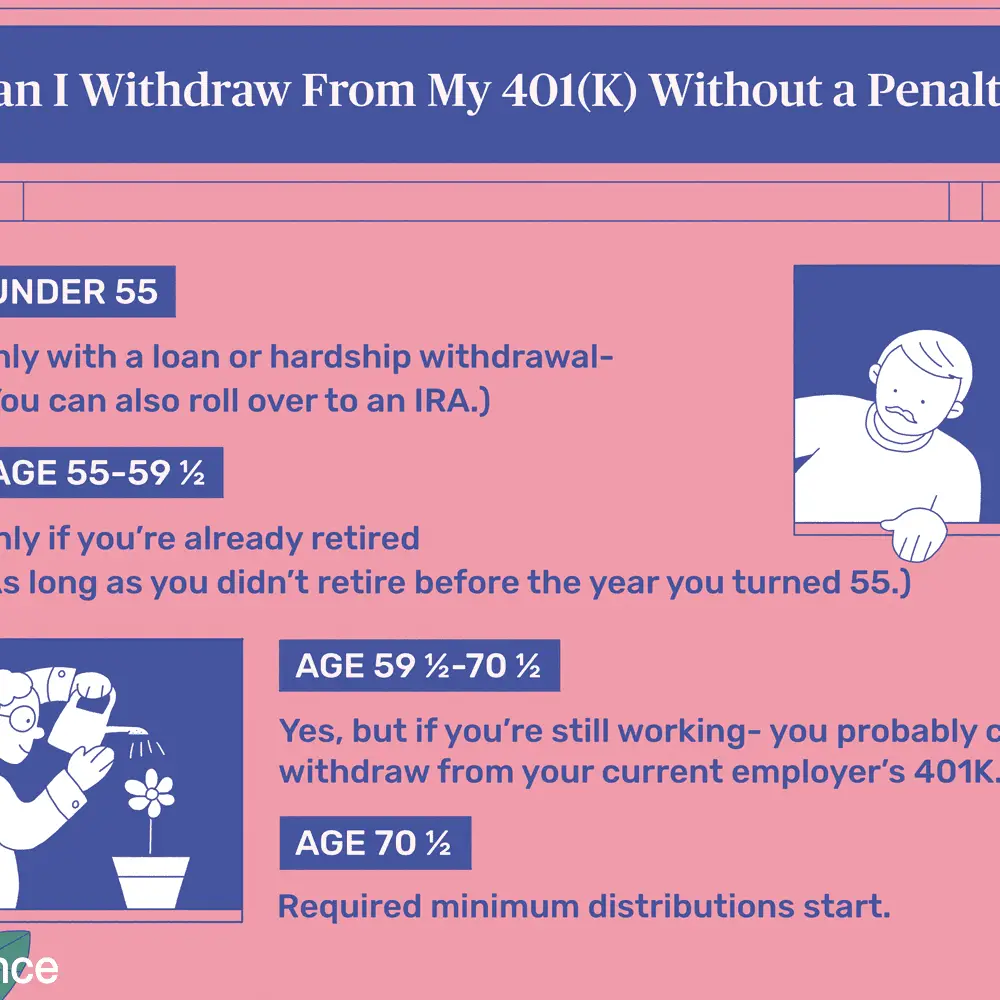

You might find yourself in a situation where you need the money in your 401 before you reach 59 1/2 years of age. The account is designed to be part of your retirement plan, but circumstances come up where you cant avoid dipping into the money for other reasons. Down payments, emergency medical bills and education costs are a few examples of expenses some people pay with 401 funds.

If this is the case for you, expect to pay a 10% penalty fee. This is on top of the income tax youll pay for withdrawing the funds. Remember, even if its paying for an emergency, its still counted for tax purposes as income. Youll want to run the numbers, adding the tax and penalty tax, to see if it makes sense to pull money out early. Its also important to factor in the opportunity cost of pulling your investments out of the market.

In some cases, there is an exception to the 10% additional tax. The IRS lists the circumstances where the tax doesnt apply. Losing your job at 55, or starting a SOSEPP plan are two examples. Youll still be on the hook for income taxes, of course.

Given the tax hit and opportunity cost of early withdrawals, its not ideal solution. Before you commit to a penalized withdrawal, consider if borrowing the money from your 401 might be a better solution.

Don’t Miss: How To File Taxes Without Income To Get Stimulus Check

Tips For Managing Your Retirement Plans

- You unfortunately cant save for retirement twice. So if you find yourself struggling to plan for retirement on your own, maybe its time to enlist the aid of a fiduciary financial advisor. These professionals often have experience building investment portfolios to serve specific financial planing goals, retirement included. Take a few minutes to go through our questionnaire so your matches are the best suited for your personal needs.

- Curious how far your current assets will get you in retirement? Our retirement calculator can help shed some light on the matter. Just tell us where you plan to retire, your current annual income, your monthly savings, your anticipated annual retirement expenses and your social security election age. Using this information, you can see how much more you need to save to reach your goals.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How Does H And R Block Charge

Withdrawing Money From The Traditional Nyce Ira

To take a distribution from your account, you must submit a Traditional NYCE IRA Withdrawal Form.

You can take a full or partial distribution from your account, or you can schedule periodic payments. Periodic payments are distributions made over regular intervals and can be made monthly, quarterly, semi-annually, or annually.

* Distributions as a result of death, disability or divorce, please contact the NYCE IRA Administrative Office at 306-7760, or 888-IRA-NYCE, if outside NYC, for instructions.

How To Calculate How Much Taxes I Have To Pay On Ira Withdrawal

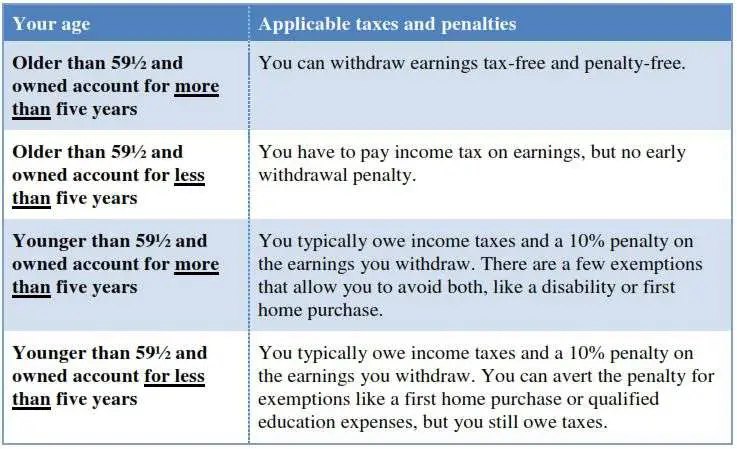

IRA withdrawals must be recorded on your income tax returns, even if you do not owe any tax. When you take a qualified distribution from a Roth IRA, meaning you are at least 59 1/2 years old and the account has been open for at least five years, you may withdraw as much as you want without paying any income taxes. With a withdrawal from a traditional IRA, the entire amount is taxable unless you made nondeductible contributions, qualified or not. However, if you take an early distribution, you also owe a penalty unless an exception applies. You can find an IRA withdrawal calculator online to figure out your taxes, but you can also calculate them on your own.

Recommended Reading: How To Buy Tax Lien Properties In California

Ira Tax Calculator Concepts

A traditional individual retirement account lets you put money into an account while you’re working, deducting the amount of your contributions from your taxable income. You can open an IRA with a bank, brokerage firm or other institution of your choice. You can generally put $5,500 into IRAs each year, although you’re allowed to put up to $6,500 once you turn 50. You will pay a penalty if you withdraw funds from your traditional IRAs before retirement age.

When you are 59 1/2 or older, you can withdraw money from your IRA without paying a penalty, though you will pay ordinary income tax on the money you take out. How much tax you owe depends upon your income tax rate, which depends on your total income, including retirement account withdrawals and any work or other investment income you may have.

For that reason, opening a traditional IRA can be especially useful if you expect you’ll be in a lower tax bracket when you retire than when you’re working. This is a common scenario, since people lose their regular salaries once they stop working.

Your total tax also depends on any deductions and credits you may have. Some common examples include deductions for mortgage or student loan interest and charitable donations or credits for dependent care.

Roth Ira Conversion Rules

A Roth IRA can be a great place to stash retirement savings. Unlike a traditional IRA, there is no income tax to pay on money you withdraw or rules forcing you to empty a minimum amount annually from your account when you reach a certain age.

Even better, these retirement accounts are pretty much available to everyone. While you canât contribute to a Roth IRA if your income exceeds the limits set by the IRS, you can convert a traditional IRA into a Rothâa process thatâs sometimes referred to as a âbackdoor Roth IRA.â

Also Check: How Much Does H & R Block Charge For Taxes

The Medicare Tax Crossover Zone

Notwithstanding the fact that distributions from retirement accounts are not treated as investment income subject to the 3.8% Medicare surtax, the reality is that distributions from such accounts actually can cause the 3.8% surtax to indirectly apply anyway. An example will help to illustrate.

Assume Betsy, a single taxpayer, has $175,000 of employment income and $40,000 of capital gains . Her Adjusted Gross Income will be $215,000, and since she is over the $200,000 threshold for individuals she will be subject to the 3.8% Medicare surtax on the last $15,000 of her capital gains , as shown in the chart to the left. If Betsy recognizes any additional capital gains , they will all fall on top above the threshold for the 3.8% Medicare surtax and thus also be subject to the tax.

However, if Betsy decides to complete a $10,000 Roth conversion from her existing IRA, her ordinary income will grow larger , which will push more of her investment income across the threshold. The end is that even though the Roth conversion or IRA distribution itself is not treated as investment income subject to the 3.8% Medicare surtax, it will push other already existing investment income over the line anyway, resulting in the Medicare surtax on the last $25,000 of capital gains!

How Can I Take The Required Distribution

You can take your distribution in one withdrawal, or make withdrawals throughout the year. To set up scheduled, automated withdrawals use the ÂAutomated Withdrawals link, and follow the instructions. If you do not set up automated withdrawals, you can take your distribution anytime before the December 31 deadline please allow enough time for any trades to settle before the last business day of the year. You can make a withdrawal from your IRA online, or request a withdrawal by phone or at a Fidelity Investor Center.

Recommended Reading: Turbo Tax 1099q

What To Know When Filing

While IRA withdrawals aren’t subject to Social Security tax, they can make your Social Security benefits taxable. You don’t normally pay tax on benefits, but that changes if you have added income. Take half your Social Security income for the year and add it to your adjusted gross income, plus any tax-exempt interest you earn. If you’re married and filing a joint return and your total AGI is $32,000 to $44,000, you may have to pay income tax on up to 50 percent of your benefits. If your income is above $44,000, up to 85 percent of your benefits are taxable. Your IRA withdrawals count as part of your AGI. So you’ll want to consider that when you decide how much to withdraw from your IRA.

Age 59 And Over: No Withdrawal Restrictions

Once you reach age 59½, you can withdraw funds from your Traditional IRA without restrictions or penalties. You can make a penalty-free withdrawal at any time during this period, but if you had contributed pre-tax dollars to your Traditional IRA, remember that your deductible contributions and earnings will be taxed as ordinary income. In other words, you will now owe the taxes that you originally deferred. You can keep taking advantage of tax-deferred contributions regardless of your age, as long as you have earned income. But, you will be required to start taking Required Minimum Distributions for the year you turn age 72. Learn more about Traditional IRA rules.

You May Like: Do I Need W2 To File Taxes

What Is An Early Distribution

A distribution from a traditional IRA prior to the age 59 1/2 is generally considered to be an early withdrawal. An early withdrawal from an IRA is potentially subject to a 10% excise tax penalty unless the distribution is rolled over or converted to another IRA within 60 days. When the early withdrawal is due to disability, or if you are the beneficiary on a deceased individual’s IRA, distribution by death, the penalty may be waived. For more information, access Fidelity’s online Retirement Investing Center and consult a tax advisor about your particular situation.

Other exceptions exist for early distributions due to:

- A series ofsubstantially equal periodic payments based on the owner’s life expectancy

- Deductible medical expenses in excess of 7.5% of adjustedgross income

- Qualified first-time home buyer expenses

- Qualified higher education expenses

- An IRS levy against the account

Please call a Retirement Specialist at 800-544-6666 for more information.

How Traditional Ira Withdrawals Are Taxed

With a traditional IRA, any pre-tax contributions and all earnings are taxed at the time of withdrawal. The withdrawals are taxed as regular income , and the tax rate is based on your income in the year of the withdrawal.

The idea is that you are subject to a higher marginal income tax rate while you are working and earning more money than when you have stopped working and are living off of retirement incomealthough this is not always the case.

Although taxes are assessed at the time of withdrawal, there are no additional penalties, provided that the funds are used for a qualified purpose or that the account holder is 59½ years of age or older. Qualified purposes for an early withdrawal from a traditional IRA include a first-time home purchase, qualified higher education expenses, qualified major medical expenses, certain long-term unemployment expenses, or if you have a permanent disability.

Traditional IRA contributions can be tax-deductible or partially tax-deductible based on your modified adjusted gross income if you contribute to an employer-sponsored plan, such as a 401.

In 2021, an individual with a MAGI between $66,000 to $76,000 is eligible for at least partial deductibility, as is a married couple filing jointly with a MAGI of between $105,000 to $125,000. For 2022, the MAGI for individuals is $68,000 to $78,000, and for married couples filing jointly, it’s $109,000 to $129,000. There are no income limits on who can contribute to a traditional IRA.

Recommended Reading: Www.myillinoistax

What Is The 5 Year Rule For A Roth Ira 2019

The five-year period begins on the first day of the tax year for which you contributed to the Roth IRA, not necessarily the year in which you retire. Therefore, if you first contributed to the Roth IRA in early 2020, but the contribution was for fiscal year 2019, five years will end on January 1, 2024.

How Much Tax Will You Pay On Withdrawals

For Roth IRAs, you can take out any contributions to account at any time without paying tax. And if you have any earnings on the money, its simple to figure out how much tax youll pay on qualified distributions: zero. That sounds suspiciously easy, but thats part of the Roths appeal.

Ok, theres one major stipulation on the Roths tax-free policy. Its called the five-year rule, and it says that you can take the earnings out tax-free only if five years have elapsed since the tax year of your first Roth contribution. Its not onerous, but its key to know about the five-year rule. Then when youre retired, defined as older than 59 ½, your distributions are tax-free. They are also tax-free if youre disabled or in certain circumstances if youre buying your first home.

In contrast, for a traditional IRA, youll typically pay tax on withdrawals as if they were ordinary income. If youre in the 20 percent marginal tax bracket, youd owe 20 percent of the withdrawal.

However, for traditional IRAs, the amount that you owe taxes on also depends on whether you were able to contribute with pre-tax money or not. If you werent able to take a tax break for current taxes, youre contributing after-tax money to the IRA. Therefore, the IRS doesnt charge you on this nondeductible portion of a withdrawal, though youll still owe taxes on any earnings.

Recommended Reading: File Missouri State Taxes Free