Here’s How Free File Works:

Most companies provide a special offer for active duty military personnel who earned $69,000 or less. Those taxpayers can choose from any participating Free File provider regardless of the company’s other eligibility standards. Free File also can be a valuable tool for younger taxpayers or first-time filers with modest incomes as well as retirees and working families seeking to save money.

Free File providers also offer state tax return preparation, some for free and some for a fee. Again, use the “look up” tool to find the right product. There are two products in Spanish. With Free File, you can even use any digital device, personal computer, tablet or smart phone. Free File products are mobile enabled so you can do your taxes on your smart phone or tablet and e-File with your hand-held device.

Anyone: Credit Karma Tax

If you arent eligible for the IRS Free File Program, you can still do your taxes online for free.

with no upsells. You cant even pay for an upgradeCredit Karma Tax is completely free. Like with , Credit Karma Tax makes money by showing you offers for financial products like credit cards and loans based on your financial situations. It includes both federal and state filingall free.

If you dont have to file a state return, you might also look at FreeTaxUSA. It lets you file a federal return for free, but requires payment for a state return.

Note that Credit Karma Tax doesnt support more complicated situations like part-year state returns, multiple state returns, and nonresident state returns. It also doesnt support forms like Form 1116 for the Foreign Tax Credit and Schedule K-1 for Estate and Trust income. Be sure to read the list of forms and situations Credit Karma doesnt support before you choose to use it.

In 2020, Credit Karmas tax software has been around for a few years, but its still new compared to its competitors. To double-check Credit Karmas work, you might want to run your numbers through a paid software product like TurboTax before filing with Credit Karma. You can double-check Credit Karmas work with TurboTax without paying anything, as you only pay TurboTax when you file. If TurboTax and Credit Karma Taxs numbers match, you can have confidence in Credit Karma Taxs numbers.

How Do I File My Taxes Online

Filing your taxes with TurboTax Free is quick and easy. First youll be asked to set up a profile and follow a simple process to find all the credits and deductions youre entitled to. With the CRAs Auto-fill my return, you can also import your tax info directly from the CRA. This service pulls info from your income slips , government benefit slips, RRSP receipts, and unused tuition credits. All the relevant info will be populated from these forms into your tax return saving you time and effort.

If you decide not to use CRAs Auto-fill my return service, or if you have additional info to enter that isnt captured through the import, you can find all the forms you need quickly and easily through TurboTaxs search feature.

You can also easily look for all the credits and deductions that apply to you using the search bar in TurboTax Free. If youre not sure where to start, heres a list of common credits, deductions, and expenses you may be eligible for:

Once youve entered all your info for the year and youre ready to file, our software will guide you through the steps to NETFILE your return online or print and mail your return. Well also give you step-by-step instructions on how to pay the CRA if you owe taxes.

Don’t Miss: When Will We Get Our Taxes 2021

How Do I Choose The Right Tax Preparation Method

If you dont feel comfortable using tax software or just want live support, free in-person or virtual tax preparation is your best option. You may be able to find tax support from your local free tax site or Code for Americas Get Your Refund service.

If you feel comfortable filing your taxes with minimal support, free online filing services like MyFreeTaxes or Free File Alliance may provide what you need.

If you have self-employment income or make more money than the income limits for certain free tax filing programs, you can find a paid tax preparer or paid tax software. For paid tax software, use NerdWallets best tax software chart to compare options and find the best choice for your specific tax situation.

If you prefer in-person paid assistance, make sure to research your options first. Unfortunately, the tax industry is not regulated, so be careful when looking for assistance. Although many paid preparers are honest, some preparers take advantage of their clients by not disclosing their fees or offering refund anticipation products.

Irs Free File A Basic But Underwhelming Solution

The IRS provides a Free File solution for taxpayers. Unfortunately, the software is limited. You need to bring your own tax preparation skills to the table. Well show you a better method further down the article.

Free File with the IRS. The IRS recently began offering Free File Fillable Forms to everyone, regardless of income .

The Free File Fillable Forms are online versions of the paper forms. However, they are designed for people who are comfortable and skilled at doing their own taxes. These forms only offer basic calculations. The other downside is that the IRS only offers the Federal versions of these forms it is up to you to track down your state tax forms if required by your state.

Free File with a Private Company. The IRS also contracts with multiple private companies to provide free tax software to taxpayers under a certain Adjusted Gross Income . Taxpayers with an AGI less than $64,000 are qualified to file their federal taxes free through a participating company. Again, state taxes are not included in the Free File offer. Companies that offer Free File may have different eligibility requirements for their Free File program, and the available forms and services may vary be sure to read the details.

Don’t Miss: How Can You File Taxes From Previous Years

Identify The Suitable Itr Form

A significant step towards filing income tax return is to identify the tax return form that is applicable for an individual taxpayer, as below:

# ITR-1

- Resident and ordinarily resident individuals with total income of 50 lakh and below,

- Having salaried income,

- Agricultural income up to 5,000,

- Income from other sources,

- Despite their source or quantum of income, non-residents cannot file ITR-1.

# ITR-2

Individuals who do not have income from profits and gains of business or profession can use ITR-2.

# ITR-3

This is apt for individuals who have an income from profits and gains of profession or business.

# ITR-4

- It is suited for individuals, and firms that are residents,

- have total income 50 lakh and below

- have income from business and profession computed under the presumptive taxation scheme.

Selection of software should be made on work requirement. If an unpaid software has the features you need, consider choosing that. Get trained on all features of the software you choose if you want its best use. It will prevent bad outcomes.

Above all, the ITR forms for the assessment year 2020-2021 have been revised. It is a mandate for everyone to understand the new form requirements before filing their income tax return. Be very careful while filling your forms to avoid any complications or legal implications.

Income Tax Return Filing the last date is September 30, 2021.

Efile For A Fee Other Available Efile Options

If you don’t qualify for free electronic filing, please visit the listing of the approved software products to determine which software product will meet your filing needs.

- Be sure the product that you select supports the forms you want to file

- If the product that you select does not offer payment options, you can use our website to pay your taxes online

To find out if you qualify to use free software, review the eFile for Free options listed above.

Also Check: What Does Locality Mean On Taxes

Irs Free File Opens Today Do Taxes Online For Free

IR-2020-06, January 10, 2020

WASHINGTON Most taxpayers can get an early start on their federal tax returns as IRS Free File featuring brand-name online tax providers opens today at IRS.gov/freefile for the 2020 tax filing season.

Taxpayers whose adjusted gross income was $69,000 or less in 2019 covering most people can do their taxes now, and the Free File provider will submit the return once the IRS officially opens the 2020 tax filing season on January 27 and starts processing tax returns.

“Free File online products offer free federal tax return preparation, free electronic filing and free direct deposit of refunds to help get your money faster,” said Chuck Rettig, IRS Commissioner. “The IRS has worked to improve the program for this year, and we encourage taxpayers to visit IRS.gov, and consider using the Free File option to get a head start on tax season.”

For 2020, the Free File partners are: 1040Now, Inc., ezTaxReturn.com , FileYourTaxes.com, Free tax Returns.com, H& R Block, Intuit, On-Line Taxes, Inc., Tax ACT, TaxHawk, Inc. and TaxSlayer .

Since its 2003 debut, Free File has served nearly 57 million taxpayers, saving an estimated $1.7 billion calculated using a conservative $30 tax preparation fee. Free File is a public-private partnership between the Internal Revenue Service and Free File Inc. , a consortium of tax software providers who make their Free File products available at IRS.gov/FreeFile.

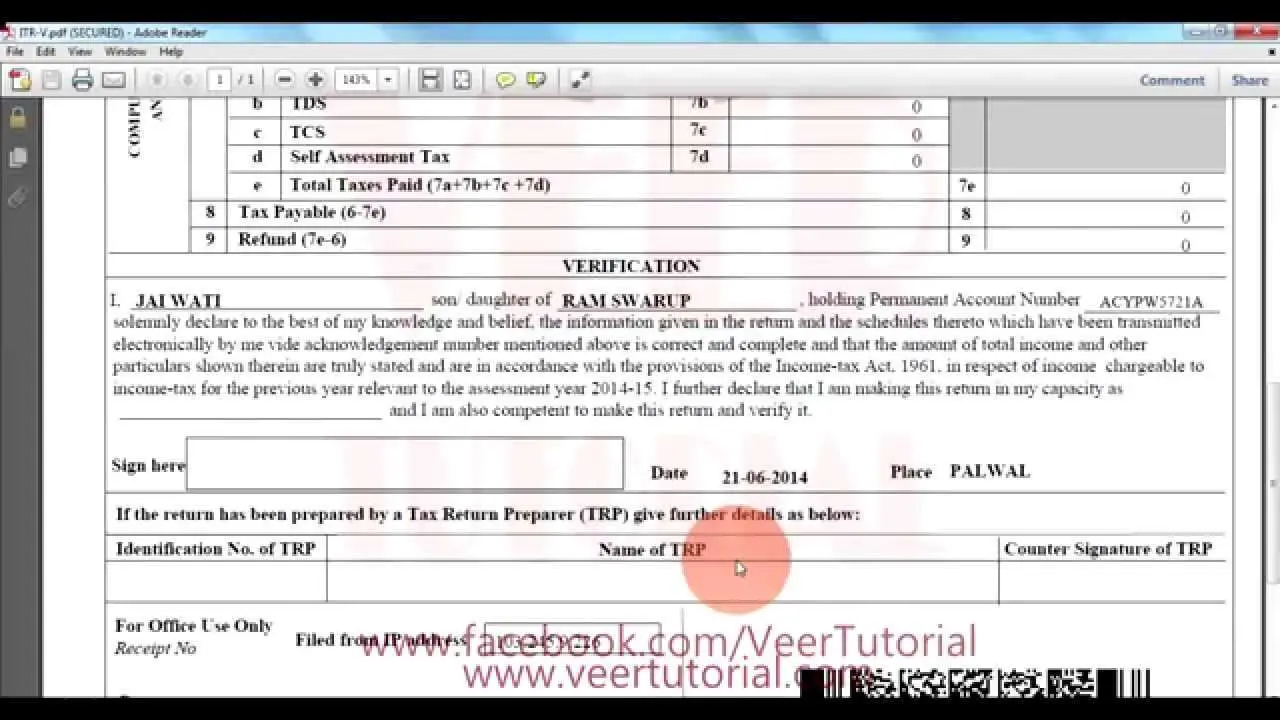

What Is Itr Form

ITR form is essentially a tax form used to file income tax with the Income Tax Department. Taxpayers file all information about their income and applicable taxes in the ITR form. For now, the income tax department has notified seven ITR forms mainly ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7.

The law requires all taxpayers to file income tax returns annually. ITR is filed against the income businesses or individuals generate during a given assessment year through all sources such as regular income, dividends, interest, capital gains, etc. Taxpayers must file their returns within the specified date, which is July, 31 for this year.

In case the tax return shows that a taxpayer has paid excess tax during a given year, the taxpayer/assesses is eligible for a tax refund based on the departments calculations.

The taxpayers sources and amount of income along with his/her income category decide which ITR form they are eligible to fill.

You May Like: How To File 2016 Taxes Online

Why Was The Free File Alliance Formed

In November of 2001, the Office of Management and Budget’s Quicksilver Task Force established 24 e-government initiatives that were a part of the President’s Management Agenda. These initiatives were designed to improve government to government, government to business and government to citizen electronic capabilities.

One initiative, IRS Free File, instructed the IRS to provide free and secure online tax return preparation and filing services to taxpayers. In accordance with this OMB directive, the IRS worked in partnership with the tax software industry to develop a solution. The result was the formation of the Free File Alliance, LLC.

Verify Dependents And Filing Status

Claiming Dependents

The IRS has strict rules for claiming dependents. Dependents are typically either qualifying children or relatives. General rules include the following:

- Meets citizenship requirements

- Has NOT filed a joint return

- Has a social security or taxpayer identification number

Children

- Lives with you half the year or more

- Is related to you

- Is under 19

- Is younger than you

Relatives

- Lives with you the entire year

- Has a gross annual income of less than $4,050

- You provide over half of his or her total support

Dependents can only be claimed by one person. In cases of divorce or legal separation, a child can only be claimed by one parent, typically the custodial parent. If you are filing taxes for the first time, you need to verify that your parent or guardian is not claiming you as a dependent if you seek a personal exemption.

You can use the IRS’ Interactive Tax Assitant to help you determine whom you may claim as a dependent.

Filing Status

Often filing statuses are straightforward. The five filing statuses are as follows:

- Single

- Head of household

- Qualifying widow with dependent child

You may qualify for more than one status. For instance, if you are married, you have the option to file jointly with your spouse or separately. Note that choosing to file jointly makes both spouses equally accountable for any tax debt and legal liability. If you must choose between two options, pick the one that has the lowest tax liability and greatest savings.

Don’t Miss: What Are The Different Tax Forms

Free File Your Crypto Taxes With The Irs

The IRS offers a program called free file which provides users with software products to help them file their taxes. The following companies let you request a filing extension for free.

We recommend OLT.com at CryptoTaxAudit, where we teach people how to prepare their tax returns to report their cryptocurrencies.

However, if youre working with an accountant or an accounting firm like us, theyll do the filing extension for you.

How Do I Get Help Filing My Taxes Online

If at any point you have a question about your taxes or the software, you can browse answers on our online help forum 24/7, or post a question for our online community of users and experts. While youre filing you may realize that youre looking for more guidance or help with your taxes. In that case you can upgrade to a different TurboTax Online product at any time without losing any of the data youre already entered.

Need more help? TurboTax Live Assist & Review gives you unlimited tax advice from one of our tax experts as you do your taxes, plus a final review before you file to make sure you didnt miss anything. Or if you want to hand off your taxes to one of our experts, TurboTax Live Full Service allows you to simply upload your documents and our experts will complete and file your return for you.

You May Like: How To Track Gas Mileage For Taxes

How Do I Estimate My Crypto Taxes

Regarding estimated tax payments, the IRS wants to receive their money as you earn it, paid every quarter this is known paying estimated taxes.

When you have a job, your employer automatically withholds the taxes, so you dont have to think about paying estimated taxes to the IRS. We recommend that you attempt to find the best crypto tax tool in order to assist with your tax estimation.

However, investors who realize gains need to be aware that the IRS will want their money quarterly.

Bear in mind that hodlrs do not realize gains until they sell something, and hodlrs only have a tax liability on the realized gains.

Extension Filers: File Your Tax Return By October 15

Your extension of time to file is not an extension of time to pay your taxes. Pay the tax you owe as soon as possible to avoid future penalties and interest.

If you didn’t get a first and second Economic Impact Payment or got less than the full amounts, use Free File to claim the 2020 Recovery Rebate Credit.

IRS Free File lets you prepare and file your federal income tax online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via Irs.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Read Also: Is There Tax On Shipping

Who Is Eligible For Irs Free File

IRS Free File is a partnership between the IRS and a nonprofit organization called the Free File Alliance. IRS Free File provides access to free tax preparation software from 10 tax-prep companies, including major brands. You must have less than $72,000 of adjusted gross income to qualify for IRS Free File . IRS Free File providers include big names such as Intuit , TaxAct, and TaxSlayer.