How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

The Internal Revenue Service can provide you with copies of your tax returns from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $50 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return is stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

How Do I Request Prior Year Federal Tax Returns

OVERVIEW

You can request prior tax returns, for a fee, from the IRS.

If you cant find one of your old tax returns, theres no reason to worry. The IRS can provide you with a copy of it if you prepare Form 4506. The IRS keeps copies of all returns you file for at least seven years. However, if the tax return you want is older than this, theres a possibility it may not be available.

You May Like: How To Appeal Property Taxes Cook County

Get Last Year’s State Return

If you need a copy of last year’s state tax return, check with your state’s tax or finance department website. You can often create an account to view old tax returns online. In other cases, your state will have a tax form for your to submit to request the tax return, and you may have to pay a fee for this service.

How About Checking The Status Of An Amended Tax Return

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”> You can use the Wheres My Amended Return IRS tool. This tool shows updates for amended returns for current years and up to three prior years. However, it is recommended that you wait three weeks after mailing your return to retrieve the most accurate status update. Before opening the tool, youll want to make sure you have a few bits of information on hand:

- tax year

- zip code

Read Also: What Are Tax Lien Properties

How To Retrieve An Old Indiana State Tax Return

Old copies of Indiana state tax returns are obtainable by any Indiana Department of Revenue District Office. The Department of Revenue understands that paperwork can go missing, things are misplaced and sometimes due to certain circumstances, information is lost. The agency has a process for helping taxpayers obtain copies of prior year tax returns. Tax returns only are obtainable by the individual who filed the return. If the return is needed for a loan or other service of that nature, permission by the taxpayer must be sent in writing to the Indiana Department of Revenue for that information. No fee is charged to obtain a copy of an old tax return in Indiana.

What Could Happen If I Dont File Back Taxes

If you dont file a tax return for a year when you should have filed, or dont pay federal income tax you owe, the IRS can take action.

The agency may send you a notice or a bill. Or, it may file a return on your behalf and might not bother to give you any tax breaks youre eligible for. Remember that the IRS can easily do this because it likely already has your income information from your employer, customers you do gig work for , banks and other sources.

Additionally, federal law generally allows the IRS to try to collect on a tax debt for 10 years, though there can be exceptions.

You May Like: Have My Taxes Been Accepted

Cybersecurity Awareness Month: The Rise Of Online Scams

According to the IRS website, as of March 5, the IRS had 2.4 million individual tax returns received prior to 2021 in the processing pipeline. As of March 5, the IRS had 9.2 million unprocessed returns in the pipeline, including 2021 returns.

Tax returns are opened in the order received, so the IRS stresses patience, and more importantly, not to file a second time.

We’re asking for patience, understand the situation we’re up against with two rounds of economic back payments, two filing seasons, an extension, all the new laws, legislation, the resource issues, the code environment to continue the process and get things done, Tulino said.

But with the clock ticking toward this years extended May 17 deadline, taxpayers want to know whether they can file 2020 returns if their 2019 returns have yet to be processed.

The IRS said they can.

The IRS will process a complete 2020,1040 if the taxpayer has not filed a prior year return, IRS spokesperson Michael DeVine told NBC Responds.

DeVine directed NBC Responds to the IRS website, which offers this clarification, If your 2019 return has not yet been processed, you may enter $0 as your prior year Adjusted Gross Income.

But refunds are not the only financial benefit being held up.

Without their 2019 returns, many people said they missed out on their full economic payment.

There is help for that too.

This article tagged under:

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Don’t Miss: How To Apply For Irs Tax Forgiveness

How Do I Submit A Late Irp5 For A Previous Tax Year On Sars Efiling

| LostWithTaxsays:4 December 2015 at 11:54I have submitted my tax return for this year but have been told they won’t pay out until I submit my outstanding tax returns from last year . I wasn’t earning a salary for most of last year but I believe I still need to submit the IRP5 which covers the last month of my employment with my previous company from that year. I got hold of my previous company and they sent through the form really quickly but I can’t figure out how to submit for a previous year on SARS eFiling. The SARS helpline just tells me that I need to submit it but not how I can do that. |

Complete And Mail The Forms And Pay Anything You Owe

You may be able to use an online tax preparation service to complete the forms, but you wont be able to e-file your back tax return. Youll need to print out and mail the forms to the address listed in the 1040 instructions for the tax year youre filing. If youre unsure how to proceed, a tax professional can help. You may also be able to get free assistance from the Volunteer Income Tax Assistance or Tax Counseling for the Elderly programs.

And if you have a tax liability back taxes, penalties and interest youll need to pay it or request a payment plan.

Recommended Reading: What Is The Sales Tax In Arkansas

How To Change A Return

COVID-19: Expect the normal timeframe for processing adjustment requests submitted by paper to be 10-12 weeks in most cases.

You can request a change to your tax return by amending specific line of your return. Do not file another return for that year, unless the return you want to amend was a 152 factual assessment.

Wait until you receive your notice of assessment before asking for changes.

Generally you can only request a change to a return for a tax year ending in any of the 10 previous calendar years. For example, a request made in 2021 must relate to the 2011 or a later tax year to be considered.

Request Federal Return From Irs

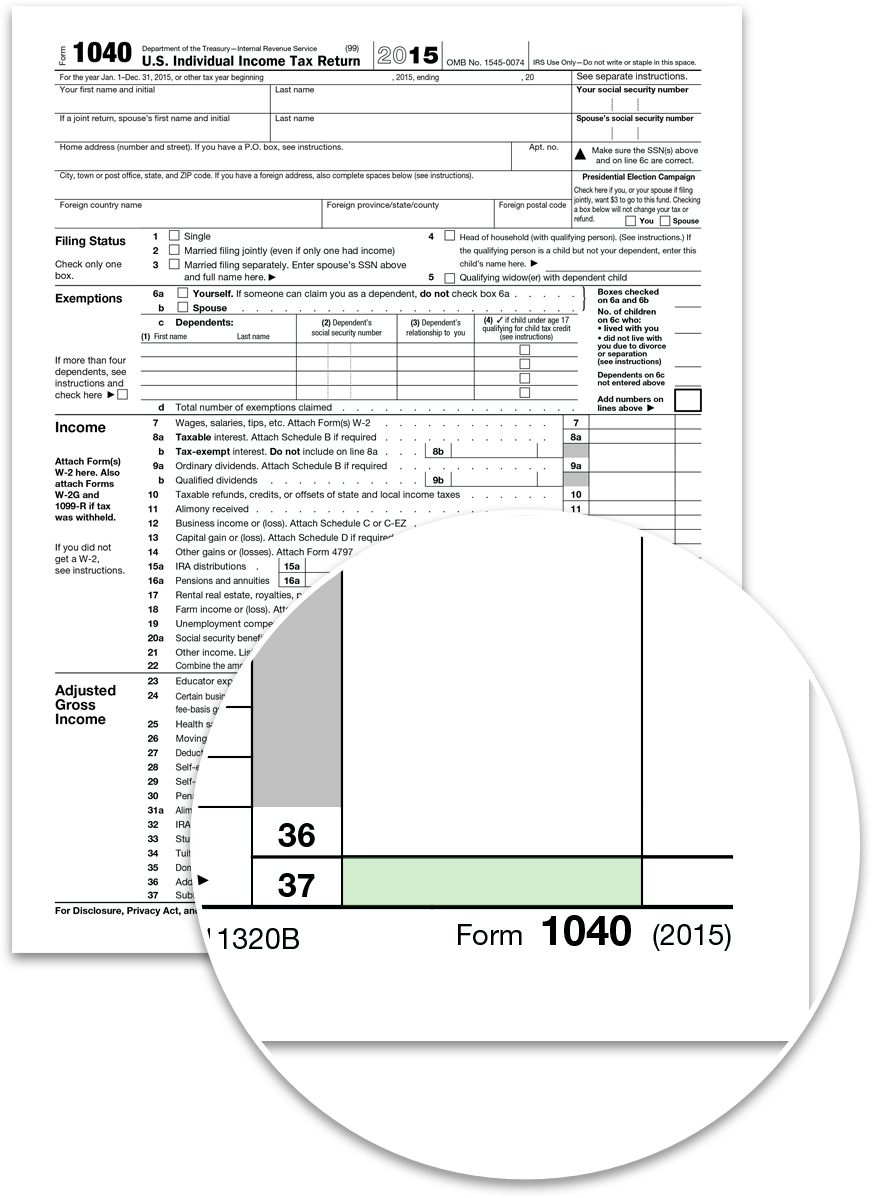

To get a photocopy of your federal tax return, download and print Form 4506 from the IRS website. Fill in the information requested about yourself and the tax return year requested and then sign the form.

You’ll need to include a money order or check for $50. However, there’s an exception if you’re eligible for a fee waiver for disaster assistance and emergency relief. The IRS notes that you’ll need to use the memo or note field to write “Form 4506 request” along with your Social Security number or tax ID.

The second page of Form 4506 will list IRS offices sorted by location. Find your local office’s address and mail the form and payment to that location. The IRS will mail the photocopied tax return within 75 days.

Recommended Reading: Is Heloc Interest Tax Deductible

Get Federal Transcript From Irs

Visiting the IRS Get Transcript page is the easiest way to get a tax transcript free. You can opt for a paper copy or an electronic version.

Look for the “Get Transcript Online” button and follow the steps to enter your personal information and confirm your identity, including entering a personal account number and mobile number. You’ll also choose the transcript type and tax year. At the end of the process, you’ll get confirmation the IRS received your request, and you’ll be able to view the transcript online within five to 10 days.

If you want a transcript physically mailed to you for free, you can simply select the “Get Transcript by Mail” option on the IRS Get Transcript page. You’ll enter similar information but won’t need to enter a phone number or personal account number. The IRS will mail the transcript so that you receive it in around the same time frame as the electronic version.

Go Online And Use The Wheres My Refund Irs Tool It Works

Although the IRS Wheres My Refund tool is available to check the progress of your return, it only applies to the tax return you filed for the mostcurrent tax year.

For example, lets say you file your 2013 tax return and soon after remember to file your late 2012 return. Although you filed your 2013 taxes before your 2012, 2013 is going to be the one that the IRS site shows the status for since it is the most recent tax year in their database for you.

Read Also: When Will The First Tax Refunds Be Issued 2021

You Cant Run From Your Pasteven When It Comes To Taxes

With federal taxes, were all, more or less, in the same boat. The IRS is a one stop shop for everyone no matter where in the country you live. When were talking state tax returns, we each seem to be out to sea on our own one-man floats. States are given some leeway to construct a unique set of guidelines for resident and nonresident taxpayers.

For federal taxes, you can always contact one entity the IRS. If you want to request prior year state tax information, youll need to contact that state specifically. Weve put together a list for you including the following information for each state:

- State revenue department telephone number

- State revenue department address

- State revenue department website link

- Price of requested documentation

Gather All Your Documents

Whenever you file a return, youll need all the forms that show your income for the tax year youre filing for. So if, for example, youre filing a return for the 2018 tax year, youll need any W-2s, 1099s, interest statements and other types of income statements that apply to that year.

Hopefully, you saved those documents in a tax records file. If youre missing information, you can request a wage and income transcript from the IRS for a previous year. The transcript will show all the information returns the IRS received on your behalf for that tax year, such as W-2s, 1099s, 1098s, IRA contributions you made and more.

And, if youre claiming certain deductions or tax credits, youll need to have all the necessary documentation, such as receipts for medical expenses or mortgage interest you paid during the tax year.

Read Also: What Is Schedule D Tax Form

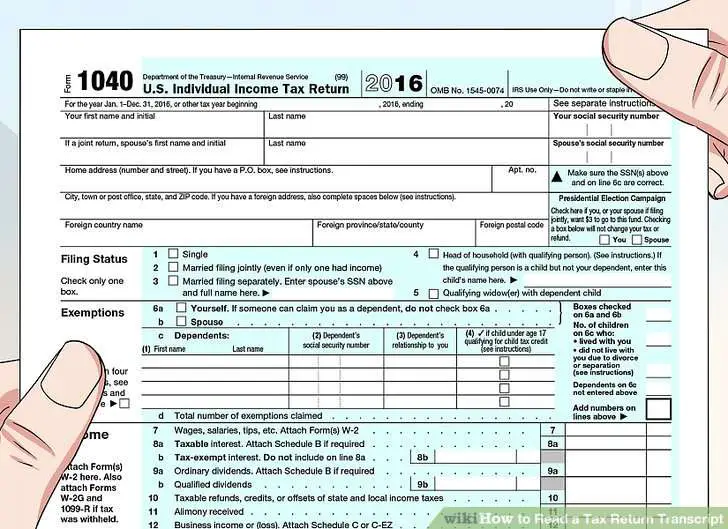

Choose The Tax Years You Want Returns For

You can request more than one tax return on Form 4506 however, you must indicate the type of form you used to file each one, such as a Form 1040, 1040-SR, 1040A or 1040EZ. In the next section of Form 4506, you must provide the tax years you are requesting. For example, if you are requesting a tax return from 2018, the IRS asks you to enter 12/31/2019 rather than just 2019″.

What If I Owe More Than I Can Pay

If youre facing a tax bill you cant afford to pay in full right away, you may have payment options.

- Consider paying the IRS with a credit card or personal loan. Using credit to pay your tax debt likely means youll pay interest to the lender. But those costs may be less than the penalties and interest you might face if you fail to pay the IRS on time and in full.

- If you owe $50,000 or less, you can request an online payment agreement from the IRS. Short-term installment agreements give you 120 days or less to pay. A long-term agreement can give you up to 72 months to pay what you owe in monthly payments.

- If you meet certain criteria, you may be able to ask the IRS for an offer in compromise, which could allow you to settle your tax debt for less than what you owe.

- In dire cases when paying anything might prevent you from covering your basic life expenses, the IRS may agree to temporarily delay collection of your past-due tax debt.

You May Like: How To Calculate Paycheck After Taxes

Here Are The Three Ways To Get Transcripts:

- Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- . Taxpayers can call to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer.

- . Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

To Request A Copy Of Your Previously Filed Tax Return:

- Complete the Request for Copy of Tax Return

- There is a $5 fee for each return you request. Full payment must be included with your request. Make check or money order payable to the Virginia Department of Taxation. Do not send cash.

Send to:Richmond, VA 23218-1317

Please allow up to 30 days to receive a copy of your return.

All requests go through an approval process to be sure that copies are sent to the rightful taxpayer or authorized representative. If youre requesting a copy of a return for a business, be sure youre authorized to act on behalf of that business. We will send you a refund of the fee for any return we cant provide. Allow 30 days for the refund to be processed.

Read Also: How To File Taxes When You Moved States

How Can I Obtain Copies Of Previously Filed Returns

You may obtain copies of previously filed returns using self-service.

Include your full name, complete current mailing address and the tax year with your request.

- Primary filers Social Security number

- Primary filers last name

- Tax year

- Adjusted Gross Income /Total Household Resources

- If your AGI is a negative number, enter – after the number. Example: 1045-

Note: If you are unable to authenticate using your current tax year information, select the previous tax year for authentication. When you submit your question, explain that you selected a previous tax year for authentication. Include the AGI/THR and tax year for which you are inquiring.

Farber Tax Solutions Helps You At Every Step Of The Way Including:

- 1| Organizing: We analyze all documents and communication, to fight the CRA on your behalf

- 2| Audits: We assist you with audits and ensure proper conduct by tax authorities

- 3| Appeals: We can prepare a Notice of Objection, clarifying your standing with the CRA

- 4| Litigation: We represent you at all levels of court

Recommended Reading: When Can I Expect My Unemployment Tax Refund

Provide Complete And Accurate Information On Form 4506

The top portion of the form requires you to enter your personal details as it appears on the original tax return you are requesting. At a minimum, the name and Social Security number you provide must match the original return. If you filed your original return jointly, you must include your spouses full name and Social Security number as well.

If you are no longer married, its not necessary for your former spouse to sign Form 4506 or even provide consent. If youve moved since filing the return, you must also provide your current address. The IRS gives you the option of having the return sent directly to a third party if you provide their name, phone number and address.