Mailing Address For Individual Tax Payment

For people who owe money on their tax balance, one way of making the payment is by mailing a money order or check to the IRS. The IRS may send you a notice stating your balance and where to send the payment, or you can use the payment voucher, which is Form 1040-V to pay the amount that is due on your Form 1040, 1040A, or 1040EZ. The following table summarizes the mailing addresses of any Form 1040-V payments according to people who live in the areas.

| Louisiana, Florida, Texas, and Mississippi | Internal Revenue Service P.O. Box 1214 Charlotte NC 28201-1214 |

|---|---|

| Arizona, Alaska, Colorado, California, Idaho, Hawaii, New Mexico, Nevada, Utah, Oregon, Wyoming or Washington | Internal Revenue Service P.O. Box 7704 San Francisco, CA 94120-7704 |

| Illinois, Arkansas, Iowa, Indiana, Michigan, Kansas, Montana, Minnesota, North Dakota, Nebraska, Oklahoma, Ohio, Wisconsin or South Dakota. | Internal Revenue Service P.O. Box 802501 Cincinnati, OH 45280-2501 |

| Georgia, Alabama, New Jersey, Kentucky, South Carolina, North Carolina, Virginia, or Tennessee | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Delaware, Connecticut, Maine, District of Columbia, Massachusetts, Maryland, New Hampshire, Missouri, Pennsylvania, New York, Vermont, Rhode Island or West Virginia | Internal Revenue Service P.O. Box 37008 Hartford, CT 06176-7008 |

The following group of people should mail their forms to the Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201- 1303.

Prior Year Forms & Instructions

Make your estimated tax payment online through MassTaxConnect. Its fast, easy and secure.

- Form 1-ES, 2021 Estimated Income Tax Payment Vouchers, Instructions and Worksheets

- Form 2-ES, 2021 Estimated Tax Payment Vouchers, Instructions and Worksheets for Filers of Forms 2 or 2G

- Form UBI-ES, 2021 Estimated Tax Payment Voucher for filers of Forms 3M, M-990T and M-990T-62

Income and Fiduciary Vouchers these estimated tax payment vouchers provide a means for paying any taxes due on income which is not subject to withholding. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year. Generally, you must make estimated tax payments if you expect to owe more than $400 in taxes on income not subject to withholding. Learn more.

Where Do I Pay My Indiana Sales Tax

Akashpaying your Indiana sales taxFileFilethe Indianayour paymentfile your sales tax

How do you pay your Indiana state taxes? When you receive a tax bill you have several options: Send in a payment by the due date with a check or money order. Contact the Indiana Department of Revenue for further explanation if you do not understand the bill. Make a payment online with DORpay by credit card or electronic check.

Read Also: How To Get Pin To File Taxes

With Electronic Funds Withdrawal

You can usually set up a direct debit from your checking account if you use tax preparation software to e-file your return, either on your own or through a tax professional. This option involves entering your bank account and routing numbers into the program, but it’s only available to taxpayers who e-file.

Filing An Extension Application

You can e-file an extension application or mail it to the IRS. There are two application forms for most circumstances: Form 7004 for corporations and partnerships, and Form 4868 for other business types and personal returns.

You can get an automatic extension by filing either of these forms.

If you were affected by winter storms in Texas, Oklahoma, or Louisiana, you do not need to file for an extension if you plan on filing taxes by June 15. If you want to delay filing until October 15, you will need to request an extension.

Regardless of your income, you can also use Free File to electronically request an extension, which will give you until October 15, 2021, to file a return. To get an extension, you must estimate your tax liability and pay any amount due.

Recommended Reading: Do You Have To Report Roth Ira On Taxes

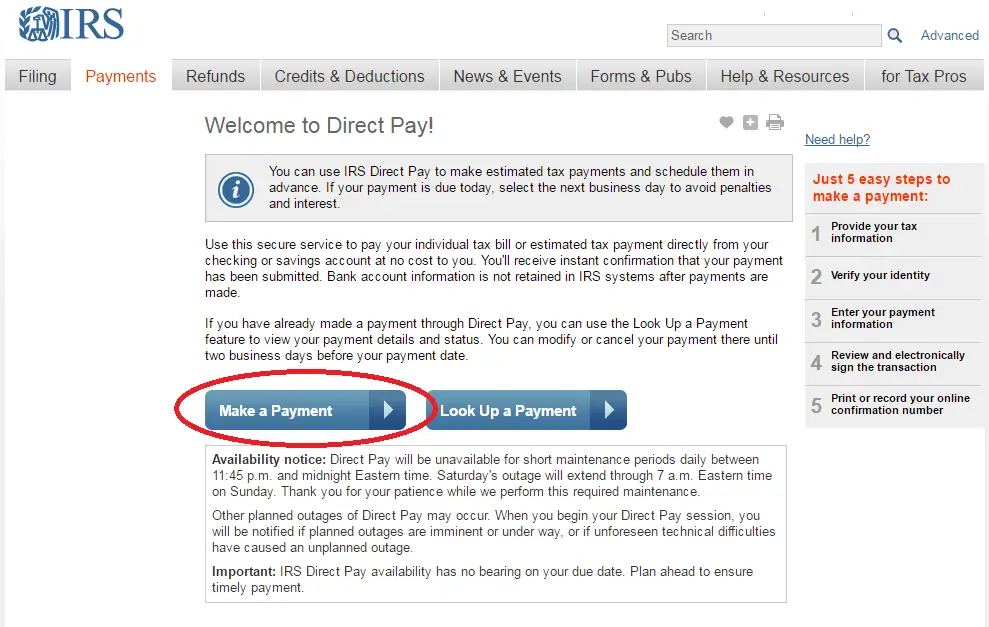

Online By Debit Or Credit Card

You can pay the IRS by credit or debit card, but you must use one of the approved payment processors. Three processors are available, and you can access any of them on the IRS website or through the IRS2Go mobile app:

They all charge a processing fee, which can vary. But this fee might be tax deductible, depending on your tax situation. It’s usually a flat fee for a debit card transaction or a small percentage of your payment if you’re using a credit card.

Your credit card company might charge you interest as well.

You can’t cancel payments using the credit card or debit card option.

Deadline To File And Pay Taxes Was May 17

Find out what to do if you cant pay what you owe. An extension to file is not an extension to pay the taxes you owe.

The estimated tax payment deadline was April 15. Get details on the 2021 tax deadlines.

Pay with your bank account for free or choose an approved payment processor to pay by credit or debit card for a fee.

Don’t Miss: Have My Taxes Been Accepted

Can I Pay My Indiana Taxes Online

You can also pay online via the Indiana Department of Revenue’s electronic tax payment service.

Can you make payment arrangements on state taxes? If you can’t afford to pay your state taxes, setup a payment arrangement. Procedures and rules to set up a payment plan are different for each state, although most states offer payment arrangements to taxpayers, although most states will impose interest and other fees on payments made after Tax Day.

Where Do You Mail Your Federal Tax Return

Form 1040 and Form 1040-SR addresses for taxpayers living within the 50 states

| If you live in | And you ARE NOT enclosing a payment use this address |

|---|---|

| Arkansas, Georgia, Indiana, Iowa, Kentucky, Missouri, New Jersey, Oklahoma, Tennessee, Virginia | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 |

Simply so, what is the address for IRS tax return?

There’s no single IRS address. The one you use depends on where you’re filing from and whether your return includes a payment. Here’s where to send yours, according to the IRS.

One may also ask, where do I mail prior year tax returns? Late tax returns must be filed on paper and mailed to your local IRS Service Center. You can use tax software to prepare your returns, but then you must print them out and mail them in. You cannot file late returns electronically. Mail your tax returns in separate envelopes and send them by certified mail.

Also Know, how do I file my taxes by mail?

. You can fill out a paper return and mail it to your local tax services office. You can get a paper return from a post office, local tax services office, or you can download tax forms from the CRA website. If applicable, you will get your refund in about 4 – 6 weeks.

How do I assemble my federal tax return?

Read Also: How Can I Make Payments For My Taxes

Hand Delivering Your Return

Under normal circumstances, you can hand deliver your return to a local IRS Taxpayer Assistance Center if there’s one near where you live. You would ask the IRS agent for a stamped receipt upon submitting it.

As of 2020, walk-ins are no longer accepted, though you may be able to make an appointment. The IRS website provides locations, addresses, and phone numbers for each state.

Choose A Payment Method

You can pay your tax instalments online, in person, or by mail. There are several payment options with different processing times for each.

- Online:

- In person or by mail:

- Use your instalment remittance voucher to pay in person or by mail

You will need your instalment remittance voucher to ensure your payment is applied to the correct account.

Your remittance voucher is included in your instalment reminder package the CRA mails to you, unless you pay instalments by pre-authorized debit.

Choose your payment method:

- call our automated TIPS line at 1-800-267-6999

If your payment is not honoured, the CRA will charge a fee.

You May Like: How Much Does H& r Block Charge To Do Taxes

If You Need An Extension Of Time To File

Some taxpayers might find that they can’t make the tax filing date. You can typically take an extension by filing Form 4868 with the IRS by the tax filing deadline, giving you until Oct. 15 to submit your return. Any payments you owe are still due by the original tax due date, however, which is usually April 15. You should submit your tax payment along with your extension request.

You’ll receive a refund if you remit too much, but you’ll owe the IRS more if you later complete your return only to realize that you’ve underpaid for the year.

The IRS extended the tax filing date for personal income tax payments from April 15, 2021, to May 17, 2021 in response to the coronavirus pandemic. It then extended the six-month extension deadline from Oct. 15, 2021 to Jan. 3, 2022 for victims of Hurricane Ida in Louisiana, and in some New York and New Jersey counties as well. Residents of all 82 Mississippi Counties and the Mississippi Choctaw Indian Reservation have until Nov. 1, 2021 to file any returns or make any payments that were due after Aug. 28, 2021. Affected residents of New Jersey and New York don’t get an extension on any tax payments due on their 2020 returns, however. You can check to see if your county is eligible at DisasterAssistance.gov.

You can ask the IRS to work with you and set up a payment plan if you have difficulty paying the full amount of tax you owe.

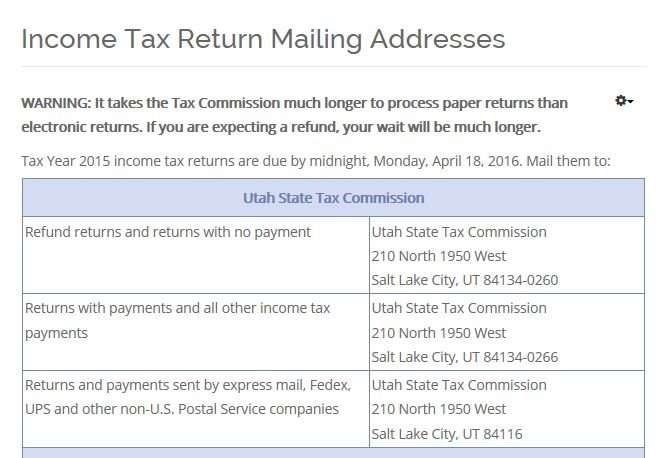

Mailing Addresses For Massachusetts Tax Forms Including Amended Returns

- Form 1 or a Form 1-NR/PY:

- Refund: Mass. DOR, PO Box 7000, Boston, MA 02204

- Payment: Mass. DOR, PO Box 7003, Boston, MA 02204

Visit Mailing addresses for Massachusetts tax forms for other form addresses.

Also Check: How Much Taxes Do You Pay On Slot Machine Winnings

Mailing Options & Services

These mailing services apply a postmark to your return. If your return is postmarked by the IRS deadline date, it is considered on time. With , you can pay for postage online and print a shipping label from your own computer. Generating a Click-N-Ship label with postage creates an electronic record for the label on that specific date, so it is important that you send your package on the shipping date you used to create the label. Your online Click-N-Ship account will save your shipping history for six months.

- 12 business day delivery

- USPS Tracking® included

- 13 business day delivery

- USPS Tracking® included

- 13 business day delivery

- Extra services available

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

Read Also: How Much Does H& r Block Charge To Do Taxes

Irs Addresses Associated With Making Payments

If you choose to make payments to the IRS by mail using a check or a money order, it is of the utmost importance to know the correct address for mailing the payments. If you are using the 1040-V tax form to make payments on a tax balance or you are required to pay estimated taxes using the 1040-ES tax form the addresses will be different depending on the form and your respective location of residence. These addresses are as follows:

- Residents of Mississippi, Louisiana, Texas, or Florida mail payments to:

- 1040-V tax form:

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Also Check: What Does H& r Block Charge

If You Cannot Pay In Full

If you are not able to pay the full amount:

- file on time to avoid paying a late-filing penalty

- make a partial payment to reduce the amount of interest you need to pay on unpaid amounts

You can set up a payment arrangement to give yourself more time and flexibility to repay what you owe. For details: Arrange to pay your personal debt over time

If you are unable to pay, you can discuss your options with the CRA.

Updates To Online Form 1 & Form 1

The following is a list of updates made to the online versions of the 2020 printed Form 1 and Form 1-NR/PY booklets:

-

Form 1 instructions page 7 Form 1-NRPY instructions page 9- Veterans Benefits instructions updated to add text for Operation Sinai Peninsula.

-

Form 1 instructions page 8 Form 1-NRPY instructions page 9- Name/Address instructions updated to remove address change language as the fill-in oval is now only for a name change.

-

Form 1 instructions, page 20- Instructions for Schedule X, line 4 updated to change the reference to Schedule FCI-I to Schedule FCI.

Don’t Miss: Do I Need W2 To File Taxes

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Do I Have A Tax Warrant In Indiana

We now have tax warrant data for the entire state of Indiana and this information can be searched from the Welcome Page or by clicking on the tax warrants tab. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income, sales tax, withholding or corporation liability.

You May Like: Do Roth Ira Contributions Need To Be Reported On Taxes

Payment For A Tax Due Return

You may choose a from a checking or savings account when the return is e-filed and supported by the software. A direct debit is a tax payment electronically withdrawn from the taxpayer’s bank account through the tax software used to electronically file the individual income tax return. Submitting the electronic return with the direct debit information provided, acts as the taxpayer’s authorization to withdraw the funds from their bank account. Requesting the direct payment is voluntary and only applies to the electronic return that is being filed.

Payments can be made by using the Michigan Individual Income Tax e-Payments system.

- If you have received an assessment from the Michigan Department of Treasury’s Collection Services Bureau, use the Collections e-Service payment system.

- Payments for 2020 tax due returns can be made using this system. Prior year payments are currently not accepted electronically.

- Any payment received after April 15th will be considered late and subject to penalty and interest charges. However, you may submit late or partial payments electronically.

- Estimate penalty and interest for a tax due return.

Payment can also be made by check or money order with your return. Make checks payable to “State of Michigan,” print your complete Social Security number and appropriate tax year on the front of your check or money order.

Heres Where You Want To Send Your Forms If You Are Not Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Florida, Louisiana, Mississippi, Texas: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0014

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0014

You May Like: Otter Tail County Tax Forfeited Land