Use Your Driving Patterns

If all the calculations are lengthy, tedious or just complex to figure out, do use your normal distance you cover in a week or month as an estimate. Again, youll need to have a credible proof that the estimates are real and realistic.

Disclaimer: this guideline only applies to those who misplaced their driving mileage logs. It should not be used to recreate the whole mileage log.

Record Mileage On Tax Return

When completing your tax returns, you’ll list the total amount of miles driven on Form 2106, Line 12. This figure is calculated by the standard mileage rate for the year to determine the dollar deductible amount.

If you’re using the actual expenses method, you’ll need to organize the receipts of the expenses into groups including gasoline, oil, repairs, insurance, vehicle rentals, and depreciation.

What Miles Can You Track As A Delivery Contractor

Related:

- The choice for the most accurate and reliable Paid Doordash Mileage Tracking App: Triplog.

Doordash’s earlier estimates were a problem because they didn’t capture all the miles you drove.

In fact only adding up the miles you drove on active deliveries fails to capture all the miles you are able to claim.

If you’re driving to position yourself for better deliveries but willing to take offers while you drive, you can claim those miles. If you dropped off somewhere and are making your way back to the zone, those miles are allowable.

However, if you deliver only for Doordash, you may be more limited in what miles you can track than you are with different platforms in delivery. That’s part of why I’m a big proponent of working multiple apps.

It all has to do with what the IRS considers commuting miles and with smaller delivery zones. Remember the criteria I mentioned above: You have to be available with intent to deliver.

Doordash requires you to be in your delivery zone to go available. If you live outside the delivery zone you intend to start with, that requires you to drive to the zone. If you’re not able to go available, those are not considered business miles. It’s not a bad idea to track them individually and call them commuting miles.

So, how do you do that?

You May Like: How Can I Make Payments For My Taxes

Here’s A Brief Rundown Of The Mileage Tracking Apps That I Looked At

Triplog.

Triplog was in my evaluation the best app and most accurate for pure mileage tracking. It has a paid version that has automatic tracking with unlimited tracking. There’s a free version that has manual tracking and limits you to 40 trip records.

Of all the tracking apps, Triplog was the only one that would let me see what the time was at given points along the route. This is a huge feature in my opinion, because it allows you to document exactly when you were at a customer’s or at a restaurant. This can make a difference when a customer claims they didn’t get the food.

Triplog has a good income and expense tracking feature as well. This makes it a well rounded app.

Hurdlr.

In my comparison article, Hurdlr ranked slightly over Triplog as an overall app on the strength of its tax calculator and its bookkeeping features. I like the user interface a little better on Hurdlr than any of the other apps.

The free version of Hurdlr is by far the best free mileage tracker app that I’ve seen. With the free version of Hurdlr, there is no limit to how many trips it will track. This makes it preferable to the free version of Triplog in my opinion.

Everlance.

Everlance provides a good overall product that also has good expense and income tracking features. I did run into times where the auto tracking did not kick in, thus losing a lot of miles. It seems like battery saving mode on my phone was more likely to cause problems on Everlance.

Gridwise and Stride Tax

MileIQ

Best Mileage Tracking Apps For Your Business Drives

As an entrepreneur, finding ways to save money is critical to ensure the success of your business. There are many ways to do so, but one that tends to be overlooked is mileage reimbursement.

For those who started their business recently and still dont know how to proceed with tax deductions, know that you can claim the miles you drove for business purposes. If your work-related commutes are long, you can earn a hefty deduction at the end of the year. TheIRS releases annually the rate each business mile driven is worth. For 2017, it was 53.5 per miles for driving to a job assignment.

Recommended Reading: How Can I Make Payments For My Taxes

Advantage Of A Gps App

The biggest advantage with a GPS app is that it provides more detail. Of course, to have that detail, you want to use an app that shows the route you took. Many popular programs only show you a start and end point.

If you have the right kind of tracker, you can look at the record and see exactly where you were. That goes above and beyond on the IRS requirement of identifying where you went.

Some trackers will automatically start and stop recording based on when you start driving. If you’re hesitant to use a written record because you’re afraid you will forget to record your miles, you want to get an app with this feature.

Of the apps that I know, automatic mileage tracking is only available on the paid versions. But think of it this way: Forgetting to record your miles for one or more days of delivery could cost you far more in additional tax liability than the cost of an automatic tracking app.

What Kind Of Tracking Does The Irs Require Of Delivery And Rideshare Drivers

The IRS requires a written record four specific things of your record.

- The date. This means you need a written record for every single day that you have business miles. You cannot lump several days together.

- A general description of where you went.

- How many miles you went.

- The business purpose of your trip.

On top of this, you need a record of the total miles driven for the year. This is best handled by taking an odometer reading at the start of the year and at the end of the year.

Also Check: Mcl 206.707

Be Wise Choose Mileagewise

Keeping a Mileage log on Paper can take up 3-5 hrs of your Time/Month. With MileageWise the same task is 7 Mins/Month. You can always decide:

Dont forget, your MileageWise Subscription is Tax deductible as a Business Expense!

The Four Best Ways To Track Mileage For Doordash Or Any Other Gig Platform

Let’s talk about tracking methods. What are the best Doordash mileage trackers? Which way should you do it?

Before we look at options, let’s talk about how to decide.

In short, the answer to all that is, use whatever method that allows you to capture as many delivery miles as possible.

I would say that the methods you can use to track fit into one of three styles, in order of accuracy.

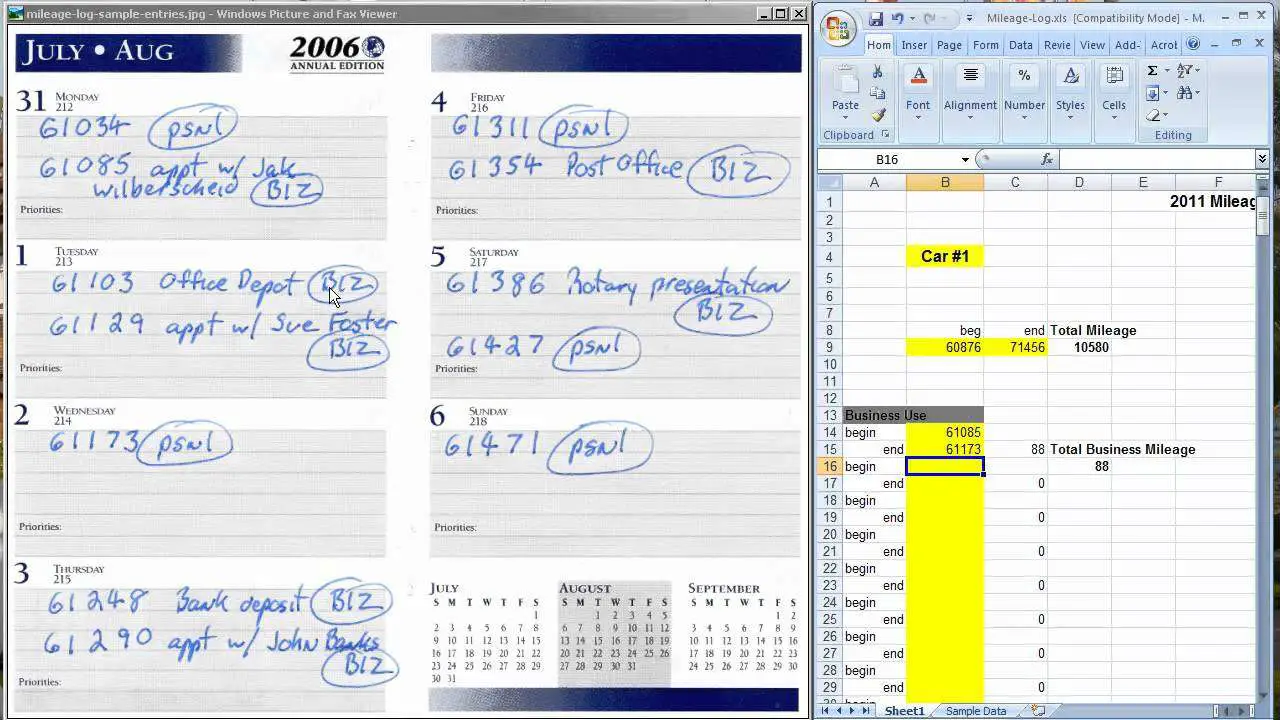

- A written manual log. You record odometer readings at the start and end of every trip.

- You can use a GPS mobile app that lets you start and stop tracking with each tap

- Some GPS mobile apps sense when you are driving and begin tracking automatically.

Recommended Reading: How Does H& r Block Charge

The Best Mileage Apps For Small Businesses In 2021

If any part of running your small business requires driving, a good mileage tracker app is a must. Mileage trackers not only track miles, but they also log them into a tax-friendly format that you can use to augment your return. Some features are automatic, and using automated services in these apps will save you time and effort as you gather accurate expense and time report data, even if they do cost a little to use.

Mileage tracking apps use GPS to track your cars motion from one location to another, and they often start recording distance when the wheels start moving and stop if you are in one place for a certain amount of time. Dont expect 100% accuracy, though its a good idea to simultaneously keep track of mileage yourself with your own odometer, just to make sure.

Each business needs different kinds of services from mileage trackers: Some need solid classifications, while others need to add more notes and reminders about each trip. Thats where many of the available apps differentiate themselves. Here are some of the highly rated mileage tracking options available as iOS apps and Android apps.

Disadvantage Of A Written Record

There are two major potential problems when you rely on your written record.

What happens if you forget to record your odometer reading?

What happens if you lose your written record?

There are actually measures in place where you can go back and recover mileage records if you forget to track your miles. If you have other evidence supporting the miles you drove, you can legally update your business mileage record accordingly.

In fact, it’s probably easier to do that with a written record than if you forget to turn on your GPS tracker, because your odometer readings from the previous day give you a point of reference.

Personally, I use Google Sheets for my written record. My record is stored in the cloud. I can access it on my phone and I can access it on my home computer. I have a shortcut on the home screen of my phone. That keeps me from losing that written record.

Also Check: What Does Locality Mean On Taxes

The Standard Mileage Deduction

This deduction is a variable rate determined by the IRS each year. For 2021, the standard rate is 56 cents per mile. Using this deduction requires only that you keep a log of all qualifying mileage driven. The easiest way to calculate business-related mileage is to use a mileage tracking app every time youre on the road. Making it a habit will ensure you dont miss out on anything.

Whats The Best App For Tracking Business Mileage

Mileage tracking apps arent necessarily one-size-fits-all. Different businesses have different needs, and may require different features. Here are some of the best mileage tracking apps currently available, broken down by the types of businesses they best serve:

Force by Mojio

Perfect for: Small business fleets.

Key benefits:Force uses live-map and GPS tracking to record every trip accurately and in real time. While its much more than just a mileage tracking app, Force can read the vehicles odometer for automated tracking across a fleet of vehicles. And, because its linked with each vehicle directly, theres no need to turn it on or off!

Unique features:

- Uses a plug-and-play GPS tracking device

- Records a history of every trip

- Tracks vehicle health and warns you about issues before they become major problems

- Reports on how your vehicles are being driven

- Sends alerts if your vehicles are tampered with

- Offers customizable location alerts

Don’t Miss: How To Buy Tax Lien Certificates In California

Why Do You Need A Mileage

- As a small business owner

Out-of-town business travel generates tons of receipts, from airline tickets, taxis, meals, laundry, accommodation, and more. Receipts verify what you purchased on the trip and act as a travel log of where time and money were spent on the business trip. Some important factors determining eligibility. For example: How much of the trip was personal, if the trip was away from your home, and if the amounts are justifiable.

Of course, business travelers can also make small mistakes, adding another reason for the IRS to audit with scrutiny. In this case, submitting receipts once you make the purchase will be a great idea. Dont wait until the end of the trip to gather all your paper trail receipts! Shoeboxed can be a helpful assistant to do this and also eliminate the possibility of losing a receipt. You wouldnt let a misplaced piece of paper allow you to lose reimbursement or deduction money, would you?

Another related issue that a small business owner will face when tracking mileage for taxes is the mixed-use asset. . The mixed-use asset requires extra care to distinguish when the vehicle is being used for business and when it is not. Since only the portion of use for business would be counted in the companys book, keeping clear and detailed records of time, route, and reason it is used for business purposes help to establish what portion of use is business-related.

See more: 5 Receipts Small Business Owners Should Take Extra Care to Keep

Keep A Detailed Mileage Log

The first option to track miles for taxes is with a mileage log template.

The IRS is very direct about this and doesn’t care for estimates.

The IRS defines appropriate records as to keep track of the following:

- Each business trip’s miles

- Total mileage for the year

- The time , place , and purpose

For example, a self-employed worker must record the odometer reading at the start of business trips, as well as the purpose, beginning location, finishing location, and date of the trip.

The final odometer reading must be recorded at the end of the trip and then subtracted from the initial reading to determine the overall number of miles driven.

If you drive for a gig platform as a Uber 1099 contractor or a Lyft driver, you’ll almost certainly have meticulous records and documentation for the miles driven for business purposes. So, you won’t exactly need to track mileage you’ve driven for every trip. The apps will automatically do the tracking for you.

A business owner can purchase a GPS device that automatically records the driver’s location, who they were visiting, and how long it took them to get there.

This information could then be downloaded into an Excel spreadsheet for future use in tax season.

Also Check: Where’s My Tax Refund Ga

What Qualifies As A Business Drive

In order to claim a tax deduction for costs associated with driving a personal vehicle for business purposes, your starting point must be your home, office or a job location.

The destination must also be home, office or job location, but the IRS doesn’t allow to side trips between two points. Your commutes have to be relatively straight to your work-related assignment.

Additionally, you can also include certain mile drives for other business related reasons such as cashing a check at the bank or meeting with professionals regarding your business.

The Two Mileage Rates For Tax Deductions

There are two different mileage rates you can use to calculate your tax deductions:

Standard mileage rate: The IRS sets a standard mileage rate in January of every year. For 2021, the rate is $0.56 per mile of business driving.

This method is less time-consuming than the expense method. However, you cant get tax deductions on your car expenses. The standard rate is supposed to cover that.

Actual expense mileage rate: This is the more complex one to navigate – particularly without mileage tracking software. The idea is that you claim deductions on all of your expenses to do with running your car. This includes gas, tolls, insurance, repairs etc.

You May Like: Www.1040paytax.com

The Actual Expenses Method

As the name suggests, the Actual Expenses method requires you to add up all the money actually spent in the operation of your vehicle. You then multiply this figure by the percentage of the vehicles business use.

- For example, if half the miles you drive are for business and half are for personal use, you will multiply your total vehicle expenses by 50% to arrive at the business portion .

Some of the costs you can include in your Actual Expenses are:

- Lease payments

- Maintenance

- New tire purchases

- Title, licensing, and registration fees

- Vehicle depreciation

How Do You Choose Which Method To Use

There are pros and cons to each method. If you want to keep it simple, standard mileage may be best. It can be a good idea to use standard mileage the first year you drive so that you have flexibility to choose between the two methods in future years.

You may be able to claim a larger tax deduction with actual car and truck expenses, especially if you drive an expensive vehicle , or if you paid a lot for car upkeep. Tracking actual car and truck expenses requires detailed record-keeping. You must keep track of all expenses and receipts related to your car, in addition to number of business miles driven. Fully track your expenses, try both calculations, then determine which method is best. Learn more about the actual expenses method.

If you choose to get help filing your tax return, free tax preparation sites like VITA or Tax-Aide cannot prepare returns that use actual car expense method because it is out of scope.

Recommended Reading: 1040paytax.com Official Site

The Irs Defines Adequate Records

Regardless of the circumstances of your employment, you will likely be asked to record the following:

- “the mileage for each business use”

- “the total mileage for the year”

- the time , place , and purpose

This is what the IRS considers adequate records when it comes to logging business mileage.

It is also required that the record is timely. This means that it must be made at or near the time of the trip. Anything that is updated weekly is considered good enough.

If you’re self-employed or a business owner, you need to adhere to the IRS’s definition of adequate records. Keep in mind that the rules cover all transportation-related expenses.