Special Considerations When Filing Form W

Form W-9 tells you to cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

You may cross out item 2 if youre filling out Form W-9 in connection with a real estate transaction. Item 2 doesnt apply in this case, so it doesnt matter if youre subject to backup withholding.

Now, if you read the fine print in the W-9 instructions carefully, it seems to indicate that most people arent required to sign this form at all. Youre generally only required to sign it if the IRS has notified you that you previously provided an incorrect TIN. Technicalities aside, however, the person who asked you to fill out Form W-9 will probably consider it incomplete or invalid if you havent signed it, and good luck trying to convince them otherwise.

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Does A Corporation Have To Supply A W9

In some cases, companies are required to complete W9 forms when hired by other companies or employers. If an individual works as part of a limited liability company such as S Company, C Company, partnership, or sole proprietorship, that individual must file Form W9 as a corporation with a corporation tax identification number.

You May Like: How Much Are Taxes On Cable And Internet

When And How Should We Collect These Tax Forms

Tax forms W8 vs. W9 what the heck is the difference?If you are a US-based company working with freelancers, this question is pertinent to your business. As you probably already know, staying on the IRSs good side makes life much easier. On the other hand, failing to fill out or submit the correct formswhether by accident or intentionallycan cause major headaches or lead to tax penalties down the road. In this guide, well define what tax forms W8 vs. W9, their differences and similarities, and how to fill them out. Once you have all of that sorted out, youll be better positioned to maximize your freelancer workforce while remaining compliant. This article is part of our guide on independent contractor taxes. What is a W-9 tax form?The full name of Form W-9 is Request for Taxpayer Identification Number and Certification. Businesses use the form to collect information from the independent contractors, freelancers, and vendors they work with who are US citizens who are required to pay taxes to the IRS.

Who Needs To Fill It Out

As discussed above, the one that is needed to fill the form is those that function as an independent entity. This will include consultants, independent service providers, or freelance entrepreneurs whose service has been utilized by a specific celebration.

The minimum amount of settlement or compensation is $600 per year. People whose solution expenses under that quantity need not complete this form.

To give a reasonable instance, allows take an example. Allows state you are a freelance copywriter that works with ABC Business. You are assigned to do a copywriting task that is worth $200 per job. Turns out that your writing is well-received and also the company asked you three more times with the same settlement. For this reason, your overall repayment from that firm is $800.

At the end of the year, the firm will send you a W9 form. Or, if the firm is not giving you the documents, just download a How To Fill W9 Form that you can obtain on-line.

Also Check: Appeal Cook County Taxes

Who Needs A W

It is a popular myth that contractors and freelancers don’t have to pay taxes. Self-employment does not erase the requirement of filing a tax return. In fact, taxes for contractors are usually more complicated than the taxes of an employee. This is because employers withhold the proper taxes on behalf of the employee. ICs and freelancers are responsible for withholding their own taxes. This guide addresses the first step of this process: the W-9.

For Independent Contractors and the Clients They Work With

Here’s a run-down of how it works for both the contractor and the business.

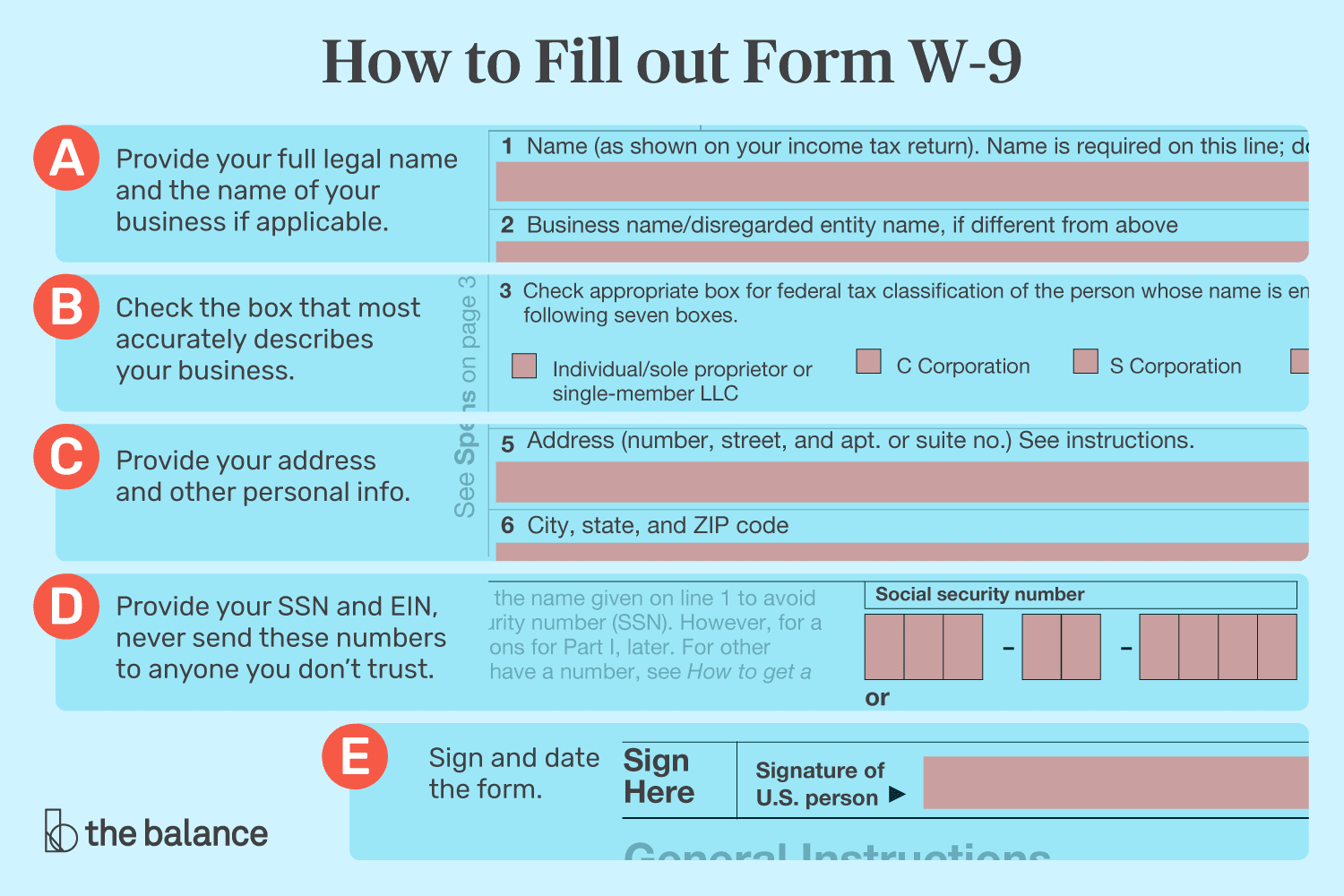

Your client will ask you to complete and return a W-9 Form. On it, you will need to provide your full legal name, address, and TIN. Your TIN may be your social security number. If you have an EIN, you may use it provided that you also include the name of your business that’s associated with it. Be sure and double-check all the information you provide for accuracy. One very important note: submit the finished W-9 to your client. Do not submit it to the IRS.

For Those Who Hire Independent Contractors

Have each independent contractor or freelancer complete a W-9. This should be done as early as possible, ideally during the time of hire. If someone takes a long time to return the W-9, follow up with them. It’s important that you get the form completed by the contractor every tax year you work with them so that the IRS doesn’t have a missing form to use as a flag for auditing you.

Employer and Employee

Tips For Getting Through Tax Season

- Its important to start collecting your tax paperwork as soon as possible. That gives you time to do your calculations, collect the correct information and submit your taxes on time. For people who want some help staying organized, a financial advisor is a great resource. SmartAssets free financial advisor matching tool can help you find advisors in your area. Get started now.

- If youre self-employed and have worked for a number of vendors, youll have to fill out multiple W-9 forms. Each vendor who paid you more than $600 in a given year will send you a 1099 the following year, by January 31. If you are missing a 1099, contact the company.

- Using the right tax filing software can help you ensure that all your tax forms are correct. If you arent sure which to use, consider two of the most popular services, H& R Block and TurboTax. They both offer clear explanations of the process and a smooth filing experience. Heres a closer look at whether you should choose H& R Block or TurboTax.

Also Check: Is Freetaxusa A Legitimate Company

Input To The Rf Business System

Taxation and exemption must be correctly coded in the RF business system. Refer to the procedure, “Processing Taxation and Exemption of Employee Payments to Nonresident Aliens” for detailed information on system input.

State and Federal Tax Exemption

If the employee is exempt, the exemption must be recorded on the Federal Tax Rules form and/or the State Tax Rules form in the RF business system.

Special Information Types

Special Information Types are added to a non U.S. citizen employee assignment in the payroll module to record residency and tax status data. The Non Citizen Residency Information SIT and Non Citizen Reporting Information SIT must be initially completed and then updated when residency or tax status changes.

- The Non Citizen Residency SIT includes a field for designating the person’s “resident alien” status. Ensure that the Res Alien for tax- meets SPT field is set to Y .

- The Non Citizen Reporting SIT data appears on the year-end 1042-S tax statement. Ensure that aline is added for the treaty exempt income and include the starting and ending dates for the exemption and the treaty country. The treaty exempt status must be entered for each calendar year.

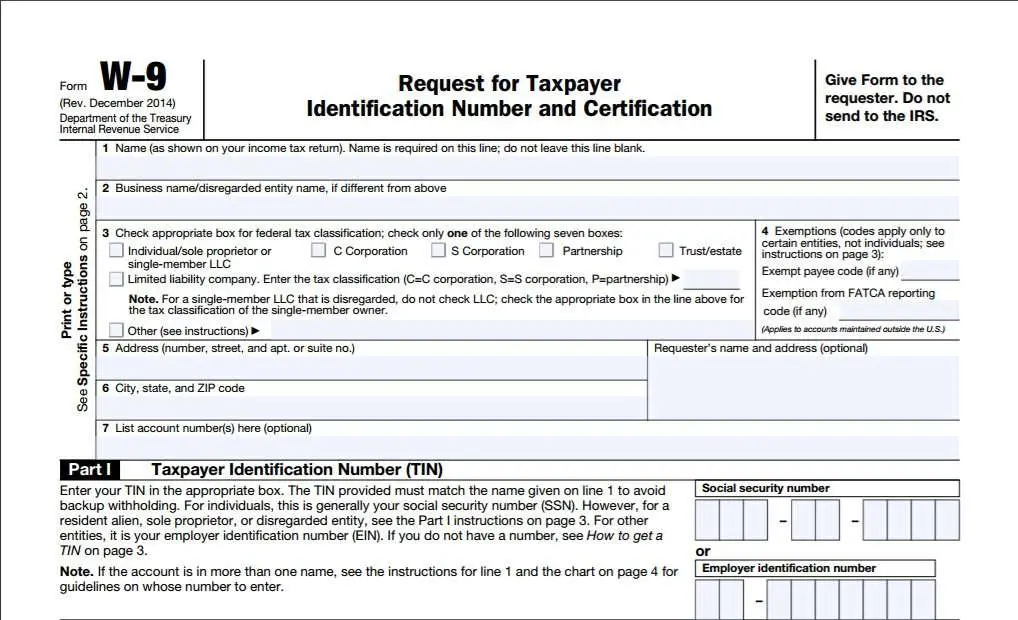

How To Fill Out Your W

Line 1 Name: This line should match the name on your income tax return. This the legal name of your as an individual or as a company.

Line 2 Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. The purpose of line 2 is to help identify your company to your customer if the name on Line 1 is not one commonly known by your customer. See our related blog, What is a disregarded entity?

Line 3 Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?

Other This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.

Line 4 Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals are not exempt from backup withholding. See the Specific Instructions for line 4 shown with the W-9 form for more detailed information on exemptions.

Line 5 Address: Enter your address . This is where the requester of the W-9 form will mail your information returns to.

Also Check: Federal Irs Tax Return

Who Is Exempt From The W9 Form

Some individuals may be perplexed when they are confronted with filling this Exemption line. According to the Internal Revenue Service information, this exemption line should be filled up if you are exempt from FATCA reporting and/or back-up withholding. You ought to fill in the blank provided with the proper code.

Watch Out For Red Flags

Although its a basic and widely used tax document, that doesnt mean you should take any less care with handling Form W-9 than you would handle other tax and financial documents. Here are a few things to look out for:

- The person or business asking you for a W-9 seems shady. In general, you should be careful giving out sensitive information like your name, address, and Social Security number. Make sure youre reasonably comfortable with the person or organization asking for a W-9 before you supply that information.

- Use only secure channels to send a W-9 tax form. If you choose to email Form W-9, make sure to send it as an encrypted attachment. You can also use another secure delivery method, such as hand delivery or regular mail.

- The purpose of a W-9 request is unclear. If youre not sure why the requestor wants a Form W-9 from you, ask them what tax documents theyll use it to prepare for you.

- You thought you were getting a Form W-4. If youre starting a new job and the employer wants a W-9 instead of a W-4, clarify whether youre an employee or independent contractor. Its against the law for them to require you to work like an employee but pay you like a contractor.

Read Also: How Do You Report Plasma Donations On Taxes

How Do I Get A W

If you are self-employed or sole proprietor, you can use your employer identification number on your W9 form and not your citizen service number . Request a free instant EIN during IRS EIN online business hours, Monday through Friday, 7am to 10pm EST.

Payroll processWhat are the steps to process payroll? The first step in payroll is calculating the payroll that will be paid to each employee. The most common billing cycles are weekly, biweekly, biweekly, and monthly. Hourly workers generally receive weekly or biweekly wages. Most companies ask their hourly employees to complete their timesheets at the end of each week.How often do I have to process payroll?You can process pa

Common Mistakes To Avoid While Filling Out Form W

Mistakes are something we all make. However, mistakes on your tax returns can prove to be costly. Many have found this out the hard way even a small typo in any of the fields could cost you big. We have prepared a list of common mistakes to avoid while you are filling out your Form W-9.

– Mistyping your name or DBA on the W-9 can actually trigger an audit since it would appear to IRS that you didn’t report your form 1099-MISC when you submit your tax return later.

– Same thing may happen if you make a typo in the SSN or EIN. Remember, your customer has no way to verify that you’ve entered the correct details on your W-9 form.

– Make sure your mailing address is correct, otherwise you will not receive your 1099-MISC form later.

Keep all the forms in one place, for example in PDF Expert on your iPad. This enables a quick access whenever you need them. Once again, make sure you provide accurate information on your W-9. This will ensure that payments you receive are properly reported to the IRS. If you are unsure of some items, always consult with your financial adviser.

Also Check: Www.1040paytax.com Official Site

When Do I Sign A W9 Form For Employees

The IRS also requires that a signed W9 form be received when the company receives the first “B” notice from the IRS. The “Notice B” is sent to the IRS when the name and TIN number on the 1099 form issued to the provider by the company do not match the IRS or Social Security records.

What Is Form W

A W-9 form is an Internal Revenue Service tax form that is used to confirm a person’s name, address, and taxpayer identification number for employment or other income-generating purposes. The confirmation can be requested for either an individual defined as a U.S. citizen or a person defined as a resident alien.

A W-9 form is also known as a Request for Taxpayer Identification Number and Certification form.

You May Like: How Much Do You Pay In Taxes Doordash

What Identification Number Do I Use For The W

- If you are an independent contractor or freelancer operating in your private capacity, you can use an employer identification number or a Social Security Number when you fill in the W-9.

- If you are a sole proprietor, you can use an EIN or SSN.

- If your business is LLC classified as a corporation or partnership, use the entitys EIN.

- If your business is a single-member LLC thats a disregarded entity, use your personal EIN or SSN.

Is It Easy To Sign A W

Signing your W9 online is easy. What is the W9 form and what is it used for? The information on the W9 form comes from the IRS 1099Misc tax form, which lists income paid to an individual in the United States that would otherwise be recorded on the IRS Form W2 used for employees.

Skyworth tvIs the Skyworth TV compatible with Android TV? While Skyworth uses LG’s webOS smart platform on some of its displays, this OLED model will use Android TV instead. This means you get the same app compatibility, Google Cast functionality, and Google Assistant integration you get on any Android TV, but not the most user-friendly experiences available on Google TV.When does the Skyworth Global TV festival start?To thank consumers for

You May Like: Tax Deductions Doordash

What Is The Deadline For Filling In Form W

Historically, the deadline for filing tax returns is April 15. Notably, since the W9s are not sent directly to the IRS, there is no deadline for filing the W9s. However, tax documents completed by W9 must be filed before the federal closing date and W9 must be completed before you begin working for an employer.

When Do I Sign A W9 Form For Social Security

The IRS recommends that you ask all sellers to file Form W9 if you intend to make payments of $600 or more to them, whether they are individuals or independent contractors, owned or part of a national trust, public partnership, corporations or limited partnerships.. acts as a responsible company. , Clubs or organizations that act in accordance with the law.

You May Like: 1040paytax Irs

What Happens If Your W

That is why they have put in place rules to ensure that all W9 forms have a correct and complete tax identification number. If you file a W9 form without a valid tax identification number, or if your tax identification number is invalid, your employer must withhold federal income tax from your payments.

Can You Sign W9 Electronically

- Please complete all required fields on the form. When you’re ready to sign the form, click the Fill & Sign link in the lower right corner of the sidebar.

- Then click the “Sign” link at the top of the form and select “Add Signature”.

- Then you will see a pop-up window where you can enter, draw or import an image with your signature.

Read Also: Amend Tax Return Online For Free

Where Can I Access Your W9 Form

For Form W9 and its instructions, such as B. For information about laws passed after publication, go to. The purpose of the form. A natural or legal person who is required to file an information return with the IRS must provide a correct Taxpayer Identification Number , which may be their Social Security number.