How Do We Receive Your Tfsa Information

If you disagree with any of the information on your TFSA Room Statement, or TFSA Transaction Summary, such as dates or amounts of contributions or withdrawals which your TFSA issuer has provided to us, contact your TFSA issuer. If any information initially provided by the issuer about your account is incorrect, the issuer must send us a revised record so that we can update our records.

You can view your TFSA Transaction Summary online. Go to My Account for Individuals to see all the contributions and withdrawals made to your TFSA.

Tax Considerations By Business Type: General Partnership

A business partnership is also not considered to be a taxable entity. In a general partnership, each partner claims their own liabilities and assets and includes it with their personal tax return. All income that comes through the business is listed and then included on the individual tax return. A general partnership will utilize the following tax documents:

- Form 1065

- Form 1040

In a general partnership, each partner can expect to receive a Schedule K-1, which shares each partner’s income. You will use this form when filling out your own income documents. Each partner can expect to pay taxes on their portion of the income received.

Ways To Keep Business Records

You can keep your records electronically or in paper form. A variety of electronic record-keeping packages are available.

To decide what records you need to keep, or to evaluate how well you are currently keeping your records, use the ATOs Record keeping evaluation tool.

Use the ATOs tools and services for small businesses:

- Small business assist – provides easy access to information on a range of tax topics.

- Small business superannuation clearing house – a free online service to help you meet your super obligations for your employees.

- ATO app – a free app with a range of tools to make it easier for you to do your tax and super.

Also Check: 1040paytax.com Official Site

How A Partnership Pays Income Tax

A partnership is the result of two or more individual taxpayers joining together for business purposes, and they share in both the profits and the losses of the business. Partnership businesses don’t pay income tax directly to the IRS. Their partners are taxed on their shares of the partnership’s income.

Business income or loss is calculated on Form 1065, and the individual partners then receive Schedules K-1 showing their shares of this income. Schedule K-1 is included with the owner’s personal tax return and taxes are paid at the owner’s personal tax rate, just as they would be if they were sole proprietors.

Partners must also pay the self-employment tax and make quarterly estimated tax payments.

Factors To Consider In Selecting A Business Type

As you start your business or consider changing your business type, consider these four important factors during your decision-making process:

- Cost and complexity of running the business, including legal fees and cost of operation

- Ownershipcontrol and the tradeoff between control and profits/losses

- Taxes on the business and how the business or owner pays taxes

- Liability of business owners for the debt of the business, for actions of other owners, and for general liability

Recommended Reading: Can Home Improvement Be Tax Deductible

How To Choose Your Llc Tax Status

LLCs are one of the most flexible business structures, especially when it comes to tax purposes. But how do you decide which method of taxation is best for your business? Keep reading to learn which tax classification is right for your LLC and its members.

Skip Ahead To:

Meet a Business Accountant

Recommended: A business accountant service can help you avoid overpaying taxes, manage bookkeeping, issue payroll, and more.

2021-08-27

Introduction To Small Business Tax

Entrepreneurs who want to start a business need to be aware of the tax obligations of running a business whether it is in the form of a legal entity or in their personal capacity. It is also important to note the various options with regard to reducing some of the administrative requirements to make tax compliance easier as well as the different tax incentives and rates that may apply in certain instances. Business Tax refers to a tax levied by the South African Revenue Services on the profits made by businesses. Small Businesses are required to follow the same tax processes as medium or large businesses, but small businesses often experience the tax process as stressful due to not being as formalised as these larger entities. The complex and strict nature of tax returns is often intimidating and can be quite a burden to small businesses.The information in this guide is aimed at alleviating tax-related stress for you and your small business whether it is a registered company or your trade in your own name.

Also Check: Where’s My Tax Refund Ga

How To Authorize A Representative

You can authorize a representative to get information about your tax matters and give us information on your behalf. We will accept information from and/or provide information to your representative only after we are satisfied that you have authorized us to do so through My Account for Individuals, or go to Representative authorization.

Your authorization will stay in effect until any one of the following situations applies:

- it is cancelled by you or your representative

- it reaches the expiry date you choose

- we receive notification of your death

You or your representative can cancel the consent you gave by telephone or in writing.

If you were the legal representative of a deceased person, see Guide T4011, Preparing Returns for Deceased Persons, to know what documents are required.

Learn more about representatives by going to Representative authorization.

Preparing For Tax Type Setup

Most businesses need to charge taxes according to eligibility requirements, and the place of supply rules as established by the federal and provincial governments. For example, if you sell to and ship to customers throughout Canada, and meet the requirements to charge taxes throughout Canada, you may need to register and set up for all of the tax types. Be sure to complete all necessary registrations in each jurisdiction and have your tax numbers handy before setting up taxes.

The tax types you set up will be available in selection lists to be applied to both sales and expense transactions.

You May Like: Www Michigan Gov Collectionseservice

Managing Your Small Businesss Taxes

If youve finished reading about the different types of small business taxes and find that your heart rate is up, dont panic! You dont need to understand every term and tax nuancethats why professionals exist.

Here are a few things that you can do now to get your taxes in order:

- Hire a professional: Work with a qualified tax professional to ensure that all your ducks are in a row. These experts can make sure youre calculating, collecting, and completing tax payments appropriately. They also can help you to find and claim valuable tax deductions.

- Put money aside ahead of time: Dont wait until tax season to start thinking about your obligations. Put your accumulated tax money in a separate bank account to prepare for the future. Set up automatic transfers to deposit money into your tax obligation account so you dont even have to touch itout of sight, out of mind.

- Pay more rather than less: When in doubt, pay more. Youll avoid trouble and possibly end up with a pleasant tax return surprise.

State Small Business Tax Rates

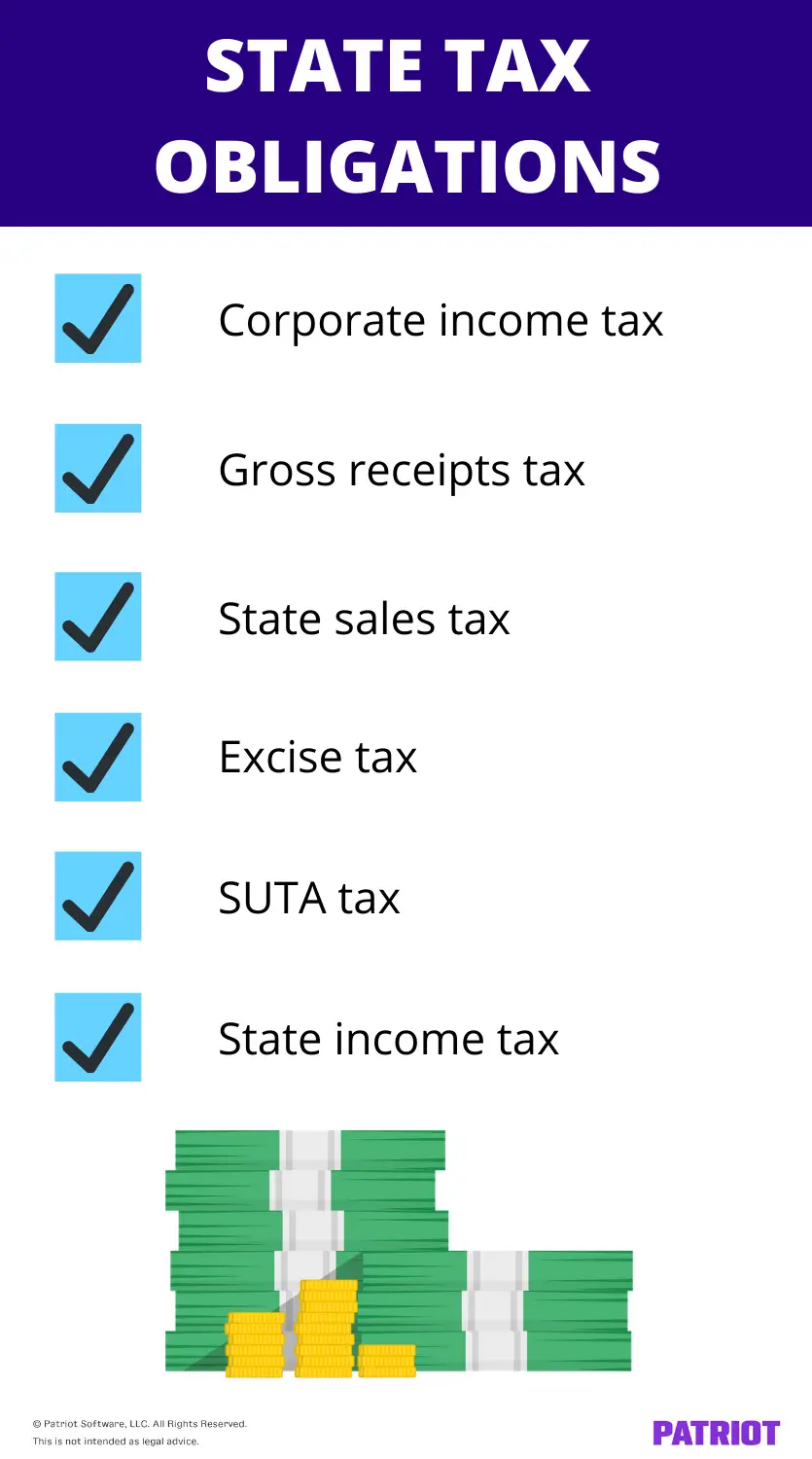

In addition to federal taxes, your business is also responsible for complying with state and local tax obligations. With the exception of South Dakota and Wyoming, all states levy a tax or charge of some sort on business income. There are three main models for state small business tax rates:

- Corporate Income Tax: In most states, C-corporations must pay a corporate tax rate of 4% to 9% on net business income.

- Gross Receipts Tax: A few states, including Texas and Washington, charge a gross receipts tax instead of a corporate income tax. Gross receipts tax is levied on a businesss gross sales, instead of net income. A business usually cant take deductions before this tax is calculated.

- Franchise Tax: Some states charge a franchise tax in addition to or instead of a gross receipts tax or income tax. A franchise tax is calculated on the value of a businesss stock or assets and usually ranges from 0.1% to 0.9%.

All of this being said, you should keep in mind that even if a state doesnt charge individual income tax, your businesses might still have tax obligations. For instance, New Hampshire doesnt levy an individual income tax, but it does have a corporate income tax and a franchise tax. In addition, states might charge their own equivalent of payroll taxes and excise taxes. Sales taxes are exclusively at the state and local levels.

Also Check: How Do I Protest My Property Taxes In Harris County

Determining Your Small Business Tax Rate

At the end of the day, understanding and meeting your tax requirements are some of the most complicated parts of running a business. There are a number of reasons why business taxes are so complexâthere are a variety of taxes to consider, your small business tax rate will differ based on your entity type, and there are deductions and credits to incorporate as well.

Therefore, the best thing you can do for your business is to work with a qualified tax professional, like a CPA, enrolled agent, or tax attorney. Their expertise can help you understand the types of taxes your business is responsible for and make sure you are paying the correct small business tax rate.

Article Sources:

Fact : The Multitude Of Business Types Encourages Inefficient Tax Avoidance

Its no surprise that business owners seek to minimize the taxes they owe. The array of different business entities to choose from and the flexibility in determining whether business owners income is distributed as profits, wages, or capital gains provides considerable opportunities to structure a business to reduce tax. Because each of these sources of income may be taxed at different rates, business owners spend considerable time and cost in efforts to structure their activities to minimize taxes.

Figure 7 provides one dimension of how these distortions affect how income is distributed to owners. Owners of small C-corporations tend to take all of their income in the form of labor earnings , which is deductible to the firm, reducing their corporate income close to zero. Because wages are taxed at a top rate of about 43.4 percent, the resulting tax bill is substantially lower than the 50.5 percent rate they would face if they first payed the corporate tax and then paid individual tax on the dividends.

Recommended Reading: How Do I Protest My Property Taxes In Harris County

Estimated Taxes For Business Owners

Because you are the owner of a business, no one withholds income tax and self-employment tax from the money you take out of the business.

The IRS requires that these taxes be paid throughout the year, so you must pay estimated taxes quarterly. The first payment of the year is due April 15, then again on June 15, September 15, and January 15 of the following year.

Businesses located in Texas and other areas affected by severe winter storms also received an extension on filing their 2021 estimated tax payments as a form of disaster relief. Estimated income tax payments due on April 15, 2021, as well as the quarterly payroll and excise tax returns normally due on April 30, are both due on June 15, 2021.

The estimated tax form for business owners combines business and personal income and taxes, including self-employment taxes.

How Do Llc Taxes Work

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesnt pay taxes on business income. The members of the LLC pay taxes on their share of the LLCs profits. State or local governments might levy additional LLC taxes. Members can choose for the LLC to be taxed as a corporation instead of a pass-through entity.

There are several types of LLC taxes. The federal government, as well as state and local governments, levy these taxes. All LLC members are responsible for paying income tax on any income they earn from the LLC as well as self-employment taxes. Depending on what you sell and whether you employ anyone, you might also be responsible for paying payroll taxes and sales taxes. To complicate things even more, an LLC can opt to be taxed as a different business entity.

In this guide, well cover the entire range of LLC taxes, what youll be responsible for, and options for reducing your tax bill. Understanding your tax burden in advance can help you make smarter financial decisions.

Don’t Miss: Buying Tax Liens In California

Business Taxes By Entity

Corporations, limited liability companies , partnerships, and sole proprietors all have different tax responsibilities. Youll need to understand your business type to ensure that you pay your taxes appropriately.

Heres a high-level overview of the tax obligations you can expect based on your business structure:

- C Corporation: Due to the Tax Cuts and Jobs Act of 2017, the tax rate dropped to a flat 21% for C corporations. C corporations pay their own taxes, meaning the owner doesnt report this income on their personal taxes. However, shareholders must pay taxes when they receive a dividend or sell stockthis is why C corporations are said to pay double taxation.

- S Corporation: The company passes through income to its shareholders, meaning that each shareholder will take a portion of the profits to report on their personal tax returns.

- Sole Proprietor: Sole proprietors simply report their businesss net income on their personal tax returns. Sole proprietors are usually a 1-person show, so they dont have to pay payroll taxes. But if this is your full-time business, youll have to pay self-employment taxes.

- Partnership: Each member of the partnership takes their portion of the profits to report on their personal tax returns.

- LLC: Single-owner LLCs are treated as sole proprietorships for tax purposes, while multi-owner LLCs are treated as partnerships. However, an LLC can elect for corporate taxation if they regularly retain a substantial amount of profits in the business.

Income Tax Rates For Pass

The federal small business tax rate for pass-through entities and sole proprietorships is equal to the owners personal income tax rate. For the 2019 tax year, personal income tax rates range from 10% to 37% depending on income level and filing status. For example, a single filer who reports $100,000 in net business income will pay a 24% tax rate.

Its important to note, however, as of the 2018 tax year, sole proprietors and owners of pass-through entities can deduct up to 20% of their business income before their tax rate is calculated. In the above example, the tax filer could deduct up to $20,000 from the net business income. Then, theyd only have to report $80,000 in income, reducing their tax rate to 22%.

There are limits, however, on this small business tax deduction based on income and type of business. In general, you must earn less than $157,500 or $315,000 to qualify for the full deduction. Additionally, professional service businesses, such as law firms and doctors offices, typically cant claim the full deduction either.

Don’t Miss: Have My Taxes Been Accepted

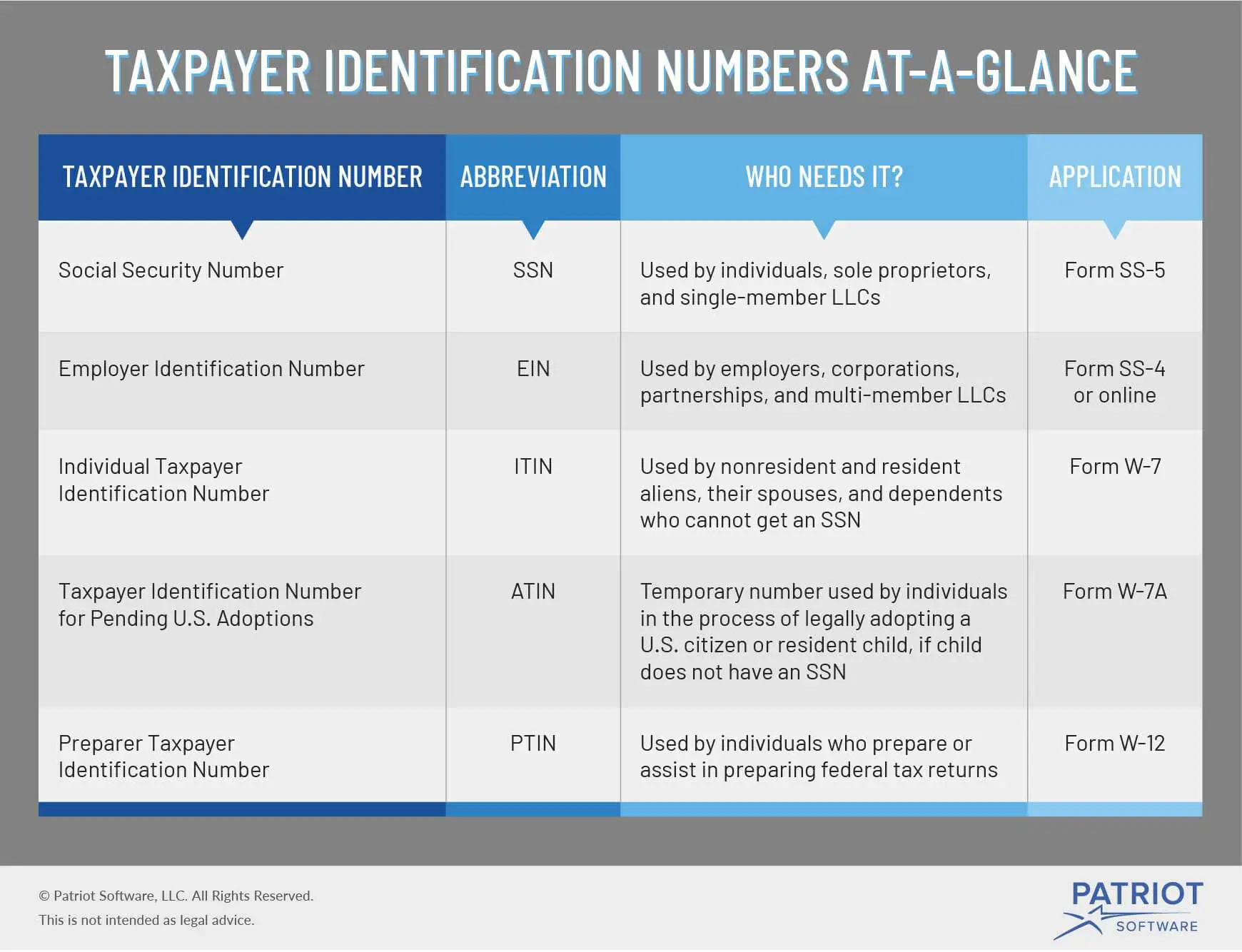

Types Of Business Taxes

According to the United States Internal Revenue Service , businesses can incur four basic kinds of federal taxes. They include income tax, self-employment tax, employment tax, and excise tax. In addition to these taxes, each state requires that businesses pay certain taxes. In all cases, the way a business operates determines which taxes it owes.

Tax Considerations By Business Type: Limited Liability Company

The government considers a limited liability company a separate entity. An LLC offers liability protection to limited liability company owners. In regards to tax expectations, LLC’s limited liability company owners. In regards to tax expectations, LLC’s are similar to a partnership. Liabilities and assets are reported on the personal income statement and taxes are paid at the individual level. LLC owners will use the following tax return documents:

- Form 1065

- Form 1040

- Schedule C

LLC businesses can also decide if they want to be considered a C corporation or an S corporation. This can affect the required tax filing documents. Limited liability companies are not a taxable entity and are instead, taxed on the individual tax return. If an LLC has more than one member, they will treat the filing process similar to filing as a partnership.

Recommended Reading: How To Get Tax Preparer License

What Happens If I Transfer The Assets From My Sole Proprietorship Into A Company

As your sole proprietorship business grows you will come to a time when it is better to incorporate in order to save tax dollars since money earned through a sole proprietorship is taxed to the individual personally. In this case, you will need to close down your sole proprietorship business, transfer the assets and liabilities to a new company and obtain a brand new Business Number for the corporation. A corporation is considered an entity on its own and therefore needs its own Business Number.

What Is The Purpose Of The Federal Business Number

The Federal Business Number is needed for you to file the federal tax return for your company and Revenue Canada will issue the Federal Business Number for a corporation immediately upon incorporation and send notification of this number to the registered office address of the corporation.

The Federal Business Number consists of three sections. The Nine Digit number represents your main base Business Number. This number stays the same no matter how many types of accounts you have with the Canada Revenue Agency.

You May Like: Www..1040paytax.com