Final Thoughts On How To 1099 Someone

This task is a headache, there is no doubt about it. However, it’s a requirement and you need to get together with your accountant ahead of time to work out the details so they can help you make the process as painless as possible.They aren’t the only ones who can assist. Refer to our 1099-MISC generator to automate your accounting and pay stub needs. And if you have to make your own paystubs, be sure to use the ultimate check stub maker.

- 1. Enter Your Information

Keep An Eye On Your Business Income

W-2 employees have it easy when it comes to tracking their yearly income. Their employer does that on their behalf. On the other hand, independent contractors need to record your business income or earnings in as much detail as possible so you can easily calculate your net income and determine your taxes.

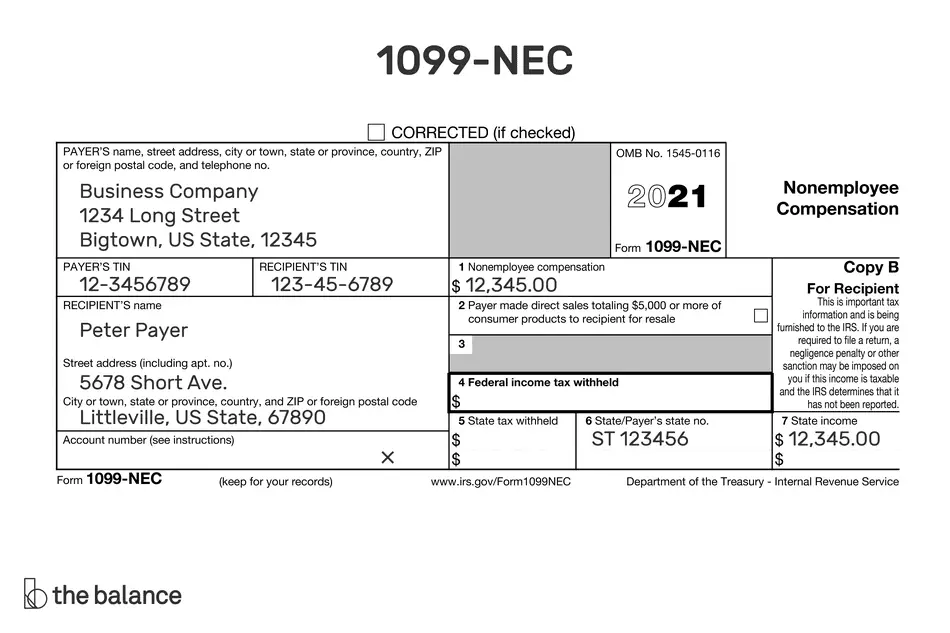

What Do You Do With Irs Nec Received

A 1099 NEC Form used to report amounts paid to non-employees which includes independent contractors, freelancers etc. Non-employees receive a Form each year at the same time as employees receive W-2 Forms. Taxpayers send this Form at the end of January every year. So, the information filled out in the Form can be in included in the recipients income tax return.Business owners are required to give a 1099 NEC form to non-employees when the total income during the year was $600 or more. If you had under reporting income which is less then $600 cut off, you wont receive the Form.If you are filing your own tax returns, youll be asked if you have any 1099 income. At this point, you can include the information from the Form you received.

Don’t Miss: Tsc-ind Ct

How To Calculate Adjusted Gross Income For Tax Purposes

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Calculating your adjusted gross income is one of the first steps in determining your taxable income for the year. Once you have determined what your adjusted gross income is, you can determine your tax liability for the year.

Here are some helpful tips for how to calculate your adjusted gross income for tax purposes.

Before you calculate your AGI, you can determine whether you need to file a tax return for the year. The Internal Revenue Service provides an interactive tax assistant that can be used to help you determine if you need to file a tax return for the year.

Filing The 1099 Tax Return

Besides paying quarterly estimates, it is all taxpayers’ responsibility to file a tax return by April 15th of the following year. If you miss the deadline, you’ll be subject to the 1099 late filing penalty rate.

This is where forms 1099 come into play.

What Are 1099 Tax Forms?

Forms 1099 are “information returns” forms, issued by the payer/client/employer to the independent consultant whose services had been contracted .

There is a wide selection of 1099s a self-employed worker can be issued. Let us take a quick look at a couple of versions you are most likely to receive as an independent consultant.

- 1099-NEC: this is the most frequently issued standard 1099 form by “the payer” to independent consultants, where the transaction for the job amounted to at least $600.

- 1099-K: if you, as an independent consultant, are making sales through third-party payment methods, like PayPal, credit cards, or freelancing platforms like Fiverr and Upwork that manage client payments on your behalf, you may receive a 1099-K from those intermediaries once you cross a certain threshold of income through sales transactions.

Other 1099 tax forms may apply for various types of independent earnings .

Under What Conditions Do You Get Issued The 1099 IRS Form?

The deadline for issuing a 1099-NEC for the year 2021 is February 1, 2022.

Under What Conditions Do You Issue The 1099 IRS Form?

What Happens If I Don’t Get A 1099 Form?

You May Like: How To Buy Tax Liens In California

What To Do With The 1099

A 1099-NEC form is used to report amounts paid to non-employees . Non-employees receive a form each year at the same time as employees receive W-2 formsthat is, at the end of Januaryso the information can be included in the recipient’s income tax return.

Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was $600 or more. If you had income under $600 from that payer, you won’t receive a 1099-NEC form, but you still must include the income amount on your tax return.

If you are doing your own tax return using a tax software program, you will be asked if you have any 1099 income. At this point, you can include the information from the form you received.

If you are having a tax preparer do your personal return, give the form to your preparer along with your other documents.

What Is The Difference Between 1099 And W

Forms 1099 and W-2 are two separate tax forms for two types of workers. Independent contractors use a 1099 form, and employees use a W-2.

For W-2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis.

W-2 positions direct employees as to how, when, and where they do a job. Workers who complete tasks or work on individual projects will fall under a 1099. An independent contractor is able to earn a living on his or her own rather than depending on an employer.

Independent contractors are often referred to as consultants, entrepreneurs, business owners, freelancers, or as self-employed individuals. They work for a number of different clients at any given time and are not an employee of any particular company.

The IRS has established certain test to determine if a worker is a contractor or an employee. The independent contractor is considered a separate business and is not considered an employee. If work is considered integral to a business, that person will likely be an employee. Temporary or non-essential work can imply the status of contractor.

Recommended Reading: Efstatus Taxact Com Return

Paying Taxes On Your Self

The biggest reason why filing a 1099-MISC can catch people off guard is because of the 15.3% self-employment tax. The 1099 tax rate consists of two parts: 12.4% for social security tax and 2.9% for Medicare. The self-employment tax applies evenly to everyone, regardless of your income bracket. For W-2 employees, most of this is covered by your employer, but not for the self-employed!

Don’t feel so intimidated by your tax liability after using our free 1099 taxes calculator. In the next section, we’ll show you how you can reduce your tax bill with deductible expenses.

How To Lower Your Self

If you are self-employed or a small business owner, you understand first-hand how awful your tax bill can be, especially with the giant 15.3% self-employment tax added on .

When youâre not an employee, you donât have anySocial Security and Medicare taxes withheld from your income.

And since thereâs no state and federal income taxes, health insurance, or social security and medicare taxes, are taken out of your paycheck, you are the one who is solely responsible to pay self-employment tax. Most individuals working a full-time job would expect a tax refund, but you’ll need to pay taxes on 1099 income.

Thankfully, there are plenty of things you can do to avoid outrageous quarterly tax payments and yearly tax payments.

Here are a few ways you can keep some extra money in your pocket when you receive a 1099.

Also Check: Where’s My Tax Refund Ga

How Do You Check If Previous Taxes Were Calculated Correctly

Once you know your net earnings, itâs simple to check on tax amounts by using the calculations above.

If youâve made quarterly payments based on a different amount, then the numbers may be off. But if youâve determined the correct net earnings and you use the correct calculations, then your tax amounts should be calculated correctly.

Recommended Reading: Which Tax Return Did You Have From Last Year

Tax Deductions For Independent Contractors

Deductions lower your taxable income for the year. Independent contractors claim them as business expenses on their taxes. Depending on the kind of business you own, your deductible expenses might include:

- Advertising costs

- Rent or lease payments

- Equipment purchases

Independent contractors can also claim a deduction for health insurance premiums they pay out of pocket. That includes premiums paid for medical, dental and long-term care insurance. If you pay for your spouses and childrens insurance, you may be able to deduct those costs, as well. The exception to the rule is that you cant deduct premiums for health insurance if you have access to a spouses insurance plan.

As an independent contractor, you can also deduct personal expenses, such as mortgage interest paid, interest paid to student loans and real estate taxes. You can also get a tax break for contributing to a self-employed retirement plan or a traditional IRA. If youre looking for a retirement plan option, consider a SIMPLE IRA, . These plans allow for deductible contributions, with qualified withdrawals taxed at your ordinary income tax rate in retirement.

Read Also: Do I Need To Report Roth Ira Contributions On My Tax Return

Do I Have To Pay Taxes On A 1099 Form

Typically, income that has been reported on a 1099 is taxable. However, there are many exceptions and offsets that reduce taxable income.

For example, let’s say a taxpayer has a gain from the sale of a home, meaning the selling price was higher than the original cost basis. The taxpayer might not owe taxes on that gain since they may qualify for an exclusion up to $250,000, depending on their tax situation.

It’s best to consult a tax professional if you’re unsure whether you need to pay taxes on 1099 income.

Stay On Top Of A New Address

Whether or not the payer has your correct address, the information will be reported to the IRS based on your Social Security number . As a result, it’s important to update your address directly with payers.

Taxpayers don’t include 1099s with their tax returns when they submit them to the IRS, but its a good idea to keep the forms with your tax records in case of an audit.

Also Check: File Missouri State Taxes Free

Do I Qualify For A 1099

In the US, the state your taxpayer information is associated with will determine your qualification for a Form 1099-K. In most states, accounts meeting both of the following criteria qualify for a Form 1099-K and must be reported to the IRS by Square:

More than $20,000 in gross sales from goods or services in the calendar year

AND more than 200 transactions in the calendar year

Square may report, solely within its discretion, on amounts below these thresholds to meet state and other reporting requirements:

Do I Have To Pay Taxes As A 1099 Employee

Yes, you are responsible for paying your own taxes. Your client will not withhold federal or state taxes like they will for W-2 employees.

If your pay is $600 or more, you should receive Form 1099-MISC to report your income to the IRS from your client. Use the form to calculate your gross income on Schedule C.

Outside of the 1099-MISC, you may need to file your estimated taxes quarterly if you will pay more than $1,000 in taxes for the fiscal year.

All 1099 employees pay a 15.3% self-employment tax. There are two parts to this tax: 12.4% goes to Social Security and 2.9% goes to Medicare. Its your responsibility to set aside money to cover these costs as clients arent required to withhold these taxes from your paycheck.

Visit the IRSs Self Employed Tax Center to learn more about taxes as a 1099 employee. If youre unsure whether you owe taxes or should file a 1099-MISC, its probably a good idea to speak with a tax professional.

How to file Schedule C for 1099-MISC

Heres a brief rundown of how to fill out Schedule C:

Read Also: How Does H And R Block Charge

You’re Responsible For Paying Quarterly Income Taxes

Curt Mastio, a CPA who runs Founders CPA and teaches at Northwestern University, said that before figuring out ways to nail your taxes every year, you have to become familiar with the differences between your old W-2 work and your new life as a 1099 worker.

The biggest change: You are now responsible to pay estimated taxes and your social security payments.

As someone employed by a company and receiving a W-2, your employer is withholding a certain amount of your paycheck each pay period and remitting that on your behalf, Mastio said. When you become self-employed, no one is doing that on your behalf.

Therefore, he said, you are responsible for making quarterly income tax payments. These payments are the governments way of making sure youre paying what you should pay ahead of time. There was a time when you had to mail in your quarterly payments but thankfully, the IRS has made it possible to pay your quarterly taxes through their website. In fact, you have the option of paying your quarterly taxes every month.

If youre someone who struggles to budget properly and have a spend it while youve got it mindset, submitting on a monthly basis can be helpful, Mastio said.

It’s Time To Lower Your Tax Bill

Filing your tax return for your IRS Form 1099-MISC doesnât need to be scary. Using tax software designed specifically for those who receive tax Form 1099s takes away the headache and worry at the end of the tax year. Simply answering some yes/no questions will get you the tax savings you are entitled to for your income taxes. Also, don’t forget to file estimated tax payments or quarterly tax payments before tax time to avoid a penalty. Consult with a CPA or professional for tax advice if you are worried about filing your own taxes. Check out Keeper Tax’s blog for more tax tips and how they can help keep more money in your pocket.

Melissa Pedigo

Melissa Pedigo has been a CPA for over 20 years and she is one of the only CPA copywriters in the world. With a vast knowledge of U.S. tax and accounting, sheâs able to write about tax and finance topics from a unique perspective…as an industry expert. When sheâs not writing or being an accounting nerd, youâll find her watching and playing tennis, reading, tending to her half-grown garden, and studying foreign languages

Also Check: How Much H And R Block Charge For Taxes

Whos Responsible For Independent Contractors Payroll Taxes

The short answer: Not your company. Thats the clear distinction between a contractor and an employee of your company that we mentioned at the beginning of this article. If your company is submitting payroll tax payments to the IRS and state and local governments, that person must be classified as an employee. A freelance worker, on the other hand, is responsible for paying all of their federal and state and local taxes as well as Social Security and Medicare taxes. Since they are self-employed, theyre also required to pay both their portion and the employers portion of those FICA taxes.

Quarterly Taxes For The Self

Earn more than $1,000? You need to pay taxes quarterly, in April, June, September, and January.

If you also work for someone as an employee, theyâll withhold taxes from your pay. But the money you make on the side is also taxed. And those taxes, in the form of a portion of your income, need to be withheld by you.

You can calculate your estimated tax payments based on last yearâs income, or on your estimated income for the present year.

Recommended Reading: What Does Locality Mean On Taxes

Forms That Independent Contractors File

The main form that all of your numbers will go on is a regular 1040. Regardless of your background and type of earnings, everyone in the U.S. submits this form. Where the paperwork veers off a little, however, is the point when you start working with the supporting schedules.

The income that you report for your independent contracting must come from a Schedule C. Furthermore, to account for the self-employment tax, you need to include a Schedule SE. If you made any estimated tax payments, which will be discussed shortly, you need to ensure that those accompany your return as well.

The best starting point is Schedule C. You begin by adding all of your earnings in Part I on lines one through seven. After that, you go through lines eight through 28 to derive the total expenses. Finally, you will get your net profit or loss on line 31. That number will go directly on line 12 of your form 1040. Also, do not forget to calculate your qualified business deduction from section 199A of the new tax law from 2017, which will amount to 20% of the net income that you made. That is, of course, as long as you satisfy certain requirements that most independent contractors do. To find out more about them, review the overview provided by the IRS.