Federal Tax On Taxable Income Manual Calculation Chart

If your taxable income is $49,020 or less.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $49,020, but not more than $98,040.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $98,040, but not more than $151,978.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $151,978, but not more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

How Much Tax Do You Pay On $10000

How much tax you pay on any amount of income depends on multiple factors, including your filing status and any deductions or credits you may qualify for. For the sake of simplicity, lets assume youre a single filer whose taxable income is exactly $9,000 and youre not taking any credits. Your 2020 federal income tax liability would be $900, according to IRS tax tables. But before you start worrying about whats next, at that income level you may not be required to file a federal return. The IRS offers an online toolto help you determine if you may or may not need to file.

State Tax Payment Options

In addition to federal taxes, some states facilitate tax payment with a credit card. This is possible for both state income taxes as well as business taxes, but only in states that offer these options.

Requirements for different states vary, as do the payment processors. Options are limited by the state in which a taxpayer resides. Costs also vary.

Mastercard offers excellent information on the various credit card processors that are authorized to allow state tax payments via credit card . The website OfficialPayments.com is the most common option available in states that allow tax payments to be made with plastic.

In Indiana, for example, its possible to use the website OfficialPayments.com to pay state income taxes for a fee of approximately 2.4%.

Don’t Miss: How Much Time To File Taxes

Avoid Interest For A Year Or Longer

For those interested in securing a short-term loan without paying interest, paying taxes with a credit card can make sense. Just remember that a fee applies any time someone pays taxes with a credit cardand that introductory 0% APR offers dont last forever.

Heres a good example of how this might work. Imagine for a moment a $7,000 federal tax bill but not enough cash in the bank to cover it. In this case, it may be advantageous to apply for a card like the Chase Freedom Unlimited® which grants cardholders a 0% Intro APR on Purchases for 15 months, followed by a variable APR based on cardholder creditworthiness .

At the moment, this card is offering the ability to earn a welcome bonus: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening. And earn 5% cash back on grocery store purchases on up to $12,000 spent in the first year.. Cardholders will also earn 1.5% back for each dollar spent on other purchases.

If a new cardholder is able to use it to pay a $7,000 federal tax bill, the minimum spending requirement would immediately be met. That would result in earnings of $305 in rewards from the welcome bonus plus those from the 1.5% cash back. With PayUSAtax, a 1.96% fee would be charged, or $137.20. After accounting for the fee, $167.80 in rewards would be left with this strategy, and the cards balance would be subject to the introductory APR offer.

Who Qualifies For Advance Payments

To qualify for advance payments of the Child Tax Credit, you must have:

- Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or

- Given us your information in 2020 to receive the Economic Impact Payment with the Non-Filers: Enter Payment Info Here tool or

- Given us your information in 2021 with the Non-Filer: Submit Your Information tool and

- Lived in a main home in the United States for more than half the year or filed a joint return with a spouse who has a main home in the United States for more than half the year and

- A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number and

- Made less than certain income limits.

Read Also: How Much Does H & R Block Charge For Taxes

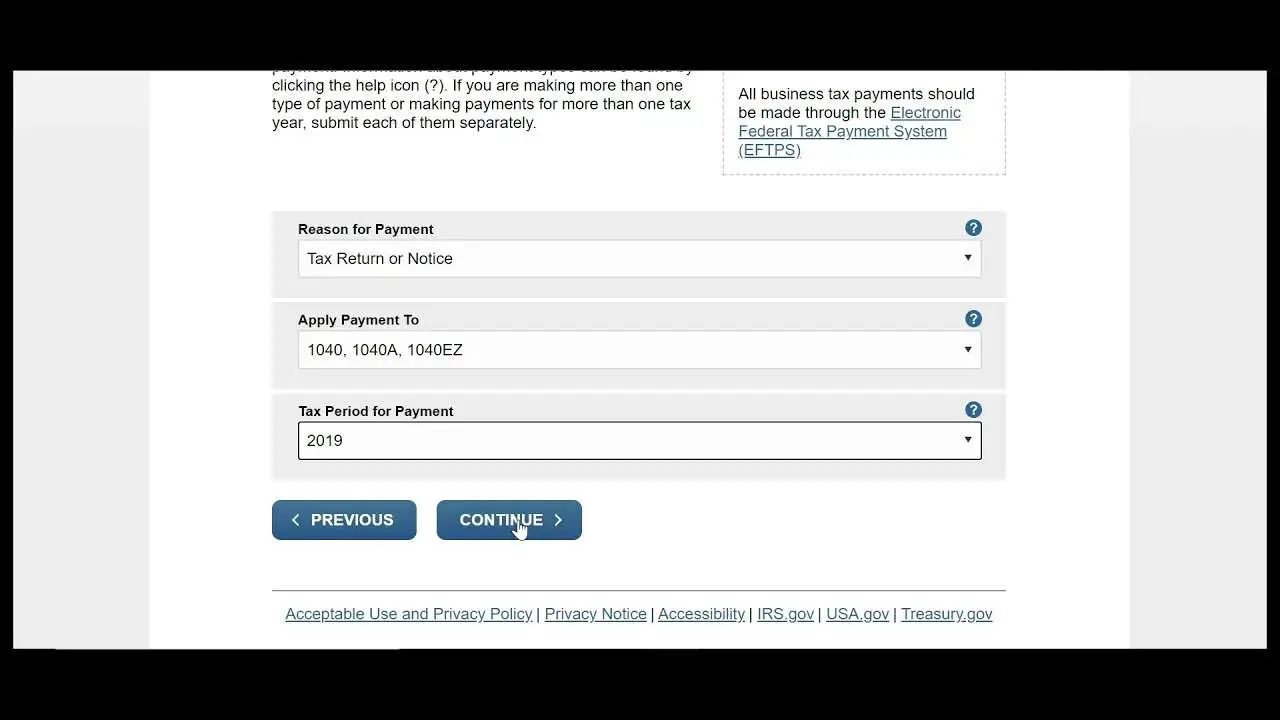

Online By Debit Or Credit Card

You can pay the IRS by credit or debit card, but you must use one of the approved payment processors. Three processors are available, and you can access any of them on the IRS website or through the IRS2Go mobile app:

They all charge a processing fee, which can vary. But this fee might be tax deductible, depending on your tax situation. It’s usually a flat fee for a debit card transaction or a small percentage of your payment if you’re using a credit card.

Your credit card company might charge you interest as well.

You can’t cancel payments using the credit card or debit card option.

Calculating Taxable Income Using Exemptions And Deductions

Of course, calculating how much you owe in taxes is not quite that simple. For starters, federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The new tax plan signed by President Trump in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

Recommended Reading: How Can I Make Payments For My Taxes

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Advance Child Tax Credit Payments In 2021

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer:

- Half the total credit amount is being paid in advance monthly payments. See the payment date schedule.

- You claim the other half when you file your 2021 income tax return.

Advance payments are sent automatically to eligible people. You do not need to take any action if we have your tax information.

You May Like: How To Buy Tax Lien Properties In California

Is Unemployment Taxable

Generally, unemployment income is taxable as income at the federal level and may be at the state level, too, depending on where you live. But if you receive unemployment benefits from a private fund that you voluntarily contribute to, its only federally taxable if the benefits you receive exceed the amount you paid into the fund.

Your Federal Tax Refund

Many people probably file their federal income tax returns hoping for a tax refund. Typically, you pay your federal income tax throughout the year, either through the payroll withholdings your employer takes out of your paycheck or through estimated tax payments if youre self-employed. Pay too little, and you could owe Uncle Sam on Tax Day. Pay too much, and you could get an IRS refund of the amount you overpaid.

Tax calculators can help you estimate your tax refund, but when will your federal refund arrive? The IRS says most people can expect their refunds in less than 21 days, and e-filing and choosing to have your refund directly deposited into your financial account can be the fastest way to get your refund. Direct deposit is not only faster than waiting for a paper check to arrive in the mail, its more secure direct deposit means you wont have your refund check get lost in the mail.

If you want to track your refund, you can use the IRSWheres My Refund? tool.

You May Like: How To Buy Tax Lien Properties In California

Make An Irs Payment With A Check Money Order Or Cashiers Check

How it works: Have one made out to the U.S. Treasury and mail it to the IRS. Make sure it includes your name, address, daytime phone number, Social Security number or employer identification number, the tax year it should be applied to and related tax form or notice number.

Cost: Stamps and/or mail delivery tracking, plus a possible fee to get a money order or cashiers check

Pros:

-

You dont need a bank account to get a money order.

-

You may not need a bank account to get a cashiers check.

-

Money orders and cashiers checks cant bounce.

-

Money orders and cashiers checks are trackable, so you can verify receipt.

Cons:

-

You have to go to the bank or another provider to get a money order or cashiers check.

-

Money orders have a $1,000 limit.

-

You must mail the check, money order or cashiers check.

-

Payment may take days or weeks to get there and post.

-

Regular checks can bounce if theres not enough money in the account or you dont have enough overdraft protection.

Enroll In Or Change Federal Benefits

-

If you are a current employee, you can only enroll in or change your federal employee benefits during the annual Open Season.

-

You may enroll in or change your plans outside Open Season only if you experience a qualifying life event, such as marriage.

New employees can enroll in benefits outside of Open Season.

Open Season does not include FEGLI. Outside of FEGLI’s infrequent open seasons, you can enroll or increase your coverage if:

You take a physical exam or

You have a qualifying life event

Learn more about enrolling in, changing, or cancelling FEGLI benefits.

You May Like: What Does Locality Mean On Taxes

State Income Tax Vs Federal Income Tax Example

Consider a single taxpayer who lives in New Hampshire and reports a taxable earned income of $75,000 a year plus interest income of $3,000 on their federal tax return. New Hampshire has a $2,400 tax exemption for the interest and dividends tax, so tax is only due on the remaining $600 of interest and dividends income.

The taxpayer would, therefore, pay just $30 in state taxes because New Hampshire doesn’t tax earned income but does tax investment income, over the exemption amount, at the rate of 5%. This individual’s effective state tax rate on their total income of $78,000 would be 0.038%.

If this same person lived in Utah, however, all of their taxable income, both earned and unearned, would be subject to that state’s 4.95% flat tax rate. In that case, their tax bill would be $3,861 .

In terms of federal taxes, in 2021, under the progressive system, this taxpayer would pay $995 on the first $9,950 of their income, which falls into the 10% tax bracket. They’d pay 12% on their income from $9,950 to $40,526 and 22% on the amount greater than $40,526 for a total federal tax bill of $12,248.40. Their effective federal tax rate would be 16.3%.

Federal Employees’ Thrift Savings Plan

The Thrift Savings Plan is a retirement plan for federal government employees and members of the military.

- Get help with life events that affect your TSP account – What to do if you have personal or career changes or changes to your active duty status.

If you have questions about the TSP or your TSP account, call the participant service line at or TTY at .

Note: There are a number of third-party mobile applications that refer to the Thrift Savings Plan and may ask you for your TSP login information. Providing your information could result in a security risk to your account. If you want to access your TSP account, log in directly at TSP.gov.

Also Check: What Does Agi Mean In Taxes

Deadline To File And Pay Taxes Was May 17

Find out what to do if you cant pay what you owe. An extension to file is not an extension to pay the taxes you owe.

The estimated tax payment deadline was April 15. Get details on the 2021 tax deadlines.

Pay with your bank account for free or choose an approved payment processor to pay by credit or debit card for a fee.

Meet An Important Spending Threshold

There are also some scenarios where it makes sense to pay taxes with a credit card in order to reach an important spending threshold, and these instances arent limited to earning credit card welcome bonuses. It may be worthwhile to spend a certain amount of money to reach the next level of elite status with a hotel credit card or an airline credit card, for example.

Take the Citi® / AAdvantage® Executive World Elite Mastercard®*, for example. This card offers consumers a welcome bonus: Earn 50,000 American Airlines AAdvantage® bonus miles and 10,000 Elite Qualifying Miles after $5,000 in purchases within the first 3 months of account opening. Plus, Admiral’s Club® membership . Cardholders also earn 2 miles per dollar spent on American Airlines purchases and 1 mile per dollar on all other purchases.

This card does charge an annual fee of $450, but comes with Admirals Club lounge membership worth $650 for non-elite members as a cardholder perk. Other cardholder benefits include a free checked bag, a fee credit for Global Entry or TSA PreCheck membership, priority boarding and priority airport check-in. Interestingly enough, this card also grants 10,000 Elite Qualification Miles after spending $40,000 on your card within a calendar year.

Also Check: How Can I Make Payments For My Taxes

I See An Irs Treas 310 Transaction On My Bank Statement What Is It

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment . This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see TAX REF in the description field for a refund.

If you received IRS TREAS 310 combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

How Much Do You Get Back In Taxes For A Child In 2020

There are multipletax breaks for parents, including the child tax credit. For 2020, the child tax credit is worth a maximum of $2,000 per qualifying child. Up to $1,400 of that amount is refundable meaning if the credit reduces your tax bill to zero, you could receive the difference back as a refund. Tax reform expanded the credit to also include a $500 nonrefundable credit for qualifying dependents who arent children, and boosted the phase-out limits to an AGI of more than $400,000 for taxpayers who are married filing jointly and $200,000 for everyone else. The higher limits mean that more people could qualify for the credit.

Also Check: How Do I Get My Pin For My Taxes

Make An Irs Payment In Cash

How it works: Go to the IRS PayNearMe website and follow the instructions to make a cash IRS payment. You get an email confirming your information, and the IRS verifies your information. You get a second email with a link to a payment code and instructions. You then go to the retail store in the email, have the clerk scan your code and then you hand over your cash. You get a receipt and payment confirmation.

Cost: $1.50 to $3.99 per payment

Pros:

-

Doesnt require a bank account.

-

Could be cheaper and more convenient than getting a money order or cashiers check.

-

Available in all 50 states.

Cons:

-

Participating retailers: 7-Eleven, ACE Cash Express, Caseys General Store, CVS Pharmacy, Family Dollar, Dollar General, Walgreens, Pilot Flying, Speedway, Kum & Go, Stripes, Royal Farms & Gomart

-

Can take two business days to process payment.

-

Can only pay $1,000 per day for some retailers there’s also a $500-per-payment limit.

-

Getting the cash may require a trip to a bank.

-

Might involve carrying a large amount of cash.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Read Also: 1040paytax.com Safe