Lets Understand It Better With An Example

Suppose your final income is $100,000. Now calculate your specific expenses from the last year. Lets suppose those expenses are:

- Your student loan interest is $300

- Educator expenses are $700

- Your contributions to the retirement accounts are $10,000

- And your contributions to the health savings account are $5,000

Your total deductions will be $16,000. Now subtract deductions from your annual income , the value $84,000 will be your adjusted gross income.

Calculating Adjusted Gross Income

To figure out AGI, start with your gross income, or all the money you’ve accrued during the course of the calendar year, and subtract all qualified adjustments. The IRS allows for specific deductions to be taken from your total gross income.

From Jan. 1, 2019, alimony is no longer an allowed deduction to be used in the calculation for adjustable gross income .

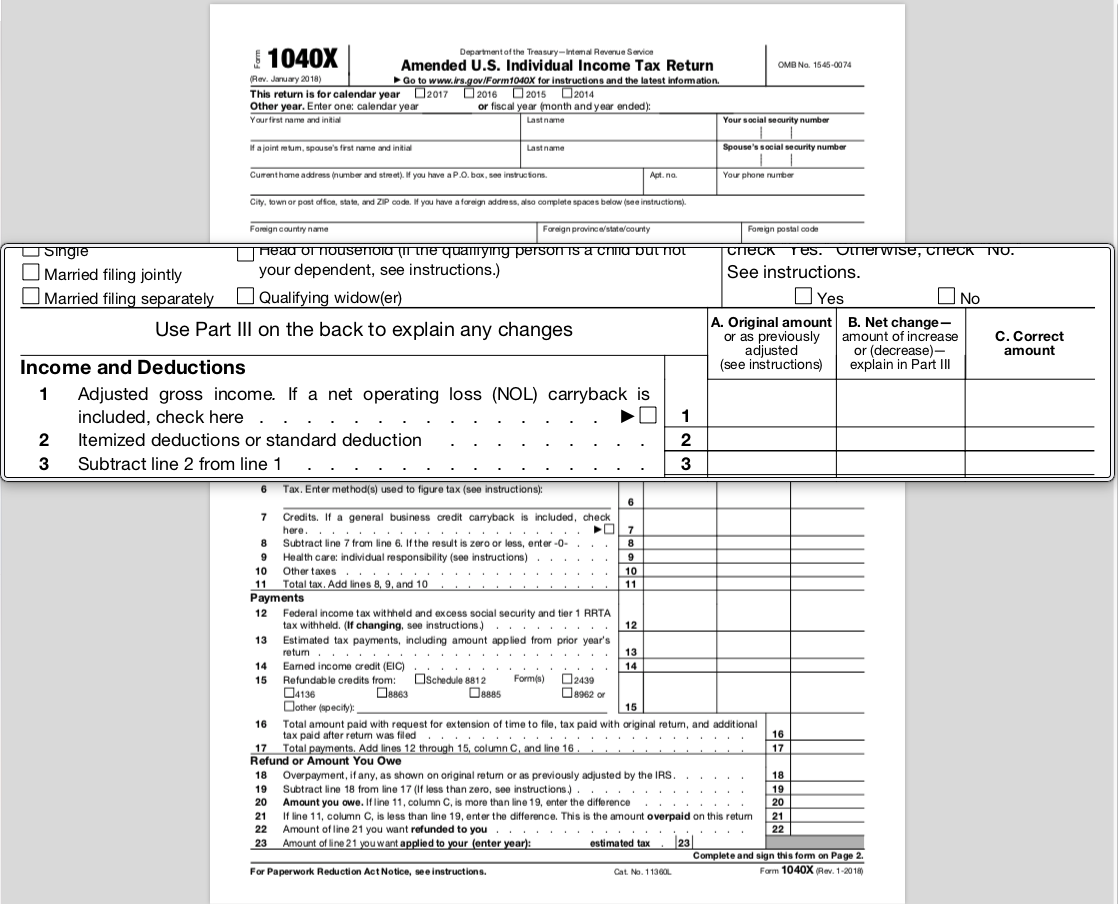

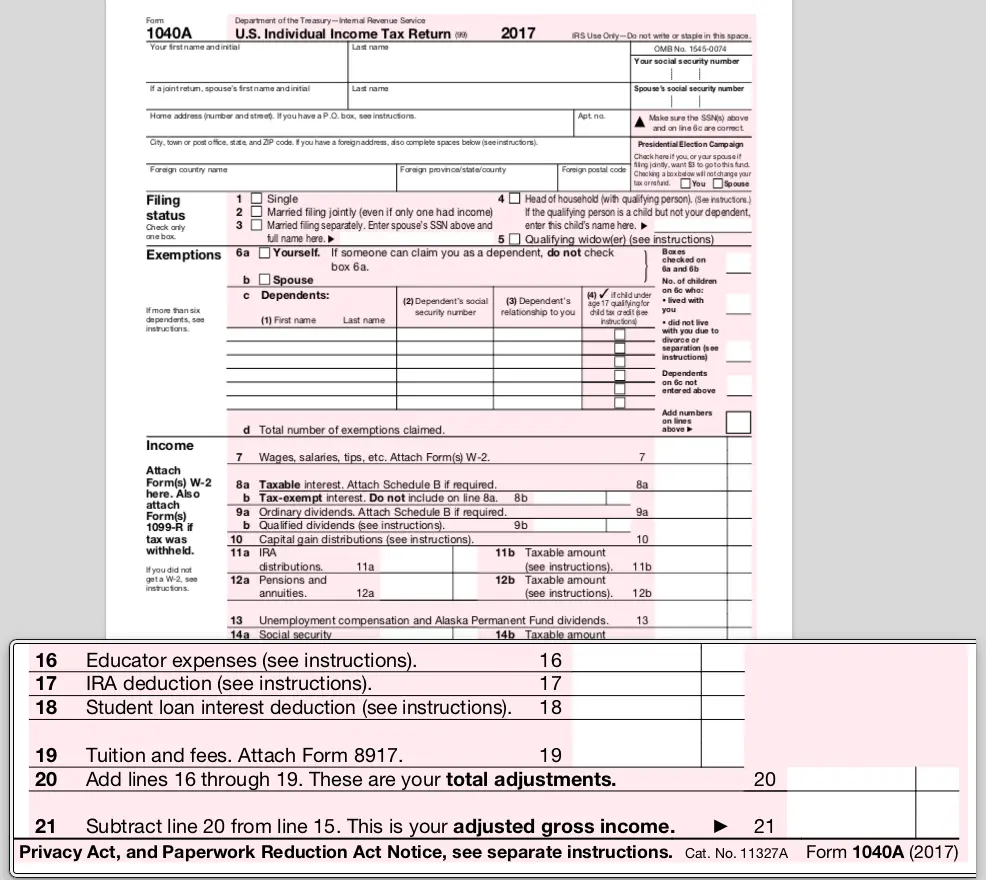

These deductions are estimated and listed when you file your taxes. Most deductions, or the above-the-line deductions, are listed on Schedule 1 and reported on Form 1040. Itemized deductions, which may not apply to every person, are listed on Schedule A and also reported on Form 1040.

How Your Agi Impacts Your Dependents

With the third stimulus check, your AGI is the main qualification for getting the money or not, due to a change in the rules and formula the IRS uses to calculate your payment total. If your AGI exceeds the limit, you won’t get a check. If it falls under $80,000 for single taxpayers , you’ll receive a full or partial check that includes up to $1,400 per dependent of any age you claim.

Your AGI is also critical in your eligibility for the child tax credit. As with stimulus checks, your total will become lower on a sliding scale if you make a certain amount of money in 2021.

You May Like: How To Get Stimulus Check 2021 Without Filing Taxes

What Is Gross Income

To define adjusted gross income, you first need to understand gross income. Gross income is all the income you receive in a year, and it can include wages an employer pays you , money you made working for yourself, interest on financial accounts, and other sources of personal revenue or gain.

But your total income is not necessarily all the income youll have to pay tax on. Thats where adjusted gross income comes in.

What Is Modified Agi

According to the IRS, for most taxpayers MAGI is simply adjusted gross income before subtracting deductible student loan interest.

If youre filing Form 1040 and itemizing so that you can take certain deductions, you may have to calculate your MAGI. It too can be a baseline for determining the phaseout level of some credits and tax-saving strategies, and sometimes the formula for MAGI can depend on the type of tax benefit it applies to.

About the author:Tina Orem is NerdWallet’s authority on taxes and small business. Her work has appeared in a variety of local and national outlets.Read more

You May Like: How To Know If You Filed Taxes Last Year

An Example Of Adjusted Gross Income Affecting Deductions

Let’s say you had some significant dental expenses during the year that weren’t reimbursed by insurance and you’ve decided to itemize your deductions. You are allowed to deduct the portion of those expenses that exceed 7.5% of your AGI.

This means if you report $12,000 in unreimbursed dental expenses and have an AGI of $100,000, you can deduct the amount that exceeds $7,500, which is $4,500. However, if your AGI is $50,000, the 7.5% reduction is just $3,750, and you’d be entitled to an $8,250 deduction.

How Your Adjusted Gross Income Affects Your Taxes

Your adjusted gross income affects the extent to which you can use deductions and credits to reduce your taxable income. For instance, consider the effect of AGI on medical and dental expenses for taxpayers who itemize.

Those who itemize can deduct only the amount of qualified medical and dental expenses that are higher than a certain percentage of their adjusted gross income. For 2020, this limit is once again 7.5% of your AGI. This means that if your medical and dental expenses dont exceed 7.5% of your AGI, you likely wont be able to deduct them at all.

AGI-related limits also apply to deductions for tuition and charitable contributions. You can generally deduct qualified charitable contributions you made only until the deduction amount reaches 50% of your AGI. Therefore, your AGI has a significant effect on which deductions and credits you can take, as well as how much theyre worth.

Your adjusted gross income is especially important if you live in a state that collects state income taxes. Many states use the AGI from your federal return as the starting point for state income tax calculations.

You May Like: Can International Students Get Tax Return For Tuition

Differences Between Agi Magi And Taxable Income

Your AGI is not the income figure on which the IRS will actually tax you. Your final income number, or taxable income, comes from subtracting even more deductions from your AGI.

For the 2020 tax year, the vast majority of taxpayers will likely use the standard deduction rather than itemize deductions. Under current laws, the standard deduction will be $12,400 for single filers and $24,800 for married couples filing jointly.

Modified adjusted gross income, or MAGI, is another term related to taxable income and adjusted gross income. MAGI comes into play when youre trying to figure out whether you qualify for certain deductions. For instance, if your MAGI is above certain income limits and you have a workplace retirement plan, you may not be able to take the full deduction for contributing to an IRA.

To calculate your MAGI, you have to add certain deductions, such as student loan interest, back to your adjusted gross income. If you didnt claim any of these deductions, your AGI and MAGI should be the same.

Agi On State Tax Returns

Just like the federal government, states with an income tax determine your taxable income by first calculating some sort of AGI. Most states start with your federal AGI and then allow some state-specific adjustments. It isnât uncommon if your state AGI is slightly lower than your federal AGI.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

Read Also: How Much Time To File Taxes

Gross Income Vs Adjusted Gross Income

When tax time comes around, Americans are often required to become better acquainted with certain tax terms even if they are not accountants. Thankfully, most of us leave the majority of the tax prep work to the tax experts. However, when it comes to the different ways in which your taxable income can be described, things can get confusing. For this reason, it’s a good idea to get to a better understanding of the difference between your gross income and adjusted gross income and how it impacts your personal financial planning.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Get Tax Credit For Solar

Where Can I Find My Prior Year Agi

AGI is a tax term that stands for adjusted gross income. Your adjusted gross income is used as the basis for lots of things, like calculating your tax bill when you file your income tax return. It also decides how much you can claim for certain tax credits and deductions. For example, you can deduct up to 10% of your AGI for unreimbursed medical expenses and up to 60% of your AGI for charitable donations.

In some cases, your AGI could even be used to determine your eligibility for benefits issued from the U.S. government.

What Are Some Of The Common Adjustments Used When Determining Agi

There are a wide variety of adjustments that might be made when calculating AGI, depending on the financial and life circumstances of the filer. Moreover, since the tax laws can be changed by lawmakers, the list of available adjustments can change over time. Some of the most common adjustments used when calculating AGI include reductions for alimony, student loan interest payments, and tuition costs for qualifying institutions.

Don’t Miss: How To Read My Tax Return

Agi Summarizes All Of Your Income Sources

One of the things AGI does do is to summarize and total all of your taxable income.

This is the highest amount of income that IRS taxes, not your total income. It includes major sources of income from the following:

- Wages, salaries and tips Adjusted Gross Income, or AGI, is a term you see often when doing your taxes. But what is it?

- Interest and dividends

- Social Security

- Any other form of reportable income

As complete as this list seems, there are income sources that are either excluded or only partially included in the total number.

For example, while you will report tax exempt interest income on your tax return, it wont be included in your final AGI.

Social Security and pension income are also reported on your tax return, but both may be only partially taxableor not taxable at alland will not be included in your final AGI.

If were talking real world income, AGI is rarely a complete number.

A better description of total income actually is found on the 2011 1040 at Line 22 Combine the amounts in the far right column for lines 1 through 21 This is your total income.

Its important to remember however that this is your total income for tax purposes only, and not your absolute total income.

What Is My Adjusted Gross Income

Your adjusted gross income is unique to you and can be found on your Form 1040. This form is the U.S. Individual Income Tax Return and on your 2020 taxes, your adjusted gross income will be on line 11.

After you’ve followed the instructions on the form in the lines before that, you’ll end up with the adjusted gross income on line 11. It will require looking at your gross income and making any adjustments from expenses, student loans, etc.

If you’re looking back at past years’ forms to understand adjusted gross income, take a look at line 8b in 2019 and line 7 in 2018.

Recommended Reading: Does New Mexico Have State Income Tax

So What Is Adjusted Gross Income On Your W

The answer is its not. However, weve heard this question before as taxpayers ask for help with their taxes. Lets face it, tax terminology can get a little confusing. When it comes to talking about income, there are several terms that sound similar, but they have their own definitions and purposes. Understanding a bit more about these terms can help us better understand what Adjusted Gross Income is and what it isnt.

Effect On Other Taxes

Increasing adjustments to income can also decrease other taxes because some surtaxes are calculated based on AGIs. The 3.8% net investment income tax is based in part on a person’s modified adjusted gross income over certain thresholds. You can avoid paying this tax if you can reduce your AGI below those thresholds.

Most tax preparation software is well-equipped to handle all these different scenarios, and you can always seek the help of a tax professional if you really don’t feel that you can handle it all yourself.

Read Also: How Are Reit Dividends Taxed

Where Do I Find My Last Years Agi

For tax years 2020 and 2021, your AGI is calculated on page 1, line 11 of your Form 1040 or 1040-SR. Your AGI for tax year 2019 is on Line 8b.

Simply look at the printed copy of last years return to find your adjusted gross income. If you filed with TaxSlayer, you can also log in to My Account to view this info on your prior year return.

When you return to TaxSlayer to file your tax return each year, your AGI is pulled forward and entered into your current tax form.

What Is Your Adjusted Gross Income

Adjusted gross income is the number you get after you subtract your adjustments to income from your gross income. The IRS limits some of your personal deductions based on a percentage of your AGI.

That’s why it’s so important. Your AGI levels can also reduce your personal deductions and exemptions. Many states also base their state income taxes on your federal AGI. The AGI calculation is at the bottom of Form 1040 in line 37.

You May Like: How To Figure Out Taxes Out Of Paycheck

How Your Adjusted Gross Income Affects You

Your adjusted gross income is typically the basis for your taxes, not your gross income. The adjusted gross income is a more accurate look at your actual income, which is why it often is considered more heavily. Your adjusted gross income is what will also qualify you for tax deductions and tax credits, which are figured by your income.

Some tax credits and deductions will benefit you more if your adjusted gross income is lower, which is why you want to calculate it properly. For example, if you itemize your deductions, you’ll reduce your medical and dental expenses by 7.5 percent of your adjusted gross income. That means you can only deduct the amount that exceeds 7.5 percent of your adjusted gross income, so the lower that number is, the more of your expenses you can deduct.

These tax credits and deductions will affect your taxable income, and you want to get that adjusted gross income to a place that’s not only correct, but that will maximize your tax return.

Your adjusted gross income is also typically the basis for your state tax return, which is why it’s important to start your federal return first to get that number. Once you’ve completed your federal return and gotten to your adjusted gross income , you can move on to your state tax returns using the numbers you’ve already found.

What Are Other Levels Of Income

Weve already discussed three types of income in depth: gross income, adjusted gross income and taxable income. But there are more you might come across when youre filing your taxes.

- Net income: If youre a business owner, your taxable income may be determined on your net income after expenses, rather than on your gross income.

- Modified adjusted gross income: Also called MAGI, this is your AGI plus some deductions added back in. Your MAGI is another number the tax code uses to determine if you qualify for certain tax breaks.

Read Also: Are Donations To Churches Tax Deductible

Net Income Vs Adjusted Gross Income : What’s The Difference

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

How Do I Find Last Years Agi

The IRS requires your 2018 AGI to verify your identity for e-filing. If you’re paper-filing your return, you won’t need your AGI because those are manually processed.

There are a few places you can get your 2018 AGI:

- If you filed your 2018 taxes with TurboTax, sign in and go down to Your tax returns & documents. Select View adjusted gross income .

- If you didnt file your taxes with TurboTax in 2018, the best place to get last year’s AGI is from the 1040 form you filed with the IRS. Look on page 2, line 7. If you filed a 1040NR, it’ll be on line 35.

- If you’re having trouble locating your 2018 return, the second-best place to get your AGI is from the IRS. You can order a free transcript of your return at the IRS Get Transcript site or you can purchase a full copy of your 2018 return. Both versions will include your AGI.

If you didn’t file a 2018 federal tax return , enter 0 as your AGI.

Don’t Miss: What Form Do I Need To File My Taxes Late

What If You Can’t Find Your Previous Federal Tax Returns

If you just can’t find your tax return, you can find your AGI in two ways:

Method 1:Go to the IRS’ Get Transcript portal and choose Get Transcript Online. You’ll need your Social Security number, date of birth, filing status and mailing address from your latest tax return. You’ll also need access to your email your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan and a mobile phone with your name on the account. Once your identity is verified, select the Tax Return Transcript and use only the Adjusted Gross Income line entry. You’ll be able to view or print your information here.

Method 2: If you don’t have internet access or the necessary identity verification documents, you can use the Get Transcript portal and choose Get Transcript by Mail, or call 1-800-908-9946 to request a Tax Return Transcript. It takes about five to 10 days to be delivered to you.

Your Agi: What It Is And How It Affects Your Stimulus Check Tax Refund And Child Tax Credit

Your adjusted gross income is an amount calculated from your total income, and the IRS uses it to determine how much the government can tax you. Gross income is the sum of all the money you earn in a year — including wages, dividends, alimony, capital gains, interest income, royalties, rental income and retirement distributions.

After you subtract allowable deductions from your gross income , the result is your AGI, or taxable income, which is used to calculate your income tax. Your AGI is reported on IRS Form 1040, and you can find it on Line 11 of this year’s version .

Since it’s a rough estimate of how much money you’re bringing in after deductions from all your streams of income, the IRS uses your AGI to calculate how much you get in a stimulus check, the amount of your tax refund , and your upcoming 2021 child tax credit .

For tax credits, as your AGI goes up, the amount you can get generally decreases. Here’s and example: The third check is more targeted than the first two rounds. Single taxpayers with an AGI over $80,000 will not be eligible for any stimulus money, down from a $99,000 cutoff for the first check, and $87,000 for the second check.

Recommended Reading: When To File Quarterly Taxes