Getting Your New Mexico Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of New Mexico, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your New Mexico tax refund, you can visit the New Mexico Income Tax Refund page.

New Mexico State Business Income Tax

The state of New Mexico taxes corporate income at different marginal rates. These rates and brackets have changed every year over the last six years. For 2018, the rates and brackets are 4.8 percent tax for a total net income that’s under $500,000. For total net income that’s over $500,000, it’s $24,000 with an extra of 5.9 percent of the net income that’s over $500,000.

New Mexico taxes all personal income at varying marginal rates that range from 1.7 percent to 4.9 percent. The state does allow specific corporations to pay tax on gross receipts from New Mexico instead of income. However, the corporation needs to meet the following requirements:

- The only activities for the corporation are sales in New Mexico.

- The corporation doesn’t rent or own real estate in the state.

- The yearly gross sales for the corporation into or in New Mexico are $100,000 or less.

Corporations that match these conditions need to pay an alternative tax that’s 0.75 percent of yearly gross receipts from New Mexico. The franchise tax is a flat yearly fee of $50 that is required to be paid by every corporation in New Mexico, including S-corporations. Both the franchise tax and corporate income tax must be paid by the 15th day on the fourth month following the company’s tax year. Any corporation in the state is subject to the franchise tax and corporate income tax of New Mexico.

Hire the top business lawyers and save up to 60% on legal fees

The New Mexico Business Taxes Your Llc Will Pay

There are a wide variety of business taxes that your New Mexico LLC will need to pay. These include tax thats payable to the New Mexico government, like New Mexico sales taxes and New Mexico state tax. You will also need to pay federal, self-employment and possibly payroll tax to the IRS.

If you want help with your taxes, Incfile provides a complete Business Tax Filing service.

Also Check: Do You Pay Income Tax On Inheritance

States With Flat Tax Rates

Among the states that do have income taxes, many residents get a break because the highest rates don’t kick in until upper-income levels. But this isn’t the case in the ten states that have flat tax rates as of 2021. The flat-tax states and their rates, from highest to lowest, are:

- North Carolina: 5.25%

- New Hampshire: 5.00%

- Illinois: 4.95%

- Pennsylvania: 3.07%

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Read Also: When Does The Irs Start Accepting Tax Returns For 2021

Gov Lujan Grisham Enacts Measure Effectively Slashing Taxes For New Mexico Working Families

Apr 6, 2021 | Press Releases

Expanding credits puts money back in pockets of middle-class New Mexicans represents the most progressive shift in state tax structure in recent memory

SANTA FE Working class New Mexico families stand to benefit immensely from the landmark expansions of two tax programs authorized Tuesday by Gov. Michelle Lujan Grisham.

Sponsored by Rep. Javier Martinez, Rep. Christine Chandler and Rep. Matthew McQueen, House Bill 291 dramatically expands both the Low-Income Comprehensive Tax Rebate, or LICTR, and the Working Families Tax Credit, making more New Mexicans eligible for the benefits and increasing the benefits they will receive.

The new law expands the Working Families Tax Credit to taxpayers without Social Security numbers and to taxpayers as young as 18 years old and also increases the value of the credit. For the 2021 and 2022 tax years, the Working Families Tax Credit will be worth 20 percent of the federal Earned Income Tax Credit, or EITC it had previously been worth 17 percent of the EITC. Beginning in 2023, it will be worth 25 percent of the EITC.

Nearly 200,000 New Mexicans claimed the Working Families Tax Credit in 2019. The governor already this year .

The Low-Income Comprehensive Tax Rebate, or LICTR, under the new law will now be worth up to $730, depending on income and family size, up from a maximum of $450 previously.

Family welfare and community advocacy groups in New Mexico praised the action.

New Mexico Tax Deductions

Income tax deductions are expenses that can be deducted from your gross pre-tax income. Using deductions is an excellent way to reduce your New Mexico income tax and maximize your refund, so be sure to research deductions that you mey be able to claim on your Federal and New Mexico tax returns. For details on specific deductions available in New Mexico, see the list of New Mexico income tax deductions.

Read Also: How Much Percent Is Tax

Standard Deduction And Dependent Deduction

New Mexico generally follows federal tax laws for its standard deduction and personal exemptions. Because it conforms to certain Tax Cuts and Jobs Act provisions, New Mexico no longer has a state personal exemption for taxpayers. The states standard deduction amounts mirror the federal amounts.

- $12,200 for single filers

- $18,350 for heads of household

- $24,400 for married couples filing jointly and qualifying widows

And starting with the 2019 tax year, New Mexico taxpayers filing as either head of household or married filing jointly can take a $4,000 deduction for all but one dependent.

New Mexico Retirement Taxes

There are a lot of great reasons to retire in the Land of Enchantment. It has an arid climate with more than 250 days of sunshine per year. The cost of living in New Mexico is relatively low, with a median home value of less than $181,000. It also has nearly 400,000 acres of national park land and more than 10 million acres of national forest land.

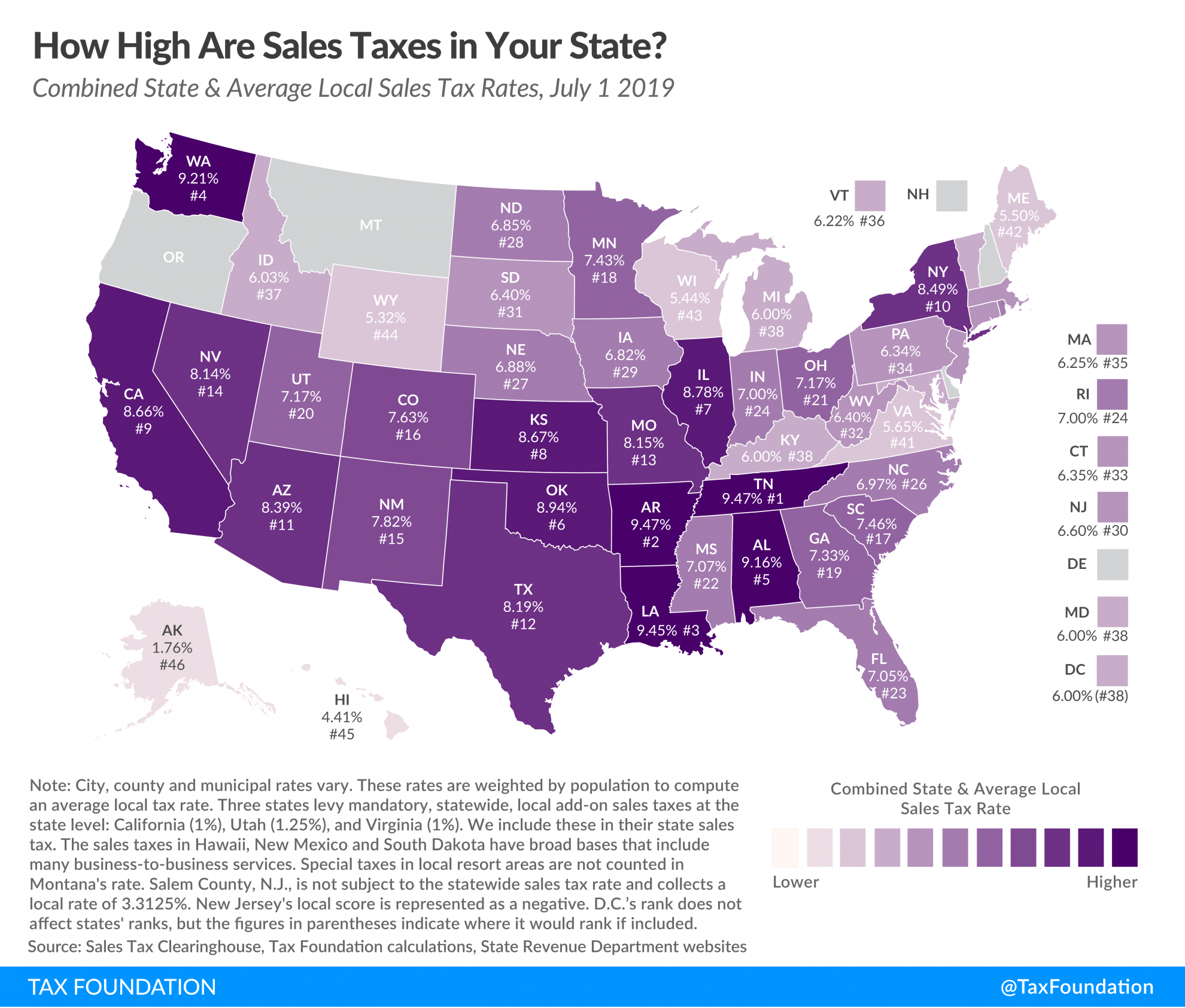

On the other hand, retirement taxes in New Mexico may be relatively high for many retirees. The state taxes all forms of retirement income, including Social Security, while offering a deduction to seniors with household income below a certain limit. New Mexicos sales taxes are also above average, but its property taxes are among the lowest in the U.S.

A financial advisor in New Mexico can help you plan for retirement and other financial goals. Financial advisors can also help with investing and financial planning – including taxes, homeownership, insurance and estate planning – to make sure you are preparing for the future.

Recommended Reading: How To Report Tax Evasion

Spending Through The Tax Code

The state spends money both directly and indirectly. Direct spending takes the form of annual budgeting for programs and services such as education, public safety, and health care. Direct state spending is covered in the companion publication A Guide to New Mexicos State Budget. The state also spends money indirectly by choosing to forego collecting certain tax revenues. While direct spending is done through the budgeting process, indirect spending is handled by changing the tax code.

Over the years, the Legislature has enacted many tax breaks, which are called tax expenditures. Many tax expenditures are enacted as a form of economic development because they provide a subsidy or incentive for specific businesses. Tax credits for solar panels is an example of this. Other expenditures are intended to help groups of people. The Working Families Tax Credit , which helps low-income working families, is one example.

Cuts in taxes almost always result in the state collecting less revenue. Lower revenue means the state will either have to cut its direct spending or it will have to raise other taxes or fees to make up the difference. Before any legislation to enact a tax break is passed, however, the state tries to estimate how much it will cost. These estimates are contained in a fiscal impact report prepared by the Legislative Finance Committee staff.

How The State Collects Money

Technical Terms

Gross Receipts Taxes Taxes collected on the gross receipts of a business or service provider. It is usually passed along to the consumer.Compensating Tax A tax on goods that are bought out-of-state for use in New Mexico. Say, for example, you open a restaurant in New Mexico but purchase your chairs and tables in Texas. You must pay compensating tax on those purchases.Excise Taxes Taxes levied on specific goods, such as cigarettes, alcohol, and cars.Income Taxes Taxes paid on an individuals personal income or a companys profits.Severance Taxes Taxes paid on natural resources such as crude oil and natural gas, so named because these resources are severed from the ground.

Also Check: How Much Is Tax In Georgia

What Is The Mexico Income Tax

Mexico’s personal income tax is a bracketed income tax that must be paid yearly by all citizens to the government of Mexico. Failure to pay, or underpayment of, the Mexico income tax can result in high fees, fines, or jail time.

In addition to Mexico’s income tax, other taxes may apply to wages or profits earned, including social services, medical care, and capital gains taxes.

New Mexico Sales Taxes For Llcs

If you sell physical products or certain types of services, you may need to collect sales tax and then pay it to the SC Department of Revenue. New Mexico sales tax is collected at the point of purchase. Sales tax rates do vary depending on the region, county or city where you are located.

You will typically need to collect New Mexico sales tax on:

- Tangible, personal property and goods that you sell like furniture, cars, electronics, appliances, books, raw materials, etc.

- Certain services that your business might provide

Most states do not levy sales tax on goods that are considered necessities, like food, medications, clothing or gas.

You May Like: Do You Have To Claim Social Security On Taxes

What Businesses Can Corporate And Franchise Tax Be Applied To

There is a corporate income tax for New Mexico, which applies to C-type or traditional corporations. A franchise tax is also applied to S-corporations and traditional corporations. On top of this, if income from the company passes through to the owner specifically, that income is subjected to taxation on the owner’s individual tax return for New Mexico.

Mexico Income Tax Allowance

Mexico provides most taxpayers with an income tax allowance of $7,394, which can be kept as a tax-free personal allowance. Mexico’s tax credit is a basic non-wastable allowance available to all taxpayers without dependents.

A tax credit is a fixed amount of money that may be kept by taxpayers without paying any income taxes. Generally, a tax credit is subtracted from your gross income before your taxable income is calculated.

Read Also: What Does Locality Mean On Taxes

The New Mexico Income Tax

New Mexico collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Like the Federal Income Tax, New Mexico’s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

New Mexico’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below New Mexico’s %. You can learn more about how the New Mexico income tax compares to other states’ income taxes by visiting our map of income taxes by state.

Some states, including New Mexico, increase, but don’t double, all or some bracket widths for joint married filers. You are required to file a New Mexico tax return if the IRS requires you to file a federal tax return.

There are -543 days left until Tax Day, on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 – you can start your online tax return today for free with TurboTax .

Best Cities For Retirees In New Mexico

When youre planning your retirement, the city you select matters. In most cases, the town has a major impact on your overall quality of life, especially when it comes to accessing critical amenities. Plus, every city has a unique vibe, and some may better suit your preferences than others.

Ultimately, New Mexico has plenty of great cities for retirees. Here are a few you may want to start with if you arent sure which ones to consider.

For some retirees, Taos may be the perfect destination. Its near the Rio Grande Gorge, so the area has a lot to offer when it comes to outdoor recreation. Plus, its brimming with amenities and has a sizable senior population, both of which may improve your quality of life.

Also Check: How To Track Your State Tax Refund

How Can I File A New Mexico State Tax Return

The easiest, most secure and fastest way to file your return is to do it electronically.

You have two options for electronic filing.

- You can file your New Mexico state tax return at the same time as your federal tax return through the federal/state e-file program.

- You can file it separately through the New Mexico Taxpayer Access site.

If you hire someone to prepare your taxes, chances are theyll use one of these two options. Depending on your filing status in New Mexico, you can also prepare and file your federal and New Mexico state tax return for free with .

If you prefer to file a paper return, you can find and print copies of any required forms from this website.

You can mail your return to the following address:

NM Taxation & Revenue DepartmentP.O. Box 25122Santa Fe, NM 87504-5122

But take note: If you owe any taxes, youll need to mail the payment separately to this address:

NM Taxation & Revenue DepartmentSanta Fe, NM 87504-8390

New Mexico Estate Tax

New Mexicos estate tax has been phased out as of Jan. 1, 2005. There is no estate or inheritance tax in New Mexico.

- The Very Large Array in Socorro County consists of 27 separate radio antennae, each of which weighs more than 200 tons.

- Truth or Consequences, New Mexico is named after a game show from the 1950s.

- Los Alamos, New Mexico has the highest concentration of millionaires of any city in the U.S. More than 10% of households in Los Alamos have a net worth of at least $1 million.

Don’t Miss: Where Can I Find My Tax Return From Last Year

How Are Businesses In New Mexico Being Taxed

The majority of states tax certain kinds of business incomes that are received from the state. Details regarding how the income from a particular business is taxed are determined by what the legal form of the company is. The majority of corporations must pay a corporate income tax. Income that comes from pass-through entities like limited liability companies, sole proprietorships, S-corporations, and partnerships, are subject to whatever the state tax is on individual income.

There are six states that don’t have to pay corporate income tax: Ohio, Texas, Wyoming, Nevada, Washington, and South Dakota. However, Texas, Nevada, Washington, and Ohio have some type of gross receipts tax for corporations. Alaska, Florida, South Dakota, Washington, Nevada, Wyoming, and Texas don’t have an individual income tax. Those who live in Tennessee and New Hampshire only get taxed on dividend income and interest.

Other New Mexico Tax Facts

New Mexico taxpayers are able to complete a variety of tax tasks electronically.

The state maintains a public list of delinquent taxpayers. People who wish to report noncompliant taxpayers can call the New Mexico Audit and Compliance Division toll-free hotline at 457-6789.

For more information, visit the New Mexico Taxation and Revenue Department website.

To download tax forms on this site, you will need to install a free copy of Adobe Acrobat Reader. Click here for instructions.

Related Links:

You May Like: How Much Should I Save For 1099 Taxes