What If I Haven’t Filed A Tax Return

TAXPAYERS had until May 17 to file an extension if they needed more time to submit their returns.

If you didnt file a tax return or an extension, but should have, you need to take action – or the penalties you face may increase.

If you file your return over 60 days late, youll have to pay a $435 fine or 100% of the tax you owe – whichever is less.

However, there is no penalty for filing a late return after the tax deadline if a refund is due, said the IRS.

If you didn’t file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest.

You won’t have to pay the penalties if you can show “reasonable cause” for the failure to do so on time – we explain how in our guide.

How To Claim Income Tax Refund

For claiming your income tax refund or TDS refund all you need to do is give a written proof to the Department about your Income and deduction details, by way of filing your Income Tax Return. Just make sure that you provide the details of all your income and tax deducted/ collected/ paid during the relevant year to ensure the component of refund is reflected in your income tax return. Remember, to claim your Income Tax Refund, online filing of the return is a must.

Income Tax Refund: This Includes 2923 Lakh Refunds Of Assessment Year 2021

New Delhi: Central Board of Direct Taxes has issued refunds worth over Rs 84,780 crore to around 59.51 lakh taxpayers, Income Tax India tweeted. The refunds are for the period between April 1, 2021 to October 11, 2021. Out of the total, Income tax refunds amount to Rs 22,214 crore and corporate tax refunds are worth Rs 62,567 crore, according to details provided by the Income Tax Department.Also Read – Income Tax Return: CBDT Issues ITR Refunds Of Over Rs 82,000 Crore Direct Link To Check Status

Recommended Reading: How Can I Make Payments For My Taxes

When & How To Apply For Refund Reissue

First verify your Income Tax Return, then track the status of your income tax refund with the department. In case, you have still not received your refund then one of the reasons for the ITR refund delay could be due to a problem in your bank account or address details.

In such a situation, you can make a request for refund reissue to the Income Tax Department but only after receiving an “Intimation”

Simple steps to apply for Refund Reissue:

- Step 1: Go to

- Step 2: Log in with your PAN card details and password.

- Step 3: After logging in, click the my My Account tab

- Step 4: In the drop down menu of My account select Service Request,

- Step 5: Under request type select New Request

- Step 6: Finally select Refund Reissue under the Request Category.

- Step-7: Click ‘Submit’ hyperlink located under Response column. After clicking submit, fill the additional details such as Bank Account number, Account Type, IFSC Code and so on Click ‘Submit’

- Step 8: For successful submission of Refund Reissue request, users must have EVC. (Users must authenticate the refund reissue request through Aadhaar OTP & EVC code.

The changes made by you, in the bank/address details will be automatically updated in the centralized TIN database, and your refund amount will be reissued to you as per your updated records.

You Have To Make Sure That Your Filled Itr Has Reached The Department Or Not Within 120 Days From The Date Of Filing Itr If Not Then Follow This Process Immediately Income Tax Return : If You Cannot Use Online Methods To Verify Your Income Tax Return You Also Have The Option To Send

You have to make sure that your filled ITR has reached the department or not within 120 days from the date of filing ITR, if not, then follow this process immediately.

Income Tax Return : If you cannot use online methods to verify your Income Tax Return , you also have the option to send ITR-V physically. For this, you will have to take a printout of ITR-V and send it to the Income Tax Department at: CPC, Post Box No. 1, Electronic City Post Office, Bangaluru-560100, Karnatak, India.

Verification has to be done within 120 days of filing ITR. So if you are using any physical method to verify your ITR, make sure it reaches the Income Tax Department on time. If it does not reach the account on time, i.e. within 120 days of filing, your refund will not be verified and the return filing process will not be completed

Why Verify ITR

You have to do the verification within 120 days of filing ITR. So if you are using any physical method to verify your ITR, the first thing to do is to ensure that it reaches the Income Tax Department on time. If it does not reach the account on time, i.e. within 120 days of filing ITR, your return filing process will not be completed if your return is not verified.

Status will be displayed as ITR Verified

Recommended Reading: Where’s My Tax Refund Ga

Income Tax Refund Will Be Payable To You Only After The Tax Department Processes Your Itr And Confirms The Same Through Intimation Notice Here Is How You Can Check The Status Of Tax Refund

income tax refundITRintimation noticeHow to track status of income tax refund

- On the new income tax portal

- On the TIN NSDL website

What the status message meansRefund is credited:

- Write a letter and send it to: State Bank of India at Survey No.21 Opposite Hyderabad Central University, Main Gate, Gachibowli, Hyderabad -50001.

- Send an email to [email protected]

- at 18004259760

Refund Returned:Adjusted against outstanding demand of previous year:Refund re-issue request

Read More News on

Income Tax Refund Latest Updates

- CBDT issues refunds of over Rs 84,781 crore to more than 59.51 lakh taxpayers from 1st April, 2021 to 11th October, 2021. Income tax refunds of Rs. 22,214 crore have been issued in 57,83,032 cases & corporate tax refunds of Rs 62,567 crore have been issued in 1,67,718 cases, Income Tax India tweeted.

- This includes 29.23 lakh refunds of assessment year 2021-22 amounting to Rs 2,241.39 crore, as per details by Income Tax India.

Also Check: How Much Does H & R Block Charge To Do Taxes

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

How To Check Itr

Upon e-filing the Income Tax Return whether offline or online it is an important task to check or verify your Income Tax Return. As a consequence, a taxpayer can authenticate his or her Income Tax Return using a Digital Signature Certificate , Aadhaar OTP, EVC using Prevalidated Bank Account Details, and EVC using Prevalidated Demat Account Details. However, taxpayers who do not wish to e-verify their Income Tax Returns must send a signed ITR-V to “Centralized Processing Center, Income Tax Department, Bengaluru – 560500” through regular or speed post within 120 days from the date of filing.

This signifies that the filed ITR should be e-Verified later using the ‘My Account > e-Verify Return’ option online, or the verified ITR-V should be forwarded to CPC, Bengaluru. Unverified ITRs are not regarded legitimate and will not be processed by the department, according to income tax regulations and additionally, if you are eligible for an income tax refund, you are required to verify your ITR by sending it to the Income Tax Department and upon successful verification by the department, the applicable refund amount will be granted. As the tax department allows a time frame of 120 days, you must ensure that your ITR-V is received by the income tax department in a timely manner. Here’s how you can check or verify the status of ITR-V on the new income tax portal.

Also Check: How To Buy Tax Liens In California

Check Your Income Tax For The Current Year

This service covers the current tax year . Use the service to:

- check your tax code and Personal Allowance

- see if your tax code has changed

- tell HM Revenue and Customs about changes that affect your tax code

- update your employer or pension provider details

- see an estimate of how much tax youll pay over the whole tax year

- check and change the estimates of how much income youll get from your jobs, pensions or bank and building society savings interest

This page is also available in Welsh .

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Includes errors such as an incorrect Recovery Rebate Credit amount

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.

- Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

- Needs further review in general

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return.

Don’t Miss: How Much Does H And R Block Charge To Do Your Taxes

How Is The Payment Of Income Tax Refund Done

The payment for your income tax refund can be done in two ways:

Income tax refunds can be paid to your via NECS/RTGS. You should ensure that you mention all required details of your bank account in order for the tax refund amount to be credit promptly. These details include IFSC code of your bank branch, bank account number, and communication address. This will facilitate easy and efficient income tax refunds transfer.

If by any chance the bank account details provided by you are improper or unclear, then this refund will be paid to you via a cheque to your bank account

Check Your Income Tax Refund Status By Just Entering Your Pan And Select Assessment Year

1. What is Income Tax refund?

3. When is interest paid by Income Tax Department on Income Tax refund?

| When is Income Tax return filed | Period for which interest on Income Tax refund will be paid | Example |

|---|---|---|

| Income tax return is filed on or before due date | Starting from 1st April of the Assessment Year till the date of grant of Income refund | Mr. B filed his Income Tax return claiming refund for Financial Year 2017-18 is filed on 25/05/2018 i.e. on or before due date. He did received his refund on 03/09/2018. He will get interest on Income Tax refund for 6 months |

| In situation other than above | Starting from date of filing Income Tax return till the date of grant of Income refund | Mr. C filed his Income Tax return claiming refund for Financial Year 2017-18 is filed on 25/08/2018 i.e. after due date. He received his refund on 03/11/2018. He will get interest on Income Tax refund for 4 months |

5. What are the different Income Tax refund status?

6. How will I receive my Income Tax refund? Whether Income Tax refund will be directly credited to my bank account?

7. My Income Tax refund went to my old address and got returned. How to get Income Tax refund now?

8.I got an Email from Income Tax Department that my refund is adjusted against an earlier demand. What should I do?

You May Like: How Much Is H& r Block Charge

Make Small Investments For Bigger Returns

ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 2.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns is made easy with ClearTax platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. ClearTax can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with ClearTax by investing in tax saving mutual funds online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download ClearTax App to file returns from your mobile phone.

These Refunds Will Be Credited Only To Those Accounts Which Are Linked With Aadhaar Pan And Are Pre

New Delhi: Income Tax Refund status check is an important process to ascertain whether one has received the refund amount sent by Income Tax Department or not. However, you will only receive this income tax refund after the tax department processes your ITR and confirms the same via an intimation notice.

This year returns have to be filed for FY2020-21 for which the extended last date is currently December 31, 2021.

The income tax refund is processed by the State Bank of India and is directly credited to the bank account nominated by the taxpayer in his/her ITR at the time of filing it. Thus, it is important to ensure that you have mentioned the correct bank account number and IFS code.

It is worth noting that the bank account must be pre-validated on the government’s new income tax e-filing portal and PAN must be linked with the bank account.

Income Tax Refund can be claimed when:

- You did not furnish all the investment proofs to your organization. As a result, the amount of taxes deducted by your employer exceeded your actual tax liability for the particular FY.

- Excess TDS was deducted on your interest income from bank FDs or bonds.

- The advance tax paid by you on self-assessment exceeded your tax liability for the applicable FY as per the regular assessment.

- In case of double taxation

How to Claim Income Tax Refund?

Ways to check Income Tax refund status?

1. On the NSDL website

2. On e-filing portal:

ITR Refund Delay:

Refund processing:

You May Like: Have My Taxes Been Accepted

Check Income Tax Refund Status Online Through Income Tax India E

Income Tax Department says : “Checking the online refund status is always good. It’s free and it tells you what’s going on?”

Please Note: Refund Status of income tax return that have been filed this year, must be updated in the Income Tax Department systems. You can check the latest status of tax refund by using this utility. Use the tool & check refund status now!

If you think your friends/network would find this useful, please share it with them We’d really appreciate it.

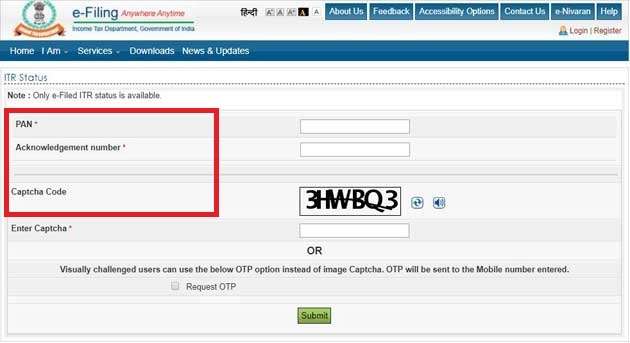

Check Income Tax Return Status Without Login Credentials

-

Step 1: On the homepage of the Income Tax Departments e-filing website, one will find the option to check the ITR Status .

-

Step 2: After selecting the ITR Status option, the user will be redirected to a new page. Enter PAN number, Acknowledgement number and the captcha code.

-

Step 3: On submitting the required details, the status will be displayed on the screen.

Recommended Reading: How Can I Make Payments For My Taxes

Check The Status Of Your Refund

The best way to check the status your refund is through Where’s My Refund? on IRS.gov. All you need is internet access and this information:

- Your Social Security numbers

- Your filing status

- Your exact whole dollar refund amount

You can start checking on the status of you return within 24 hours after the IRS received your e-filed return, or four weeks after mailing a paper return.

Generally, the IRS issues most refunds in less than 21 days, but some may take longer.

On the go? Track your refund status using the free IRS2Go app. Those who file an amended return should check Wheres My Amended Return?