When Should I Adjust My Tax Withholdings

Youll need to complete a new Form W-4 if youre starting a new job. For everyone else, you might want to adjust your tax withholdings when:

- You want a larger paycheck instead of a tax refund.

- You get married, divorced or become a widow.

- You have a baby or adopt one.

- Your child turns 17.

- You buy a new home.

- Your income changes drastically, including unemployment or getting a new job.

- You pay off student loans.

Can I adjust my W-4 at any time during the year?

Yes. But the earlier in the year you update your W4, the more time it allows for the changes to take effect.

How To File An Amended Tax Return With The Irs

OVERVIEW

Did you make a mistake on your tax return or realize you missed out on a valuable tax deduction or credit? You can file an amended tax return to make the correction. Filing an amended tax return with the IRS is a straightforward process. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Apple Podcasts | Spotify | iHeartRadio

Mistakes happen even on tax returns. That’s why the IRS allows taxpayers to correct their tax returns if they discover an error on a return that’s already been filed. Here’s what you need to know about filing an amended tax return.

Know Your Tax Bracket And Filing Status

Other errors that require amendment include filing under the wrong tax bracket or status.

This is especially applicable to people whove recently had life changes that change filing status, such as a divorce, marriage, or birth.

Make sure you are filing as the right kind of taxpayer and under the right kind of tax bracket. Learn more here.

Also Check: What Does Agi Mean For Taxes

What Is An Amended Return

An amended return is a form filed in order to make corrections to a tax return from a previous year. An amended return can correct errors and claim a more advantageous tax status, such as a refund. For example, one might choose to file an amended return in instances of misreported earnings or tax credits. Mathematical errors, however, do not require amendments because the IRS automatically corrects for such errors when processing the tax return.

Does An Amended Return Increase Your Chances Of An Audit

Some tax experts believe amending increases your chances of an audit, but theres no clear data to support this. The IRS only says that filing an amended return by itself does not trigger an audit.

IRS employees manually review all amended returns rather than computers. However, this is primarily for reasonableness and accuracy. This is not as thorough as an audit, and the people doing the review are not auditors.

The bottom line: If youve done your best to complete your original tax return accurately and have the supporting documents you need, dont leave money on the table by not amending because youre afraid of an audit. If the IRS does ask for additional information, you can just explain why youre right.

Recommended Reading: Where Do I Get Federal Tax Forms

So What Do You Do When You Just Cant Get Your Return Accepted

First, be absolutely sure of your numbers. Dont just enter from memory, look at the actual document. For example, when signing your return with your AGI from last years return, actually look it up on your return be sure of the number.

But what if you are sure of your data, and the IRS still says its wrong? This sometimes happens with names, Social Security Numbers and birth dates. You could be entering exactly whats on your childs Social Security card, but the IRS says that isnt correct. Whats going on? In this case, the IRS is probably just going by incorrect data it got from the Social Security Administration errors do sometimes creep in.

Our recommendation is to simply mail your return in cases like this. You can try to correct the problem with the SSA and IRS, but it isnt a quick resolution, and you neednt hold your return up while youre waiting.

Dont get us wrong were crazy about e-filing. We know its the quickest, safest way to file your taxes. But for a tiny percentage of returns, its not perfect. Just like people and computers.

Qualify For Head Of Household

If you are unmarried, see if you qualify as head of household. Filing as head of household rather than single allows you to claim a much larger standard deduction. However, this tax filing status requires that you pay more than half the costs to maintain your home and to have a dependent who lives with you for more than half the tax year.

Married taxpayers are generally ineligible to claim this filing status. If you are married, you must determine whether to file jointly or separately. Unless you have extenuating circumstances, you should file a joint return with your spouse to take advantage of the larger standard deduction and lower tax rates.

Read Also: How Much Is Inheritance Tax In Indiana

Taxslayer Terms Of Service

Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website . TaxSlayer, LLC. may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

General Terms and Conditions. In consideration of use of the Site, you agree to: provide true, accurate, current and complete information about yourself as prompted by the registration page and to maintain and update this information to keep it true, accurate, current and complete. If any information provided by you is untrue, inaccurate, not current or incomplete, TaxSlayer has the right to terminate your account and refuse any and all current or future use of the Site. You agree not to resell or transfer the Site or use of or access to the Site.

You acknowledge and agree that you must: provide for your own access to the World Wide Web and pay any service fees associated with such access, and provide all equipment necessary for you to make such connection to the World Wide Web, including a computer and modem or other access device.

User Conduct On the Site.

While using the Site, you may not:

IRS Circular 230 Notice. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

- PreSDDSpare, E-file, and Print

- Prepare, E-file, and Print

- Prepare, E-file, and Print

If You Need To Change Your Return

You can make a change to your tax return after youve filed it, for example because you made a mistake. Youll need to make your changes by:

- 31 January 2022 for the 2019 to 2020 tax year

- 31 January 2023 for the 2020 to 2021 tax year

If you miss the deadline or if you need to make a change to your return for any other tax year youll need to write to HMRC.

Your bill will be updated based on what you report. You may have to pay more tax or be able to claim a refund.

Theres a different process if you need to report foreign income.

Don’t Miss: How Much Is Tax In Washington State

How Long Do You Have To File An Amended Return

- If you or the IRS changes your federal return, you must file an amended Virginia return within one year of the final IRS determination.

- If you file an amended return with any other state that affects your Virginia income tax, you must file an amended Virginia return within one year.

Interest on any amount due will still accrue from the original due date, so file the corrected return as soon as you can.

If Changes to Your Return Result in a Refund

We can only issue a refund if the amended return is filed within:

How To Change Your Income Tax Return After You File It

May 20, 2021

Ottawa, Ontario

Canada Revenue Agency

If you think that the income tax and benefit return you filed for the 2020 tax year is missing important details such as the Home office expenses for employees or you made a mistake, you dont need to file a new return. Heres what you can do if you need to change your return.

Don’t Miss: How Much Is Washington State Sales Tax

Filing Business Tax Or Other Amended Returns

Most business and fiduciary taxpayers are able to simply:

- Adjust the amounts shown on the original return and

- Submit a revised return to DOR online through MassTaxConnect

Corporate excise filers can file amended returns electronically through third-party tax preparation software whether the amendment increases or decreases the tax due. Fiduciary filers may also be able to file amended returns using third-party software.

To learn more about third-party software options, read “DOR e-filing and payment requirements.”

Keep in mind that some taxpayers are required to file amended returns electronically.

Refer to TIR 16-9 to see if the electronic filing and payment requirements apply to you.

Filing electronically is always the quickest option, but if you are not required to file electronically you still have the option to check the amended return oval on your paper return and file it the way you usually do.

How Do You Track The Status Of An Amended Return

Use the IRS Wheres My Amended Return tool to check the status of your amended return. Since this is a mailed form, it takes at least three weeks for it to show up in the tracking system. The IRS takes up to 16 weeks to process amended returns. It may take another 4-6 weeks after processing to receive your refund if youre owed one. You can review the IRS instructions for Form 1040X here.

COVID-19 may delay updates and processing of your amended return. The IRS has been months behind on mailed returns due to related delays. If your amended return isnt showing up in the tracking tool, it may be sitting in a truck or warehouse waiting for IRS employees to catch up on their backlog. Use certified or priority mail if you want to know whether your amended return was delivered.

You May Like: How Much Federal Income Tax Should Be Withheld

Start Preparing Your Amended Return

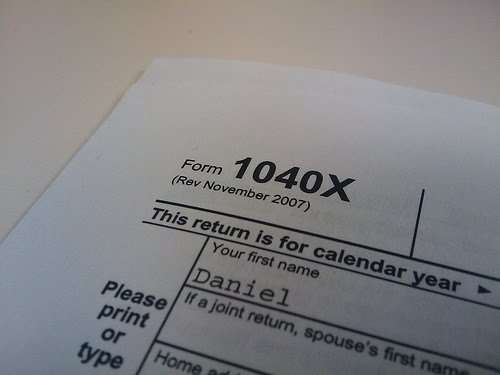

Next, its time to start preparing your tax return. If youve decided to do it yourself, the good news is the form isnt terribly difficult to understand. In fact, the form uses much of the same information youll find on your regular Form 1040. If you have questions, refer to the Form 1040-X instructions you secured earlier.

The amended return form features a three-column setup.

- In the first column, you input the information you reported on your original tax return.

- In the right column, you put the new corrected amount for each line item.

- In the middle column, you list the difference. .

You then fill out the information related to your new refund or tax you owe based on the amended return. Youll also need to explain why youre making changes to your return in Part III of Form 1040-X.

When Do You Need To File An Amended Return

There are several circumstances when you may need to file an amended return.

- You noticed a mistake right after you filed. You shouldnt just send a second return, and if you e-filed, the IRS wont accept a second return.

- You learned a filed form you received from a third party was incorrect.

- You forgot to include income or learned that income you didnt report was taxable.

- You forgot to include or learned about deductions or tax credits you didnt take.

- You received a notice or letter from the IRS, dont agree with their calculation of what you owe, but no longer believe your original return is completely accurate.

- You included income or deductions in the wrong year.

- You need to add deductions or credits that carry back to prior years or carry forward to future years.

You May Like: How To Calculate Sales Tax From Total

How Do I Fix A Mistake On My Taxes After The Irs Accepts My Return

If youve found a mistake after the IRS officially accepts your return, you may wonder if theres anything actually wrong with it. After all, if the IRS approved it, doesnt that mean your tax return was fine?

That depends on the error on the return. You normally dont need to correct math errorsthe IRS will catch and make those changes for you.

On the other hand, mistakes having to do with personally identifiable information , filing status, dependents, total income, or tax breaks should be fixed, which is done by using Form 1040X.

Where’s My Amended Return

Track the progress of your amended tax return using the IRS’s online tracking tool.

You can also the progress of your amended tax return by calling the IRS.

-

It can take three weeks for an amended return to show up in the IRSs system and up to 16 weeks to process an amended return.

-

If nothing has happened after 16 weeks, call the IRS again or ask someone at a local IRS office to research your amended return.

Check out our top picks for online financial planners below, or see our full roundup of the best online financial advisors.

|

VANGUARD PERSONAL ADVISOR SERVICES |

Also Check: How To Get The Most Out Of Tax Return

Irs Bank Account Information Update Tool

When the first and second stimulus checks were rolling out, the IRS had the non-filers tool where taxpayers could update their bank account information. Although this was a tool that was mostly designed for nonfilers to give their bank account information to the Internal Revenue Service, it was also used by those that needed to update it with the agency.

Since were not expecting another stimulus check as the COVID-19 pandemic is slowly ending, the tool isnt there anymore. As a nonfiler that wants to update bank account information with the IRS, what you need to do is file a federal income tax return. This is the only way you can update your payment information with the IRS, even if youre not required to file a tax return.

How To Complete An Amended Return

You can file your amended return electronically, or on paper. If you file electronically, follow the instructions for your software provider.

In either case, make sure to indicate that its an amended return before filling it out.

For paper returns, mark the oval labeled Amended Return. Complete the new return using the corrected information, as if it were the original return. Do not make any adjustments to your amended return to show that you received a refund or paid a balance due with your original return. Attach a complete copy of your federal amended return, if applicable.

If your amended return results in additional tax due, interest must be paid on the tax you owe from the due date on the original return to the date filed or postmarked.

Recommended Reading: How To Pay Llc Taxes

What Happens If You Dont File An Amended Return

What happens if you dont amend your return depends on what you owe.

- If you would have owed additional tax, the IRS will charge interest and penalties through the date you finally pay the tax. If the IRS believes you were aware you owed additional tax but didnt amend your return, it may also pursue additional civil or criminal penalties.

- If you originally overpaid and the amended return would have resulted in a refund, you will lose the right to claim that refund.

Checking Your Amended Tax Return Status

Amended tax returns dont process anywhere near as fast as a regular tax return. For many, this is frustrating, especially if youre expecting a refund.

The IRS says it may take up to three weeks for the return to show up in their system. Then, it may take an additional 16 weeks to be processed.

Thankfully, you can check on the status of your amended tax return with this IRS tool. You need the following to be able to check the status of your return:

- Social Security Number.

- Zip Code.

You May Like: What Happens If I Forgot To File Taxes

How To Amend A Federal Tax Return

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She has over 13 years of tax, accounting, and personal finance experience. She received her BA in Accounting from the University of Southern Indiana in 2006. This article has been viewed 82,165 times.

The Internal Revenue Service allows anyone to make an adjustment or change to an already filed tax return. You can change a tax return if you have had a change in dependents, income, credits, filing status, or deductions since you filed. A very common reason is receiving a tax document after you have filed your return because the information on that document wasn’t included in the initial return. If you follow a few simple steps, you can learn how to amend a federal tax return.

How To Change Bank Account With Irs

Changing bank account information with the Internal Revenue Service is easier than ever. Whether youre changing your bank account with the IRS for receiving another stimulus check although its not for certain yet, or your next tax refund, it doesnt take much of a hassle. The Internal Revenue Service will send your payment to the bank account in their database.

There are several ways to change your bank account information with the IRS. If youre changing your bank account due to a change in accounts to receive your upcoming tax refund, know that filing a federal income tax return with the new bank account information on it is enough. However, you still can change your bank account with the IRS after filing your tax refund. For that, call the IRS at 1-800-829-1040. The IRS representatives are available between 7 AM and 7 PM, Monday through Friday. Youll need to verify your identity when speaking to an IRS representative and calling using the registered phone number is a good step to start this.

Read Also: How To Buy Tax Lien Properties In California