S For Retirees To Prove Florida Residency

- Register to vote in Florida, and if you receive a jury summons, perform your civic duty

- Apply for a library card

- Change your drivers license and car registration

- Establish relationships with health care providers in your new location

- Open an account at a local bank, and keep receipts of ATM withdrawals

- Shopping locally is also a good idea: State tax auditors sometimes review credit card records to determine where you were during the year

- File a Declaration of Domicile with your local county court.

Florida Llc State Income Tax

Although LLCs do not pay federal income tax, if you opt to be taxed as an S corporation at the federal level you will be subject to state income tax per the Florida Income Tax Code. This also applies to LLCs classified as partnerships that have at least one corporate owner. These businesses must file Form F-1065.

This does not apply to single-member LLCs that are treated as disregarded entities at the federal level. This type of business must report its income to the state using Form F-1120. Income and losses are reported on the owner’s individual income tax return.

All businesses that conduct business, exist within, or receive income from Florida must pay the state’s corporate income/franchise tax. This is adjusted based on the percentage of business conducted in Florida compared to the percentage in other states and considers the company’s payroll, sales, property, and assets.

Corporations that do business outside Florida adjust their federal income using a weighted average formula that apportions 50 percent to sales and 25 percent each to payroll and property. Exemptions are then subtracted to arrive at net income in Florida. The tax rate on this income is 5.5 percent. For example, if your business’s net income in Florida is $50,000, it will be taxed $2,750.

Keep in mind that you can receive tax credits for providing salaries to Florida residents, paying other taxes and assessments, and making certain investments in your business.

Corporate Taxes In Florida

Unless a small business is set up as a C corporation, Florida does not impose state income taxes on it. That means the S corps, LLCs, and sole proprietorships are tax exempt. For corporations, state taxes in Florida are still low compared to most states. The standard corporate tax in Florida on federal taxable income is 5.5%, but exemptions often lower a corporation’s effective tax rate significantly. A corporation is required to pay the higher amount of the standard rate minus all exemptions and credits, or an alternative minimum tax rate of 3.3%.

As of 2019, under both methods, the standard rate and the alternative minimum tax, the first $50,000 in income is exempt from Florida’s corporate tax. A Florida corporation must remit its income tax on April 1 if it uses the calendar year as its tax year or on the first day of the fourth month after its tax year ends.

Don’t Miss: Where Is My State Refund Ga

Capital Gains Tax Calculator

A Florida capital gains tax calculator will help you estimate and pay taxes based on your situation. You can use a capital gains tax rate table to manually calculate them, as shown above.

For example, if a person earns $50,000 per year and earns a capital gain of $1,000, they will have to pay $150 in capital gains taxes to the IRS.

Real Estate Estate Tax And Other Factors To Consider

Establishing a domicile in Florida and establishing residency is a complicated process. Ideally, you can make a clean break by selling all real estate, moving all business activities, and fully investing in your life in Florida by buying a home in Florida. This is the best way to indicate intent to make Florida your domicile.

Along those lines, be cautious of how you handle any real estate sales you may initiate you want to take advantage of the capital gains exclusion on the sale of your primary residence. To do this, the home you are selling must have been your primary residence for two of the last five years. For example, if youre selling your New York residence in year five of claiming Florida residency, you would not be able to take the capital gain exclusion since the New York residence would have been your primary residence for only one year in the last five years.

If you choose instead to maintain multiple properties between Florida and another state, youll want to keep detailed records of financial transactions and travel plans to document where you have been in the event you are audited by the state.

Youll also want to consider estate taxes when youre considering relocation to Florida, especially if you are at or near retirement age. Florida, as you may know, doesnt have an estate tax, but your current state may. Its important to update your estate plan to reflect Floridas laws upon establishing domicile in Florida.

Don’t Miss: How To Find Your Employer’s Ein

What Is The 2 Out Of 5 Year Rule

Those two years do not need to be consecutive. In the 5 years prior to the sale of the house, you need to have lived in the house as your principal residence for at least 24 months in that 5 year period. You can use this 2 out-of-5 year rule to exclude your profits each time you sell or exchange your main home.

Florida Car Sales Tax: Everything You Need To Know

When you purchase a car in Florida, a Florida car tax is imposed on the purchase price of the car. The amount of taxes you pay, however, depends on which county you live in, whether you purchased the car out of state, and whether you’re trading in a car for the new one.

When you purchase a car in Florida, a Florida car tax is imposed on the purchase price of the car. The amount of taxes you pay, however, depends on which county you live in, whether you purchased the car out of state, and whether you’re trading in a car for the new one. Regardless of whether you purchased a new or used car, you’ll need to calculate the amount that of money that will go to the Florida Department of Revenue and county tax collector to know the total cost of the vehicle.

Recommended Reading: Where Can I File An Amended Tax Return For Free

Florida Communication Services Tax

In addition to the above taxes, Florida also collects a special communication services tax on all phone, internet and television services. The total tax rate is 7.44%, but service providers are only allowed to directly bill consumers for 5.07% of that. For the remaining 2.37%, consumers must report and pay the tax independently.

For satellite-based services like DirecTV, the rate is even higher at 11.44%. So if you are a big spender on high-speed internet, multiple phone lines and the top-of-the-line cable TV packages, expect a slightly higher price-tag when it comes time to pay up.

Tax Returns And Refunds: A Few Things To Consider

Regardless of whether you are a U.S. citizen or a foreign investor, the IRS requires you to file a tax return upon the sale of your property. If you are due a refund, be aware that the IRS begins processing tax returns and refunds at the beginning of the next calendar year.

1031 Exchange

A 1031 Exchange is a mechanism for real estate investors to delay taxes on the gain they realized from the sale of their real estate investment. This mechanism is available to all owners/sellers of real estate in the U.S.

For all sellers that want to defer their capital gain, they are required to:

Generically, these are the basic steps for all investors. There is a fee for the 1031 Exchange and global investors will also have to comply with the FIRPTA requirements in addition to the general investor requirements. However, in our experience, 1031 exchanges are straightforward to facilitate.

Final Points on Capital Gains Tax Advantages for Residents

Knowing Your Residency Status for Tax Purposes: The 183 Day Rule

Sharing is caring!

Don’t Miss: How Much Is H& r Block Charge

Avoid The Taxes By Selling Your Fl House As

Now that you know about the taxes involved when trying to sell your house in Florida, its a lot of information and a lot to take in. But there is another solution where you can sell your house and avoid these kinds of extra payments. You can sell your house as-is directly to a cash buyer like Florida Cash Home Buyers. We are professional FL home buyers and we offer cash for houses in Florida.

We work with hundreds of Florida homeowners who are looking for ways to sell their homes and save money on taxes. We will buy your house in any condition or situation, even if youre already dealing with tax or lien issues. Well review the details of your house and find time to meet you at the property quickly. Well handle all the repairs so you dont even need to worry about it. Then, well make you a fair cash offer based on the value of the house. Even better, there are no fees youll need to deal with beyond that offer.

If you accept, you set the closing date. Then, all you need to do is sign the contract and get your cash. No taxes to deal with and no extra costs to worry about. You can simply move forward with your life and Florida Cash Home Buyers will handle the concerns of the house from here.

Estate Tax Unified Credit

Each U.S. citizen may exempt from estate taxation on assets in their taxable estate up to approximately $11,500,000 . The exemption increases with inflation. Recently, the estate tax law was changed so that a decedents estate tax exemption may be applied against lifetime gifts and after death bequests or trust. For married couples, any part of the $11,500,000 credit which is not used by the first spouse to die may be carried over to the surviving spouse. The carried over credit is referred to as the Deceases Spousal Unused Exclusion . Therefore, a married couple may exempt approximately $23 million of assets from federal estate taxation when their assets are passed to their children and other heirs. Very few Florida residents are concerned about estate tax liability because few people are worth more than $23 million.

To take advantage of the DSUE the law requires the surviving spouse to file a federal estate tax return, Form 706, upon the death of the first spouse and properly elect DSUE on the Form 706. Preparing a Form 706 is complicated even for smaller estates and families should expect to pay legal and accounting fees.

In all cases where estate tax is due, a Form 706, Estate Tax Return must be filed within nine months after the decedents death, although an extension of an additional six months is generally granted upon the filing of an application for extension.

You May Like: How To Appeal Property Taxes Cook County

Special Real Estate Exemptions For Capital Gains

Since 1997, up to $250,000 in capital gains on the sale of a home are exempt from taxation, if you meet the following criteria:

- You have lived in the home as your principal residence for two out of the last five years. The two year residency test need not be “continuous.”

- You have not sold or exchanged another home during the two years preceding the sale.

- The method of holding title does not matter. Title can even be held in a revocable trust.

Also please be aware, you may additionally qualify for this exemption if you meet what the IRS calls “unforeseen circumstances” such as job loss, divorce, or family medical emergency. Military and Foreign Service personal also get special considerations. Inquire with your tax advisor for specific details regarding these particular situations.

“Special Note:” Beginning January 1, 2009, new rule changes will go into effect regarding the Captial Gains exclusion for properties used as a rental or vacation home. The new rule will be based on “Qualified” versus “Non Qualified Use.” You’ll need to consult with your CPA or Tax Advisor regarding this change!

For more information on this real estate topic, please feel free to contact us directly. Our associates will be more than happy to assist you in answering any and all questions you may have.

And, please be sure to check out our other Florida home seller information pages. They are full of useful information for buying or selling a Southwest Florida home or condominium.

How To Calculate Florida Lottery Taxes

When people dream of winning the lottery, they give little consideration to the taxes they’ll pay on that money. Most imagine the mansion, luxury car or yacht they’ll buy, along with quitting work and traveling the world. But if you hit the jackpot, Uncle Sam will come calling all too soon. It’s important to think about both state and federal taxes if that lottery ticket pays off, whether you win a billion-dollar Powerball or $1,000 on a scratch-off ticket.

Also Check: Www.1040paytax

The Florida Property Tax

The Florida constitution reserves all revenue from property taxes for local governmentsthe state itself doesn’t use any of this money. Property taxes are based on the “just value” or market value of properties as they’re assessed by a local appraiser as of Jan. 1 of each year.

Increases in value are limited to 3% of the previous year’s assessment or the Consumer Price Index , whichever is less. This limitation is known as the “Save Our Homes” cap.

Taxes are based on millage rates set by local governments, with 10 mills being equal to 1%. The millage rate is multiplied by the value of the property to determine the dollar amount of the tax. County, city, and school districts are permitted to levy taxes at up to 10 mills each.

Special districts, such as water management, can levy additional taxes, usually at under 2 mills.

Property Tax And Exemptions

While Florida does not assess a property tax on real estate, state localities may assess property taxes. Also, it provides a property exemption, which allows property owners to qualify for a reduction in their property tax liability to homeowners, disabled and senior citizens, veterans and active-duty military service members, disabled first responders, and other properties.

Also Check: How To Appeal Property Taxes Cook County

In California And Elsewhere Moving Out Of A State May Subject Someone To A Residency Audit Which Is Not Cheap Or Fun

What might cause you headaches if youre selected for this scrutiny?

- Living in your new low tax state for less than 183 days a year. How could they possibly know that? By combing through your credit card and bank statements as well as other records. It would be hard to claim that youve lived in Florida for seven months out of the year, if your credit card statements show that you have put gas in your car and visited various restaurants every week in New York for any months during that time. Some states may count any days without proof otherwise, as days lived in your old state.

- You still own that Mansion in the high tax state while claiming that you live full-time in a small condo in Florida.

- You claim to live in Florida but your spouse lives in New Jersey or your children still attend school nine months out of the year in the state.

The Siren Song Of Tax Incentives

Many states across the country are currently operating at a deficit and the loss of income taxpayers to greener pastures, so to speak, is driving an increase in those states residency audits. By and large, rules havent changed but states are getting more aggressive and fewer exceptions may be made than in the past.

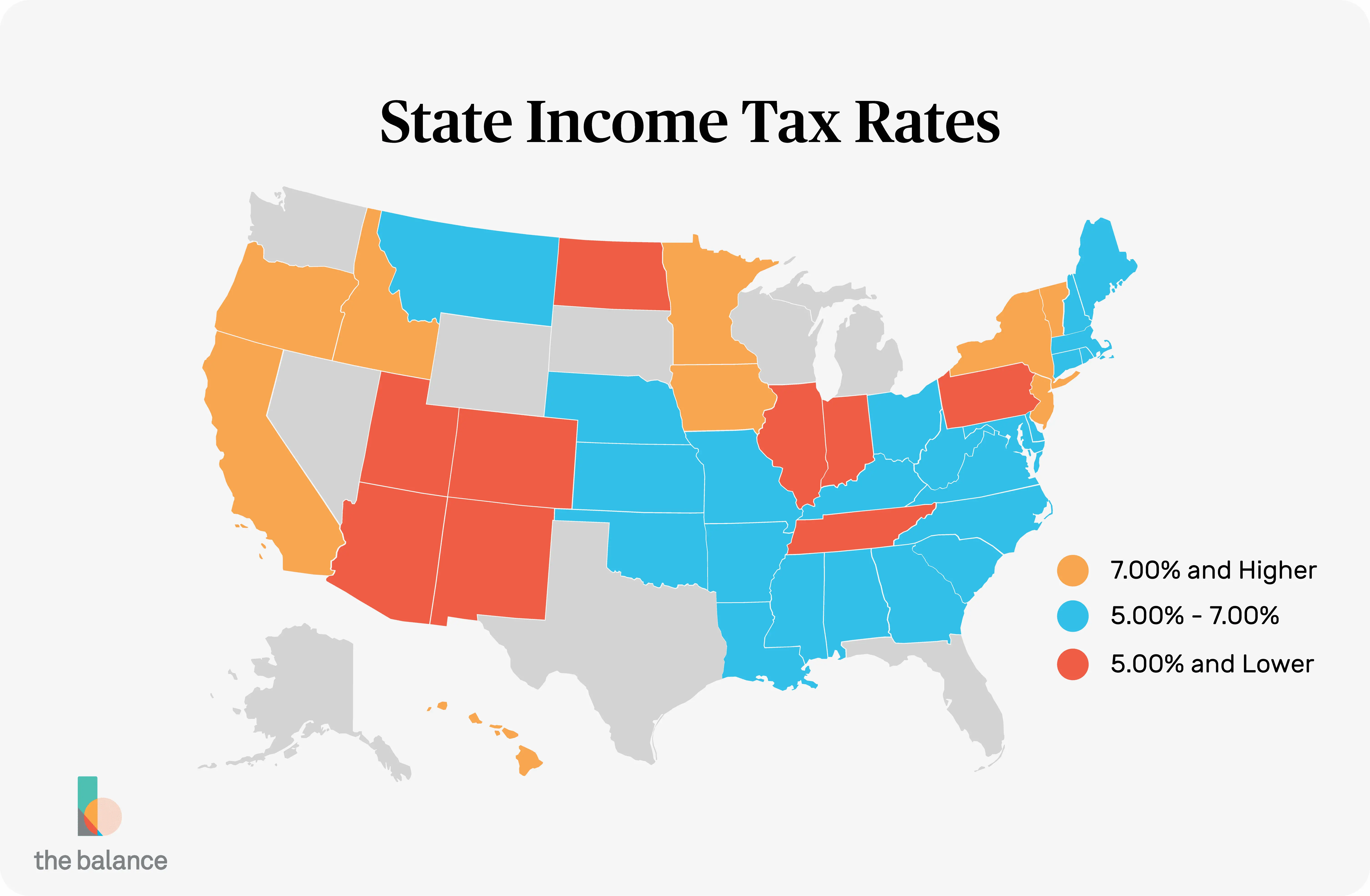

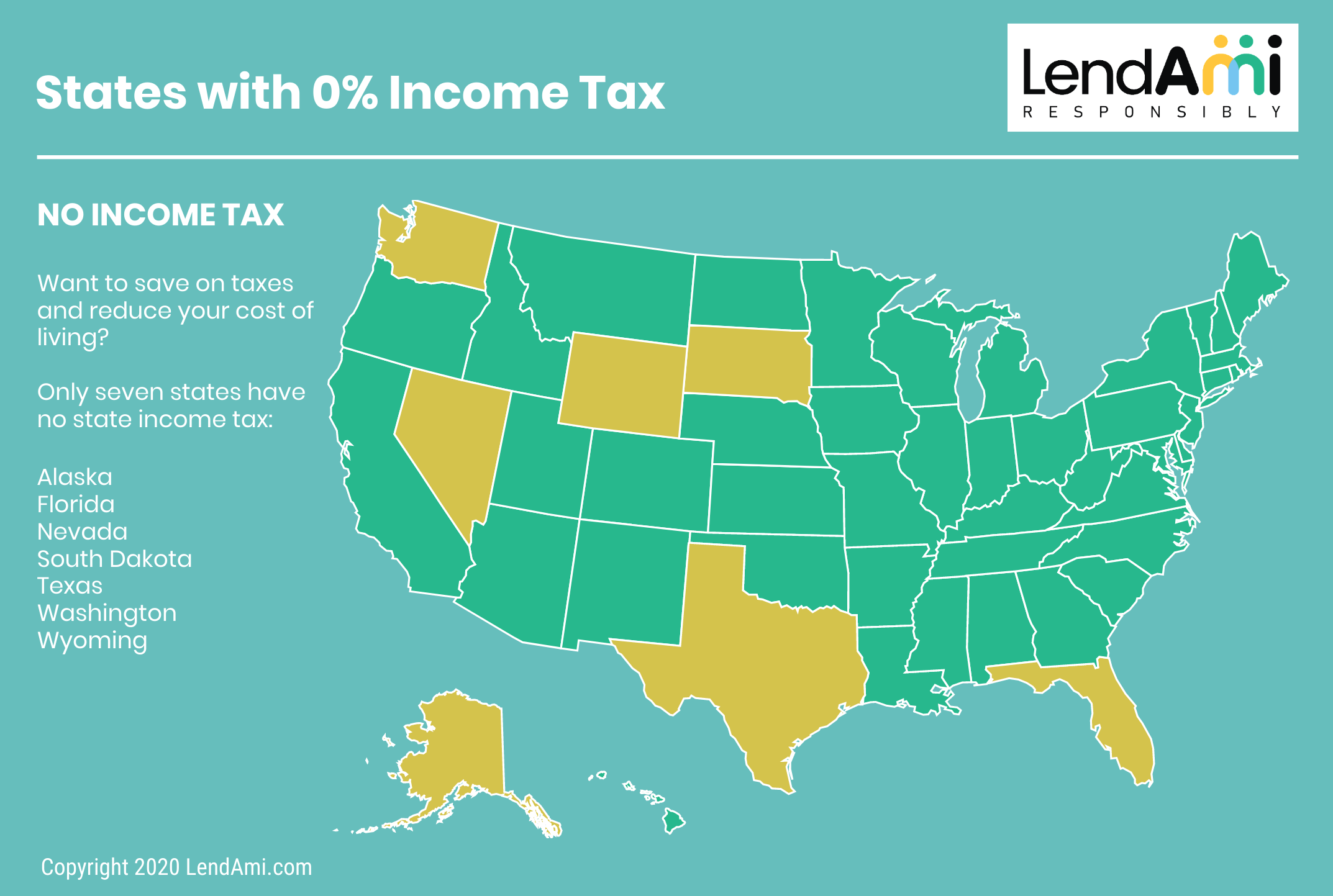

Florida is one of the few U.S. states with no state income tax, so its no surprise that people from the high-income tax states are among the top relocators. The Tax Cuts and Jobs Act has left some people looking to improve their tax position.

Before the TCJA, individuals in higher-taxed states were able to benefit from State and Local Tax deductions on federal income tax forms. But now the TCJA limits the SALT deductions to $10,000 annually. SALT deductions have historically represented big tax breaks for individuals who itemized their Schedule A deductions. For those in high-income tax and property tax states, this has been a big hit.

But to see these tax benefits, one has to officially change their state of residence. For those planning on splitting time between Florida and their previous state, there are a few important factors to weighand a few things to watch for.

Read Also: How Can I Make Payments For My Taxes

Taxes In Florida For Small Businesses: The Basics

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Florida offers a host of advantages to prospective small business owners. Compared to many states, small business regulations in Florida are minimal, and the state imposes fewer barriers to entry for new businesses. Florida’s labor force is expanding at an annual rate of 1.9% compared to .9% at the national level as of February 2020. The state’s unemployment rate, at just 2.8% as of February 2020, is close to what most economists consider to be full employment. Lastly, and for some most importantly, Florida pays its workers and business owners an attractive bonus in the form of 12 months of warm weather, abundant sunshine and easy access to the country’s most popular beaches.