The Most Accurate Tax Calculator

At Etax, after you register and log in, then start a tax return, the tax refund calculator shows your tax refund estimate at the top of the screen.

The tax refund calculator shows your ATO tax refund estimate. The more details you add to your tax return, the more accurate the tax calculator becomes

It is accurate to the cent, based on the information you add to your return and it updates as you go.

Etax includes the all tax cuts and tax rebates in your refund estimate, for 2021.

Each time you add a new detail to your return, the tax refund calculator re-calculates your tax estimate. You can see how each number and each tax deduction affects your overall tax refund.

This happens automatically, helping you see how different items in your return can affect your refund. Thats not possible with most tax calculators!

Understand How Education Savings Plans Work

Parents and students can save for school using education savings plans. These plans can help pay for elementary, secondary, and higher education expenses. The money you save or withdraw from your savings plan for qualified education expenses is tax-free. There are two types of savings plans:

-

529 plans are qualified tuition programs sponsored by states and colleges. Theyre authorized under Section 529 of the Internal Revenue Code. With these plans, you can:

-

Prepay or contribute funds to an account to help cover qualified higher education expenses

-

Transfer or rollover funds from the 529 plan to an Achieving a Better Life Experience account. These funds can benefit the savings account holder or a family member. Learn how an ABLE account can help a person with a disability pay for education, housing, health, and other qualified expenses.

-

Pay off up to $10,000 in student loan debts.

-

Pay for fees, books, supplies, and equipment required under qualified apprenticeship programs.

The Coverdell Education Savings Account can be used to pay for eligible K-12 and higher education expenses. You may contribute up to $2,000 per year for each eligible student. When you open the account, the person receiving the benefits must be under 18 or have special needs.

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

Don’t Miss: Csl Plasma Taxes

What To Do If You Have Tax Owing

2020 was a financially rough year for many Canadians, and the federal government stepped in where they could and offered benefits to those who were struggling to make ends meet during the COVID-19 pandemic. What many Canadians failed to realize, is that those benefits were taxable. As a result, you may find yourself not getting money back at tax time, but instead, youll owe a portion of your benefits back to the government. Heres what to do if you suspect you may owe money at tax time.

- Prepare your return promptly if you think you might owe money at tax time, prepare your return as soon as possible. Preparing early will show you exactly how much you owe, and give you time to plan to pay it back

- File on time if you owe a tax balance, dont delay filing because of it. Filing after the deadline results in a late filing penalty and wont affect your taxes owing youll need to pay those anyway.

- Make a plan to pay your taxes if you dont have the cash on hand to pay your tax bill, consider tapping your cash resources. Emergency funds are there for a reason and paying an outstanding tax bill is one of them.

- Consider paying in installments If you dont have the cash on hand to pay your tax bill, consider making payments in installments. The Canada Revenue Agency will charge interest on your outstanding balance, but the interest rate is low.

Who Cannot Get An Estimate Online

You cannot get an estimate online if you:

- are entitled to claim

- were born on or before 5 April 1938 and get the higher allowances

- have other taxable income, for example from dividends and trusts

- are a higher rate taxpayer and want to estimate your Gift Aid tax relief

You can check youve paid the right tax by contacting HMRC or by getting help from an accountant.

Don’t Miss: File Amended Tax Return Online Free

How Can I Make Sure I Don’t Owe The Irs Money Next Year

To reduce your chance of receiving an overpayment this year, sometime in September you’ll be able to update the IRS with your current family status using the child tax credit portal. You should continue to keep the IRS up to date with family changes through the end of 2021.

Know that if your household’s adjusted gross income, or AGI, for 2021 is below a set income level, you likely won’t owe the IRS anything, even if you received more child tax credit money than you technically should have. This is what the IRS calls “repayment protection” so that lower-income families won’t be on the hook to repay money. Above a certain income level, the amount you need to repay increases, or phases in, until you owe full repayment.

A letter the IRS will send you in January 2022 will help you determine if you received an overpayment and if you need to repay all or part of the advance payments. See below for more on that letter.

Your Federal Tax Refund

Many people probably file their federal income tax returns hoping for a tax refund. Typically, you pay your federal income tax throughout the year, either through the payroll withholdings your employer takes out of your paycheck or through estimated tax payments if youre self-employed. Pay too little, and you could owe Uncle Sam on Tax Day. Pay too much, and you could get an IRS refund of the amount you overpaid.

Tax calculators can help you estimate your tax refund, but when will your federal refund arrive? The IRS says most people can expect their refunds in less than 21 days, and e-filing and choosing to have your refund directly deposited into your financial account can be the fastest way to get your refund. Direct deposit is not only faster than waiting for a paper check to arrive in the mail, its more secure direct deposit means you wont have your refund check get lost in the mail.

If you want to track your refund, you can use the IRSWheres My Refund? tool.

Don’t Miss: Doordash Tax Forms

If You Are Unemployed Or Out Of Work Sick

If tax has been deducted from your pay since 1 January last and you are nowunemployed, you may be entitled to a tax refund. If you have not paid any tax,you will not be due a refund.

To decide if you are eligible for a refund, your wages are added to thetaxable amount of the payments you are getting.

Taxable payments include:

When Does Netfile Open For 2021

NETFILE opens on Monday, February 22, 2021, for filing personal tax returns for the 2020 tax year. To file online, you must use CRA-certified tax-filing software products that use the NETFILE web service. You can also file previous tax years back to 2015, but returns for tax years earlier than 2014 must be done on paper.

Also Check: Plasma Donation Tax

Will I Get A 2021 Tax Refund

Typically, you receive a tax refund after filing your federal tax return if you pay more tax during the year than you actually owe. This most commonly occurs if too much is withheld from your paychecks. Another scenario that could result in a refund is if you receive a refundable tax credit that is larger than the amount you owe. Life events, tax law changes, and many other factors change your taxes from year to year. Use our tax refund calculator to find out if you can expect a refund for 2021 .

Work Mileage And Tax Rebates

Travel to temporary worksites is one of the main reasons why people end up being owed tax rebates each year. Our quick and simple will give you an instant estimate* of how much you can claim back from HMRC for your work travel.

The basic system works like this: HMRC has decided on a set of for essential work travel. If youre footing the bill for public transport or travel in your own vehicle to a temporary workplace, the taxman says you can be reimbursed up to the appropriate AMAP rate. If youre getting nothing toward your travel from your employer, or getting less than the AMAP rate you qualify for, you can claim back the difference as a tax rebate.

Cars and vans:

- 45p per mile for the first 10,000 miles.

- 25p per mile after that.

Motorcycles:

Tax Refund Calculations

You May Like: Tax Preparation License

If I Lost More Money Than I Made With A Business Can I Get That Back In Taxes

Although starting a business can be risky, the tax code provides some protection for business owners who experience financial losses. In general, a business owner whose business loses money can recover some of this loss by using the amount of the loss to create a tax deduction. A business owner should be aware of how the tax code treats business losses and consult with her tax professional or accountant on proper reporting of the loss.

Makes Casino Winnings Tax Refunds Easy

If you find youre filling out multiple forms, your withholding tax professional is not earning their fee. The point to using a service when getting tax back from casino winnings is that they do all the leg work and make sure its done right.

RMS is the leading provider of withholding tax services for non-US residents. Learn why RMS is the right choice for claiming tax back from your US casino winnings and apply now for free.

Don’t Miss: Do I Have To Claim Plasma Donations On My Taxes

Heres How To Calculate Your 2021 Tax Refund

Lots of people are curious about their tax refund estimate right now.

Will the latest Government tax cuts mean a bigger tax refund for you? Have you continued to work from home and have some extra deductions to claim?

You can calculate an accurate tax refund estimate in a few minutes. The 2021 tax refund calculator inside Etax is the most accurate tax calculator available in Australia.

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Also Check: Protest Property Taxes Harris County

Subtract Deductions And Adjustments

As I noted at the end of Step 1: Your business expenses don’t go here. You don’t need to itemize to claim those business expenses. What we’re talking about here are your personal tax deductions.

For the sake of simplicity, this calculator is going to do three things:

Add Any Other Income To Your Business Profits

If you worked another job, you’ll add your income from that job . Did you have other taxable income? Did you have a profit from another business? That all gets added in as well: Investments and income, certain benefits that are taxable, etc, add it all up.

Are you filing a joint return? You’ll add in your partner’s income as well.

This is all for income tax purposes. Income tax and self employment tax gets calculated differently. As we noted, self-employment tax is only based on your business profit and it isn’t adjusted by personal deductions. Income tax on the other hand is based on the combination of all forms of income.

You May Like: License To Do Taxes

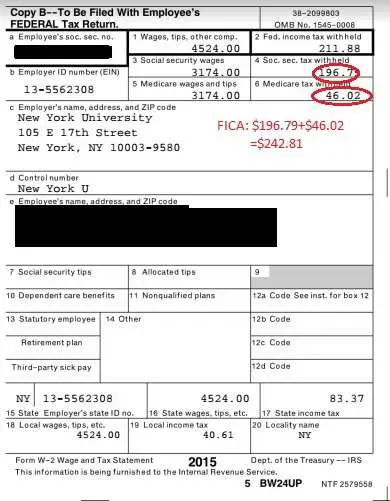

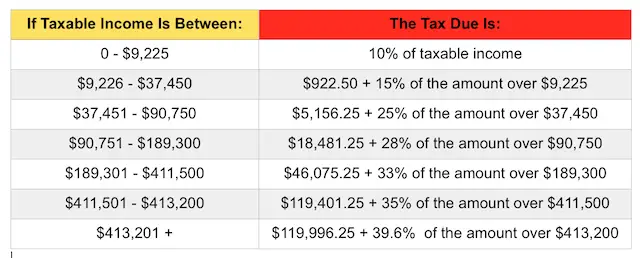

How Is Federal Income Tax Calculated

Calculating your federal income tax is complicated, but federal tax brackets are an important starting point. A tax bracket is a range of taxable income with a corresponding tax rate. The U.S. has seven federal tax rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Tax brackets basically help you understand what tax rate will apply to your taxable income in federal income tax calculations.

Here are the tax rates and their corresponding tax brackets based on filing status.

Try The Tax Calculator Now

plus you can finish your tax return in minutes, or save it all for later.

The Tax Return Calculator is a free part of the Etax online tax return . The calculator provides an instant estimate of your tax refund .

If you decide to complete and sign your tax return , our qualified accountants check your return, and look for suggestions about further deductions or adjustments that can boost your tax refund or prevent ATO trouble.

If you just want to try the calculator, you are not obligated to sign and pay for a tax return.

But after trying it, most people use Etax for their tax return, because it is done from your home, affordable, convenient, and includes friendly support from real accountants and no appointments needed. Etax is the top-rated tax service in Australia you can read more at the Etax reviews page.

Read Also: Ein Reverse Lookup Free

Why Not Use The Basic Ato Tax Calculator

For starters, its the ATOs job to collect revenue, not help you get a better refund.

It is risky to rely on an over-simplified tax refund estimate and even more risky to enter rough details then count on a tax refund estimate.

Also, using the ATOs system, you dont get any tips about tax deductions that can improve your tax refund.

A calculator that tells you the highest refund right now might make you feel good, but later if your real ATO tax refund is lower, ouch.

Its best to use a calculator like Etax that tells you an accurate refund estimate, and enter all your details carefully, so youll know how much to expect from the ATO.

Etax.com.au includes a live tax calculator that updates automatically based on each piece of information you enter, ensuring an accurate, personalised tax refund estimate.

To start using the tax calculator, just register and start your online tax return. The more details you add about income and deductions, the more accurate your tax calculator will be.

Remember: The sooner you lodge your tax return, the sooner youll get your refund!

What Is My Filing Status

It depends the filing statuses are single, married filing jointly, married filing separately, head of household, and qualifying widow. If you support a child or relative, they may qualify as your dependent. There are different requirements for qualifying children and qualifying relatives, but both types of dependents must be a U.S. citizen, U.S. national, or U.S. resident alien. You must be the only taxpayer claiming them, and they must be filing single or married filing separately if they’re required to file their own return. For more, see Who Can I Claim as a Dependent?

Don’t Miss: Is Door Dash 1099

Estimate Your Income Tax For A Previous Tax Year

Use this service to estimate how much Income Tax you should have paid for a previous tax year.

There are different ways to:

If youre self-employed, use the HMRCself-employed ready reckoner to budget for your tax bill.

You may be able to claim a refund if youve paid too much.

You need details of:

- your earnings, before and after tax – get this from your P60

- any savings – get this from your bank statements or annual statement from your bank or building society

- any Gift Aid donations youve made to charity