The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Recommended Reading: How Do I Get My Pin For My Taxes

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Other Payroll Tax Items You May Hear About

-

FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds a federal program that provides unemployment benefits to people who lose their jobs. Employees do not pay this tax or have it withheld from their pay. Employers pay it.

-

SUTA tax: The same general idea as FUTA, but the money funds a state program. Employers pay the tax.

-

Self-employment tax: If you work for yourself, you may also have to pay self-employment taxes, which are essentially the full load of Social Security and Medicare taxes. Thats because the IRS imposes a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Typically, employees and their employers split that bill, which is why employees have 6.2% and 1.45%, respectively, held from their paychecks. Self-employed people, however, pay the whole thing. A 0.9% additional Medicare tax may also apply if your net earnings from self-employment exceed $200,000 if youre a single filer or $250,000 if youre filing jointly. Because you may not be receiving a traditional paycheck, you may need to file estimated quarterly taxes in lieu of withholdings.

You May Like: Property Tax Protest Harris County

Previous Years Tax Brackets

Taxes were originally due April 15, but as with a lot of things, it changed in 2020. The tax deadline was extended to July 15 in order to let Americans get their finances together without the burden of a due date right around the corner.

Here is a look at what the brackets and tax rates were for 2019:

| Tax rate |

|---|

How Do I Compare Fees To Cash My Paycheck

You can cash your paycheck at a business to get money in your hands. You might cash your paycheck at:

- a bank or credit union

- some convenience stores, grocery stores, or other stores

- check-cashing stores

Cashing a paycheck at your bank or credit union is usually free. Sometimes, the bank named on the check might cash a paycheck if you do not have an account.

Businesses charge different fees for cashing a check. Call, visit, or go online to find out what a business charges. Check-cashing stores sometimes charge high fees.

You May Like: How To Appeal Property Taxes Cook County

Paycheck Calculators To Estimate Your Pay

Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

ADP Salary Payroll Calculator

Free salary reports covering virtually every occupation, as well as information on salary, benefits, negotiation, and human resources issues for U.S. and Canadian markets. Salary negotiation tips, small business solutions, and cost of living comparisons are also available.

How To Calculate How Much Tax You Owe

It’s a fact: The more you earn, the more taxes you pay. But the progressively higher tax rate takes some of the sting out of pulling in more cash. The tax tables below show the rates the IRS imposes on income for the tax year 2021 :

| Tax Brackets, 2021 | |

|---|---|

| Over $523,600 | Over $314,150 |

Your is the rate of tax that applies to each additional dollar of income earned. If you’re single and earned $39,475 that year, you are in the 12% marginal tax bracket. Your tax liability for 2021 was $995 plus 12% of the amount of your earnings over $9,950which is $29,525. So, you owe $995 plus 12% of $29,525, which is $3,543. Your total tax for 2020 is $4,538.

While your marginal tax rate was 12%, your effective tax rate, or the average rate of tax you paid on your total income, was lower. To calculate your effective tax rate, divide your total tax by your total income. In this case, $4,538/39,475 gives you an effective tax rate of 11.5%.

Now, let’s see what happens to your tax liability if you got a $10,000 raise that elevated your annual income for 2021 to $49,475. You already know that you owe $4,538 on the first $39,475 you earned. But now that your total income falls between $40,526 and $86,375, your $10,000 raise bumps you into the 22% tax bracket. Fortunately, that 22% rate only applies to your $10,000 additional income. For that, you would owe an extra $2,200 a year in tax, for a total tax bill of $6,738 .

Also Check: Is Donating Plasma Taxable

How To Calculate Spendable Income

Pay stubs often look like itemized receipts. First, there’s the amount of money you earned during that pay period, followed by one or more deductions. The final total shows what you ultimately deposit in your bank account. The difference between your initial income and final deposit may leave you wondering exactly what percentage is withheld for tax purposes.

The answer depends on two main factors: How much money you make and your marital status. Your employer uses form W-4 to determine how much income tax to withhold, and this form does give you some control over how much or how little is withheld. If too much money was withheld, you’ll receive an income tax refund after filing your taxes the following spring.

TL DR

How Your Paycheck Works: Deductions

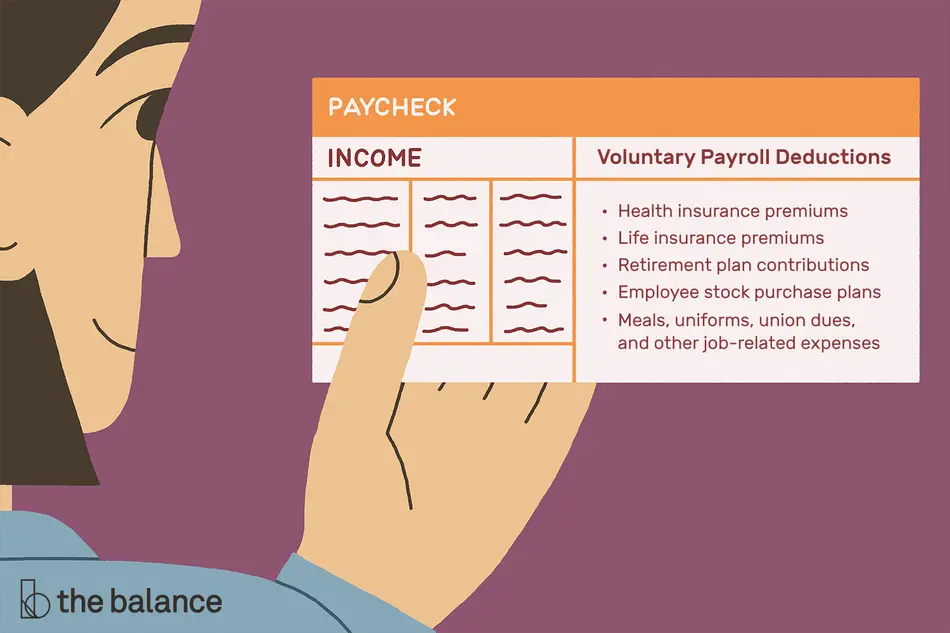

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

You May Like: How Much Is Payroll Tax In Louisiana

Everything Deducted From Your Paycheck Explained

Congratulations, youve earned your first paycheck! Youre probably excited, as you should beyou put in work, and have some cash in the bank to show for it. But if youre like many newly employed people out there, you might also be a little bit confused after running the numbers and noticing that your take-home pay isnt exactly as much as you thought it would be.

Whats up with that? Upon further examining your paystub at your first job, youll notice a few line items categorized as deductions.Deductions are all of the things that were taken out of your gross pay, leaving you with your net pay, or take-home pay. While there are some deductions you cant really control, others are part of your employee benefits package, so you can adjust them according to what works for you and your budget.

Its OK to be a bit baffled on your first payday. Weve all been there before. To help clear up the confusion, we broke down typical paycheck deductions, where your earnings are going, and how much control you have over it.

Find The Federal Tax Brackets

IRS Publication 15 details various withholding procedures for employers and features tables delineating the percentage tax rate for employees based on their withholdings. Before consulting a percentage tax withholding table, determine the amount of gross pay to remove from the tax calculation.

A single worker with one allowance listed on the W-4 has $155.80 removed. If the worker earns $800, the $155.80 is subtracted and the new total of $644.20 is plugged into the IRS percentage method table. The table reveals the worker is taxed $35.90 plus an additional 15 percent of any earnings in excess of $447.

Recommended Reading: Have My Taxes Been Accepted

State By State Tax Comparison

Besides federal taxes on income, US citizens are also expected to pay various state taxeson property, sales, vehicles and yes, income again. At least one or two of these are just as inescapable as any other kind of tax, so don’t bother scouring a state tax chart to find out what states have no state tax whatsoever.

That said, a comparison of taxes by state can reveal, if not the best tax states, then at least which ones are better than others in specific areas of taxation. State tax in Florida, for example, does not include any state income tax. The same is true of various other states, including Alaska, Wyoming, South Dakota and Nevada. Of course, you’ll still have to pay federal income tax.

How Much Of Your Paycheck Goes To Taxes And Why

Its your first payday at a new job. You make $15 an hour, and you worked 80 hours over the past two weeks. Your paycheck hits your account, but you dont see $1,200 you see something closer to $950.

Thats because your employer deducted the taxes you owe the federal government. If you were a contractor or freelancer, you would have to calculate this amount and pay it yourself, but your companys payroll administrator does it for you as an employee.

Taxes are important. They fund essential public services and spaces like education, transportation, Medicare, Social Security, parks, and much more. Theyre not a bad thing it just sucks when people who make a lot of money dont have to pay nearly as much as you do in comparison. Instead of making $2,400 every four weeks, you earn about $1,900, so now you have to budget accordingly.

Several factors influence how much of your paycheck goes to taxes, though. Lets go over where your money goes and whether or not you could see it again.

Read Also: 1040paytax.com Official Site

Best Free Paycheck And Salary Calculators

If youve ever had a job before, you know that your gross pay is significantly more than your net pay, the number you deposit in your bank account. So, how can you figure out how much money you’ll take home when you get paid? What will you net after taxes and other deductions are taken out of your paycheck?

Tax On Pensions By State

Similarly, when people reach a certain age, they may want to know what states don’t tax pensions. If this sounds like you, you might be interested in comparing taxes by state for retirees. As with income tax, there actually are some pension tax-free states for retirees, while some others may provide credit for a portion. A tax credit is a dollar-for-dollar reduction in your tax bill.

New York is one example of a state offering a total exemption or partial credit for pension tax. Others include Alabama, Colorado, Georgia, Iowa and Wisconsin.

Retirees may also want to consider state estate taxes before choosing to relocate for favorable pension tax rates. While the federal exclusion amount was $11,180,000 in 2018, for instance, some states levied taxes on far less. The NY state tax department levies taxes on estates over $2,062,500, for example.

Read Also: Where Do I File My Illinois Tax Return

What Is Federal Income Tax Withholding

Every time you get a paycheck, your employer withholds, or sets aside, taxes based on the information you provided on your Form W-4 when you first started your job.

Your Form W-4, also known as your Employees Withholding Certificate, provides financial details that allow your employer to deduct the correct amount of federal income tax from your pay.

If not enough federal tax is withheld, youll owe the IRS money and may have to pay a penalty, depending on the size of the shortfall. If too much is deducted, youll be owed a tax refund.

When any big changes happen in your life you get married, have a child, or get a big raise, for example you will need to update and resubmit your W-4 to your employer so your paychecks can be adjusted accordingly.

The IRS recently redesigned Form W-4, and the changes could mean that your refund will be smaller than expected this year. Even if your financial situation stayed the same in 2019, H& R Block recommends that you review your W-4 to see how youve been affected.

Some of the changes to Form W-4 include the elimination of withholding allowances, one new blank for you to include income that doesnt come from jobs, and another that allows you to factor in likely deductions.

How Do I Sign Up For Direct Deposit

Many employers will put your paycheck into your bank or credit union account. This is called direct deposit. You do not have to pay fees to cash your check. You will get your money sooner.

Ask your employer if it has direct deposit. To sign up for direct deposit, give your employer information about your bank or credit union account.

Read Also: Can Home Improvement Be Tax Deductible

Canada Pension Plan Contributions

If you are 18 years old or older, but younger than 65, you are employed in pensionable employment, and you do not receive a CPP retirement or disability pension, your employer will deduct CPP contributions from your pay.

If you are at least 65 years of age but under 70 and you work while receiving a CPP or QPP retirement pension, your employer will continue to deduct CPP contributions from your pay, unless you elect to stop paying CPP contributions. You cannot elect to stop contributing to the CPP until you are at least 65 years of age. For more information, see Canada Pension Plan contributions for CPP working beneficiaries.

The CPP provides basic benefits when you, a contributor to the plan, become disabled or retires. In the event of your death, the plan provides benefits to your survivors.

Your employer will calculate how much CPP to deduct with approved calculation tools, using the annual CPP contribution rates and maximums.

Your employer remits these deductions to us, along with his or her share of contributions, through payroll remittances.

To get information on the CPP, go to Canada Pension Plan Overview.