Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual’s wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There’s no employer match for Additional Medicare Tax. For more information, see the Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

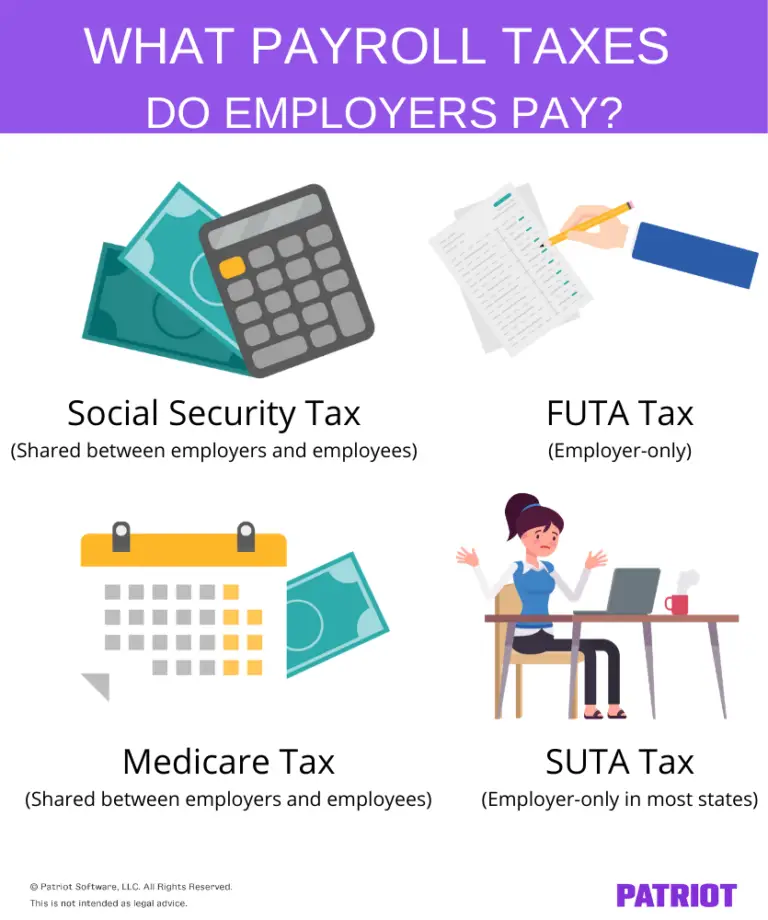

Does Your Employer Really Pay A Portion Of Your Payroll Taxes

Employers pick up part of the cost of your FICA taxes. But, of course, employers are aware of these costs when they hire workers and they account for their tax obligations when setting your salary.

So, while employers do technically pay payroll taxes, each employee indirectly pays these taxes because employers adjust wages to account for their obligations to the government when hiring.

Recommended Reading: Irs Forgot Ein

State And Local Taxes

Depending on the state you live in, you may have to pay state and/or local income taxes. There are currently seven states that do not impose a state income tax, including Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

Generally, state and local taxes are lower than federal income taxes and go toward the state government. Each state and local government has its own tax rates, which means the amount you pay can vary. Fortunately, the IRS allows taxpayers to claim a deduction on their federal tax return for the amount they paid in state income tax.

If you recall, Hectors bakery is located in the sunny state of California. California has one of the highest state income tax rates in the country. There are nine tax rates in California, starting at 1% and going up to 12.3%. Similar to calculating federal income taxes, taxpayers have to make adjustments to their gross income to get to their adjusted gross income. Adjustments are made by taking certain tax deductions and credits into consideration. You will then use your states tax rates to determine how much state income tax you owe.

Eight : Take Other Deductions

You’re not quite done yet with deductions. Here are some other possible deductions from employee pay you might need to calculate:

- Deductions for employee contributions to health plan coverage

- Deductions for 401 or other retirement plan contributions

- Deductions for contributions to internal company funds or charitable donations.

Remember, all deductions start with and are based on gross pay.

Read Also: Doordash Tax Forms

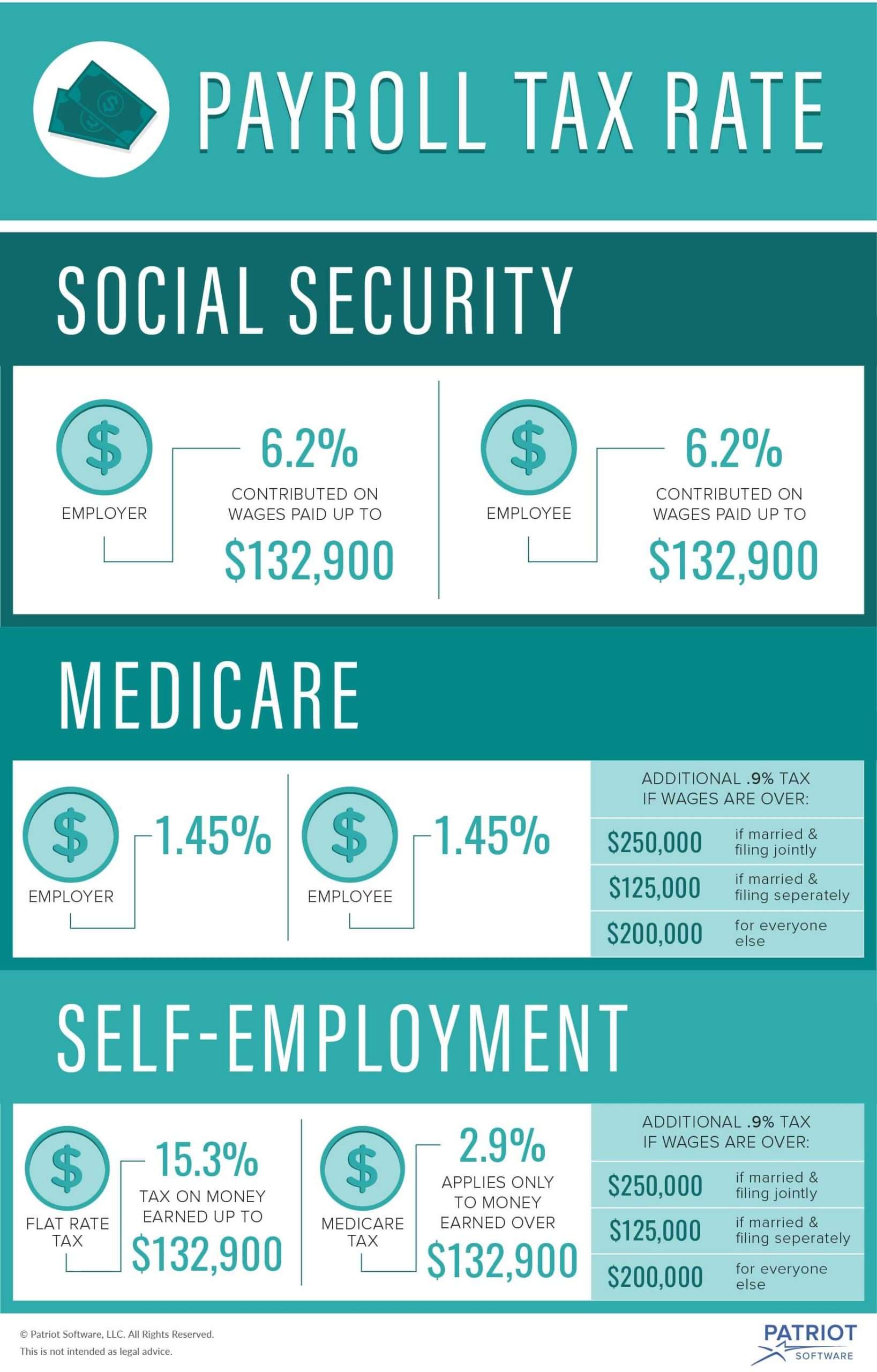

Generally Speaking What Are The Payroll Tax Rates

There are typically four types of taxes that youll notice on your pay stub: federal income tax, Social Security tax, Medicare tax, and a state income tax .

Both the IRS and state tax agencies publish annual tables to determine the amount of tax to be withheld from each paycheck depending on the employees gross wages, filing status, number of withholding allowances and pay frequency. Social Security and Medicare taxes put together are called FICA taxes and have specific rates and thresholds.

For 2020, the Social Security tax rate is 6.2% on the first $137,700 of wages paid. The Medicare tax rate is 1.45% on the first $200,000 of wages .

Simple Annual Overview Of Deductions On A $4000000 Salary

Lets start our review of the $40,000.00 Salary example with a simple overview of income tax deductions and other payroll deductions for 2022. The table below provides the total amounts that are due for Income Tax, Social Security and Medicare. We will look at each of these and a periodic split as we go through the salary example.

$40k Salary Tax Calculation – Salary Deductions in 2022| What? | |

|---|---|

| Salary After Tax and Deductions | $32,838.05 |

It is worth noting that you can print or email this $40,000.00 salary example for later reference. There is a lot of detailed information which is worth reading and using as a reference, particularly if you file your own tax return without using a tax return software provider and/or accountant.

Save this Salary Tax Calculation for later use

Also Check: Is Plasma Donation Income Taxable

Choose Your Calculation Method

Once youve gathered all the W-4 and payroll information you need to calculate withholding tax, you need to choose a calculation method. There are two methods you can choose from:

- The Wage Bracket Method: The wage bracket method of calculating withholding tax is the simpler of the two methods. Youll use the IRS income tax withholding tables to find each employees wage range. The instructions and tables can be found in IRS Publication 15-T.

- The Percentage Method: The percentage method is more complex and instructions are also included in IRS Publication 15-T. The instructions are different based on whether you use an automated payroll system or a manual payroll system. The worksheet walks you through the calculation, including determining the employees wage amount, accounting for tax credits, and calculating the final amount to withhold.

Does Everyone Pay Payroll Tax

In general, most employers and employees pay Social Security and Medicare taxes. Exemptions apply, however, for certain classes of nonimmigrant and nonresident aliens. Examples include nonimmigrant students, scholars, teachers, researchers and trainees , physicians, au pairs, summer camp workers, and other nonimmigrants temporarily present in the United States in F-1, J-1, M-1, Q-1 or Q-2 status.1

You May Like: How To Appeal Cook County Property Taxes

What Are Income Tax Withholding Tables

Federal withholding tables dictate how much money an employer should withhold from their employees wages. This includes federal income tax, Social Security and Medicare tax, and sometimes state income tax as well. A federal withholding tax table is usually in the form of a table or chart to simplify this process for employers. To determine the amount to withhold, you will need an employees W-4 information, filing status, and pay frequency. Every new employee at a business needs to fill out a W-4 for this purpose.

Form W-4, Employees Withholding Certificate, is a tax form issued by the IRS that all U.S. employees must complete. These are the components of 2020 or later Form W-4:

Why Do I Have To Pay Fica Tax

Employers have to withhold taxes from employee paychecks because taxes are a pay-as-you-go arrangement in the United States. When you earn money, the IRS wants its cut as soon as possible.

Some people are exempt workers, which means they elect not to have federal income tax withheld from their paychecks. Social Security and Medicare taxes will still come out of their checks, though.

Typically, you become exempt from withholding only if two things are true:

-

You got a refund of all your federal income tax withheld last year because you had no tax liability.

-

You expect the same thing to happen this year.

You May Like: H& r Block Early Access W2

Simple Annual Overview Of Deductions On A $400000 Salary

Lets start our review of the $4,000.00 Salary example with a simple overview of income tax deductions and other payroll deductions for 2022. The table below provides the total amounts that are due for Income Tax, Social Security and Medicare. We will look at each of these and a periodic split as we go through the salary example.

$4k Salary Tax Calculation – Salary Deductions in 2022| What? | |

|---|---|

| Salary After Tax and Deductions | $3,694.00 |

It is worth noting that you can print or email this $4,000.00 salary example for later reference. There is a lot of detailed information which is worth reading and using as a reference, particularly if you file your own tax return without using a tax return software provider and/or accountant.

Save this Salary Tax Calculation for later use

What’s New As Of January 1 2022

The major changes made to this guide since the last edition are outlined.

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2022. At the time of publishing, some of these proposed changes were not law. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2022.

For 2022, employers can use a Federal Basic Personal Amounts of $14,398 for all employees.

The federal income tax thresholds have been indexed for 2022.

The federal Canada Employment Amount has been indexed to $1,287 for 2022.

The Ontario income thresholds, personal amounts, surtax thresholds and tax reduction amounts have been indexed for 2022.

Also Check: Doordash Payable 1099

Who Has To Pay Futa Taxes

There are two ways to know if you have to pay the FUTA tax. It depends how much youre paying in employee wages during a given calendar year. Heres the exact wording from the IRS website:

- You paid wages of $1,500 or more to employees in any calendar quarter during 2019 or 2020, or

- You had one or more employees for at least some part of a day in any 20 or more different weeks in 2019 or 20 or more different weeks in 2020. Count all full-time, part-time, and temporary employees.

Best Practices For Filing Payroll And Income Taxes

Whether you manage it yourself, have a staff member to help or outsource the task, it’s important to put enough resources into tax compliance to do it right. Errors in determining the amount owed, or delays in making payments or filing returns, could lead to fines and other financial penalties that your business can’t afford. Small-business owners can ensure that their business expenses remain manageable and their taxes are paid on time with these best practices:

Don’t Miss: Www 1040paytax

What Is Income Tax

Income tax is money taken from an employee’s wages. The federal government, most state governments and some local governments collect income taxes to fund their programs. The Internal Revenue Service sets the laws and rules for how federal income tax is calculated and collected. Each employee pays a different amount of income tax depending on their personal elections and wages earned. As a business, you don’t actually pay this tax for your employees, but you are required to withhold it from their pay and remit it to the IRS or the applicable state or local tax authorities.

This government database lists the state and local governments that currently collect income taxes.

Staying On Top Of Payroll Taxes

Payroll tax deductions can change depending on an employeeâs personal circumstances, such as marital status, and on the amount of money theyâve earned in a period. And because income tax rates change with earnings, you canât easily use spreadsheet formulas to figure out what they owe from pay run to pay run.

For that reason, small businesses with several employees often use payroll software to do the math. As a bonus, these types of systems also auto-fill tax returns and allow you to file online.

Whatever system you use, make sure you update employee payroll records regularly. Your employees are supposed to tell you about important changes that affect their deductions, but they may not remember to. Ask them if anything on their W-4 has changed on a yearly basis.

Read Also: Www.efstatus.taxact.com

Which Provincial Or Territorial Tax Table Should You Use

Before you decide which tax table to use, you have to determine your employee’s province or territory of employment. This depends on whether or not you require the employee to report for work at your place of business.

If the employee reports for work at your place of business, the province or territory of employment is considered to be the province or territory where your business is located.

To withhold payroll deductions, use the tax table for that province or territory of employment.

If you do not require the employee to report for work at your place of business, the province or territory of employment is the province or territory in which your business is located and from which you pay your employee’s salary.

For more information and examples, see Chapter 1, “General Information” in Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

If you ended up with a huge tax bill this year and dont want another, you can use Form W-4 to increase your tax withholding. Thatll help you owe less next year.

If you got a huge tax refund, consider using Form W-4 to reduce your tax withholding. Youre giving the government a free loan and even worse you might be needlessly living on less of your paycheck all year. It may feel great to get a tax refund from the IRS, but think of how life mightve been last year if youd had that extra money when you needed it for groceries, overdue bills, getting the car fixed, paying off a credit card or investing.

You May Like: Can Home Improvement Be Tax Deductible

What Is The Difference Between Payroll Tax And Income Tax

Payroll taxes have flat rates and are sent directly to the program for which they are intended, e.g., Medicare, Social Security, etc. Income taxes, on the other hand, have progressive rates that vary with total income and go to the U.S. Department of the Treasury, where they may be used to fund various government initiatives. In addition, some payroll taxes have a wage base limit, after which the tax is no longer deducted from the employees wages for the remainder of the year. Income taxes have no such cap.

Get 3 months free* when you sign up for payroll processing today.

* See the Terms & Conditions

Adjust Gross Pay For Social Security Wages

Now that you have gross wages, take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

IRS Publication 15 has a complete list of payments to employees and whether they are included in Social Security wages or subject to federal income tax withholding.

To calculate Federal Income Tax withholding you will need:

- The employee’s adjusted gross pay for the pay period

- The employee’s W-4 form, and

- A copy of the tax tables from the IRS in Publication 15: Employer’s Tax Guide). Make sure you have the table for the correct year.

Starting January 1, 2020, use the new IRS Publication 15-T that includes the tax tables for the new W-4 form. It also includes tables for the old W-4 form for employees who haven’t changed their withholding since January 1, 2020.

Also Check: Efstatus Taxactcom

What Is A Marginal Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.

For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $41,000 of taxable income, however, most of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

You May Like: Efstatus.taxactcom