What Is A Tax Identification Number / Tin

A tax or taxpayer identification number, also known as a TIN for short, is a number issued to individuals and organizations to track tax obligations and payments they make to the Internal Revenue Service . It is issued by the federal government. A TIN can be assigned by the Social Security Administration for individuals, or by the IRS for businesses and other organizations.

Ein Lookup: Finding Your Ein Is Simple And Easy

How do I find my EIN number?! Its so hard!

It can be frustrating to attempt to open a new business account or apply for financing, be asked for your EIN, and proceed to find out that youve lost it and all relevant paperwork with your EIN or Tax ID number on it .

However, there are several simple and easy ways to obtain your EIN even if you dont have a single tax return or your confirmation letter.

If you cant find your EIN or Tax ID number, look around for your confirmation letter, and if you cant find it, look through your relevant tax and business documents. If that doesnt work, simply give the IRS a call and provide the necessary information.

No matter what, obtaining your EIN should be easy. So, if youve lost it, and not having it is holding you back from moving forward with something important, dont sweat it.

Apply For A Fein Online By Phone Or Through The Mail

If you are required to have a FEIN, there are several ways you can apply for one:

- You can find Form SS-4 here and locate the fax number and mailing addresses for your location on the IRS website.

- On the IRS website: You can file Form SS-4 online or participate in an interview-style live chat that will ask you questions and issue you a FEIN if you require one. This service is available Monday through Friday, 7 a.m. to 10 p.m. EST.

Regardless of the method you choose, it will take two weeks for your number to be active in the IRS system.

Even if your business is not required to have a FEIN, you may decide that its worth applying for one anyway. There is no charge to do so, and you never know when you may decide that its time to hire an employee or when your business circumstances might change.

You May Like: Where To Mail Federal Tax Return 2021

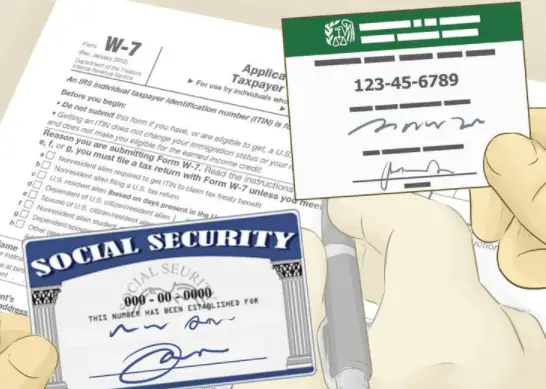

Foreign Nationals: Individual Taxpayer Identification Number

For those who do not have a Social Security Number — such as nonresidents and resident aliens — they may need to apply for an individual taxpayer identification number , which is also nine digits. To apply, you’ll need to file Form W-7: IRS Application for Individual Taxpayer Identification Number. You will be asked to provide proof of your legal resident or visitor status and will have to file it through an “Acceptance Agent” authorized by the IRS.

Information Required For Obtaining A Tax Id

You must provide the following information while applying for a tax ID:

- Your business address

- Complete name of the owner, manager, and principal officer

- In case of an LLC, total number of members

- Primary activities your business is involved in

- The date of commencement of business

- The accounting year that your business follows

- An estimated number of employees you’d be hiring next year

- Details of any previous EIN that you hold

- Your telephone and fax number

You May Like: How Are Lump Sum Pensions Taxed

Crown Dependencies And Overseas Territories

For Gibraltar the identifier to be reported for individuals is a social security number.

For Guernsey the identifier to be reported for individuals is a social security number.

For the Isle of Man the identifier to be reported for individuals is a national insurance number.

For Jersey the identifier to be reported for individuals is a social security number.

If All Else Fails For An Ein Lookup Call The Irs

If none of the above search methods work for you, calling the IRS is another simple and straightforward option.

The IRS Business & Specialty Tax Line is accessible at 1-800-829-4933 from 7:00 A.M. to 7:00 P.M. Monday through Friday.

Simply call the number and tell the representative you need your EIN. For this method to work, you need to have access to certain sensitive identification information, however, if youve got that then its a pretty painless process aside from the typically long wait times.

Keep in mind that to obtain your EIN over the phone you must be able to prove that youre a qualified person including:

- The sole proprietor in a sole proprietorship

- Partner in a partnership

- Corporate officer

Once youve answered their security questions, theyll be able to provide your business EIN.

You May Like: When Does My Tax Return Come

What If Im Not Sure I Need A Fein

If youre not sure you need a FEIN, you can consult the Internal Revenue Services website. According to Melvin Springer, a New York-based financial executive, a good rule of thumb is that if you record them on your personal tax return, you are not required to have one, as you can use your Social Security number. If you intend to report them on a business tax return, you will be required to have a FEIN.

If this is confusing to you, you can hire a online payroll service to help with processing and reporting payroll-related taxes.

Credit For Other Dependents

A $500 non-refundable credit is available for families with qualifying relatives. This includes children over 17 and children with an ITIN who otherwise qualify for the CTC. Additionally, qualifying relatives who are considered a dependent for tax purposes , can be claimed for this credit. Since this credit is non-refundable, it can only help reduce taxes owed. If you are eligible for both this credit and the CTC, this will be applied first to lower your taxable income.

Read Also: How Much Is Capital Gains Tax On Stocks

Reportable Information: Tax Identification Number

The taxpayer identification number is the unique identifier assigned to the Account Holder by the tax administration in the Account Holders jurisdiction of tax residence. It is a unique combination of letters and/or numbers used to identify an individual or entity for the purposes of administering the tax laws of that jurisdiction.

Any identifier assigned by a jurisdiction of source, for example, for identifying a person whose income has been subject to withholding tax at source, should not be reported.

Some jurisdictions do not issue a TIN and where that is the case there will be nothing to report unless they use other high integrity numbers with an equivalent level of identification. For individuals these include:

- Social security number

- Citizen or personal identification code or number

- Resident registration number

For entities, jurisdictions may use a business/company registration code or number where no TIN has been issued.

Some jurisdictions that issue TINs have domestic law that does not require the collection of the TIN for domestic reporting purposes, Australia for example. In such cases the Reporting Financial Institution is not required to collect the TIN for those jurisdictions.

Information on the structure and form of TINs used by tax administrations, including those where domestic collection of the TIN is not required, has been published on the OECD website.

The TIN, or TIN equivalent, must be reported for all new accounts where issued.

Preparer Tax Identification Number

What it is: A PTIN is a Preparer Tax Identification Number. The IRS requires anyone who prepares or assists in preparing federal tax returns for compensation to have a PTIN. Tax preparers must put their PTIN numbers on clients tax returns.

How to get a PTIN: Preparers can get PTINs from the IRS online in about 15 minutes. Alternatively, they can fill out and mail IRS Form W-12. That method takes about four to six weeks.

Note:

Don’t Miss: Where Can I Get An Income Tax Loan

When To Apply For A New Ein

Your EIN or Tax ID number will stay with your business for the life of the company.

However, if certain changes are undergone a new EIN needs to be issued. So, if youre moving forward with any of the below changes to your business, keep in mind that your old EIN is not going to work and youll need to apply for a new one:

- Ownership has changed

- You were a sole proprietor when you received your EIN and have since incorporated

- Youre a sole proprietor and youve recently established a retirement or profit-sharing plan

- You purchase a pre-existing business

- Your business becomes a subsidiary

For more information and a complete list of cases where your business will need to obtain a new EIN, see irs.gov/pub/irs-pdf/p1635.

One common case where you would not need to apply for a new EIN is in the case of a business ceasing operation and then picking up shop again later. If youre picking up operations again after a hiatus, your EIN is still relevant.

Does My Business Need To Reapply For A New Ein

Sometimes, your business may need to reapply for a new EIN. The IRS requires you to reapply for one rather than amending your business’s existing EIN. According to the IRS, here are the most common reasons:

- You change the structure of your business, like incorporating or turning your sole proprietorship into a partnership.

- You purchase or inherit an existing business.

- You created a trust with funds from an estate.

- You are subject to a bankruptcy proceeding.

If your circumstances require you to reapply for an EIN, the application process is the same as if youre applying for one for the first time.

Read Also: How To Find Delinquent Property Tax List

What Is A Tax Identification Number

A Tax Identification Number is a nine-digit number used as a tracking number by the Internal Revenue Service . It is required information on all tax returns filed with the IRS. All U.S. tax identification numbers or tax I.D. numbers are issued directly by the IRS except Social Security numbers , which are issued by the Social Security Administration . Foreign tax identifying numbers are also not issued by the IRS rather, they are issued by the country in which the non-U.S. taxpayer pays taxes.

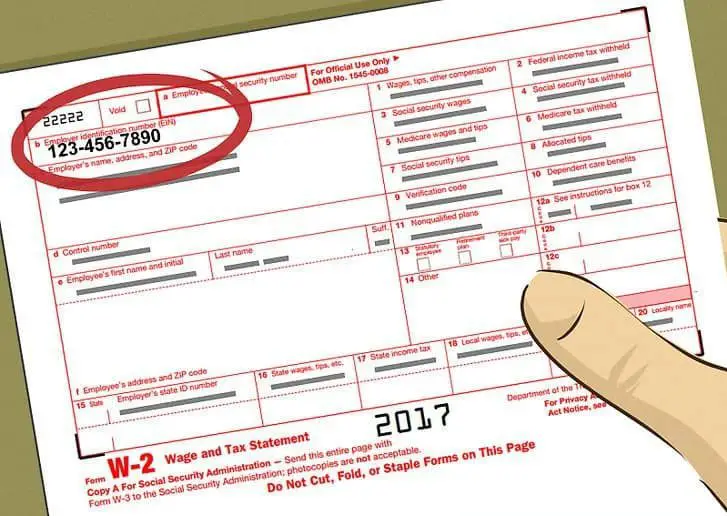

Option : Check Other Places Your Ein Could Be Recorded

If you’ve misplaced your EIN confirmation letter, then you’ll need to get a little more creative to find your business tax ID number. Fortunately, once you get an EIN, your tax ID typically won’t change for the entire lifespan of your business. That makes locating the EIN easier.

These are some additional places where you can locate your EIN:

1. Old federal tax returns

2. Official tax notices from the IRS

3. Business licenses and permits and relevant applications

4. Business bank account statements or online account profile

5. Old business loan applications

6. Your business credit report

7. Payroll paperwork

Note that your EIN generally will not appear on business formation paperwork, such as articles of incorporation, articles of organization, or a fictitious business name document. These documents establish your business’s legal setup but don’t contain your business’s tax ID number.

Also Check: Can I File My Taxes For Free

What Is An Itin Used For

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

An ITIN does not:

- Provide eligibility for Social Security benefits

- Qualify a dependent for Earned Income Tax Credit Purposes

What Is The Difference Between A Tax Id Number And A Corporate Number

The term taxpayer identification number refers to five different types of numbers used to identify taxpayers:

- Social Security numbers

- Taxpayer identification numbers for pending U.S. adoptions

- Preparer tax identification numbers

For businesses, EINs are the most relevant tax ID numbers. These help the government track business taxation at the federal level. Sole proprietorships and single-member LLCs may use Social Security numbers as their businesss tax ID number.

The terms corporate number and EIN can be used interchangeably. The official term used by the IRS and other government entities is employer identification number or federal tax identification number.

Tax ID numbers are used for federal taxation and apply to both individuals and businesses, whereas corporate numbers and EINs apply solely to businesses.

Key takeaway: There are five different kinds of tax identification numbers, including employer identification numbers. Corporate numbers and EINs are considered the same.

Also Check: Where Do I Pay Property Taxes

What Is A Tax Id Number And When Is It Needed

Sandy Ahluwalia

What is a Tax ID number?

A Tax ID or Taxpayer Identification Number , is a number used for tax purposes in the United States . It can be an Employer Identification number a social security number or a business number.

When is a Tax ID required?

A tax id is required when importing goods into the United States that require a formal entry.

When does a shipment require a formal entry?

As of the time of writing, when importing a shipment into the the US, a formal entry is normally required for commercial products valued at over $2,500 USD. According to the US customs and border protection , good are usually cleared informally when the shipment is for personal use, valued under $2,500 USD , and are not in commercial quantities.

For more information, please visit:

What Is My Tin Finding Out Your Own Tax Number

The IRS have to process huge amounts of data from millions of different US citizens. Organizing this is a real challenge, not only because of the sheer volume of data to be processed, but also because identifying people can be quite tricky without the right system. For example, according to the Whitepages name William Smith has over 1,000 entries in the State of Alabama alone. Across the USA this number increases, and the likelihood is that some of these individuals will have the same date of birth, for example, which is often used to identify people. This means that there needs to be another system for keeping track of individuals for tax purposes in the US other than just their names: A taxpayer identification number serves this purpose.

A Taxpayer Identification Number is often abbreviated to TIN and is used by the Internal Revenue Service to identify individuals efficiently. Where you get your TIN, how it is structured, and whether a TIN is the right form of identification for your purposes sometimes seems like it isnt as straightforward as it should be. However, this guide will look at exactly these issues which should show that finding out this information can be as easy as 1,2,3. In this article, we want to concentrate on the tax number that you as an employee will need for your income tax return or the number that you as an employer require for invoicing, and well explain exactly where you can get these numbers.

Contents

Recommended Reading: Who Qualifies For California Earned Income Tax Credit

Ein Lookup: How To Find A Business Tax Id

An employer identification number is like a Social Security number for a business. The IRS assigns an EIN also known as a federal tax ID number to any business that is eligible. EINs aren’t always necessary, but we’ll walk you through why having one can benefit your business and how to do an EIN lookup when you cant find yours.

Why Do I Need A Sales Tax Permit

You can read more about how sales tax works here, but in general terms & depending on what you sell, getting a sales tax permit with your state is a requirement for doing business. Anytime you make a sale to a customer in your same state, you should be collecting sales tax. You then periodically remit this money to your state and/or local government.

Fortunately, being known to your state government has also got its perks. If you purchase business goods or supplies from a wholesale seller, you can usually provide your sales tax ID , and you dont have to pay sales taxes on your purchase. If you want to attend a trade show or shop at certain wholesale supply websites online, you might be asked for your sales tax ID number or to show your sales tax permit.

Your sales tax ID number can sometimes be referred to as your resale or reseller number. I live in Texas and have used my sales tax ID number from my sales tax permit for every craft show Ive sold at, every trade show Ive purchased supplies at, and every wholesale website Ive purchased from for my business. However, another state-by-state caveat some states issue separate wholesale account numbers that you might use in similar situations instead.

Don’t Miss: How To File Joint Taxes For The First Time

Adoption Taxpayer Identification Number

What it is: An Adoption Taxpayer Identification Number, or ATIN, is a temporary, nine-digit tax ID number the IRS gives to people who are in the process of adopting a child. The IRS provides the number if the adopting parents cannot get a Social Security number for the child in time to file their tax return. The number identifies the child, not the parent, and is needed for the parent to claim the child as a dependent.

How to get an ATIN: To get an ATIN, file IRS Form W-7A. Youll need to attach a copy of the placement documentation. The child must be legally placed in your home for adoption. If youre adopting a child from another country, you can still get an ATIN, but there are more rules .

Note:

-

You cannot claim the earned income tax credit with this tax ID number .

-

It takes four to eight weeks to get an ATIN once the IRS gets your Form W-7A, so ask for it well before your tax return is due.

-

Unless you notify the IRS that the adoption is still pending, the IRS will automatically deactivate an ATIN after two years.