How To File Your Connecticut State Tax

You can e-file your state tax return for free through the Taxpayer Service Center, or via paid or free tax software programs.

If youd prefer to file a paper return, you can and print your tax forms including Form CT-1040 from the DRS website and fill them out with a pen. Mail your CT-1040 return to:

If you expect a refund:

Department of Revenue Services

The Case For A Meals Tax Cut

That leaves us with the meals tax, which Connecticut can afford to drop. In fact, Gov. Ned Lamont is leaning toward asking the legislature to revisit that meals surcharge, he told me in an interview Friday.

Enacted to fill a $1.5 billion budget gap Lamont inherited in 2019, the surcharge brings the total sales tax on restaurant meals and prepared foods in grocery stores to 7.35 percent. It raises about $70 million a year.

If were in solid financial position next year as we were this year, well be free to do other things, Lamont said in West Hartford. Speaking of the 1 percentage point surcharge, he said, That will be something I will probably put on the table.

It makes more sense to cut that one, more than cutting the truck taxes, because its a direct tax on consumers, like the income and sales taxes, but the cut is sustainable.

Republicans say the last one-third of 1 percent of the sales tax and the 1 percent restaurant and prepared foods surcharge hurt the middle class badly. Thats not wrong but cutting these taxes would only bring so much help to most families.

Youd have to spend $10,000 on restaurants and prepared foods $27 a day, every day of the year to save $100. To save $100 on a sales tax cut from 6.35 percent to 5.99 percent, youd have to spend $27,777 on taxable goods and services.

How Do You Pay Ct State Income Tax

You can pay Connecticut state income tax online, at the following portal:

If you choose to paper file your return, make your check or money order payable to: Commissioner of Revenue Services. Please write the tax year and form name in the memo. You can send the Connecticut state tax form and payment to the following addresses, based on the form you completed and if a payment is due.

Don’t Miss: Did They Extend The Tax Deadline

More Help With Taxes In Connecticut

Understanding your tax obligation is important. Whats even more important is how to deduct Connecticut tax from your federal taxes as an itemized deduction.

So, get help with H& R Block Virtual! With this service, well match you with a tax pro with Connecticut tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your CT taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find Connecticut state tax expertise with all of our ways to file taxes.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Overview Of Connecticut Taxes

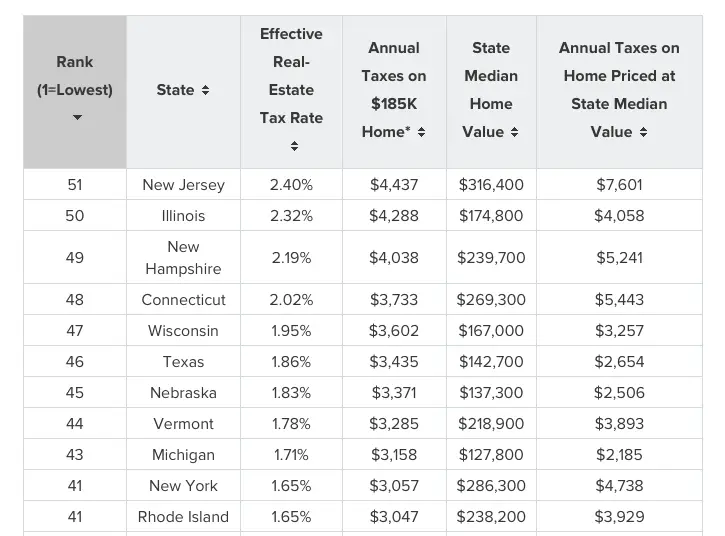

Connecticut has above average state income and sales taxes, and property taxes are likewise on the high side. But there are no extra income taxes or sales taxes at the local level in the state.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Recommended Reading: What Happens If You Cannot Pay Your Taxes

What Is The Estate Tax

The estate tax is a tax applied to an estate after a person dies but before the persons money gets passed on to heirs. It is sometimes called the death tax. Only estates that reach a certain threshold are subject to the estate tax.

The estate tax is not the same as the inheritance tax, which is levied after the estate is dispersed to a persons beneficiaries. While the estate tax is taken out of the estate, the beneficiaries are responsible for paying the inheritance tax.

Car Sales Tax On Private Sales In Connecticut

You will have to pay sales tax on private vehicle sales of a 1991 or newer passenger car or light duty truck in Connecticut.

On private vehicle sales of under $50,000, the state sales tax is 6.35%.

If you purchase a vehicle, in a private sale for more than $50,000, then the state sales tax is 7.75%.

Don’t Miss: What School District Am I In For Taxes

The Basics Of Connecticut State Tax

Whether you file on your own or have someone else prepare your state tax return, its important to know about deadlines, credits, tax rates and more.

If you are a resident of Connecticut for all or part of the tax year, you may be required to file a state income tax return depending on how much income you earn and if certain conditions apply to you. Part-year residents may also be required to file if they meet certain conditions.

Connecticut State Tax Liability For Resident And Non

In any calendar year, you could have a different status for immigration, federal income tax purposes, and state income tax purposes.

You are a resident for the current taxable year if:

- Connecticut was your domicile for the entire taxable year or

- You maintained a permanent place of abode in Connecticut during the entire taxable year and spent a total of more than 183 days in Connecticut during the taxable year.

Nonresident aliens who meet either of these conditions are considered Connecticut residents even if federal Form 1040NR-EZ or federal Form 1040NR is filed for federal income tax purposes.

You must file a Connecticut state income tax return if any of the following is true.

- You had CT income tax withheld, or

- you had made estimated tax payments to CT, or

- you had a federal alternative minimum tax liability, or

- you meet the Gross Income Test for 2016, if your gross income exceeds

- $12,000 and you file as married filing separately, or

- $15,000 and you file as single, or

- $19,000 and you file as head of household, or

- $24,000 and you file as married filing jointly

If none of the above apply, do not file a CT state income tax return for the current year. Gross income includes income from sources within Connecticut and outside of Connecticut.

Gross income includes, but is not limited to:

You May Like: What Form Do I Need To File My Taxes Late

Tax Policy In Connecticut

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in Connecticut |

| Total state expenditures State debt Connecticut state budget and finances |

Connecticut generates the bulk of its tax revenue by levying a personal income tax and a sales tax.

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Connecticut Estate And Inheritance Taxes

Connecticut has an estate tax with a $9.1 million exemption for 2022 . The tax due is limited to $15 million.

Connecticut is the only state with a gift tax on assets you give away while you’re alive. If you made taxable gifts during the year, state law requires that you file a Connecticut estate and gift tax return to identify such gifts. However, taxes are due in 2022 only when the aggregate value of gifts made since 2005 exceeds $9.1 million .

Estate and gift tax rates for 2022 are either 11.6% or 12% .

Read Also: Where To Mail California Tax Return

Connecticut Tax Id Number Application

Home » Apply Online » Connecticut Tax ID Number Application

Looking to obtain your Tax ID Number in Connecticut? This short Connecticut Tax ID Application Guide will walk you through the basic steps you need to follow to apply for your Tax ID Number in the state of Connecticut. Whether you own a Partnership, multi-member LLC, Corporation, Non-Profit, or Estate, this guide will help you learn what you need to know to obtain your official within minutes.

Connecticut Tax Brackets 2022

Looking at the tax rate and tax brackets shown in the tables above for Connecticut, we can see that Connecticut collects individual income taxes differently for Single versus filing statuses, for example. We can also see the progressive nature of Connecticut state income tax rates from the lowest CT tax rate bracket of 3% to the highest CT tax rate bracket of 6.99%.

For single taxpayers living and working in the state of Connecticut:

- Tax rate of 3% on the first $10,000 of taxable income.

- Tax rate of 5% on taxable income between $10,001 and $50,000.

- Tax rate of 5.5% on taxable income between $50,001 and $100,000.

- Tax rate of 6% on taxable income between $100,001 and $200,000.

- Tax rate of 6.5% on taxable income between $200,001 and $250,000.

- Tax rate of 6.9% on taxable income between $250,001 and $500,000.

- Tax rate of 6.99% on taxable income over $500,000.

For married taxpayers living and working in the state of Connecticut:

- Tax rate of 3% on the first $20,000 of taxable income.

- Tax rate of 5% on taxable income between $20,001 and $100,000.

- Tax rate of 5.5% on taxable income between $100,001 and $200,000.

- Tax rate of 6% on taxable income between $200,001 and $400,000.

- Tax rate of 6.5% on taxable income between $400,001 and $500,000.

- Tax rate of 6.9% on taxable income between $500,001 and $1,000,000.

- Tax rate of 6.99% on taxable income over $1,000,000.

You May Like: Does Contributing To Roth Ira Reduce Taxes

Are Ct Taxes High

Connecticut Thats the third-highest in the U.S. However, residents in high-income areas such as Fairfield County typically pay more than $10,000 in property taxes each year. State income taxes on are the high end, too. Connecticut income taxes for our make-believe middle-class are above average, but not sky high.

Who Pays Ct Income Tax

Just like the federal level, states impose additional income taxes on your earnings if you have a sufficient connection to the state. An example would be if you are a resident of the state or you work within the state.

So, if you earn an income connected to CT, you must pay CT income tax. As a traditional W-2 employee, your CT taxes will be drawn on each payroll period automatically. You will see this on your paycheck stub, near or next to the federal taxes.

If you work remotely, you should pay taxes to the state in which the work is performed. Employers will generally also pay taxes on wages paid to these workers to the same state, even if the employer has no physical presence in that state. However, some states may require that workers be taxed based on their employers location. These rules may change if you are working from home due to COVID.

Recommended Reading: Why Do I Have To Pay Taxes This Year

The Connecticut Income Tax

Connecticut collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Like the Federal Income Tax, Connecticut’s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Connecticut’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below Connecticut’s %. You can learn more about how the Connecticut income tax compares to other states’ income taxes by visiting our map of income taxes by state.

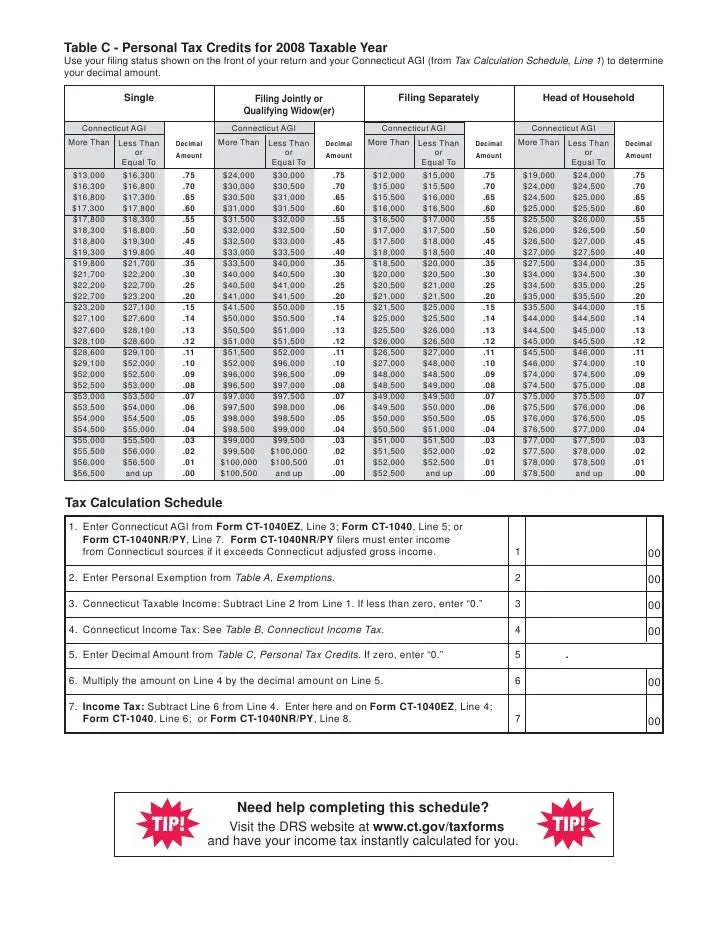

Connecticut’s personal exemption incorporates a standard deduction, and is phased out for households earning over $71,000. An additional state tax credit, ranging from 75% to 0% of taxable income, is available based on your adjusted gross income.

There are -869 days left until Tax Day, on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 – you can start your online tax return today for free with TurboTax .

Connecticut State Tax Payments

Connecticut has many income tax payment options. Find the option that works best for you below.

Due by April 18, 2022

Connecticut Department of Revenue Contact Information:Phone: -297-5962Phone: -382-9463 Online: Connecticut Department of Revenue ServicesEmail: [email protected]Connecticut Contact Form

Recommended Reading: Does Washington Have Income Tax

How To Calculate Connecticut Sales Tax On A Car

To calculate the sales tax on your vehicle, find the total sales tax fee for the city. The minimum is 6.35%. Multiply the vehicle price by the sales tax fee.

For example, imagine you are purchasing a vehicle for $35,000 with the state sales tax of 6.35%. The trade-in value of your vehicle is $5,000 and you have a $1,000 incentive. The total taxable amount is $30,000 since trade-ins are not taxable, but incentives/rebates are.

In this example, multiply $30,000 by 0.0635 to get $1,905, which makes the total purchase price, $30,905 .

But let’s say the vehicle sales price was $65,000. In this example, you would still subtract the trade-in value , but you would multiply by .0775 instead of .0635.

Income Tax Filing With Other States

If you earned income in another state had a paid summer internship in NY or if you transferred from another U.S. institution in another state to Yale in the tax year), you may need to file an income tax return for the state in which you earned income. Each state has its own income tax regulations, forms, and definitions of tax status, so be sure to do your research. You will need to refer to the information from that particular state’s Department of Revenue.

This information is intended only for international students and scholars with income sources and level typical of students and scholars at Yale University. Although the information contained in this site has been reviewed carefully and should be adequate to assist most international students and scholars, it is not a substitute for advice obtained from the Internal Revenue Service or a qualified tax accountant. If your visa status has changed in the past year, or you believe you have a complicated tax issue, please consult the IRS or a qualified tax accountant.

In addition, while the tax preparation software Sprintax is being provided to help you with your tax filing obligations, you are individually responsible for verifying that the correct information has been entered into the tax preparation software and included on all forms and/or other documents printed or derived from the tax preparation software, and ultimately responsible for any errors or omissions.

Also Check: How To Do Llc Taxes Yourself

Can I File Without A Ssn/itin

If you do not have a social security and have not received your ITIN by April 15, you can file your return without the ITIN by attaching a copy of the federal Form W-7. The CT Department of Revenue Services will contact you upon receipt of your return. DRS will hold your return until you receive your ITIN and forward the information to them. If you fail to submit the information requested, the processing of your return will be delayed. Please refer to the CT Department of Revenue Services page for more information on this topic.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Read Also: How To File Joint Taxes For The First Time