How To Mail Tax Return

How to mail a tax return? If youre filing a paper tax return despite the IRS suggesting that you file electronically, a paper Form 1040 must be mailed to IRS.

Before you get to mail your tax return, make sure to go over your tax forms and schedules once again. If there are any missing forms or schedules or information found on these documents, you will need to mail to the IRS again to make corrections. Since you would want to file a tax return only once, these are quite important.

As for how to prepare your tax return before mailing, here are the things you should do:

- Review your documents to see there isnt any missing or false information.

- Look at the forms and schedules you need to file your tax return with and make sure everything is attached to your tax return.

- You can staple forms and schedules in on the upper right or left corner of Form 1040. Sort your forms and schedules orderly so the IRS workers have an easier time processing your tax return.

You shouldnt have a hard time with your tax return later on once everything above is correctly done. Then, you can mail your tax return to the IRS.

The Internal Revenue Service has multiple mailing addresses depending on your state of residence and whether or not youre paying the IRS.

Here is where to mail Form 1040.

If you owe taxes and pay the IRS, mail it to :

| State |

|---|

Sales And Use Tax And Special Taxes And Fees

California Department of Tax and Fee AdministrationPO Box 942879

- TDD service from TDD phones: 1-800-735-2929

- TDD service from voice phones: 1-800-735-2922

- Faxback: Call the Information Center: 1-800-400-7115

- Sellers permit number verification: 1-888-225-5263

Representatives are available to assist you Monday through Friday, except State holidays, from 8 a.m. to 5 p.m.

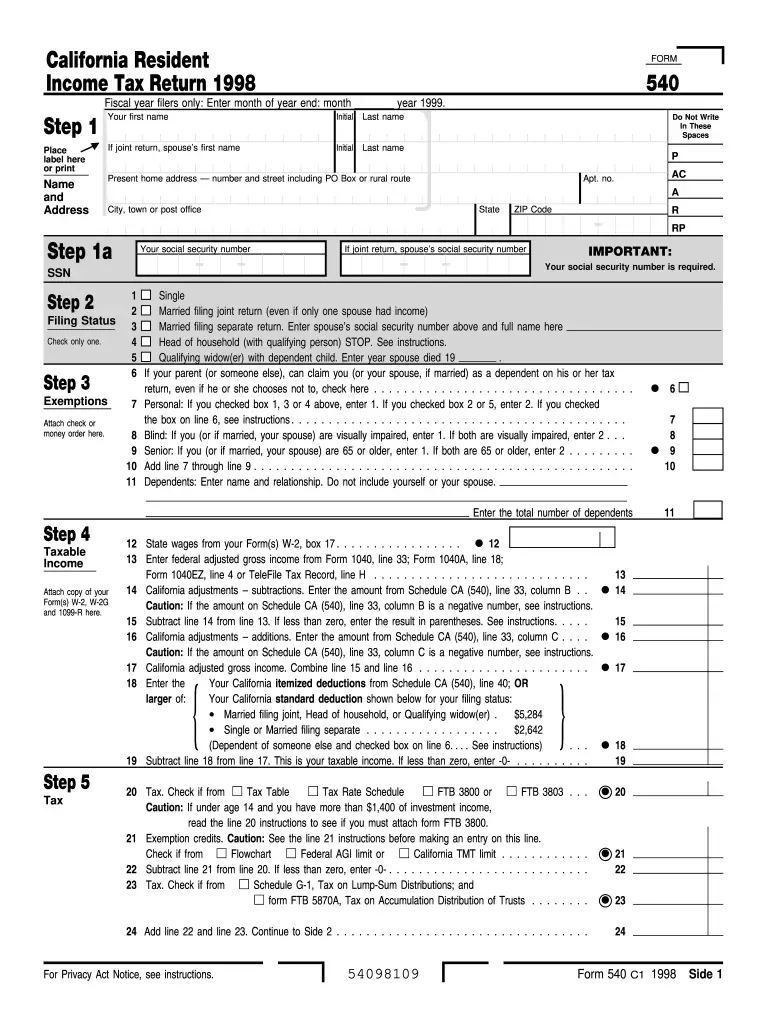

Are You A Nonresident Or Part

If you work in California but are a resident in another state, or only a part-time resident in California, you will need to double-check to make sure your California taxable income on line 35 of Form 540NR is the correct amount. It needs to be accurately transferred from line 5, Part IV of Schedule CA.

Also Check: How Do I Get My Pin For My Taxes

Business Return General Information

Due Dates for California Business Returns

Corporations – April 15, or same as IRS

S-Corporations – March 15, or same as IRS

Partnerships – March 15, or same as IRS

Fiduciary & Estate – April 15, or same as IRS

Business Extensions

Corporations – The extension period for filing a C corporation tax return has changed from seven months to six months.

If the corporation cannot file its California tax return by the 15th day of the 4th month after the close of the taxable year, it may file on or before the 15th day of the 10th month without filing a written request for an extension unless the corporation is suspended on or after the original due date. An automatic 6-month extension will be granted.

An automatic extension does not extend the time for payment of tax the full amount of tax must be paid by the original due date of Form 100. If there is an unpaid tax liability, complete form FTB 3539, Payment for Automatic Extension for Corporations and Exempt Organizations. To access Form FTB 3539 in the program, from the main menu of the California return select Heading Information > Additional Information > File CA Extension . Form FTB 3539 cannot be electronically filed. Mail Form FTB 3539 to the appropriate mailing address. .

Amended Business Returns

If there is a balance due on the amended return, Form FTB 3586, Payment Voucher for Corporations and Exempt Organizations must be mailed to the appropriate mailing address .

How Do I File An Extension On Form 540

If you want to file a tax extension for California tax Form 540, you can recieve an automatic 6 month extension to send in your return. Its important to remember that this does not mean you have an extension on paying your taxesthose must be paid in full by the standard due date of April 15th if you want to avoid interest and penalties. If you fail to turn in Form 540 by October 15th, unfiled tax returns will likely be penalized with a fee.

Read Also: Doordash Mileage Calculator

Be Sure To File Properly

When you ask the question, “where do I mail my California tax return,” keep in mind that you also need to send in all of the proper paperwork and you must have it post marked by April 15 at the latest.

- Ensure the right tax form for your particular situation is complete and signed by all parties listed on the form.

- Mail payment with your tax form if you owe money to the state. This payment can be sent in either a check or money order that is made payable to the Franchise Tax Board.

- Enter your social security number or the California business’s tax identification number on the check or money order. Also, include the tax year on the money order or the check.

- For business tax returns, ensure the business’s full legal name is clearly marked, including its legal address.

How To File Your California State Tax Return

You have multiple options for tax preparation, filing and paying your California state income tax.

- E-file and pay for free with CalFile through the Franchise Tax Boards website. Youll need to create an account.

- File for free through an online tax-filing service like ®. But if your filing status is married filing separately, you wont be able to use Credit Karma Tax® to prepare your California state tax return.

- E-file through a fee-based tax-filing service.

- through the FTB website. You can complete and mail these forms to the Franchise Tax Board, PO Box 942840, Sacramento, CA 94240-0001, if no balance is due or youre owed a refund. If youre filing with a payment, mail it to PO Box 942867, Sacramento, CA 94267-0001.

Don’t Miss: How Do I File Taxes For Doordash

New Mailing Address For Some Western States As Fresno California Paper Tax Return Processing Center Closes

IR-2021-185, September 14, 2021

WASHINGTON The Internal Revenue Service will close its paper return processing center in Fresno, California, permanently at the end of September this year. Originally announced in 2016, this closure is part of a larger, ongoing efficiency strategy as most taxpayers now file electronically.

The number of individual returns taxpayers filed electronically has grown from 90 million in 2008 to over 145 million in 2020, which is more than 90% of all returns filed. The IRS expects this trend to continue for both individual and non-individual returns.

California State Tax Credits

Available California tax credits include the following:

- Child adoption costs: 50% of qualified costs for a qualified adoption in the year an adoption is begun.

- College access tax credit: 50% of contributions to the College Access Tax Credit Fund, Californias Cal Grants financial aid program.

- Earned income tax credit: Similar to the federal earned income tax credit, Californias credit is intended for lower-income working people. If your income qualifies you, the amount of the credit depends on your income and the number of qualifying children you have.

Don’t Miss: Pastyeartax Reviews

Help With California Tax Laws

Its important to avoid state tax issues and potential financial liability for failing to pay taxes. If you need help navigating your state tax obligations, get help with H& R Block Virtual! With this service, well match you with a tax pro with California tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your CA taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find California state tax expertise with all of our ways to file taxes.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Other Common Tax Mistakes In California

Watch out for these other issues as well:

- If you’re filing an amended return, make sure all the information from your original return matchesâexcept for the information you’re amending.

- Double-check that no one else is claiming any of your dependents.

- Make sure you qualify for the Earned Income Tax Credit if you’re claiming it. The rules can be tricky.

- Do the math, then check it twice, especially if you’re itemizing numerous deductions.

Read Also: Doordash Taces

Where Do I Find California Tax Forms

If you are trying to locate, download, or print California tax forms, you can do so on the state of California Franchise Tax Board website, found at .

Commonly used California income tax forms are also available at Franchise Tax Board offices, most public libraries, post offices, and other county offices.

The Earned Income Tax Credit

The Earned Income Tax Credit helps low-to-moderate-income working taxpayers get more money back when they file their federal income tax return.

Federal forms and instructions for previous years are available for downloading.

- 4868 -automatic extension of time to file as an individual.

or order forms by phone: Call

All forms and publications for 2020 and for previous years are available from the California Franchise Tax Board.

To order forms by phone: Call 800-338-0505

Read Also: How Can I Get My 1099 From Doordash

Claim The Correct Withholding Amount

Make sure you enter all California withholding from your W-2s or 1099 statements. Confirm that you’re claiming only California income tax withheld and that your math is correct. Attach copies of all statements to your return as support for the withholding amount you’re claiming.

You can also verify your withholding amount using “My FTB Account” at ftb.ca.gov.

Filing And Payment Deadline

For 2019 state taxes, the state has extended the filing and payment deadline. California residents now have until July 15, 2020 to file their state returns and pay any state tax they owe. As with the federal deadline extension, California wont charge interest on unpaid balances between April 15 and July 15, 2020.

You dont need to do anything to get this extension. Its automatic for all California taxpayers. But keep in mind that if youre expecting a refund, you might want to go ahead and file as soon as possible. During the coronavirus crisis, the state is continuing to process tax returns and issue refunds.

While this year is a little different, generally, Californias Tax Day is the same as the deadline for filing your federal income tax return April 15. However, if the 15th falls on a Sunday or holiday, the deadline may be extended.

Don’t Miss: When Does Doordash Send 1099

Should I Staple My California Tax Return

Do not staple anything to the scannable forms, including the check or W-2s, and do not staple page 1 to the rest of the return. You do not need to sign copies of any attached federal returns or other forms or schedules requesting signatures.

- Do not staple or paperclip your return. The only thing that should be stapled is/are your W2 form or income documents that have tax withholding. Page 2 of the 1040 has a place marked at the top left where these items should be attached. Do I need to attach my federal return to my California return?

Tougher Than Irs California Franchise Tax Board

When it comes to taxes, most people think about the IRS. But if you live or do business in California, state taxes are a big piece of what you pay. California does a good job of aggressively drawing people into its tax net of high individual and business tax rates. Add the states notoriously aggressive enforcement and collection activities, and its a perfect storm. The states tax system is complex too. Rather than adopting federal tax law wholesale like many states, Californias legislators pick and choose. California adopts some federal rules but not others, so its tax law has many nuances that do not track federal tax law. Even Californias tax agencies and tax dispute resolution system are unusual. Combined with its unique tax statute of limitations, the situation can be downright scary.

Book with California taxes on a desk.

Getty

Yes, it happens. Californias FTB often comes along promptly after the IRS to ask for its piece of a deficiency. But regardless of whether California gets notice of the adjustment from the IRS, California taxpayers must notify the FTB and pay up. If you forget, they usually find you at some point. This coattails concept in California law applies to amended tax returns as well. If you amend your IRS tax return, California law requires you to amend your California return within six months if the change increases the amount of tax due. If you dont, the California statute of limitations never expires.

Read Also: Doordash State Id Number For Unemployment California

Assistance With Filing Your Return

-

Volunteer Income Tax Assistance and Tax Counseling for the Elderly – Search by city or county for best results.

-

Tax Aid provides free high-quality tax return preparation for Bay Area families.

-

Earn it! Keep it! Save it! List of Bay Area counties that offer tax help, courtesy of the United Way.

- Free Tax Help: File your taxes for free online and by phone.

-

If you believe a federal tax issue cannot be resolved online or over the phone, call the Taxpayer Assistance Center at 1-844-545-5640.Or find a TAC near you. Assistance at the TAC requires an appointment.

Where Do I Mail California Tax Return

mailformsTaxrefundfilingmail

. Keeping this in consideration, where do I send my California tax return?

Without payment: When sending in a California tax return without a payment, use the following address: Franchise Tax Board, PO Box 942840, Sacramento, CA 94240-0001.

Additionally, where do you mail federal tax returns?

| Form | |

|---|---|

| Department of the Treasury Internal Revenue Service Fresno, CA 93888-0002 | Internal Revenue Service P.O. Box 802501 Cincinnati, OH 45280-2501 |

| 1040NR | Department of the Treasury Internal Revenue Service |

In this regard, where do I mail my California non resident tax return?

. Print out your amended return and mail it to: Franchise Tax Board, PO Box 942867, Sacramento CA 94267-0001 or Franchise Tax Board, PO Box 942840, Sacramento CA 94240-0001 .

Where do I mail CA Form 100?

Payments

- Mail Form 100 with payment to: Mail Franchise Tax Board. PO Box 942857. Sacramento, CA. 94257-0501.

- e-filed returns: Mail form FTB 3586, Payment Voucher for Corporations and Exempt Organizations e-filed Returns, with payment to: Mail Franchise Tax Board. PO Box 942857. Sacramento, CA. 94257-0531.

You May Like: How Much Do I Pay In Taxes For Doordash

Californians Love A Lot Of Things About Their State But Few Probably Include State Taxes On Their List Of Likes About The Golden State

California taxes the personal income of its residents to fund government operations and programs, like health and human services, as well as education. The cost for all those services is a state and local tax burden that the Tax Foundation says ranks as the sixth-highest in the nation.

If youre looking for tips on how to file your California state tax return, here is helpful information.

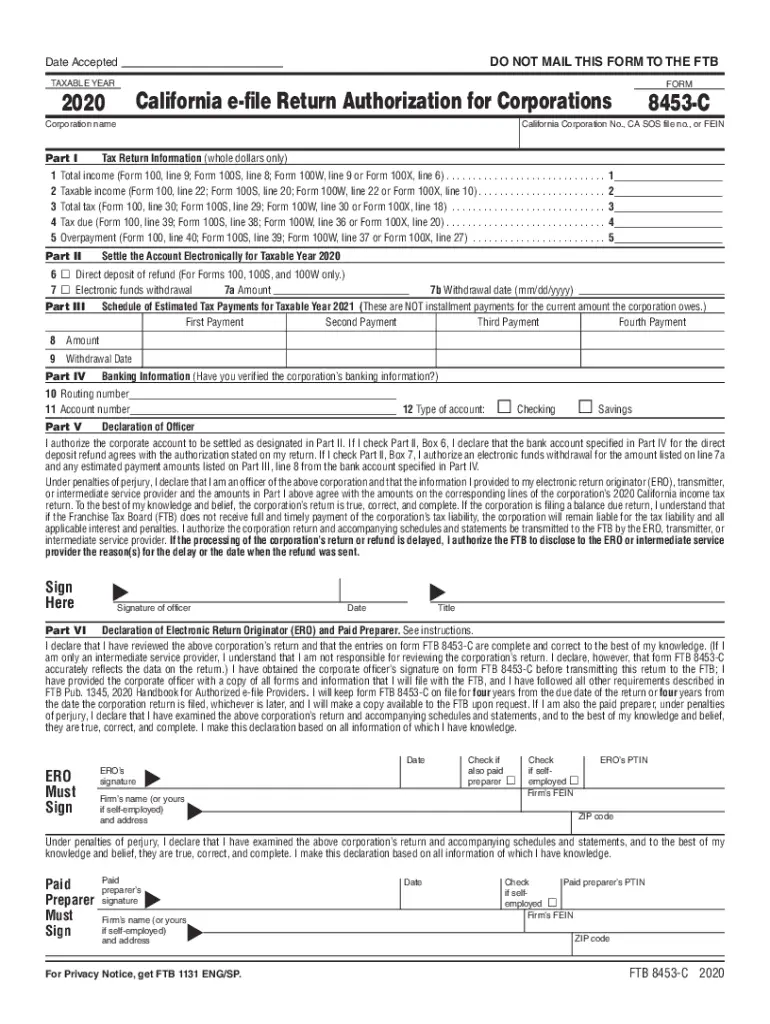

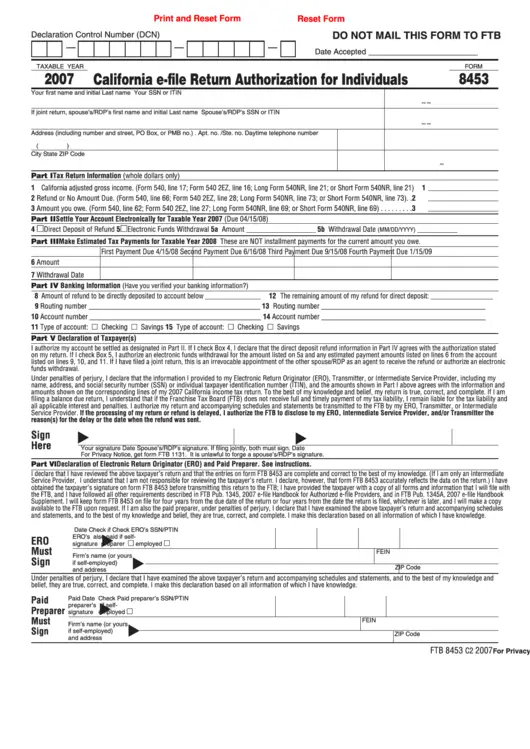

Business Return Electronic Filing Information

Business Electronic Filing Mandate – Effective January 1, 2015, for taxable years beginning on or after January 1, 2014, California law requires business entities that prepare an original or amended return using tax preparation software to electronically file their return to FTB. Any business entity required to file a tax return electronically under R& TC Section 18621.10 may annually request a waiver from their e-file requirement.

For more information, visit the CA FTB Tax Professionals website and click Business e-file Requirement.

Also Check: Does Doordash Pay Taxes

More Information About California Tax Payments

This information is provided for informational purposes only. State requirements are subject to change. To verify current requirements or to get more information on filing California tax returns, visit FTB.ca.gov. Alternately, you may call the customer service department of the California Tax Board at 800-852-5711 between 7 a.m. and 5 p.m. PST. The agency also has an automated help line, which can be reached 24 hours per day by calling 800-338-0505. Contacting customer service is a good option if you are wondering about the status of your tax filing, payment, or refund.

If You Owe And Cant Pay

If you cant pay your tax bill and its less than $25,000, you may be able to set up an installment agreement. You can apply online, by phone or mail. Theres a $34 set-up fee, and 60 months is the maximum payment term.

Keep in mind that even with a payment plan, interest and penalties will continue to accrue until you pay your bill in full.

Recommended Reading: How To Get My Doordash Tax Form