How To Do Cryptocurrency Taxes With Turbotax

TurboTax allows cryptocurrency users to report their cryptocurrency taxes directly within the TurboTax app. To enable this functionality, the TurboTax team has partnered with CryptoTrader.Tax.

In this guide, we walk through the step-by-step process for crypto and bitcoin tax reporting within TurboTaxâboth online and desktop versions.

Can I File More Than 5 Tax Return With Turbotax

With TurboTax CD or Download, you can generate up to 20 returns at a time. There is only a limit of five e-filings. You can also mail in the rest as well. This means that you had to purchase a replacement TurboTax product, with a different email address, so that you might file 5 additional income tax returns using that product.

Turbotax For Tax Year 2021 Is Now Available

The New Year has just arrived and the 2021 tax season is right around the corner. Its a good time to start going over what your filing options are and what youll need as you prepare to file your tax return. No matter how complex your tax situation is, were here to make things easier.

With TurboTax you can file on your own, get help and advice from tax experts, or even have a dedicated expert do your taxes for you, from start to finish. We know that every Canadian has a unique tax situation and theres no one-size-fits-all. To make sure youre getting the best there is to offer,were always improving our products to give you all the tools and levels of help you need to make the most out of your taxes, no matter what your tax situation is.

For the 2021 tax year, we are launching an improved lineup of tax filing options catered to your unique needs, guiding you step by step so you feel confident your taxes are done right, and you get every dollar you deserve.

Recommended Reading: License To Do Taxes

When Is The First Day To Start Filing Taxes In 2022

The Internal Revenue Service will most likely set the opening day for the 2021, 2022 filing season on or about Jan. 20th, 2022. Thats the day the IRS will start accepting and processing 2021 tax year returns.

But, if you file your taxes online with TurboTax, you can prepare your tax return early and have it automatically submitted on the day the IRS starts accepting tax returns.

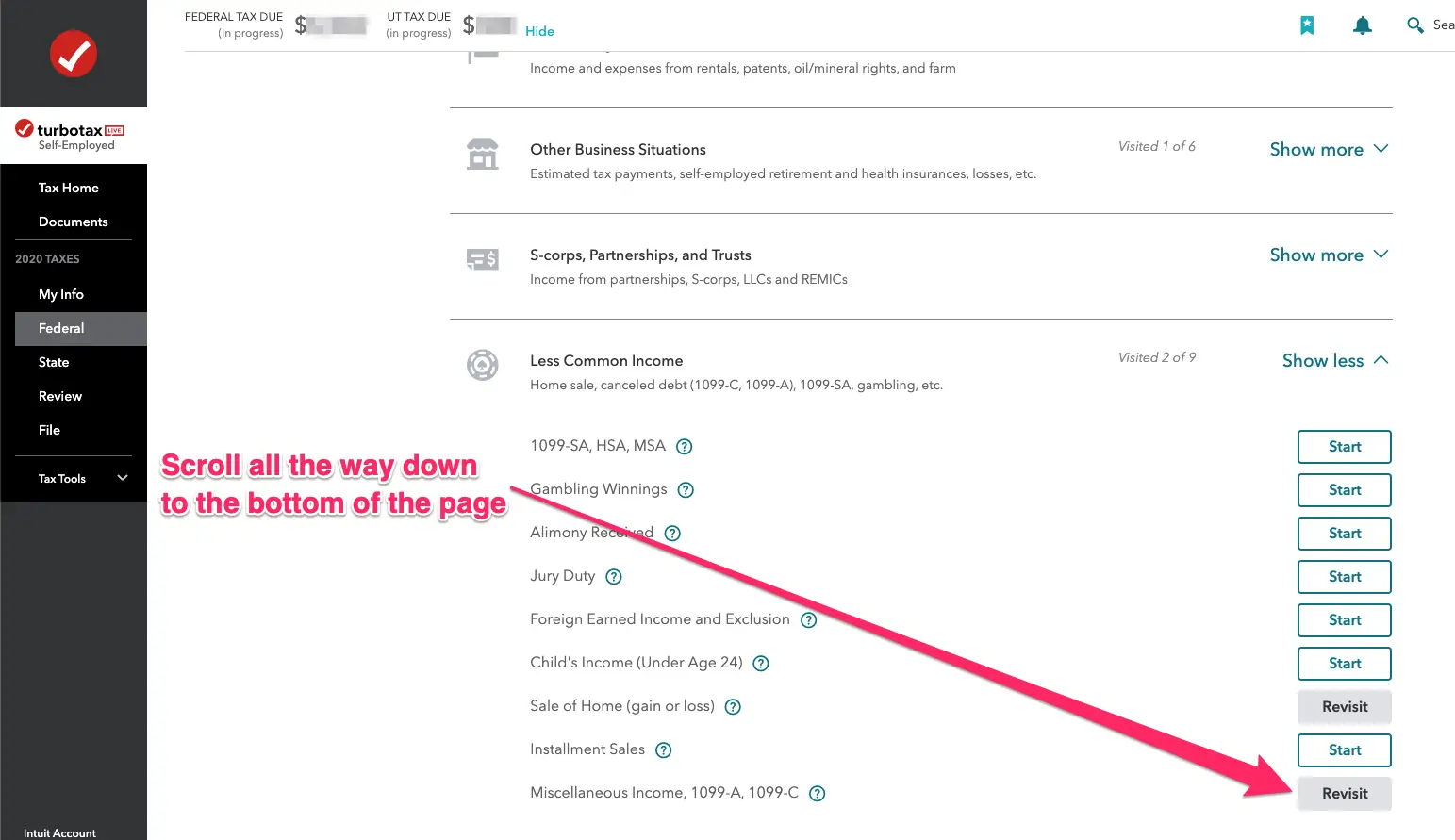

How To File Your Crypto Taxes With Turbotax

Filing crypto taxes with TurboTax? Learn how to import your Form 8949 from TokenTax.

This article is part of our tax guide. Get help with cryptocurrency tax.

TurboTax and TokenTax have partnered to make it easier for investors to report crypto assets on their tax returns. Users can now automatically import crypto data created in TokenTax to their TurboTax account.

Don’t Miss: How To Get Pin To File Taxes

Navigate To The Cryptocurrency Section

To move forward into the cryptocurrency section within the app, navigate to Federal > Income & Expenses > Cryptocurrency .

If you didnât select âI Sold or Traded Cryptocurrencyâ in the initial prompts as discussed in Step 3, you can add it in this Income & Expenses section by clicking âAdd more incomeâ on this screen.

Free Turbotax Live Full Service Basic Offer

If you have a simple tax situation, you can fully hand your taxes off to a TurboTax Live tax expert with our TurboTax Live Full Service Basic Offer for free. With TurboTax Live Basic Full Service Offer, you get matched with the right tax expert for your situation, who will do your taxes for you from start to finish. Simply upload documents, and the expert takes it from there, keeping you in the loop at each step for $0 through February 15, 2022.

Recommended Reading: Look Up Employer Ein Number

Last Years Tax Info Transferred

Now that youve transferred last years info, you can continue through TurboTax to review and complete your return.

*If you havent yet completed this years tax return with TurboTax, check out our TurboTax coupon page with an exclusive 10-20% discount for all editions of TurboTax including: Basic, Deluxe, Premier, and Self-Employed.

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

Also Check: Efstatus Taxact Com 2016

The Unholy Alliance Of Big Tax Prep And Anti

So why hasn’t return-free filing happened yet? The short answer is lobbying, and in particular lobbying by companies like Intuit. In 2013, ProPublica’s Liz Day wrote an incredible exposé on just how hard Intuit has lobbied to stop return-free filing from becoming a reality:

a bill to limit return-free filing was introduced by a pair of unlikely allies: Reps. Eric Cantor, R-Va., the conservative House majority leader, and Zoe Lofgren, D-Calif., a liberal stalwart whose district includes Silicon Valley.

Intuit’s political committee and employees have contributed to both. Cantor and his leadership PAC have received $26,100 in the past five years from the company’s PAC and employees. In the last two years, the Intuit PAC and employees donated $26,000 to Lofgren.

â¦In 2005, California launched a pilot program called ReadyReturn. As it fought against the program over the next five years, Intuit spent more than $3 million on overall lobbying and political campaigns in the state, according to Dennis J. Ventry Jr., a professor at UC Davis School of Law who specializes in tax policy and legal ethics.

Who Qualifies For Turbotax Free Edition

If you make less than $34,000 per year, you can file your taxes for free with TurboTax Free File. This edition is required as part of the industrys deal with the IRS. You can access the TurboTax Free File program here.

TurboTax also offers a Free Edition for people who are filing very simple returns. Warning: The Free Edition puts many people on track to pay is not part of the IRS Free File program.

Remember: If you make under $66,000 per year, you are still eligible to prepare and file your taxes for free under the IRS Free File program.

If you make under $66,000 per year, to find another free tax preparation offer from IRS Free File.

Don’t Miss: Do I Have To Pay Taxes For Doordash

Blocking Search Engines From Indexing Its Free File Program Page

Citizens of the US that make up to $72,000 per year are eligible for free preparation and filing of tax forms through the IRS Free File program. However, TurboTaxs free file program page contains specific HTML tags which block search engines from indexing it. TurboTax has been deceiving customers which were eligible for the free submission into signing up for their commercial product. Starting December 30, 2019, under a new agreement from the IRS, TurboTax can no longer hide their free version services from search results.

Dont Miss: How Much Does Tax Take

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

You May Like: Wheres My Refund Ga State

Turbotax Products And Pricing

TurboTax Canada offers a variety of tax software products to meet the needs of most tax filers. From simple to complicated and even self-employed income tax returns, theres a TurboTax software that can do the job.

The paid versions of TurboTax offer an added advantage for users who are not familiar with how the tax system works in Canada. When you combine the savings from over 400 deductions and credits the software helps you find, you could easily save more than the fee you have paid.

How To Get Copies Of Past Years Tax Returns

Heres how to obtain copies of a prior year return you filed in TurboTax Online:

If you dont see your tax year listed, you may have multiple accounts.

Hope this was helpful!

Read Also: What Do Tax Accountants Do

Also Check: How Do You Do Taxes With Doordash

Can I File My 2017 Taxes In 2021

Time matters with tax refunds

April 15, 2021 is the last day to file your original 2017 tax return to claim a refund. If you received an extension for the 2017 return then your deadline is October 15, 2021. For the 2018 tax year, with a filing deadline in April of 2019, the three-year grace period ends April 15, 2022.

Recommended Reading: How Do You Find Property Taxes By Address

Turbotax Federal Free Edition

Like H& R Block, TurboTax has a Free tax filing option that allows you to file your federal return and one state return for free. However, the free option only supports simple returns with form 1040. The free option includes one free state return. TurboTaxs free option supports form 1040 with some child tax credits.

Recommended Reading: Irs Gov Cp63

Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

How To File For Free With Turbotax

This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow’s legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 4,220 times.

Under an agreement with the IRS, TurboTax and other tax software companies offer a Free File Program that allows you to use their software to file your federal taxes for free. However, the free file program may be difficult for you to find on your own. If you file your taxes on the regular TurboTax page, you may end up being charged a fee to use the service. Make sure you qualify, then go directly to the website for the TurboTax Free File Program. That way, you can be certain that you won’t be charged by TurboTax to file your federal taxes.XResearch source

Read Also: How Do You Pay Taxes On Doordash

Who Qualifies For Free File

If your adjusted gross income was $73,000 or less in 2021, you can use free tax software to prepare and electronically file your tax return, according to IRS instructions online for the 2021 tax season. If you earned more, you can use Free File forms.

See IRS.gov/freefile to research options.

Roughly 70% of taxpayers, based on income, qualify for some software services offered. But only a small fraction of those who qualify actually use Free File.

More than 4.2 million taxpayers used one of the free online partner products that are part of Free File in 2020, according to data from the IRS. That is excluding the millions of nonfilers who used the system to claim Economic Impact Payments.

For fiscal year 2020, the IRS processed more than 150 million individual electronically filed returns.

Why has Free File participation been so historically low even after an uptick in 2020? Is it because taxpayers don’t know about the heavily hyped Free File? Or did taxpayers go online and end up being directed somewhere else for tax services?

We’re not talking about a new program. It has been about 20 years since the IRS first entered into a special agreement to encourage tax software companies to provide free tax return software to a certain percentage of U.S. taxpayers. But in exchange, the bargain included getting the IRS to agree that it would not compete with these companies by providing its own software to taxpayers.

Request Tax Documents From The Irs

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you haven’t filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It won’t have information about deductions and credits you may qualify for, though, so you’ll still need to do some work on your own.

Read Also: Pay Taxes On Plasma Donation

How Do You Get A Copy Of Your W2 If You Lost It

If you lost or havent received your W-2 for the current tax year, you can:

Also Check: How Much Taxes Do You Pay On Slot Machine Winnings

Tax Filing Updates In Canada

For your 2021 tax return, the tax deadline is on May 2, 2022. If you are self-employed, your tax filing deadline is on June 15, 2022.

Below is a summary of tax changes to watch out for in Canada in 2022.

Those who received the Canada Recovery Benefit , Canada Recovery Caregiving Benefit , and Canada Recovery Sickness Benefit can expect to receive a T4 from the CRA.

The CPP contribution rate has increased to 5.70% in 2022 or a total of 11.40% if you are self-employed.

The RRSP contribution limit for 2022 is 18% of your earned income in 2021 or a maximum of $29,210.

The TFSA contribution limit for 2022 is $6,000 .

Recommended Reading: Look Ein Number

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Free Turbotax Live Basic Offer

If you have a simple tax situation, you can also get expert help along the way and a final review of your return before you file to give you the confidence that your taxes are done right for $0 through March 31, 2022.

TurboTax Free Edition, TurboTax Live Basic, and TurboTax Live Full Service Basic are designed for tax filers with a simple tax situation, filing Form 1040 only. Simple situations covered include W-2 income, limited interest, dividend income, standard deduction, Earned Income Tax Credit, Child Tax Credit, and Student Loan interest.

Read Also: Efstatus/taxact

Save With Turbotaxs Deluxe Service

If your taxes are more on the complicated side , consider upgrading to TurboTax Deluxe. In addition to guiding you through the unique circumstances of your return, TurboTax will search over 350 deductions and credits to help maximize your refund. You could potentially save more with their Maximum Refund Guarantee, where theyll match any other tax preparation method you used that resulted in a larger refund or smaller tax due. Homeowners can also benefit from TurboTax Deluxe, with thorough advice regarding mortgage interest, property taxes, and much more.

Can I File My Taxes For Free With Turbotax

TurboTax free file service is aimed at the average American with simple tax affairs.

More complex tax affairs will require you to purchase the upgraded service. There are three paid packages you can take advantage of.

Furthermore, youll be able to enjoy the benefits of specialist support and the chance to take advantage of filing your state taxes at the same time.

However, even with the free service, you get the guarantee of 100% accuracy with no mistakes. Plus, you can still take advantage of the live chat feature, which is run by professional tax preparers who know what theyre doing. You always have a limited amount of support, even with the free service.

You May Like: Do You Claim Plasma Donation On Taxes