States Without An Income Tax

There are also seven states that dont impose an income tax at all. These are Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. The lack of an income tax is not to say that the citizens of these states dont pay any tax to the stateresidents in each of these states have to pay a variety of other common state taxes including a sales tax, a gasoline tax, a cigarette tax and property taxes. According to data compiled by the Tax Foundation, however, residents of the states with no income tax consistently bear a lower total per capita tax burden than those who live in states that impose an income tax.

Making Estimated Tax Payments

Many business owners think that the income tax payment deadline is on âtax day,â which falls in mid-April. However, federal income taxes must be paid as they are incurred. This means that most small businesses must make estimated tax payments throughout the year based on an estimate of their total taxable income at the end of the year.

Calculating Employee Payroll Taxes In 5 Steps

Once your employees are set up , youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheld. And, if necessary, making deductions for things like health insurance, retirement benefits, or garnishments, as well as adding back expense reimbursements.

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $12.29 using the new W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,911.66.

From time to time, there may be other things youll need to add or deduct from your employees paychecks. When these items are added and subtracted, the rest of the basic math outlined above stays the same.

Read Also: Property Tax Protest Harris County

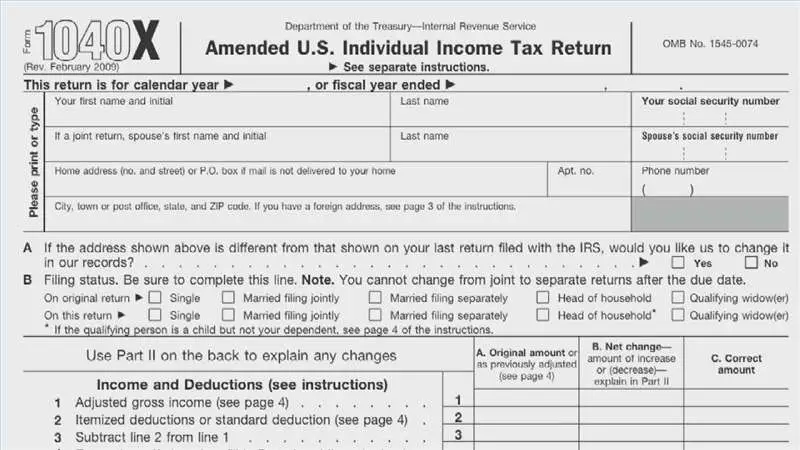

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Making Payments To The Irs

Just because youve calculated payroll and paid your employees doesnt mean your job is done. You also need to send the taxes you withheld to the respective taxing authority. For FIT and FICA, that is the IRS. For state and local income taxes, that is your states withholding tax agency.

Be sure to send both the taxes you withheld from your employees paycheck as well as the taxes that you as the employer are responsible for.

The timing of when you send the federal taxes depends on how much you pay employees, how frequently you pay them, and your lookback period . The IRS Form 941, Employers Quarterly Federal Tax Return, provides details on how, when, and where to pay FIT and FICA.

The deadline to file Form 941 is the last day of the month following the end of a calendar quarter. For example, for the quarter ending on March 31st, Form 941 is due on April 30th. There are significant penalties for not filing this form, so dont forget!

For state tax filings, you should contact your states withholding tax agency for filing requirements for state and local income tax rates. Each state is different.

Recommended Reading: Buying Tax Liens California

What Is Total Or Gross Income

Your total or gross income includes:

- Earned income, which comes from employment and can take the form of wages, salary, tips, commissions and bonuses. Earned income may be subject to both income and payroll taxes.

- Unearned income, which comes from sources other than employment, such as dividends, interest, capital gains or U.S. savings bonds. Most unearned income is subject to income taxes.

Important things to remember

- Other sources of taxable income include alimony, unemployment compensation, gambling winnings or lottery winnings.

- Income that’s not taxable include: a gift or inheritance, child support, life insurance proceeds following the death of the insured, interest from municipal bonds , disability income if you paid the premium with after-tax dollars, and certain employee fringe benefits.

- If you have stocks, bonds or other investment assets in a taxable account your profit or loss is known as a capital gain or a capital loss. Capital gains are currently taxed at a maximum rate of 20 percent, but only for people in the highest tax brackets. Otherwise, long-term capital gains are taxed at 15% or 0%, depending on your marginal tax bracket.

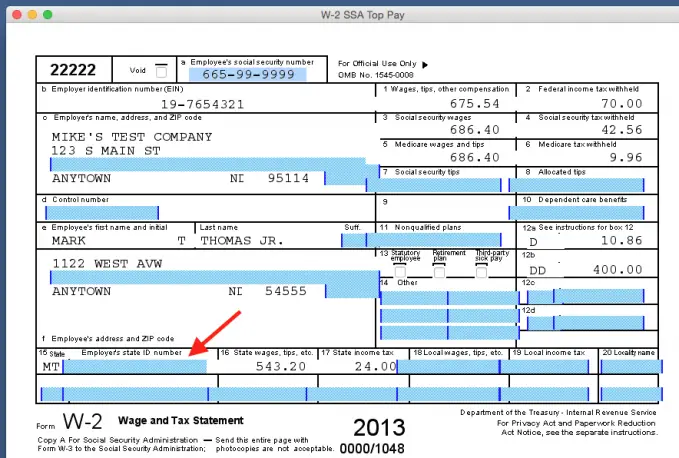

Federal Insurance Contributions Act Withholding

FICA taxes are Social Security and Medicare taxes and are withheld in each paycheck you receive unless youre exempt. This happens even when there are no other withholdings. Your employer withholds 6.2% of your gross earnings for social security up to USD$142,600 in 2021. The total Social Security tax is 12.4%.

The employer only withholds 6.2% of your gross salary from your paycheck and pays the other 6.2% as the employer contribution. As for the Medicare taxes, this pays for expenses for Medicare beneficiaries. The employer withholds 1.45% of your gross income and pays an additional 1.45% as an employer contribution to Medicare.

Even though theres no annual limit like the one on Social Security tax, individuals earning over USD$200,000 annually are subject to an additional 0.9% tax.

Recommended Reading: Efstatus.taxact.com.

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Recommended Reading: Does Doordash Pay Taxes

Whats Your Entity Type

There are many business âentity typesâ out there . But for the purposes of figuring out how much tax your small business owes, thereâs only C corporations, and everything else. If youâre not sure what your entity type is, ask your accountant. If you have a small operation, no accountant, and youâve never thought about entity type before, chances are the government is automatically classifying you as a sole proprietor.

C corporations are the only type of business that pays corporate income taxes. If your business is not a C corp, then itâs known as a âflow-throughâ entity because profits and losses flow through the business to owners and shareholders, who pay taxes at their individual tax rates.

S0F2lz5XEenbEKLO4cDbA

How To Figure Out Your Tax Rate If Youre Not A C Corp

If your business is not a C corporation, that means itâs a flow-through entity, meaning youâll pay the taxes yourself, instead of the business paying them.

Your tax rate will depend on the amount of the businessâ taxable income and your tax filing status.

If youâre single and:

| Your total taxable income is: | Your taxes are: |

|---|

| $164,709.50 plus 37% of any income you made above $612,350 |

Also Check: How Do You Pay Taxes For Doordash

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2011 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

Also Check: Efstatus Taxact Com Login

Why Estimated Taxes Are Important

You are probably a small business owner paying taxes as a sole proprietor, LLC owner, or partner. In these cases, you must pay your business income taxes through your personal tax return. This is called “pass-through taxation.”

Let’s say you make a profit this year in your business. If you were an employee, you would have payroll tax deductions for income taxes due on your income . But as a business owner, you aren’t an employee, so no taxes on your income from the business are taken out.

You are also required to pay Social Security and Medicare taxes on your business income. The combination of income taxes and Social Security/Medicare taxes on your business income is called “self-employment taxes.”

Your payments to yourself as an owner are considered an owner’s draw, not a salary, and taxes haven’t been withheld the way they would be from an employee’s paycheck.

This is where estimated taxes come in. You must pay quarterly estimated tax to avoid penalties and interest on late payments.

How To Deduct Sales Tax In The Us

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year’s worth of purchase receipts. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid.

For more information about or to do calculations involving income tax, please visit the Income Tax Calculator.

Recommended Reading: Does Doordash Take Taxes Out Of Your Check

Should I Be Making Quarterly Tax Payments To The Irs

If you expect to owe more than $1,000 on taxes, then you should be making quarterly estimated tax payments. This basically means you need to pay a portion of your expected tax bill four times per year, instead of all at the end of the tax year.

Feel free to use our free quarterly tax calculator to calculate exactly how much you should be paying ! You’ll also find detailed instructions for how to pay quarterly taxes on the same page.

What Is Sales Tax

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax or goods and services tax , which is a different form of consumption tax. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. In other countries, the listed prices are the final after-tax values, which include the sales tax.

Also Check: Efstatus.taxact 2013

Calculate Federal Income Tax Withholding Amount

On emphasis, determining the correct federal tax withheld depends on what the W-4 form you filed with your employer says. The amount you see on your paycheck is based on W-4 information, such as your filing statusthat is, whether youre single or filing jointly with a spouse and also the number of allowances and dependents indicated.

A W-4 form that hasnt been filed correctly can lead to overpayment of withholding tax, leading to a tax refund. However, the overpayment can also occur when you calculate tax refund with the last pay stub, which means you may have overestimated the withholding amount.

Eight : Take Other Deductions

You’re not quite done yet with deductions. Here are some other possible deductions from employee pay you might need to calculate:

- Deductions for employee contributions to health plan coverage

- Deductions for 401 or other retirement plan contributions

- Deductions for contributions to internal company funds or charitable donations.

Remember, all deductions start with and are based on gross pay.

Read Also: Www.efstatus.taxact.com

What Is State Tax Apportionment And How Do You Calculate It

State income tax is a direct tax on business income youve earned in a state. It sounds straightforward, but this is a complex topic: States have various ways of calculating how much of your corporations business income is attributable to its presence and activity there. Each state gets to decide what matters most your payroll, property, or sales and in what ratio to account for them. This can make calculating state income tax complex, particularly if you do business in multiple states.

Tax teams that are equipped with a knowledge of state requirements, and that have the technology to help track their many facets and frequent changes, are best positioned to stay in compliance.

What Are Withholding Allowances

Withholding allowances were exemptions that employees used to use to claim from federal income tax, using Form W-4. Withholding allowances were used to determine an employees withholding tax amount on their paychecks. The more allowances an employee choose to claim, the less federal tax their employer deducted from their pay.

Withholding allowances are no longer used on the 2020 W-4 form.

Recommended Reading: Protest Taxes Harris County

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

How Do You Minimize Taxes In Retirement

The best way to minimize taxes in retirement is by planning ahead. Ideally, you would meet with a financial advisor who specializes in retirement planning well before your retirement date. A retirement planner can help you strategize about the vehicles you’ll use to fund your retirement and minimize taxes. It doesn’t hurt to consult a professional for advice even if you’re close to retirement, or already retired.

Also Check: Calculate Doordash Taxes