All Turbotax Products Include

- 100% accuracy guaranteed

Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

- Maximum refund guaranteed

We search over 350 deductions & credits to find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- Get the green light to file

CompleteCheck will run a comprehensive review of your return before you file so nothing gets missed.

Create Your Myblock Account

If you filed your taxes yourself on the H& R Block website or signed up for their virtual tax prep service, then you already have the MyBlock account you need to access prior tax records. But if you had a tax professional do your taxes in an H& R Block office, you’ll need to first sign up for a MyBlock account and verify your identity before you can access your prior H& R Block tax records.

Video of the Day

Visit the H& R Block website and click the menu icon that looks like a person, since this will show an option to either log in or create an account. Choose the “Create an Account” option and follow the screens to set up your login information, choose three security questions and verify your email address. You can then log in and click the “Confirm My Identity” option, where you’ll enter your name, birthday and Social Security number.

Once you’ve finished the account setup, you’ll have access to your H& R Block tax records online.

Can You Get Prior Year Tax Information From The Irs

There are a few times where you may run into a situation where you need to provide a copy of your prior year tax return. For instance, you could be applying for a home mortgage loan and need proof of income or maybe you misplaced it and would just sleep better at night knowing you have a copy in your filing cabinet. Either way, in most circumstances, a paper transcript of this information will do. Before venturing to the IRS website, be sure to have the following information ready:

- social security number

- street address currently on file with the IRS

- zip code currently on file with the IRS

- type of transcript needed

Happy hunting!

Tags: amended tax return, contact the IRS, progress of tax return, tax refund, where’s my refund tool

This entry was postedon Thursday, October 20th, 2016 at 3:22 pmand is filed under Taxes for Prior Years.You can follow any responses to this entry through the RSS 2.0 feed.You can leave a response, or trackback from your own site.

You May Like: How To Get Tax Information From Doordash

Filing Back Tax Returns

You may be able to fill out past-due tax returns through online software or with an accountant, but youll need to print the forms and mail them to the IRS.

Mail your back tax returns to the IRS in separate envelopes and send them by certified mail so that you have proof that the IRS received each individual tax return. Mailing them in separate envelopes will also help prevent the IRS from making any clerical errors in processing them. It takes about six weeks for the IRS to process accurately completed back tax returns.

Remember, you can file back taxes with the IRS at any time, but if you want to claim a refund for one of those years, you should file within three years. If you want to stay in good standing with the IRS, you should file back taxes within six years.

How To Open Previous Tax Returns In Turbotax

You might need a copy of a previous year’s tax return for any number of reasons, from applying for a loan to qualifying for certain benefits during national times of trouble. You can get one for free if you used Intuit TurboTax to prepare your return for the year in question, and it won’t be just a bare-bones copy of the document, either. TurboTax will obligingly include any schedules that you also filed, as well as the worksheets that you used to arrive at the numbers you reported.

TurboTax is available in both desktop and online versions, and TurboTax past returns can be accessed a little differently depending on which you used to prepare your tax return.

Video of the Day

Also Check: Does Doordash Take Out Taxes

Buying A Car Or Truck This Year Expect Higher Than Usual Prices

According to the IRS website, as of March 5, the IRS had 2.4 million individual tax returns received prior to 2021 in the processing pipeline. As of March 5, the IRS had 9.2 million unprocessed returns in the pipeline, including 2021 returns.

Tax returns are opened in the order received, so the IRS stresses patience, and more importantly, not to file a second time.

We’re asking for patience, understand the situation we’re up against with two rounds of economic back payments, two filing seasons, an extension, all the new laws, legislation, the resource issues, the code environment to continue the process and get things done, Tulino said.

But with the clock ticking toward this years extended May 17 deadline, taxpayers want to know whether they can file 2020 returns if their 2019 returns have yet to be processed.

The IRS said they can.

The IRS will process a complete 2020,1040 if the taxpayer has not filed a prior year return, IRS spokesperson Michael DeVine told NBC Responds.

DeVine directed NBC Responds to the IRS website, which offers this clarification, If your 2019 return has not yet been processed, you may enter $0 as your prior year Adjusted Gross Income.

But refunds are not the only financial benefit being held up.

Without their 2019 returns, many people said they missed out on their full economic payment.

There is help for that too.

This article tagged under:

How To Get An Irs Transcript Online

Requesting an IRS transcript online is likely the fastest way to get a tax transcript. Here’s how to do it.

-

Go to the IRS Get Transcript site.

-

If you want the transcript to show on your screen , youll need to authenticate your identity.

-

You’ll need to supply your Social Security number, date of birth, filing status and mailing address from your latest tax return. You’ll also need to have access to your email account and be able to supply your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan, as well as from a mobile phone with your name on the account.

You May Like: How To Pay Taxes Doordash

Here’s How To Request A Copy Of Your Tax Return

IRS tax transcripts are not photocopies of your actual tax return with all the forms and attachments.

-

If you want an actual copy of an old tax return, youll need to complete IRS Form 4506 and mail it to the IRS.

-

Theres a $43 fee for copies of tax returns , and requests can take up to 75 days to process.

Go Online And Use The Wheres My Refund Irs Tool It Works

Although the IRS Wheres My Refund tool is available to check the progress of your return, it only applies to the tax return you filed for the mostcurrent tax year.

For example, lets say you file your 2013 tax return and soon after remember to file your late 2012 return. Although you filed your 2013 taxes before your 2012, 2013 is going to be the one that the IRS site shows the status for since it is the most recent tax year in their database for you.

Recommended Reading: Is Plasma Donation Taxable Income

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

The Internal Revenue Service can provide you with copies of your tax returns from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $50 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return is stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

When Your Tax Return Goes Missing Or Is Lost

Tax returns can go missing for a variety of reasons, such as moving, a flooded basement, or lost or stolen mail. The CRA may be willing to waive those penalties if you can provide proof that you mailed in your tax return. If you mailed in your tax return by regular mail, you cannot provide proof, but if you sent in your package via courier or registered mail, you can provide a tracking number as proof and check the status of your package.

Don’t Miss: How To Protest Property Taxes Harris County

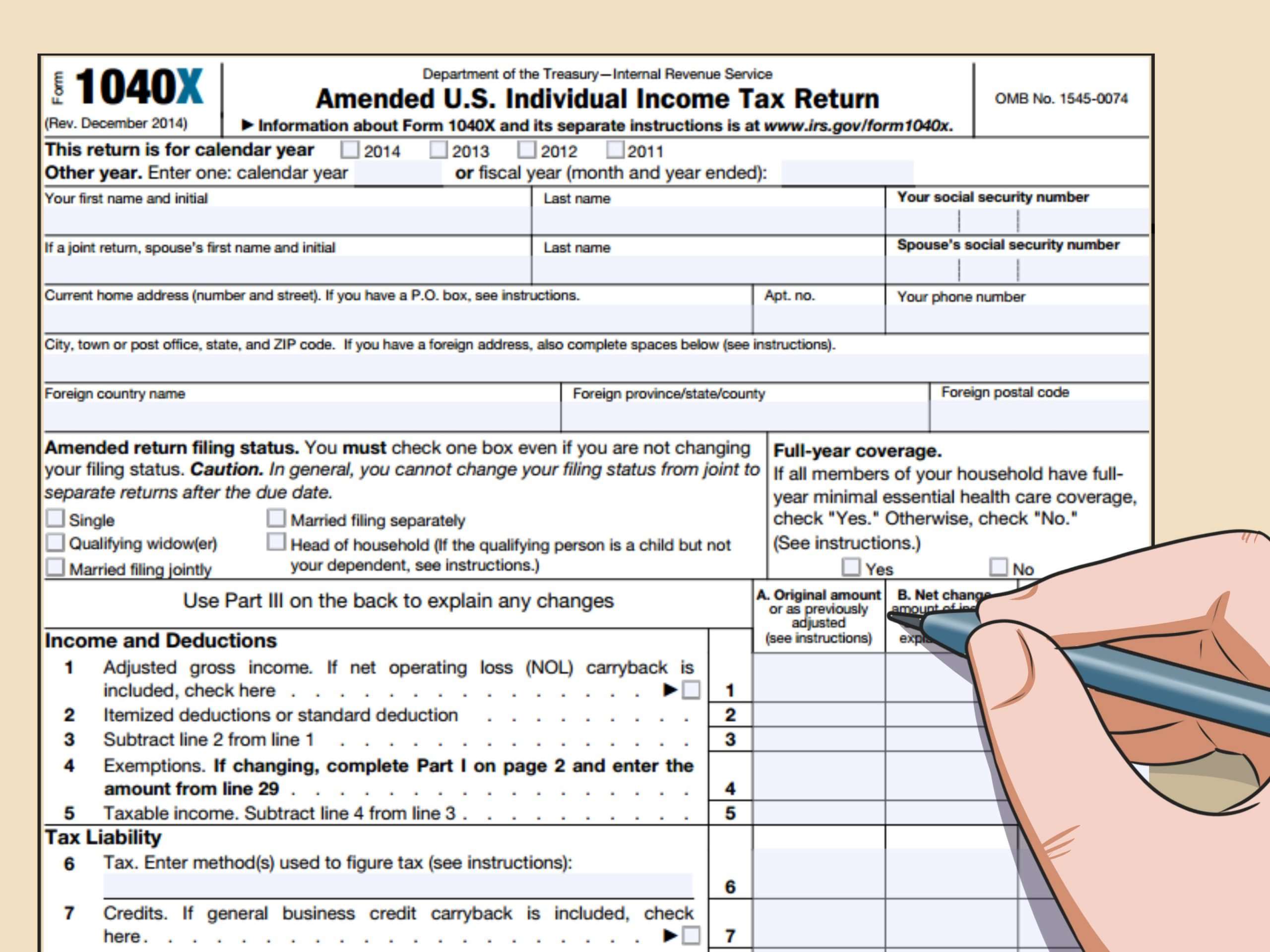

How About Checking The Status Of An Amended Tax Return

You can use the Wheres My Amended Return IRS tool. This tool shows updates for amended returns for current years and up to three prior years. However, it is recommended that you wait three weeks after mailing your return to retrieve the most accurate status update. Before opening the tool, youll want to make sure you have a few bits of information on hand:

- tax year

- zip code

Use A Tax Return To Validate Identity

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

Read Also: Do You Get A 1099 From Doordash

Your Return Is Incomplete

Having an incomplete return can also trigger an IRS review, which could mean a longer wait for your refund. For example, if you filed a paper return and forgot to enter a key piece of information, such as your SSN, or you failed to sign your tax forms, then the IRS wont process your return until those items are checked off.

View Your Tax Return Online

If you paid a professional tax preparer to file your tax return, the easiest way to view this information online is to access an online account that the tax preparer set up for you. You may need to create an online account if you dont already have one, but your tax preparer can walk you through the steps. If this option is not available to you, theres another way to retrieve your tax information, by accessing the database of the IRS.

Read More:How Long Does it Take to Process Tax Returns?

Also Check: Do You Claim Plasma Donation On Taxes

What Tax Documents Do I Need To File Back Taxes

When was the last year you filed? Do you have a copy of that tax return? Do you still have W-2s and other tax documents for the years you didn’t file?

You can request copies of your tax documents from the IRS if youre missing anything by filing Form 4506-T, or you can contact your employer or the institution that would have sent them to you.

Keep in mind that current or former employers or other establishments might not still have these documents on file, or at least they may not be easily accessible. There might also be a fee if you choose this option.

At a minimum, youll need Forms W-2 and 1099 for any income you brought in during the year in question, as well as specific tax returns and forms for that tax year. For example, you cant file a 2020 Form 1040 to report 2019 income. You should also gather supporting documentation of anything you spent that year that might be tax deductible or that will qualify you for tax credits, such as bank statements and credit card statements for that period of time.

Irs To Accept 2021 Tax Returns Starting Jan 24

The IRS will begin accepting and processing 2021 tax returns starting Jan. 24, the Service announced Monday.

In News Release IR-2022-08, the IRS stated the date will allow it time to perform necessary programming and testing in advance of return filing, which it urged taxpayers and paid preparers to do electronically.

“Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year,” IRS Commissioner Chuck Rettig said in the release.

Rettig acknowledged that the Service is still processing some tax year 2020 returns. All paper and e-filed returns with refunds owed that were received before April 2021 have been processed if they did not contain any errors or require further review however, as of Dec. 23, 2021, there were still some 6 million unprocessed individual returns. And the Service has struggled to answer a record number of taxpayer and preparer phone calls, Rettig said.

“In many areas, we are unable to deliver the amount of service and enforcement that our taxpayers and tax system deserves and needs,” Rettig said. “This is frustrating for taxpayers, for IRS employees, and for me.”

Taxpayers who received the third economic impact payment during 2021 should receive Letter 6475, Your Third Economic Impact Payment, to help them and their preparers determine whether they are eligible to receive a rebate recovery credit for missing stimulus payments.

Don’t Miss: Do I Have To Pay Taxes On Plasma Donation

You May Face A Delay If You Claim These Tax Credits

There are a couple of issues that could cause delays, even if you do everything correctly.

The IRS notes that it can’t issue a refund that involves the Earned Income Tax Credit or the Child Tax Credit before mid-February. “The law provides this additional time to help the IRS stop fraudulent refunds from being issued,” the agency said this week.

That means if you file as soon as possible on January 24, you still might not receive a refund within the 21-day timeframe if your tax return involves either of those tax credits.

The reason relates to a 2015 law that slows refunds for people who claim these credits, which was designed as a measure to combat fraudsters who rely on identity theft to grab taxpayer’s refunds.

Get Federal Transcript From Irs

Visiting the IRS Get Transcript page is the easiest way to get a tax transcript free. You can opt for a paper copy or an electronic version.

Look for the “Get Transcript Online” button and follow the steps to enter your personal information and confirm your identity, including entering a personal account number and mobile number. You’ll also choose the transcript type and tax year. At the end of the process, you’ll get confirmation the IRS received your request, and you’ll be able to view the transcript online within five to 10 days.

If you want a transcript physically mailed to you for free, you can simply select the “Get Transcript by Mail” option on the IRS Get Transcript page. You’ll enter similar information but won’t need to enter a phone number or personal account number. The IRS will mail the transcript so that you receive it in around the same time frame as the electronic version.

Recommended Reading: Doordash Taxes 2021

Child Tax Credit Payments: Here’s How To Get The Rest Of Your Money In 2022

Many parents received half of their child tax credit money in advance payments last year. Learn how to get the remaining money this year.

No advance child tax credit payments have been announced for 2022 yet.

Tax season starts Jan. 24 which means you can file your taxes with the IRS in just under a week. When you do so, you can claim the rest of your enhanced child tax credit money. The payments ended in December, but there’s still more money parents will receive with their 2021 tax refunds. The remaining half of the expanded child tax credit for 2021 will become available to parents when they file their tax returns this year.

To make sure you get the rest of your child tax credit money, keep Letter 6419 from the IRS. It contains details about your child tax credit money that you’ll need for your taxes. If you haven’t received that form yet, keep an eye out for it in the mail.

When you file your taxes, you’ll be able to claim any child tax credit money you didn’t receive in 2021 — at least half, or more if you opted out of advance child tax credit payments or had a new baby later in 2021. The IRS letter will tell you how much money you received in 2021 and the number of qualifying dependents used to calculate payments.

How To Get A Copy Of Last Year’s Tax Return From H& r Block

Whether you’re applying for some type of loan or just need a copy of your last year’s tax return for your records, H& R Block allows you to access your last six years of returns that you’ve filed at their tax offices or through their website or mobile app. You can often simply log in to the H& R Block website to view and print last year’s return, although you’ll need to do some extra work if you had used H& R Block software installed on your computer. The Internal Revenue Service also offers some options if you can’t get the return from H& R Block.

You May Like: Is Door Dash 1099