File Form 4868 Or Pay Your Tax Electronically

There are two ways to request an automatic three-month extension: File Form 4868 or make an electronic tax payment. Either way, you need to act by the midnight deadline.

You can file Form 4868 by mail or electronically. If you mail a paper version of the form to the IRS, it must be postmarked by May 17, 2021. If you’re mailing a payment, you have to use the U.S. Postal Service to mail the form, since it must be delivered to a P.O. box . If you’re not making a payment, you can use certain private delivery services to mail the form. If you submit the form electronically either on your own computer or through a tax professional have a copy of your 2019 tax return handy, since you’ll be asked to provide information from that return to verify your identity. If you want to save a few bucks, use the IRS Free File or Free File Fillable Forms to prepare and e-file the form at no cost. Both are available on the IRS website.

The other way to get an automatic tax extension is by making an electronic tax payment by today’s midnight deadline. Simply pay all or part of your estimated income tax due using the IRS Direct Pay service , the Electronic Federal Tax Payment System, or by using a credit or debit card . You’ll also need to indicate that the payment is for a tax extension. Make sure you keep the confirmation number for your payment, too. Start at the IRS’s “Paying Your Taxes” webpage to make an electronic federal tax payment.

Tax Dates To Remember

- Deadline to file 2020 individual income tax returns

- Deadline to file for an extension and pay any taxes owed to the IRS

- Deadline for 2020 IRA contributions

- Consider any relevant state tax due dates to determine if any extension requests are necessary for the state

- Deadline to file 2020 individual income tax returns

You Can Extend Your Filing Deadline But Not Your Payment Deadline

Tax deadlines have a way of creeping up on you, so filing for a tax extension might be something you need to do at some point in your life.

If you need more time to prepare your returnwhether you are busy with school, travel, or a family emergency, or are simply disorganizedyou can request a six-month filing extension by submitting the proper form to the Internal Revenue Service . Of course, theres also a deadline for that, but the good news is that getting an extension is easier than you might think. Heres what you need to know, from dates and forms to special rules.

Recommended Reading: How To Find Employer Ein Number Without W2

Does My Ira Contribution Deadline Get Extended As Well

Contributions to Traditional and Roth IRAs for the prior year are due by the tax filing deadline regardless of whether or not you file for an extension. However, if you are a sole proprietor the deadline to contribute to a or SIMPLE IRA does get extended along with the tax filing if you file an extension.

Tax Return Extensions For Natural Disasters

Sometimes you may get an extension and other tax relief due to a natural disaster. The IRS can institute these extensions based on FEMA declarations and presidentially declared disaster areas. Congress can also pass laws specifically permitting extensions and tax relief after disasters like hurricanes and wildfires.

In the case of Covid-19, all individual taxpayers received an extension two years in a row.

Tax relief and extension details vary in these cases. Speak with a tax professional or check out IRS.gov to see if you qualify.

Don’t Miss: Wheres My Refund Ga State

How Do You File A Tax Extension

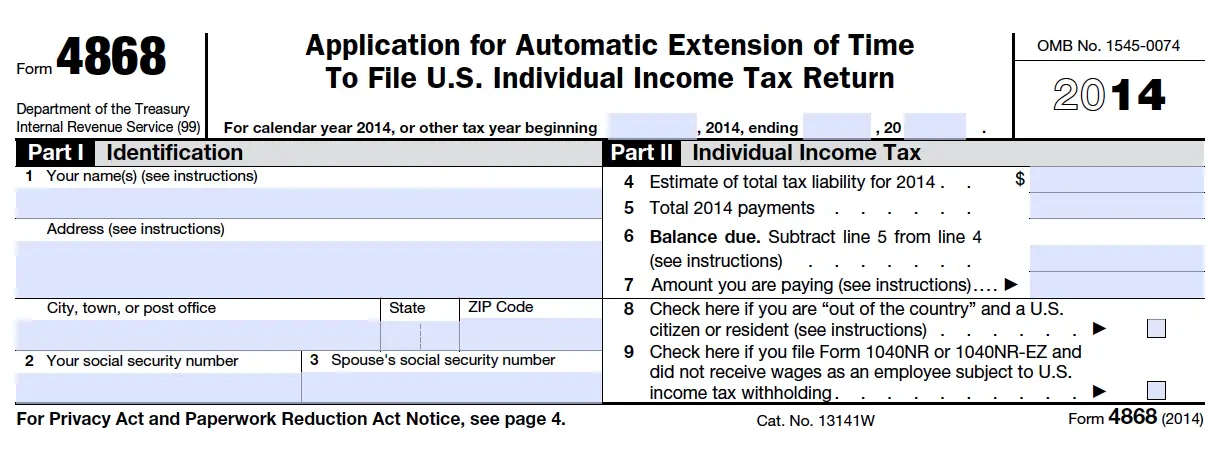

This one is easy. Youll need to fill out IRS Form 4868, then mail in your form or file it electronically using IRS e-file. To get an extension without the form, you can pay all of your estimated income taxes online. Youll get an automatic extension just by paying, but you do have to fill out your return eventually.

Go to IRS.gov to download the form or get more details about making a payment.

Tax Extensions When Youre Living Overseas

You are allowed an automatic two-month extension to your time to file if you live abroad.

You qualify for this extension if your main place of business or duty station is outside the United States and Puerto Rico, or if you are in military service outside the United States and Puerto Rico.

This extension does require that you pay interest on any tax due that you didnt pay by the original filing deadline.

Also, the automatic two-month extension does apply to married couples who are filing joint returns, even if one spouse does not otherwise qualify for this extension.

If spouses file separate returns, only the one living overseas qualifies for the extension.

This extension is automatic. You do not need to apply for it in advance, but you do need to attach a statement to your tax return indicating how you qualify for the extension.

Recommended Reading: Is Freetaxusa Legitimate

You Might Want To Think More Seriously About Working With A Tax Preparer This Year

The pandemic and its impact on our lives have made taxes more complicated for many. “You might have gone freelance or moved and now owe taxes in multiple states,” Burhmann said.

In 2021, 26 states and the Washington, DC, changed their tax codes, either increasing or changing income taxes. So there are changes not just on the federal but state level, Burhmann said.

Many taxpayers qualify for access to free assistance through the IRS Free File program and at Volunteer Income Tax Assistance and Tax Counseling for the Elderly locations across the country.

How To File A Tax Extension For An Individual

Recommended Reading: Look Up Employer Ein Number

You Missed Both Deadlines What Will You Do

The first thing to do is file as soon as possible. Immediately. Right now. As long as you defer filing, the penalties pile up. The IRS may not be busting down your door, but dont think this will go away if you ignore it.

The very next thing to do is pay as much of the balance as possible. The less you owe, the less interest you must pay. If you just cant manage the entire amount , you have a couple of options.

- If you can pay the entire amount within 120 days, you can apply for a full-payment agreement. You can pay a monthly amount to pay off the tax debt over 120 days.

- If the bill is still too big, you might be eligible for an installment plan. The nice thing is that with an installment plan in place, you stop accruing interest and penalties. Also, future refunds will not be claimed to pay any remaining balance.

- Good news. You may be able to get a temporary delay in debt collection if you can show severe financial hardship is likely to occur if you pay the full amount. Bad news, the federal government may place a lien against your assets for protection.

- If no other option is available to you, you may qualify for an offer in compromise. Under this situation, you would be allowed to sharply paying far less than you owe.

Now, the October deadline is just barely passed. Hurry up and file, then get your tax payments in order. After all, April 2020 isnt that far away. But hey, no pressure.

How To File A Tax Extension By Mail

The process for filing a tax extension by mail is the same as filing online, except youll need to submit a hard copy of the required form. Heres how:

Obtain and fill out IRS extension Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Mail your completed tax extension form for 2020 to the IRS using the correct address for your location you can find it on page 4 of Form 4868.

Once youve filed your completed tax extension form, youll automatically get the five-month extension to file your 2020 tax return, provided you meet the qualifying criteria.

Its possible to get the automatic extension for an individual tax return without filing the IRS 4868 tax form. To do this, pay all or part of your estimated income taxes that are due. You must provide relevant tax information and indicate that the payment is for a tax-filing extension using one of the IRS-approved methods of payment. Youll then receive a confirmation number for your records.

Find Out: What To Do When You Cant Pay Your Tax Bill

Don’t Miss: Www Michigan Gov Collectionseservice

Automatic Tax Extension: How To Know If You Qualify

Most taxpayers can qualify for the automatic income tax filing extension from the IRS if they cant file their tax returns by the due date. The automatic income tax extension allows you five more months to submit your federal tax forms.

Six months or five months for tax year 2020 is generally the longest amount of time allowed for an extension for filing taxes, though certain exemptions exist.

Tax Extensions For Military Members

Yes, you can make a written request for a tax payment extension if you are performing military service. But, you must notify the IRS that your military service has substantially impacted your ability to pay the income tax.

IRS publication 3 outlines the process for requesting this extension, but you should speak with a tax professional before you make the request.

If approved, you have up to 180 days after your military service ends to pay your taxes. If you pay the tax in full by the end of the 180 days, then you wont owe penalties or interest.

Also Check: 1099 From Doordash

Why Might A Tax Extension Request Be Rejected

Nine times out of ten, if you file on time and fill out the form correctly, you should have no issue getting an extension.

In most cases, applications are rejected for minor discrepancies that can easily be rectified. If it comes down to a misspelling or providing information that doesn’t corroborate with IRS records, the tax authority will usually give you a few days to sort out those errors and get the form filed againthis time accurately.

The IRS tends to take less kindly to unrealistic tax liability estimates. If it disagrees with your figures, your application for an extension may be denied and you could even be hit with a penalty.

Tax Return Extensions For Military Combat Zones And Contingency Operations

Yes, this extension commonly referred to as the Combat Zone Extension may be the most helpful one.

You qualify for this extension if you are a member of the armed forces and have qualifying service in a combat zone. Some service outside of combat zones qualifies, including certain contingency operations.

Usually the qualifying service members spouse qualifies for the extension as well. IRS Publication 3 provides details on criteria for both service members and spouses. The combat zone extension applies to the filing deadline, tax payments, claiming a refund and other actions with the IRS.

This extension pushes your filing deadline out to 180 days from your last date in the combat zone, qualifying service outside a combat zone, or in a contingency operation.

If you were hospitalized for an injury from service that qualifies for the extension, you have 180 days from the end of your hospitalization to file.

If you started your tour of duty before the original filing deadline, you can extend the 180 days by the number of days between the start of your service and the filing deadline. For example, if the original filing deadline was April 15 and your qualifying service began on March 1, then you can add 46 days to the 180 day deadline for a 226-day total extension.

The combat zone extension is automatic and does not require you to file a form or request an extension before you file your tax return.

Military OneSource can connect you with tax consultants for free.

Read Also: Is Freetaxusa A Legitimate Company

You Should Still File Your 2021 Return Even If You’re Awaiting Processing Of A Previous Tax Return

You don’t need to wait for your 2020 tax return to be fully processed to file a 2021 return.

According to the IRS, as of Dec. 3, 2021, nearly 169 million 2020 tax returns were processed — including all paper and electronic individual returns received prior to April 2021 that included a refund and did not have errors or need additional review.

“The IRS continues to reduce the inventory of prior-year individual tax returns that have not been fully processed,” Rettig said.

Can You File A Second Tax Extension

By Top Tax Staff | Oct 16, 2019 3:00:00 PM | Back Taxes, Tax Tips and Help

You knew you werent going to make the tax filing deadline last April, so you requested an extension. But now that second deadline has come and gone. Can you file for another extension?

The short answer is no, no, you cannot. However, not all is lost. Even if you werent ready when October 15 came around, you can still make things right with the IRS and avoid some of the penalties and fees they love to give out.

Lets see what your options are for getting your taxes filed and paid once and for all. At least, until April 15, 2020.

Also Check: Does Doordash Tax Tips

Get An Extension To File Your Federal Return

You do not need to request an extension to file your Georgia return if you receive a Federal extension. The due date for filing your Georgia return will be automatically extended with an approved Federal extension. Attach a copy of Federal Form 4868 or the IRS confirmation letter to the Georgia return when filed. Contact the IRS at 1-800-829-1040 or visit their website at www.irs.gov to obtain Form 4868 and additional extension information.

How To Request Your Extension

- You can complete your request for free using our online service starting in January.

- You must e-file your extension if you prepare your extension using software that supports e-file.

- If your paid preparer is required to e-file your tax return, and is also preparing your extension request, the preparer must e-file your extension request.

The online and e-file options provide you with a confirmation that we received your extension request.

Fiscal year filers should contact us to request an extension.

Read Also: Harris County Property Tax Protest Services

We Follow Irs Rules For Extensions Of Time For Filing A Return

If you have obtained a Federal Automatic Extension, you do not need to submit an Application for Extension of Time to File. It is not necessary to file a New Mexico Extension of time to file unless you need more time than the Federal Automatic Extension allows.

An extension of time to file your return does NOT extend the time to pay. If tax is due, interest accrues from the original due date of the tax. If you expect to owe tax when you file your return, the best policy is to make a payment. For income taxes use an extension payment voucher.

How Does A Tax Extension Work

Tax extension forms for 2021 are due by April 18, 2022 and April 19, 2022 for Maine and Massachusetts residents. Filing for an extension will give most taxpayers until October 17th to file their returns.

But what it doesnt do is give you an extension on your payment. If you owe money to the IRS, those taxes are still due on April 18th or April 19th for Maine and Massachusetts residents if you want to avoid penalty fees and interest.

When is filing an extension a good idea?

The IRS recommends filing your taxes and making payments on time. But it may be worth filing an extension if any of these situations apply to you:

- You ran out of time but want to make sure you take advantage of as many tax deductions and credits as possible.

- You plan on itemizing your taxes but need more time to scrounge up receipts and documentation.

- Youre still waiting on specific tax forms to come in the mail.

If you decide to file an extension, estimate your tax payment first to ensure youre not hit with any late-payment penalty fees. If your tax situation hasnt changed much from the previous year, you can estimate your tax liability based on last years return.

Otherwise, use an online calculator to estimate your payment. Many tax software programs have calculators on their website you dont have to sign up to use them.

How do I know if my extension was accepted?

You May Like: Tax Id Reverse Lookup

What Is A Tax Extension

A tax extension gives you until Oct. 15 to file a tax return. A tax extension gives you an extension to file, but doesn’t give you an extension if you owe money to the IRS.

“Most people think that if they owe the IRS, this waives a few extra months for payment when that is not the case,” says Nakiea S. Cook, an accountant and the owner of NC Accounting & Consulting Solutions. “In fact, you can compute the amount you owe and send payment with your tax extension form.”

Note: You’re allowed an additional two months, usually until June 15, to file your tax return and pay any taxes due without requesting an extension if you’re a US citizen or resident alien and are living outside of the US and Puerto Rico and your main place of business is outside the US and Puerto Rico. If you need more than the additional two months, you can apply for another four month extension.

If you owe money, you’ll need to make a payment by the filing deadline which is April 18 for 2021 and April 19 for residents of Maine and Massachusetts in order to avoid penalties and interest. However, if you cannot pay the full balance due, it is still recommended that you file your tax return in order to avoid a failure to file penalty. You can apply for an installment agreement with the IRS online or by completing Form 9465. The failure to pay penalty is reduced when you have an approved payment plan with the IRS.