Missing Property Tax Exemptions Homeowners Can Apply For Certificates Of Error

The regular application filing period is now closed however, if your home was eligible for the Homeowner Exemption in tax years 2020, 2019, 2018, or 2017 and the exemption was not applied to your property tax bill, the Assessors Office can help you obtain a refund through what is called a Certificate of Error.

Certificate of Error applications for tax years 2020, 2019, 2018, and 2017 can be filed now by clicking the links below. As a reminder, it is recommended to apply online so that the application can be easily tracked and our representatives can provide status updates.

Addremove If I Move Out And Rent My House To Someone Else Am I Still Eligible For The Exemption

No. If you do not own and occupy your home as your principal place of residence, you must cancel your Homeowners’ Exemption. You can cancel the exemption by writing to our office or using the termination form included with your property tax bill. Please let us know the date you moved and provide your new mailing address.

Other Property Tax Resources

You can find a list of all our property tax pages on the Property Tax Hub.

The Tax Commission doesn’t collect property tax. Counties collect property taxes. The Tax Commission just oversees the property tax system to ensure compliance with state laws. Read more in our Understanding Property Tax guide.

Also Check: How To File Missouri State Taxes For Free

About Those Home Improvements You Made

Improving your home results in increased assessed value and this means paying more in property taxes. Maybe your property assessed at $275,000 last year, and then you added an attached apartment for your recently widowed mother-in-law. Now your property assesses at $350,000. Will you be paying your property tax rate on $75,000 more?

Not if you live in Illinois, at least not right away. The state offers a Home Improvement Exemption that lets you make up to $75,000 in improvements without your homes assessed value increasing for a safe period of four years as of 2017. But the change has to qualify as an improvement. Normal maintenance doesnt count.

In fact, several states will let you upgrade your home without increasing its value for a while, particularly if you do so to accommodate a disability, although not all states set this requirement. In fact, Smithtown, New York will totally exempt that apartment addition if you add it to accommodate a grandparent.

Bismarck, North Dakota will give you a five-year grace period if your home is more than 25 years old and while theres no dollar limit here, its only three years in areas of Washington State.

How To Claim Your Senior Property Tax Relief

Its important to file for your senior tax exemption by the deadline imposed by your state. Each state has different deadlines.

Most states have websites where you can find the deadlines for filing, along with the necessary forms and instructions.

Most states have websites where you can find the deadlines for filing, along with the necessary forms and instructions.

Applications for property tax exemptions are typically filed with your local county tax office.

While most states offer basic exemptions for those that qualify, your county may offer more beneficial exemptions.

Whether you are filing for exemptions offered by the state or county, you should contact the tax commissioner or the tax assessors office in your county for more information or clarification about qualifying for tax exemptions.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

If You Are Married Or Living Common

You could get $500 if your adjusted family net income for the previous year was $45,000 or less.

If your income is over $45,000, your grant will be reduced by 3.33% of your income over $45,000.

You do not qualify for the grant if your adjusted family net income is $60,000 or more. Only one person per couple can receive this grant.

Whos Eligible For The Homestead Tax Exemption

In some states, youll get the homestead exemption if your income is low, youre a senior, you have a disability or you are a veteran. In most cases, these exemptions cant be combined if you fall into more than one category. Some states also set an upper limit on the value of homes that can qualify for exemptions.

State governments cant directly affect property tax rates because rates are set at the local level. So statewide homestead tax exemptions are a way for state governments to lower property tax bills indirectly. They do this to encourage homeownership, keep residents happy and give a property tax discount to people in need of a tax break.

Don’t Miss: Tax Lien Investing California

How Do Property Taxes Work

Real property tax is handled a bit differently than personal property or income taxes. Property taxes are based on the assessed value of your home. In all cases, this is based on your property value. However, whether its your full property value depends on the jurisdiction youre in.

For example, the taxable portion of your homes value given by an assessor may be limited to some portion of its actual value pursuant to state law. If the valuation is $250,000, the taxable value of the property may only be $125,000, for example.

Property taxes are assessed using a unit called a mill. Mill might strike you as meaning million, but for the sake of tax math, you want to think back to science class and the metric system. Mills are assessed based on every $1,000 of property value.

The above concept is important to know because when tax policies are put to vote, its often in a millage. What youre voting for or against is a tax of a certain amount per $1,000 of property value. Special local assessments are often put to a vote.

Im going to give an example of the way local taxes are worked out. Before I get into this, these budget numbers are purely pulled out of thin air. City managers and school district officials, please dont write us.

What Are Tax Exemptions On A House

Federal tax deductions for homeowners are exemptions issued by local, state, and federal governments. The tax deductions for homeowners 2021, which are issued by these various levels of government, are not the same but carry different eligibility clauses. These exemptions are designed to do two things. Firstly, to protect homeowners in certain economic classes and secondly, to reward them for paying their taxes.

These exemptions are simply a reduction in the value of taxes charged on their real asset holdings. So, therefore, if you get an exemption on a property you own, you pay less tax on the property compared to what you would have paid without the exemption.

There are different types of personal tax deductions for homeowners, and we briefly review them below.

Don’t Miss: How To Buy Tax Lien Properties In California

Senior Property Tax Exemption

States often provide tax exemptions for senior citizens who have reached certain years of age. Some areas may base eligibility on Social Security status. The details of the senior exemption vary based on the state, and there are often residency and income restrictions. Some of the statutes just defer the taxes until the property is sold. For details, contact your local department of revenue.

Youll have to read the fine print, but its still worth looking into the tax laws in your area.

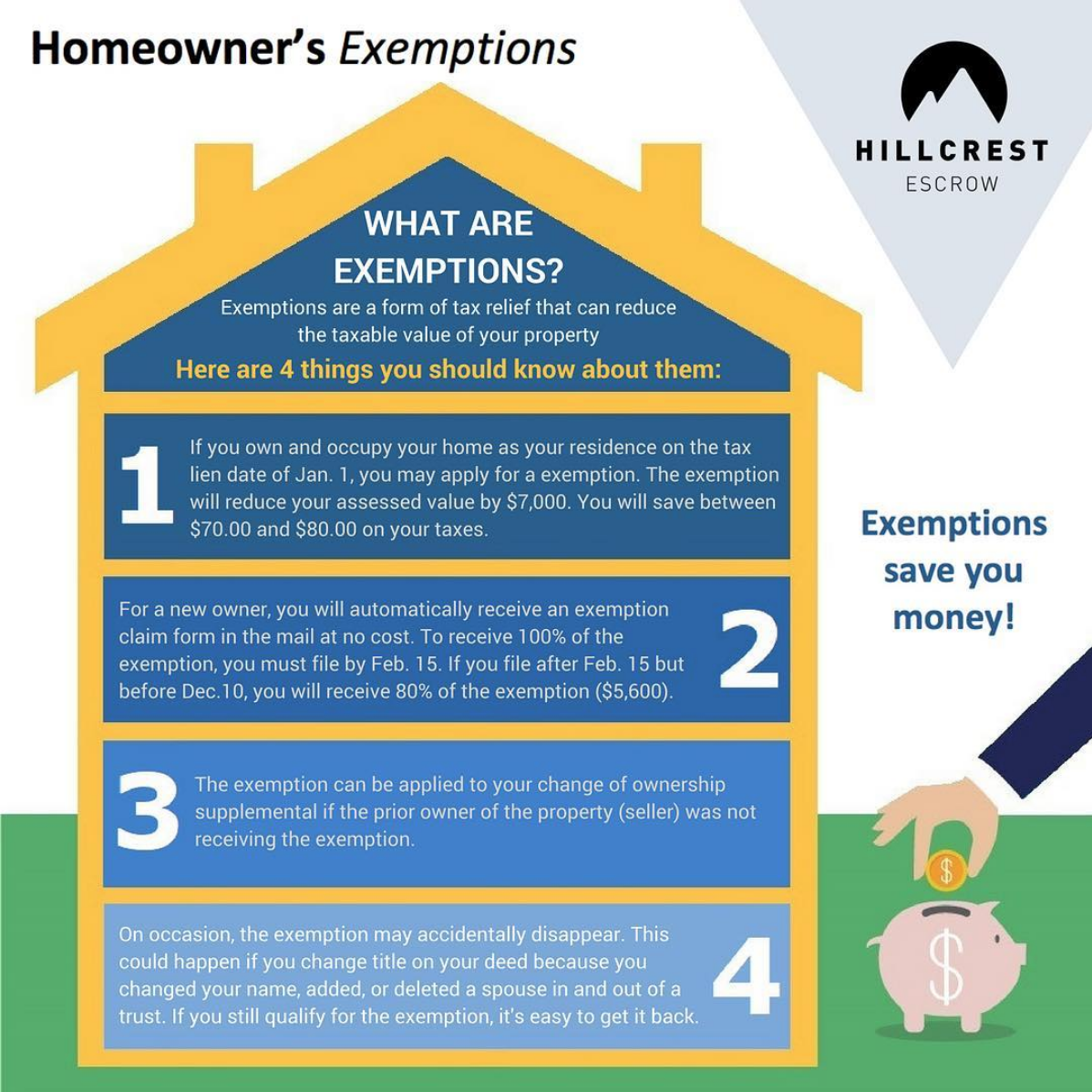

What Is A Property Tax Exemption

If you own real property tied to land or a home, then youll owe property taxes to the county or local tax authority. The amount owed is based on the assessed value of your home. Some states only reassess your property value upon certain events like the sale of your home or a new edition, but many others have been assessor look at the value on a regular basis. So, if the value of your home continues to rise, your property tax bill will likely rise with it.

To get an idea of when and if property taxes are reassessed, you can contact your local assessors office for more information.

Property taxes can be a burden on any budget but they can especially impact certain homeowners. With that, the government has created property tax exemption programs to assist property owners by lowering or eliminating their property tax bill. Although the rules will vary by state, you could stand to save thousands from a property tax exemption. Be sure to speak with a financial advisor or certified tax preparer in order to find out if you can benefit.

Exemptions are significantly different from tax deductions available to homeowners. An exemption can help you avoid a property tax bill completely. A deduction can help you lower your tax liabilities at tax time.

Great news! Rates are still low in 2021.

Missed your chance for historically low mortgage rates in 2020? Act now!

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

How The Homeowners Exemption Works

The homeowners exemption doesnt cut your property taxes directly. Instead, it exempts a certain amount of the propertys assessed value, so you pay taxes based on that lower rate, rather than receive any type of rebate. For example, if your house is assessed at $200,000 and the exemption is 25 percent, you will pay property taxes as if your house was assessed at $150,000.

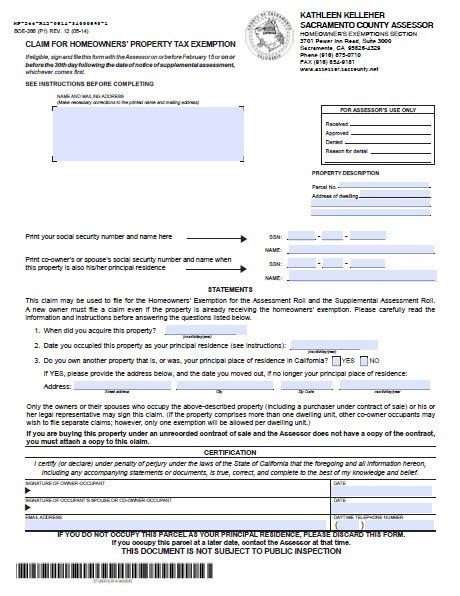

How To Apply For A Homeowners Tax Exemption

Homeowners tax exemptions can vary so much that your first step should be to contact the property tax authority for your area to find out whats available in your location. Many special exemptions and the rules for qualifying can be unique to your specific area theyre not necessarily statewide so youll probably have to do a little research.

If you do think you qualify, your next step is typically to submit an application to the taxing authority. You can often do this for free, but in some areas, there might be a small fee. You must often apply by the first day of the tax year, but you might have a few more months, depending on where you live. Youll also need some identifying information regarding your property, which can normally be found on your deed or through the tax assessor.

Some areas will automatically renew your exemption year after year when you apply for and are approved for an exemption the first time, assuming you havent sold your property. Others require that certain special exemptions, such as the ones for senior citizens and disabled individuals, must be renewed annually. Still, others require that all exemptions be renewed annually. Property tax waivers for veterans can be either permanent or annual, depending on your location.

Also Check: How Do I Get My Pin For My Taxes

What Is Tax Deductible

Tax deductible or tax reductions 2021 means a lowering of the tax liabilities on your income. Remember that for all incomes you earn, you are liable to pay the government income tax. However, for your real estate holdings, you are also liable to pay tax on that as well. So when you enjoy a certain percentage of tax deductibles, you subtract the deductions from your income so as to reduce your tax bill. In clear terms, this means that the lower your taxable income, the lower the tax you are to pay annually.

Homeowners Property Tax Exemption

Another program that may be beneficial to look into is called the Homeowners Property Tax Exemption.

You can inquire about it by visiting the county Assessors Office or by visiting their website.

It isnt very hard to figure out and it is easy to qualify for.

This exemption allows for a $7,000 reduction when it comes to assessing the value of your home.

This translates into saving approximately $70 on your taxes, on average.

Keep in mind that your houses value is assessed each year and that is how the amount of tax is calculated when it comes to your property taxes.

In general terms, your tax amount is equal to 1% of the value your home was assessed at, plus any applicable bonds or fees.

This means that a $7,000 reduction on that amount can really help you out.

Even though it amounts to less than $100, as long as you keep qualifying for it, you can keep saving.

These savings can really add up too.

For example, if you qualified for 15 years, thats over $1,000 worth of savings on your taxes.

To qualify for this program, youll have to use your house as your primary home as of January 1.

You can fill out this application for the program on the Assessors website.

Normally, when any home is purchased, a form is automatically sent to the residence as well.

Besides just being able to print a form from their website, youll also be able to request to have one sent to your house.

You May Like: Can Home Improvement Be Tax Deductible

Disabled Veterans’ And Homeowners’ Exemption Match And Multiple Claims Listing

The homeowners’ exemption allows an owner to reduce property tax liability on a dwelling which is occupied as the owner’s principal place of residence as of 12:01 a.m. on the lien date . The maximum exemption is $7,000 of the full value of the property. Once granted, the homeowners’ exemption remains in effect until such time as:

- Title to the property changes

- The owner no longer occupies the dwelling as his or her principal place of residence on the lien date or

- The property is otherwise ineligible.

The disabled veterans’ exemption allows for an exemption of $100,000 , as adjusted for the relevant assessment year for property that constitutes the principal place of residence of a veteran or the principal place of residence of the unmarried surviving spouse of a veteran who, because of injury or disease incurred in military service, is blind in both eyes, has lost the of two or more limbs, or is totally disabled. The $100,000 Basic Exemption increases to $150,000 of assessed value , as adjusted for the relevant assessment year, if the household income for prior year did not exceed $40,000, as adjusted for the relevant assessment year.

How Property Tax Exemptions Work

The first thing to know is that property tax exemptions dont have any effect on the tax rate. And, they typically dont come off your tax bill.

Instead, they usually reduce the value of your home thats subject to taxation.

Some areas offer a certain percentage off home values, while others offer dollar amounts.

Savings from exemptions will vary widely depending on where you live, the value of your home, and what you qualify for.

You will need to find out the property exemptions that are offered in your area and then apply for them.

You May Like: How Can I Make Payments For My Taxes

How Homestead Exemption Works

A version of the homestead exemption provision is found in every state or territory with some exceptions, such as New Jersey and Pennsylvania. Yet how the exemption is applied, and how much protection it affords against creditors, varies by state. The homestead exemption is an automatic benefit in some states while, in others, homeowners must file a claim with the state in order to receive it.

Since a homestead property is considered a person’s primary residence, no exemptions can be claimed on other owned property, even residences. Further, if a surviving spouse moves their primary residence, they must re-file for the exemption.

The homestead tax exemption helps to shield a portion of a home’s value from property taxes. Homeowners may need to apply for the benefit and should check with their local government how to do so.

Allow The Assessor Access To Your Home

You do not have to allow the tax assessor into your home. However, what typically happens if you do not permit access to the interior is that the assessor assumes you’ve made certain improvements such as added fixtures or made exorbitant refurbishments. This could result in a bigger tax bill.

Many towns have a policy that if the homeowner does not grant full access to the property, the assessor will automatically assign the highest assessed value possible for that type of propertyfair or not. At this point, it’s up to the individual to dispute the evaluation with the town, which will be nearly impossible unless you grant access to the interior.

The lesson: Allow the assessor to access your home. If you took out permits for all improvements you’ve made to the property, you should be fine.

You May Like: Where Is My State Tax Refund Ga

Protection From Creditors Under Homestead Exemption

The exemptions for homestead properties vary from state to state. A few states, including Florida and Texas, afford unlimited financial protection against unsecured creditors for the home, although acreage limits may apply for the protected property. More common, however, is a limit for protection from creditors that ranges between $5,000 and $500,000, depending on the state, with many states in the $30,000 to $50,000 range.

However, the protection limits are not for the value of the home, but for the homeowner’s equity in itthe value of the property minus the balance of the mortgage and other financial claims on that property. If the equity held is less than the limit, the homeowner can’t be forced to sell the property to benefit creditors. If a homestead’s equity exceeds the limits, however, creditors may force the sale, although the homesteader may be allowed to keep a portion of the proceeds.

Additionally, the protection for the homestead property does not apply for secured creditors, such as the bank that holds the mortgage on the home. Instead, the homeowner is protected only from unsecured creditors who may come after the home’s value to satisfy claims against the homeowner’s assets.

What Home Expenses Are Tax Deductible In 2021

One of the benefits of home purchase tax deductions 2021 is that you can reduce your tax liabilities based on certain expenses you accrue on your property. States and the federal governments provide taxpayers with deduction opportunities on certain expenses such as

- Insurance

- Maintenance

- Utilities

However, you should note that not all taxpayers will qualify for tax deductibles on all these expenses. Secondly, you will have to meet certain requirements to claim deductions.

Read Also: Otter Tail County Tax Forfeited Land