What Is Free File

Yet a simple way to cut down on costs which many people oddly don’t tap into remains using the IRS Free File system, if you qualify. Why pay $40 or $50 or more for online software if you don’t have to do so?

The Free File program at IRS.gov gives eligible taxpayers free access to brand name software programs offered by rival tax-prep companies. Those who qualify can use online software that prompts filers with key tax questions, does the math and allows you to file returns electronically for free. E-filing helps the IRS process returns and issue refunds more quickly than a return filed by paper.

TurboTax was but one partner in Free File. Those who selected TurboTax last year are able to opt for another online tax preparation service in the Free File program. Last year, there were nine tax software products available via Free File in English and two in Spanish.

What Are The Most Common Tax Forms And Types Of Tax Returns Prepared By A Tax Preparer

Depending on levels of experience, your client roster, and the specifics of your business, the types of tax returns a preparer will work on can range from an Individual Income Tax Return, Form 1040 to a Corporation Income Tax Return, Form 1120 to interpreting complex partnership agreements.However, most tax forms will break down into two different groups:

- Individual forms, such as 1040.

- Business returns, including corporations, partnerships, trusts, not for profit exempt organizations.

Most preparers will usually focus on 1040s/individual tax preparations when starting out. This is generally because theyre easier to prepare and, honestly, easier clients to get. For some preparers, staying 1040 focused is a career choice, doing a little bit of business work as it arises from current clients.

However, often tax preparers are looking to get more business work, and their 1040 clients are a bridge to that career goal. Doing individual returns gets cash flow underway. Over time, they can get enough money and clients to transition to a more business-focused client list.

How Fast Will You Get Your Tax Refund This Year

When it comes to taxes, one of the most important questions we are often asked at Jackson Hewitt is, Will I get a tax refund? When the answer turns out to be YES! this good news leads almost immediately to clients asking, How fast can I get my refund?For millions of Americans, your tax refund feels like the biggest paycheck youll receive all year, so filing your taxes is your most important financial transaction*.

Read Also: Doordash 1099 Nec

Where Can Taxpayers Go For Help

There are various options to help taxpayers, including numerous Volunteer Income Tax Assistance and Tax Counseling for the Elderly locations across the country as well as the IRS Free File program.

Also, taxpayers can set up an online account at irs.gov to access information more quickly.

“We have invested in developing new online capacities to make this a quick and easy way for taxpayers to get the information they need,” Rettig said.

IRS Free File opened on Jan. 14, when participating providers started to accept completed returns and hold them until they can be filed electronically.

Free File is open to people who made $73,000 or less in 2021. The program enables taxpayers to file electronically at no cost using select commercial software programs.

More information on these programs is available at irs.gov.

Filing If You Received Covid

The CRA and Service Canada processed more than 27 million Canada Emergency Response Benefit applications, totaling more than $81 billion in payments to Canadians. The CRA also processed more than 2 million Canada Emergency Student Benefit applications that totaled more than $2 billion in payments.

If you received CERB, CESB, Canada Recovery Benefit , Canada Recovery Sickness Benefit , or Canada Recovery Caregiving Benefit payments, you will have to enter on your return the total of the amounts you received. You will receive a T4A and/or a T4E tax slip in the mail with the information you need for your return. You can view tax slips online as of February 8, 2021 in My Account. Residents of Quebec will receive both a T4A and RL-1 slip from the CRA, however, the RL-1 slip will not be available for viewing in My Account.

The CRA recognizes that receiving these slips might generate questions for Canadians. Individuals who believe they received a T4A or a RL-1 by mistake or believe there may be discrepancy with the information provided on these slips should contact the CRA.

If you received the CERB or CESB, no tax was withheld when payments were issued. If you received the CRB, CRSB, or CRCB, 10% tax was withheld at source. For Quebec residents who received the CRB, CRSB, and CRCB, 5% of the tax withheld will be reported on the T4A slip and the other 5% will be reported on the RL-1 slip.

Read Also: How To Take Out Taxes For Doordash

Are Social Security Benefits Taxable

Yes, some households have to pay federal income taxes on their Social Security benefits.

This usually happens if you have other substantial earnings on top of your benefits – for example wages, self-employed earnings, interest, dividends or other taxable income.

However, Supplemental Security Income is never taxable.

There’s No Time Limit On The Collection Of Taxes

If you have old, unfiled tax returns, it may be tempting to believe that the IRS or state tax agency has forgotten about you. However, you may still be on the hook 10 or 20 years later.

There is generally a 10-year time limit on collecting taxes, penalties, and interest for each year you did not file. However, if you do not file taxes, the period of limitations on collections does not begin to run until the IRS makes a deficiency assessment.

State tax agencies have their own rule and many have more time to collect. For example, California can collect state taxes up to 20 years after the assessment date.

Don’t Miss: Doordash Taxes Calculator

So Can You Tell Me How To Get An Efin

Its a 3-step process. Heres the process to obtain an EFIN:

1. Create an IRS e-Services account on the IRS website.

2. Complete and submit your application to become an authorized IRS e-file provider. It can take up to 45 days for the IRS to approve an e-file application, so plan accordingly. All applicants must provide the following:

- Identification information for your firm

- Information about each Principal and Responsible Official in your organization

- Your e-file provider option

If the Principal or Responsible Official is a certified or licensed professional, such as an attorney, CPA, or enrolled agent, they must provide their current professional status information.

All other applicants must provide a fingerprint card, which can be arranged by calling the IRS toll-free at 866-255-0654. If you need to be fingerprinted, work with a trained professional. There are commercial services, but your local police station will likely provide this service for a modest fee. Then mail the signed and completed card to the IRS.

3. Pass a suitability check. After you submit your application and related documents, the IRS will conduct a suitability check on the firm and each person listed on your application as either a Principal or Responsible Official. This may include: a credit check a tax compliance check a criminal background check and a check for prior non-compliance with IRS e-file requirements. Once approved, you will receive an acceptance letter from the IRS with your EFIN.

You Can Get A Refund Of Withheld Or Estimated Taxes

If your employer withheld federal income taxes from your pay or you made estimated tax payments, filing a tax return may allow you to receive some or all of those overpayments back in the form of a tax refund.

Keep in mind, if you regularly file a tax return just to get a refund of the tax your employer withheld, you might want to decrease your withholding.

File a new Form W-4 with your employer to reduce your withholding and increase your take-home pay, and you wont have to worry about filing a return unnecessarily.

Recommended Reading: Does Doordash Tax

How Can Taxpayers Avoid Delays

Rettig urged taxpayers to file electronically and sign up for direct deposit. That has become standard advice, as in past years.

Among other suggestions, the IRS urges people to organize and gather 2021 tax records before preparing and submitting returns. That includes Social Security numbers and, possibly, other information such as Individual Taxpayer Identification Numbers.

Also, taxpayers can check irs.gov for updates, including the latest on reconciling advance payments of the Child Tax Credit or claiming a Recovery Rebate Credit for missing stimulus payments.

Taxpayers also should start watching for documents including W-2 forms from employers 1099s for dividends, unemployment compensation and the like a 1099K or 1099 MISC for gig-economy work a 1099-INT for bank interest or the Health Insurance Marketplace Statement known as 1095-A.

Tax forms usually start arriving by mail or are available online from employers and financial institutions in January. If the information shown on a form is wrong, taxpayers should contact the issuer for a correction.

Investing lessons:Why inflation, political strife and debt didn’t hurt investors in 2021

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Don’t Miss: Pastyeartax Com Reviews

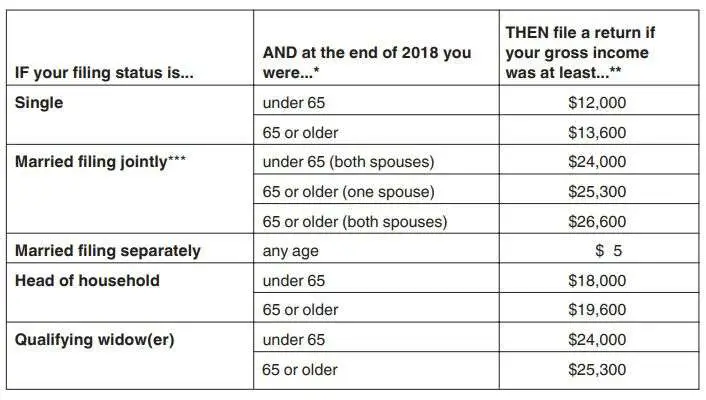

Income Thresholds For Taxpayers 65 And Older Are Higher

If you are at least 65 years old, you get an increase in your standard deduction. You also get an increased standard deduction if:

- You are blind

- Or your spouse is also at least 65

- Or if your spouse is blind

The largest standard deduction would be for a married couple that are both blind and both over 65 years old.

Having a larger standard deduction can allow you to have more income than someone under age 65 and still not have to file a return. TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

Not Everyone Has To But Be Sure You Know What Your Situation Requires

This may come as a surprise to many people, but not everyone needs to file a federal tax return. The Internal Revenue Service has threshold levels for tax return requirements just like tax brackets. Whether or not you need to file is primarily based on your level of gross income and status for the tax year. However, keep in mind that even if you arent required to file because of your gross income, you may still be eligible for a refund.

Read Also: How To Appeal Cook County Property Taxes

What If You Lost Or Threw Away Letter 6419

Of course, the IRS urges everyone to not throw away Letter 6419, since it’s necessary for confirming the amount of advance child tax credit payments and the number and ages of your children. If you did accidentally dispose of it or lose letter 6419, don’t panic — your child tax credit information will be available via the child tax credit portals on the IRS website.

Registering for an account on the IRS site takes a bit of time and patience, but once you’re in, you will have all the necessary information for the child tax credit, along with other useful IRS information for preparing your taxes.

The amount of child tax credit money you get depends on a number of things.

How You Can Move Fast To Get Your Money

If you received the advanced child tax credit in 2021, you can also refer to the child tax credit update portal on the IRS website to see how much you’ve already received.

People can submit their taxes as early as Jan. 24, all the way through Apr. 18. However, the IRS will not issue a refund for the child tax credit until mid-February.

When you are ready to file your taxes, do so electronically and set up a direct deposit in order to receive your return the quickest way possible .

“Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year,” warns IRS Commissioner Chuck Rettig in a company press release. “And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

While individuals making under $73,000 can utilize the guided tax preparation through the IRS, individuals making more than $73,000 can use the free fillable forms. Free fillable forms, however, do not offer users any tax preparation advice or guidance. If you need help when filing taxes, you might opt to use a tax filing software program.

Tax-filing programs like TurboTax and H& R Block both offer a free program for simple returns and, for a fee, advanced programs when dealing with more complicated filings.

Also Check: How Much Does Doordash Take In Taxes

Ways To Do Your Taxes

When you file an individual tax return, there are many ways to file. Choosing the one thats right for you depends on your circumstances. Your choices are the free file choice of certified tax software , authorization of a family member, friend, or an accountant to complete your taxes, a community volunteer tax clinic, a tax preparer, or a paper tax return.

Tax Filing Faq How To File Taxes

- What To Do If You Have Not Received Your T4

Every employer should give you a T4 slip if you worked for them in the last tax year. Sometimes, you can have multiple employers and multiple T4s to submit for your federal income tax. However, your address and contact information may have changed, and you dont have a T4.

The Canada Revenue Agency has a My Account online portal to help you access processed T4 slips. With the portal, you can check balances and forward unused credits from the year before.

- How Much Do I Have to Make to File Taxes?

If you earn less than the basic personal credit of $12,000, you dont have to file a return. Some exceptions do apply, of course. For Canadian taxes, the circumstances when paying your taxes is another factor. For example, a self-employed person must pay their Canada Pension Plan and Employment Insurance premiums and file taxes.

- How Should I Pay My Taxes?

The CRA allows several ways to pay your taxes besides a cheque. The easiest way is to pay your taxes online. You can pay with a credit or debit card, PayPal, or Interac e-Transfer. Another way is to pay by pre-authorized debit from your bank account.

If you arent comfortable with pre-authorized debit, you can still use your bank account for payments. Other choices are the My Payment. This is an electronic service that lets you make payments to the CRA with your bank access card. Filing with online options means you can receive your refund faster, especially if you use direct deposit.

You May Like: How Much Money Should I Save For Taxes Doordash

Dont Forget About State Returns

The filing requirements outlined above apply to federal income tax returns, but if you live in a state with a state-level income tax, you may also need to file there.

Filing requirements vary by state, so check with a tax professional or your states tax agency to figure out whether you need to file a state return.

Do I Need To File A Federal Tax Return

Under 2019 IRS filing guidelines, the minimum income amount at which you need to file depends on two main factors. The two factors are status and age. Status means whether you are filing as single, married, head of household, or married filing separate. If you are under age 65, are single, and have Social Security income below $12,200, you generally dont have to file a federal tax return. If you are older than 65, the amount goes up to $13,850 before you must file a federal tax return.

Hopefully, this answer is what you need to know about filing taxes with just Social Security income.

You May Like: Protesting Harris County Property Tax

What If You Don’t Get A Letter From The Irs

If you haven’t received a letter yet, keep an eye on your mailbox because the IRS is still working to send them out. However, if you still haven’t received a notice by the time you’re ready to file your taxes, there could be an issue — for instance, maybe you moved and the agency doesn’t have your current mailing address yet.

If you don’t receive a letter by the time you need to prepare your return, you’ll need to either use the online child tax credit portals to confirm your information or contact the IRS directly via mail or by phone at 1-800-829-1040. If you contact the IRS via mail, expect to wait at least 30 days for a response.

How Long Does It Take To Become A Tax Preparer

The simplest answer to this is: in the time it takes to apply for and receive a PTIN and an EFIN.

However, how long it takes to become a seasoned tax preparer is perhaps the more correct question to ask, as the ability to make money and build a career is dependent upon a certain amount of experience and skill.

In most cases, it takes about two seasons to learn the basics of tax preparation. Whether you plan on starting at a firm or becoming a sole practitioner, the career progression looks similar. In the first year, most new preparers will focus on raw data entry. The second year brings a little more autonomy. By the third year, youre armed with the necessary experience and skills to work as a full-fledged staff preparer.

After the initial period of seasoning, it takes about five years to learn the nuances and niche areas of your clients and your practice. In that time, you gain expertise that differentiates you as a tax preparer and allows you to set yourself apart in the market.

“We find the people who have done some write-up have the easiest transition to tax prep. We start them out entering W2s and 1099s into UltraTax CS, and then transition to Schedule C and F, etc. We have them print out the organizer, and enter the info on it before they enter it into UltraTax CS. It makes it easier for us to review the return, and see where they may have gone wrong, and go over the return with them to point those things out.”

– UltraTax CS user Lynn Wells of Paul T. Wells CPAs

Recommended Reading: Tax Id Reverse Lookup