When To Deposit Employment Taxes

Employers are legally obligated to place withholding on deposit. The rules for depositing can vary depending on the nature of your business and how much you withhold. Employers must deposit:

- Any federal income tax withheld

- The employer and employee portion of Social Security taxes

- The employer and employee portion of Medicare taxes

If you are self-employed, these deposits are covered by your quarterly tax payments.

Traditional employers must deposit either monthly or semi-weekly the schedule you will need to use depends on the type of business you have. Most employers will file Forms 941, 944, or 945 and can determine their deposit schedule using Publication 15 employers with agricultural employees file Form 943 and will need to use Publication 51 to determine their schedule.

Monthly deposits are due by the 15th of the following month, and semi-weekly deposits are due on by the Wednesday following a Wednesday, Thursday, or Friday payment. If you paid your employees on Saturday, Sunday, Monday, or Tuesday, deposits must be made by the following Friday.

The regularity of state and local deposits can depend on the laws where you are reporting.

Paying Social Security Tax

The Social Security component of the payroll tax is set at 12.4 percent of taxable income as of 2018. The tax is shared by employer and employee, who each pay 6.2 percent. The tax is used to pay for federal old-age, disability and survivors insurance. It is withheld by your employer and reported separately from the Medicare tax on your pay stub. Social Security tax is collected on the first $128,400 of employee wages, known as the wage base. Income above the wage base is not subject to Social Security tax.

Fica Taxes And Unemployment Taxes

Federal Insurance Contributions Act taxes fund Medicare and Social Security. Currently, the employers payroll expense is a 6.2% Social Security tax and a 1.45% Medicare tax . Each worker pays the same 7.65% tax through payroll withholdings.

The Federal Unemployment Tax Act and the State Unemployment Tax Act were passed to provide temporary income for workers who lose employment.

The current employers FUTA tax rate is 6% on the first $7,000 in gross income earned by the worker. If the wages are subject to a state unemployment tax, the employer can use a 5.4% FUTA credit, which reduces the FUTA tax to 0.6%. The total federal and state unemployment taxes will vary depending on each states unemployment program.

Recommended Reading: Protest Property Taxes Harris County

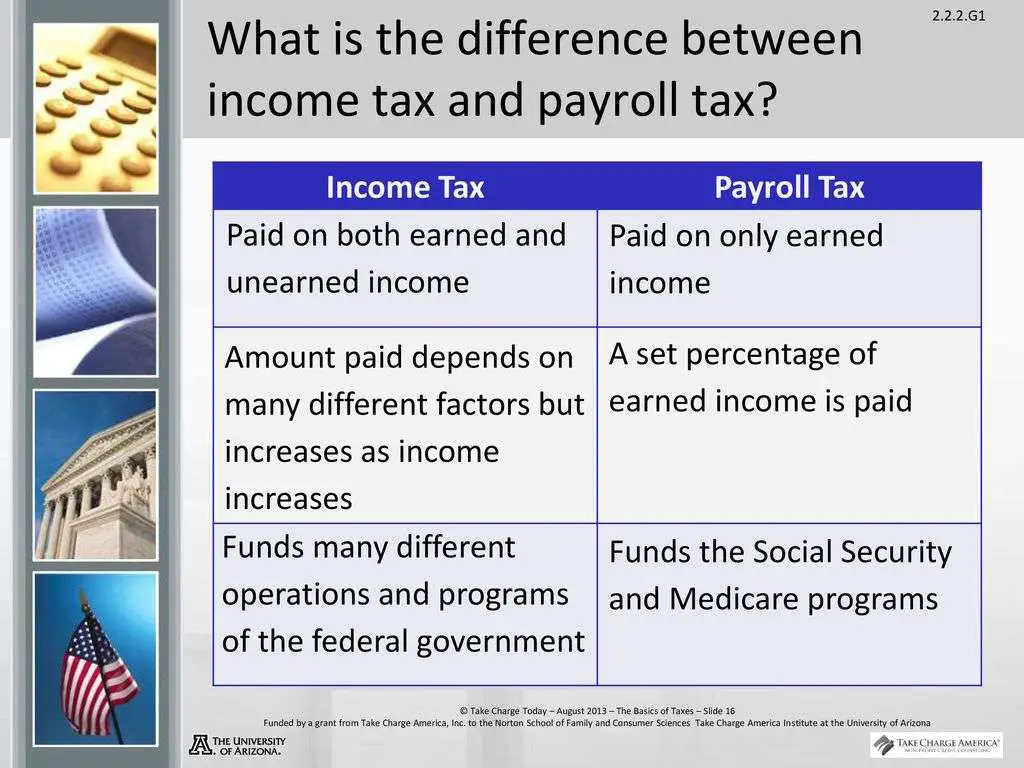

Payroll Taxes Vs Income Taxes: An Introduction

Payroll taxes are paid for by both an employer and an employee, and go toward Social Security and Medicare. In 2021, both employer and employee pay 7.65% on the first $142,800 and then 1.45% on earnings above that figure. There is a further, additional Medicare tax of 0.9% for those earning $200,000 and above.

Income taxes are paid by employees only, operate at a federal, state or local level, and fund government spending and public services. Federal income taxescalculated using an employees W-4 formare progressive, dependent on their household and marital circumstances, and employees will only pay if they earn over a certain threshold.

Accounting For Payroll Liabilities And Expenses

Every business should use the accrual method of accounting, which matches revenue earned with expenses incurred. The accrual method records payroll expenses in the month they are incurred, regardless of when the expenses are paid in cash. The matching concept presents a more accurate picture of company profit.

Read Also: Roth Ira Reduce Taxable Income

Examples Of Payroll Taxes

You may wonder which taxes are examples of payroll taxes. The Social Security tax, also called FICA for the Federal Insurance Contributions Act, covers the cost of benefits for retirees, disabled people and their dependents. Survivors of people who received benefits may also be eligible for benefits. The Medicare tax covers medical benefits for retired workers and their spouses. These payroll taxes are deducted from the wages of all workers. Unlike income taxes, they cannot be decreased by deductions or credits on your tax return.

Payroll Vs Income Taxes

The difference between Payroll and Income Taxes is that both of them are paid by different people of society. While only employees have to pay the incomes tax, the payroll tax has to be paid not only by employees but also by employers. Both of them are different. Incomes tax is a progressive tax, whereas payroll tax is a regressive tax. Incomes tax contributes more to social development, while payroll only contributes to the beneficial development of employees and employers. Except these, they also differ in terms of source, what they are consist of, and purposes.

Payroll taxes are taxes paid by both employers and employees. The amount of tax paid depends on the salary paid by employers to their staff . As the salary increases, the tax rate decreases. They are collected to provide the benefits or increase their benefits in the future. They can be medicare tax, unemployment tax, or social security tax.

Income tax is paid by employees on their income or profit they make. The tax rate depends on the type and amount of income. They are collected by the government for making the development in society and environmental progress, for example, to make a contribution in the military sector. The rate of tax increase if the income or profit of the individual increases. They are not paid by employers. If not paid on time or at all, the income saved is turned into black money.

Read Also: 1040paytax.com Official Site

Income Tax And Payroll Taxes 2021 Calculation

There are some sets of rules to follow while calculating income and payroll taxes 2021. They depend on the kind of tax you are paying for. Although there are some exceptions to the calculations. However, it is good to allow a tax accountant to take you through the calculations before processing the payroll. This enables you to know which calculations suit your business and employees.

This section details the comprehensive method of calculating income tax and payroll taxes in 2021

Payroll Taxes Vs Income Taxes: A Brief Introduction

There are many similarities between income and payroll taxes. Both of these taxes are withheld from an employees paycheck. First, you tot up the total hours worked per employee. This will give you the gross pay.

After all of the deductions and contributions have been shaved off the top, you are left with net pay, alternatively called the take-home pay. This is what you actually pay your employees. The two primary distinctions between payroll and income taxes are that:

So both taxes go to different funds and thus have to be accounted for differently. You must withhold each tax separately. However, you can account for both on the same form .

Don’t Miss: Do You Get Taxed For Donating Plasma

The Importance Of Accurate Small Business Accounting

With so many complex nuances in the realm of compliance and accounting, it is essential that you have a streamlined payroll and accounting system in place. There are local, state, and Federal income taxes to be paid, as well as FICA taxes for fixed employees. And this is the only payroll for typical services. How do you account for professional services such as legal and finance on a consultancy basis? How do you account for short term freelancers?

Only by having a secure and automated payroll and accounting system can you expect to handle all of these components successfully. All employee records will be automatically stored in the appropriate repositories for quick and easy retrieval. And files will be automatically filed before the relevant IRS deadlines.

What Are Income Taxes

It is a tax collected by the government of the country during the financial year on the income of the person. They are several objectives of collecting this tax some of them are listed below:

Recommended Reading: Plasma Donation Taxable Income

You’re Now Leaving Chase

Chase’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you’re about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isnt responsible for any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

A List Of The Federal Taxes Withheld From Most Employee Paychecks

If you work for a paycheck, you know that your gross pay is not the same as the amount you take home on payday. This is because your employer is required by the federal government to withhold part of your pay to cover payroll and income taxes and to submit it to the government on your behalf. The main difference between payroll tax and income tax is that payroll tax supports Medicare and Social Security costs, while income tax is used for national defense, social programs and other federal government expenses. Another difference is that you may be able to get a refund on some of the income tax thats withheld from your salary when you file your annual tax return, but this is not the case for payroll taxes.

Also Check: Reverse Ein Search

What Is The Federal Income Tax Right Now

The following is a table listing the Federal income tax for a single individual. Federal income Taxes will change depending on whether you are married and filing jointly or not.

| Rate of Taxation | |

|---|---|

| $518,401 and above | $156,235 + 37% of the amount over $518,400 |

There is too much variance in local and states taxes to outline specifically. Check with the appropriate authorities to find out what you are expected to pay. Keep in mind that taxpayers in the most expensive states can pay three times more than the cheapest states. But also keep in mind that this is never the full story, and you can only compare your entire tax burden to another state. You have the look at the whole thing to see it clearly, and not just one or two figures.

Paying State And Local Taxes

If you live in a state and/or municipality that charges income tax, your employer will withhold the appropriate amounts from your paycheck. These local income taxes do not affect your payroll taxes. If you are self-employed, you might have to pay estimated state/local taxes on your income.

References

Writer Bio

Eric Bank is a senior business, finance and real estate writer, freelancing since 2002. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get.com, badcredit.org and valuepenguin.com. Eric holds two Master’s Degrees — in Business Administration and in Finance. His website is ericbank.com.

You May Like: Doordash Mileage Calculator

What Is The Limit On Earnings Subject To The Social Security Payroll Tax

The Social Security payroll tax only applies up to a certain amount of a workers annual earnings that limit is often referred to as the taxable maximum or the Social Security tax cap. For 2021, the maximum earnings subject to the Social Security payroll tax is set at $142,800, an increase of $5,100 from the 2020 level.

When the tax dedicated to Social Security was first implemented in 1937, it was capped by statute at the first $3,000 of earnings . Since 1975, the taxable maximum has generally been increased each year based on an index of national average wages. Each year, about 6 percent of the working population earns more than the taxable maximum, which has been the case since 1983.

The Income Tax System

Income taxes refer to taxes paid based on how much money employees make from a variety of sources. Income taxes are generally paid on money that is earned at a job or from self-employment, as well as funds from other sources like bank interest, dividends paid by stocks or gains from the sale of assets.

Income taxes are typically used for funding defense and national security programs. Employers are responsible for withholding taxes based on the taxpayers W-4 withholding form. When the taxpayer files their income tax return, they either pay any remaining balance or receive a tax refund.

The federal government imposes income tax, as well as many states. Some cities also have their own income tax for people who live or work there.

Overall, the federal income tax system is a progressive tax system, where tax rates are higher for people with higher incomes. Each taxpayer falls into a federal tax bracket. In 2019, there are seven tax brackets based on earnings and filing status10%, 12%, 22%, 24%, 32%, 35%, and 37%. State income taxes vary considerably from state to state, but most states that have an income tax have a progressive income tax.

Recommended Reading: Is Donating Plasma Taxable Income

How Do You Determine How Much Income Tax You Should Withhold

Your employees make a lot of the decisions here. They’ll use Form W-4 to decide how much they want to have withheld, based on their household and personal financial circumstances. You’ll need every new worker to fill out a Form W-4 then, you can use that information and the employee’s earnings to calculate how much tax to deduct.

Even though you’re not paying the employees tax for them, it is important to manage the withholding correctly and ensure that the proper amount is sent to the IRS. Check out the IRS’s Publication 15, Employer’s Tax Guide, for more information about payroll and income taxes and your responsibilities as an employer. You can also use the online Tax Withholding Assistant tool on the IRS website to help you create a spreadsheet that calculates the right amount of federal income tax to deduct for each employee.

How Income Tax Is Calculated

Income taxes are only paid by employees, and are imposed at a local, state or federal level. These taxes fund government spending. All but nine states tax employee incomesthe exceptions are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. In addition, many cities and counties across the country impose further, local income taxes.

Employers can calculate the amount of federal income tax to withhold based on an employees W-4 form filing. To assist calculations, employers can refer to IRS Publication 15 Circular E. Paying state or local income taxes will also require employees to submit a withholding form.

Employees are responsible for paying income taxes on sources of income outside their primary employment, like bank interest, dividends, or profit from the sale of stocks or property.

Calculating taxes correctly is essentialbut if you try to do this alone, you risk making costly errors. The good news is, Paycor can help. Our Human Capital Management platform gives HR leaders the technology and expertise they need to save time, stay compliant and start making a difference. To learn more, talk to a member of our sales team.

Don’t Miss: Taxes On Plasma Donation

Calculating Federal Income Tax For A Self

Self-employed federal income tax is also regarded as a tax liability. This is the amount of tax that you will pay based on your business type. This taxing system depends on the legal structure of your business. It means that you either register your business as a sole proprietorship, partnership, corporation, or limited liability company .

Except you run your business as a corporation, you should calculate your tax every quarter. As a result, you wont have to pay a huge tax after each fiscal year. Below are the steps on how to calculate your federal income tax as a self-employed individual.

Determine your yearly business income

The best way to do this is by calculating your income based quarterly. Then, you use it as a benchmark for a yearly estimate. Meanwhile, you should adjust your overall income if there is an increase in earnings or unexpected expenses throughout the year.

Determine your yearly deductible yearly expenses

You follow the same process as in the first step. You determine your possible expenses based on the first quarter expenses. You can then multiply it by four to get a hold of what your yearly estimate can be. Meanwhile, including the possible variations for the next quarter while making your estimation. Calculating your possible yearly tax is crucial despite paying every quarter.

Determine taxable income

Split into quarterly payments