Which Form Should Be Used

In addition to completing the federal TD1:

- Employees who claim more than the basic personal amount have to complete the TD1 that corresponds to their province or territory of employment. To determine which is the province or territory of employment, go to Which provincial or territorial tax tables should you use?

- Pensioners who claim more than the basic personal amount have to complete the TD1 that corresponds to their province or territory of residence.

- Individuals paid by commissions and who claim expenses can elect to use Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions, to take into consideration the expenses in the calculation of their income tax.

Note

Should You File Early

Many American taxpayers wait until the April 15 deadline to complete and file their taxes. However, if procrastination stresses you outor if you’re expecting a refund and you want it as soon as possibleyou can file your 2020 return as early as Feb. 12, 2021.

That’s a little later than usual, and the reason is important: If you didn’t receive the economic stimulus check approved by Congress by the end of 2020, you can claim it on your 2020 return.

Another reason to file early is to reduce the risk of someone stealing your identity to file a false return using your Social Security Number and claim a fraudulent refund.

How To Find And File Your Federal Tax Forms

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

If bureaucracies are good at anything, its creating paperwork, and the Internal Revenue Service is the king of all bureaucracies, especially when it comes to tax forms. Most paperwork needed for filing your federal tax return can be completed and submitted electronically, but youll need to acquire some forms, on paper or via the web, to get the job done. Well explain how to find and obtain the forms you need, how often the IRS updates its forms, and the options for filing your tax forms online.

Don’t Miss: 1040paytax Irs

Where To Get Copies Of Tax Forms Due To You

Before you can file, youll need tax forms from the financial institutions with which you have accounts. They should either arrive in the mail, or you’ll receive information on how to access them online. These forms report how much interest youve earned on high-yield savings accounts and certificates of deposit, how much money you made or lost from selling investments, and the amount of any distributions youve taken from retirement accounts.

Youll also need tax forms documenting your earned income and the taxes youve already paid. The most common of these is Form W-2 employees receive it from their employers. Freelancers and independent contractors should receive Form 1099-MISC from each client who has paid them $600 or more . You might also receive a 1099-MISC for certain other types of income, such as prize money.

In addition, you may receive forms documenting any interest youve paid on a student loan or mortgage. This interest may be tax-deductible, depending on your circumstances.

Traditionally, financial institutions, employers, and clients mailed paper copies of these forms to you. Today, you may need to retrieve them yourself by logging into your account online. Sometimes this service is optional, but other times it will be the only way you can get the forms you need.

Licenses And Occupational Taxes

Many jurisdictions within the United States impose taxes or fees on the privilege of carrying on a particular business or maintaining a particular professional certification. These licensing or occupational taxes may be a fixed dollar amount per year for the licensee, an amount based on the number of practitioners in the firm, a percentage of revenue, or any of several other bases. Persons providing professional or personal services are often subject to such fees. Common examples include accountants, attorneys, barbers, casinos, dentists, doctors, auto mechanics, plumbers, and stockbrokers. In addition to the tax, other requirements may be imposed for licensure.

All 50 states impose a vehicle license fee. Generally, the fees are based on the type and size of the vehicle and are imposed annually or biannually. All states and the District of Columbia also impose a fee for a driver’s license, which generally must be renewed with payment of fee every few years.

Don’t Miss: How To Buy Tax Lien Certificates In California

Health Care And Ez Limits

If you previously filed Form 1040EZ, but bought health insurance through an Affordable Care Act state or federal exchange, known as the marketplace, you can no longer file this simplest form.

When individuals purchase a policy through an exchange, they have an option to receive advance payment of the premium tax credit. This tax credit helps cover some of the insurance costs. The advance credit amount, however, must be accounted for when the policy recipient files his or her tax return.

If the advance premium amount was too small, the taxpayer will get the extra. However, if too large of an advance premium credit was paid, the taxpayer must make up the difference, either by paying any tax due or by having the amount taken from an expected refund.

Such calculations are made on Form 8962, which only can be filed with Form 1040A or 1040. If you received advance payments of the premium tax credit, you must file one of these longer forms instead of the 1040EZ.

Even if you did not get the premium credit in advance but got health care through an exchange and want to claim it when you file, you must complete 1040A or 1040.

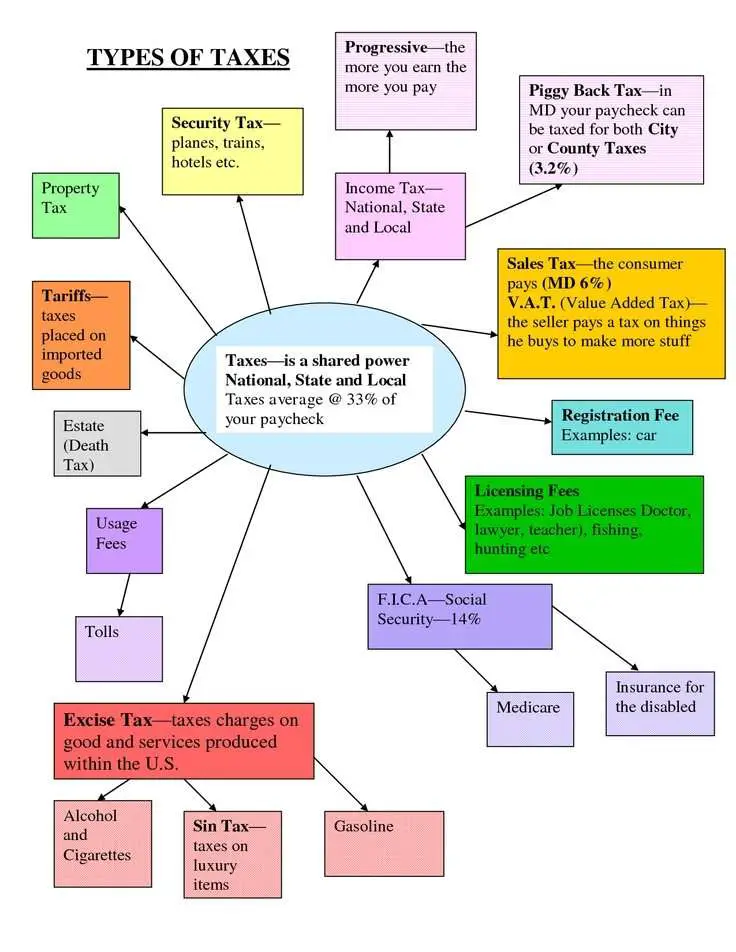

Levels And Types Of Taxation

The U.S. has an assortment of federal, state, local, and special-purpose governmental jurisdictions. Each imposes taxes to fully or partly fund its operations. These taxes may be imposed on the same income, property or activity, often without offset of one tax against another. The types of tax imposed at each level of government vary, in part due to constitutional restrictions. Income taxes are imposed at the federal and most state levels. Taxes on property are typically imposed only at the local level, although there may be multiple local jurisdictions that tax the same property. Other excise taxes are imposed by the federal and some state governments. Sales taxes are imposed by most states and many local governments. Customs duties or tariffs are only imposed by the federal government. A wide variety of user fees or license fees are also imposed.

Read Also: H& r Block Early Access W2

Schedules And Extra Forms

Since 1961 Form 1040 has had various separate attachments to the form. These attachments are usually called “schedules” because prior to the 1961, the related sections were schedules on the main form identified by letter. Form 1040 currently has 20 attachments, which may need to be filed depending on the taxpayer. For 2009 and 2010 there was an additional form, Schedule M, due to the “Making Work Pay” provision of the American Recovery and Reinvestment Act of 2009 .

Starting in 2018, 1040 was “simplified” by separating out 6 new schedules numbers Schedule 1 through Schedule 6 to make parts of the main form optional. The new schedules had the prior old 1040 line numbers to make transition easier.

In addition to the listed schedules, there are dozens of other forms that may be required when filing a personal income tax return. Typically these will provide additional details for deductions taken or income earned that are listed either on form 1040 or its subsequent schedules.

| Type |

|---|

In 2014 there were two additions to Form 1040 due to the implementation of the Affordable Care Actâthe premium tax credit and the individual mandate.

Changes To Complexity And Tax Rates

The complexity and compliance burden of the form and its associated instructions have increased considerably since 1913. The National Taxpayers Union has documented the steady increase in complexity from a 34-line form in 1935 to a 79-line form in 2014, decreasing to 23 lines in 2018. Quartz created an animated GIF showing the gradual changes to the structure and complexity of the form. The NTU table is below with data through 2014:

| 1 | 2 |

In addition to an increase in the complexity of the form, the tax rates have also increased, though the increase in tax rates has not been steady in contrast with the steady increase in tax complexity.

Don’t Miss: Payable Doordash 1099

What Do I Need To Fill Out Form 1040

You’ll need a lot of information to do your taxes, but here are a few basic items that most people have to collect to get started:

-

Social Security numbers for you, your spouse and any dependents.

-

Dates of birth for you, your spouse and any dependents.

-

Statements of wages earned .

-

Proof of any tax credits or tax deductions.

-

A copy of your past tax return.

-

Your bank account number and routing number .

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

“Planning for the nation’s filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare,” said IRS Commissioner Chuck Rettig. “The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

Don’t Miss: Federal Tax Return Irs

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Get the IRS tax forms and publications you need to file taxes.

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Recommended Reading: Efstatus.taxact.xom

Deadlines For Making Tax Forms Available To You

The IRS has established deadlines by which employers and financial institutions must mail you these forms or make them available electronically. Here are the deadlines for when youre supposed to receive some of the most common forms people need to file their 2020 tax returns.

- 1099-S, Proceeds from Real Estate Transactions Feb. 1

- Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc. March 15

Transfers From Your Rrsp

If you transfer an investment from your RRSP to your TFSA, you will be considered to have withdrawn the investment from the RRSP at its FMV. That amount will be reported as an RRSP withdrawal and must be included in your income in that year. You can claim the tax withheld on the withdrawal at line 43700 of your income tax and benefit return. If the transfer into your TFSA takes place immediately, the same value will be used as the amount of the contribution to the TFSA. If the contribution to the TFSA is deferred, the amount of the contribution will be the FMV of the investment at the time of that contribution.

Except in certain circumstances, you cannot exchange securities for cash, or other securities of equal value, between your accounts, either between two registered accounts or between a registered and a non-registered account .

Read Also: How To Get A License To Do Taxes

File Your Missing Returns

You may want to file your old returns before a demand is made. There’s no time limit for submitting a previously unfiled return. However, if you’d like to claim your refund, you have up to 3 years from the due date of the return. It may be a good idea to speak with an experienced tax attorney or CPA before amending or filing old returns. Here are some benefits of getting missing tax returns filed:

- Protect your Social Security benefits: If you’re self-employed and don’t file, you won’t receive credits toward Social Security retirement or disability benefits.

- Avoid issues obtaining loans: Loans may be denied or delayed if you cannot prove income by providing tax returns or reportable income.

- Not having to worry about your unfiled taxes: Once your tax issue is resolved, it will free up your time for more enjoyable pursuits.

List Of The Most Common Federal Irs Tax Forms

As tax season heats up, your mailbox will be flooded with tax-related forms. While many have familiar names and numbers, a slew of new schedules was introduced in recent years. Each has a particular purpose and carries information critical to completing your tax return.

Here are this years most important tax forms, including how to figure out which are best for you. For more help, check out our complete tax filing guide.

Also Check: Www.1040paytax.com.

You Can File The 1040ez Return If:

- Your filing status is single or married filing jointly.

- Youre younger than 65. Your spouse also must meet the age requirements if you file a joint return. If you or your spouses 65th birthday is Jan. 1, then for filing purposes you are considered to have turned 65 last year and therefore cannot file this form.

- You were not legally blind during the last tax year.

- You have no dependents.

- Your interest income is less than $1,500.

- Your income, or combined incomes for joint filers, is less than $100,000.

The ease of the one-page 1040EZ is appealing, but it limits the number of ways to save on your tax bill.

As already mentioned, this shortest personal return restricts filers to claiming just one credit: the earned income tax credit, or EITC, a tax break designed to help out individuals who dont make much money.

You also need to look at those other two individual tax returns to take advantage of additional income adjustments and tax credits.

RATE SEARCH: Looking for a high-yielding savings account? Compare rates at Bankrate.com today!

Is This Guide For You

This guide is for individuals who have opened or who are considering opening a tax-free savings account . It gives general information on this investment opportunity including who is eligible to open a TFSA, what the contribution limits are, possible tax situations, non-resident implications, transfers on marriage or relationship breakdown, what happens when a TFSA holder dies, and various other topics. For more information on the TFSA, go to Tax-Free Savings Account.

This guide does not deal with every tax situation. It is not intended to cover all possible situations or to replace professional financial, tax, or estate planning services.

As with other important investment decisions, you should speak with your financial advisor or a representative at your financial institution to be sure you are aware of any conditions, limitations, or administrative fees that can apply.

We have included definitions of some of the terms used in this guide in the Definitions section. You may want to read this before you start.

Recommended Reading: Doordash Paying Taxes