Iowa Local Option Remedial Action Iowa Code Section 427b20

Description: Provides a credit for a portion of the property taxes, not to exceed the actual costs paid by the owner or operator of an underground storage tank in connection with a remedial action for which the Iowa comprehensive petroleum underground storage tank fund shares in the cost of corrective action.

Eligibility: By ordinance of a county board of supervisors or a city council as described in 427B.20.3

Filing Requirements: Must be filed with your county board of supervisors or city council by September 30 of each year.

Form: Local Option Remedial Action Credit

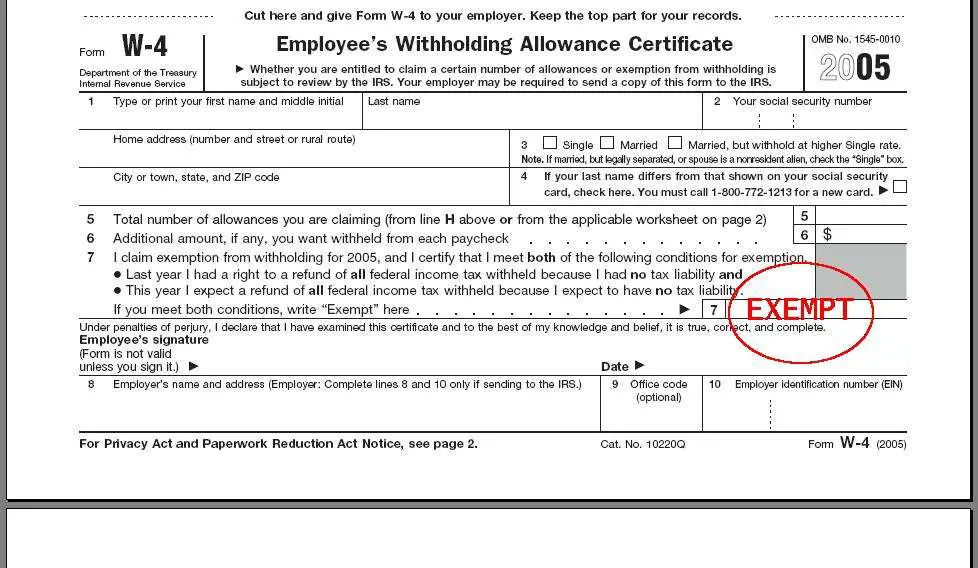

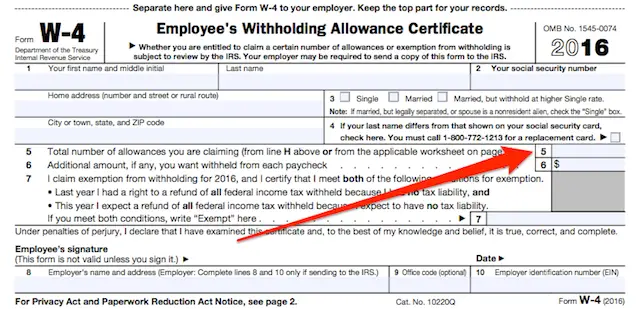

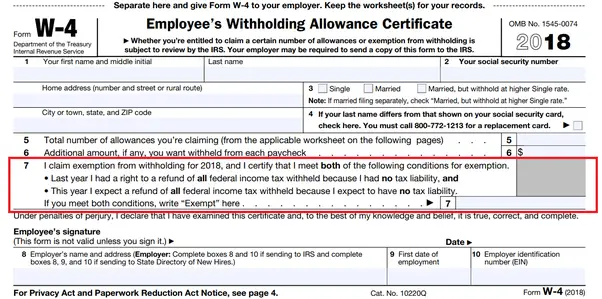

There Was A Substantial Change In The W

The W-4 has undergone a substantial change lately. Prior to 2020, employees could claim allowances on their W-4 to lower the tax withheld. However, the 2017 Tax Cuts and Jobs Act overhauled a lot of tax rules, which did away with personal exemptions. This change is a good reason to revise your W-4 based on your recent tax returns. If there has been a big personal life change like marriage or divorce, the birth of a child, or a new side job, it might also be a good idea to update your W-4.

The new W-4 still requires basic personal information but doesn’t ask for a number of allowances or personal exemptions. Employees who want to lower their tax withholding can still claim dependents. You can still increase or decrease your withholding amount based on factors like a second job or your eligibility for itemized deductions.

Sh Block Tax Services Is Here To Help With All Of Your Tax Needs

At S.H. Block Tax Services, we have the skill and experience taxpayers need to file accurate, timely, and complete tax returns in accordance with the ever-changing tax code. And if you need help or advice in tracking down important receipts or other financial documents, were here to help.

If youd like to learn more about our firm and how we can help with any tax issues or liabilities you have, please contact us today by calling or completing this brief form.

The contentprovidedhere isfor informational purposes only and should not be construed aslegal advice on any subject. Please read our full disclaimerhere.

You May Like: How To File Taxes Working For Doordash

The Effect Of Exemptions On Refunds

Obviously, its better to claim too few allowances than too many, but this isnt ideal either. Youre effectively using the IRS as a savings account when you claim fewer allowances than you have to. Too much in the way of tax is withheld from your pay.

You and the IRS will realize that you overpaid when you complete and file your tax return. The IRS will obligingly send you a refund for the amount you overpaid. Youll get that money back, but the IRS doesnt pay interest. It gets to use your money for the year, then just give it back to you. Your money would be better off sitting in even a low-interest savings account.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify forGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Doordash Taxes Calculator

Can I Claim Capital Gains Exemption Under Section 54 On Sale Of Multiple Properties

Can I claim capital gains exemption under section 54F on sale of multiple properties? A taxpayer who sells multiple properties and invests all proceeds into one house can claim an exemption under section 54F .

What property qualifies for lifetime capital gains exemption?

When you make a profit from selling a small business, a farm property or a fishing property, the lifetime capital gains exemption could spare you from paying taxes on all or part of the profit youve earned.

What is the capital gain exclusion for primary residence?

If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.

What is the capital gains exemption for 2021?

You may qualify for the 0% long-term capital gains rate for 2021 with taxable income of $40,400 or less for single filers and $80,800 or less for married couples filing jointly.

Claiming Exemption From Withholding Starting January 1 2020

A new W-4 form is now in effect, starting January 1, 2020, for all new hires and employees who want to change their W-4 forms. If an employee wants to claim exemption, they must write “Exempt” on Form W-4 in the space below Step 4 and complete Steps 1 and 5.

An employee who wants an exemption for a year must give you the new W-4 by February 15 of that year. If an employee who is currently getting a tax exemption expects to owe tax for the next year, they must change their W-4 by December 10th of the current year.

Don’t Miss: Do I Have To Pay Taxes For Doordash

When Should I Claim Exempt On My W4

One may claim exempt from 2020 federal tax withholding if they BOTH: had no federal income tax liability in 2019 and you expect to have no federal income tax liability in 2020. If you claim exempt, no federal income tax is withheld from your paycheck you may owe taxes and penalties when you file your 2020 tax return.

How Long Do You Need To Live In A House To Avoid Capital Gains Tax

In the interest of avoiding capitals gains tax, youll need to live in the property for a minimum of six months for it to be considered your main residence before moving out and using it as an investment property. After that period, you can move out of your main residence and rent it out for up to six years.

You May Like: Does Doordash Take Taxes Out Of Your Check

Circumstances When You Cant Claim Exempt

- If an employee makes at least $950 in the tax year and at least $300 of that income is from non-work related income, i.e. dividend distribution, then he or she cant claim exempt on the W-4 form.

- If an employee will be claiming dependents on the tax return, then he or she cant claim exempt.

- If an employee plans to itemize deductions, then they cant claim exempt.

- If you are 65 or older or blind, you must look at IRS Worksheet 1-3 or 1-4 to verify if you are exempt.

Last Chance To Qualify

The IRS gives you a three-year grace period to file your tax returns, making this the last year you can file for 2017. If you realized you missed out on claiming exemptions for periods prior to 2017, you’re too late.

Although you can no longer enjoy the personal exemptions for tax years from 2018 to 2025, there is still a suite of other benefits that can help reduce taxable income, including deductions and tax credits. It always makes sense to look for ways to cut your tax bill when you can.

Recommended Reading: Doordash How To File Taxes

How Can You Use 4 4 And 4 For Withholding Tax

You can estimate your income from other sources like a second job, capital gains, and interest on investments by updating line 4 of your W-4. If you plan to itemize deductions instead of claiming a standard deduction , you can estimate those extra deductions and change line 4 on Form W-4.

If you want a specific amount of extra money withheld from your paycheck, you can indicate that on line 4 of the form. These line items will make a change in the tax being withheld from your pay in each period.

Tax withholding occurs throughout the year. The earlier you check, the more time there is for withholding to take place evenly. See the #IRS FAQs on performing a #PaycheckCheckup:

What Are Withholding Allowances

Exemptions go hand-in-hand with the allowances you claim on the W-4 form you submit to your employer. Your employer bases the amount of tax withheld from each of your paychecks and subsequently forwarded to the IRS on your behalf on the information you include on this tax form, including your filing status and the number of allowances you want to claim.

The more allowances you claim, the less money is deducted from your pay and sent to the IRS. You can claim up to two allowances if youre single and working just one job. You can claim up to three allowances if youre married, filing jointly, and you but not your spouse work one job. Things get trickier if you have kids. Now your available allowances are based on your income, but the IRS provides instructions and a worksheet online to help you figure it out.

So what happens if you claim too many or too few allowances? Youll notice the effect at tax time. If you claim too many, youll find that not enough money was withheld from your pay so youll owe the IRS. You might even owe an underpayment penalty.

Read Also: Reverse Ein Lookup

Agricultural Taxes: The Basics

If youre a farmer, youre no doubt familiar with the complicated tax landscape for farmers in this country and you may even use a tax accountant to help you get as many tax breaks as youre eligible for. If you can prove that you farm as a business and not just for recreation, you can get both property tax breaks and income tax breaks.

But you dont have to be a full-time farmer to take advantage of agricultural tax breaks that will help you with your property taxes. In some cases, all you need is a piece of land thats not currently being used. You can say that the land is preserved wilderness, or put it to some kind of agricultural use to save on property taxes.

The size of agricultural property tax exemptions varies from state to state because property taxes arent administered at the federal level. Qualifications for agricultural tax exemptions vary from state to state, too. Some states base eligibility on the size of the property, while others set a minimum dollar amount for agricultural sales of goods produced on the property. Many use a combination of gross sales and acreage requirements. Grazing a single cow on your property can be enough to trigger series tax breaks in some places.

The Tax Exempt Definition Is Slightly Different

The term tax-exempt relates to sources of income that arent taxable and legal entities that arent subject to taxation, such as churches and certain charities. Its slightly different from tax exemption. One refers to income and the other refers to deductions you can take from income.

Tax-exempt income sources include things like the value of health insurance provided by your employer, life insurance proceeds and inheritances.

You May Like: Doordash Independent Contractor Taxes

Iowa Mobile Home Reduced Tax Rate

Description: Enacted as a supplement to the Disabled and Senior Citizens Property Tax Credit. The objective is to provide mobile, manufactured and modular home owners with equivalent aid.

Eligibility: Must be an Iowa resident, 23 or older and meet annual household low income requirements.

Filing Requirements: On or before June 1 of each year, each mobile, manufactured and modular home owner eligible for a reduced tax rate must file a claim with the county treasurer. The county treasurer or the director may grant an extension of time to file.

What Are Tax Exemptions

Tax return exemptions are amounts of money youre permitted to subtract from your taxable income as you prepare your return. Heres a tax exemption example in very basic terms: You earned $45,000 last year. Youre entitled to claim a $2,000 exemption. Now you only have to pay taxes on $43,000 in income.

Technically, any tax deduction is an exemption. There are three kinds: itemized deductions, the standard deduction and above-the-line adjustments to income.

Unfortunately, you cant claim both itemized deductions and the standard deduction. You must choose between these options at tax time, so it only makes sense to claim the one that results in a larger overall exemption when you add up all your qualifying itemized expenses. But you can claim adjustments to income in addition to itemizing or claiming the standard deduction.

You May Like: How Does Doordash Do Taxes

Iowa Historic Property Rehabilitation Tax Exemption Iowa Code Section 42716

Description: Property approved by the assessor is eligible for a property tax exemption for up to four years if it meets the definition of historic property.

Eligibility: The property must meet the requirements found in Iowa Code section 427.16.

Filing Requirements: Must be filed, mailed, or postmarked to your city or county assessor by February 1 of the assessment year.

Form: Historic Property Rehabilitation Exemption

Line 13010 Taxable Scholarships Fellowships Bursaries And Artists’ Project Grants

Note: Line 13010 was line 130 before tax year 2019.

Report amounts that you received as a scholarship, fellowship or bursary, or a prize for achievement in a field of endeavour ordinarily carried on by you that were not received in connection with your employment or in the course of business, to the extent that these amounts are more than your scholarship exemption. If you received a research grant, see Line 10400 Other employment income.

Elementary and secondary school scholarships and bursaries are not taxable.

A post-secondary program that consists mainly of research is eligible for the scholarship exemption, only if it leads to a college or CEGEP diploma, or a bachelor, masters, or doctoral degree . Post-doctoral fellowships are taxable.

Don’t Miss: Doordash Driver Tax Calculator

Am I Exempt From Federal Withholding

You use a Form W-4 to determine the determine how much federal tax withholding and additional withholding you need from your paycheck. Form W-4 tells an employer the amount to withhold from an employees paycheck for federal tax purposes.

As you fill out the form whether you take a new job or have a major life change you might wonder am I exempt from federal withholding?

This May Be Your Last Chance To Claim Them For Quite Some Time

Tax exemptions can work wonders for your return, giving you the opportunity to pay less tax and stash away more cash. But if you didn’t take advantage of personal and dependent tax exemptions before the implementation of the Tax Cuts and Jobs Act of 2017, you can very likely forget about them, at least until 2025. They’re only available to those who still need to file or amend a 2017 tax return by April 15, 2021 .

Here’s what to keep in mind as you maneuver through the tax filing process and recall the days when tax exemptions were a big deal. Even if you don’t qualify for the normal tax exemptions, there are still ways to reduce your tax bill.

You May Like: Doordash Income Tax

Are There Any Exceptions

In some cases, claiming exempt is just not an option. Below are some reasons why it may not be for you:

- If your income is $950 or more and at least $300 of that is from un-work-related income , then you cannot claim exempt from taxes.

- If you plan to claim dependents on your tax return, then you cannot claim exempt from taxes.

- If you will be itemizing your deductions on your tax return for the year, then you cannot claim exempt from taxes.

- If you are Age 65+ or blind, you must use IRS Worksheet 1-3 or 1-4 to determine if you can claim exempt.

Iowa Pollution Control And Recycling Exemption

Description: Provides an exemption for certain pollution control and recycling property.

Eligibility: Exemption is limited to market value of property used primarily for pollution control or recycling. Must be certified as eligible by the Iowa Department of Natural Resources.

Filing Requirements: Application must be filed with the assessor no later than February 1.

Form: Pollution Control and Recycling Property Tax Exemption

Read Also: Do You Have To Report Income From Plasma Donations

What Does Exempt Mean

Generally, the IRS will issue a tax refund when you pay more tax than what is actually owed in that specific tax year. When you file exempt with your employer, however, this means that you will not make any tax payments whatsoever throughout the tax year. Therefore, you will not qualify for a tax refund unless you are issued a refundable tax credit. Come tax season, your employer will provide you with Form W-2, which identified the total amount of taxes that was withheld throughout the year. If your tax liability is less than the amount withheld, the IRS will issue you a tax refund for the difference.

Who Qualifies For A Fica Refund

Who Qualifies for a FICA Tax Refund? If you are in the United States on an F-1, J-1, M-1, Q-1 or Q-2 visa or are classified as a non-resident immigrant, you qualify for a FICA tax refund. The refund also applies to those who overpay the system once they reach the wage base limit of $142,800 in 2021.

Recommended Reading: Doordash 1099-nec Schedule C