Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Continued Existence In Pennsylvania And Received Decennial Report

The Decennial Report is used by the Pennsylvania Department of State, not the Department of Revenue. The state department requires most all entities registered to do business in Pennsylvania to identify business names and marks that are no longer in use. That way, the state may reissue the name and place it back into the stream of commerce. The decennial report must be filed every ten years. The form Decennial Report of Association Continued Existence must be completed and mailed with the payment.

If the report is not timely filed, the entity is deemed to be no longer registered with the Department of State and registration may be restored only by filing an original application of registration. The business may also lose exclusive rights to use of its name on or after January 1, 2022.

Further information can be found on the state website. Please let us know if you have any questions or would like to discuss.

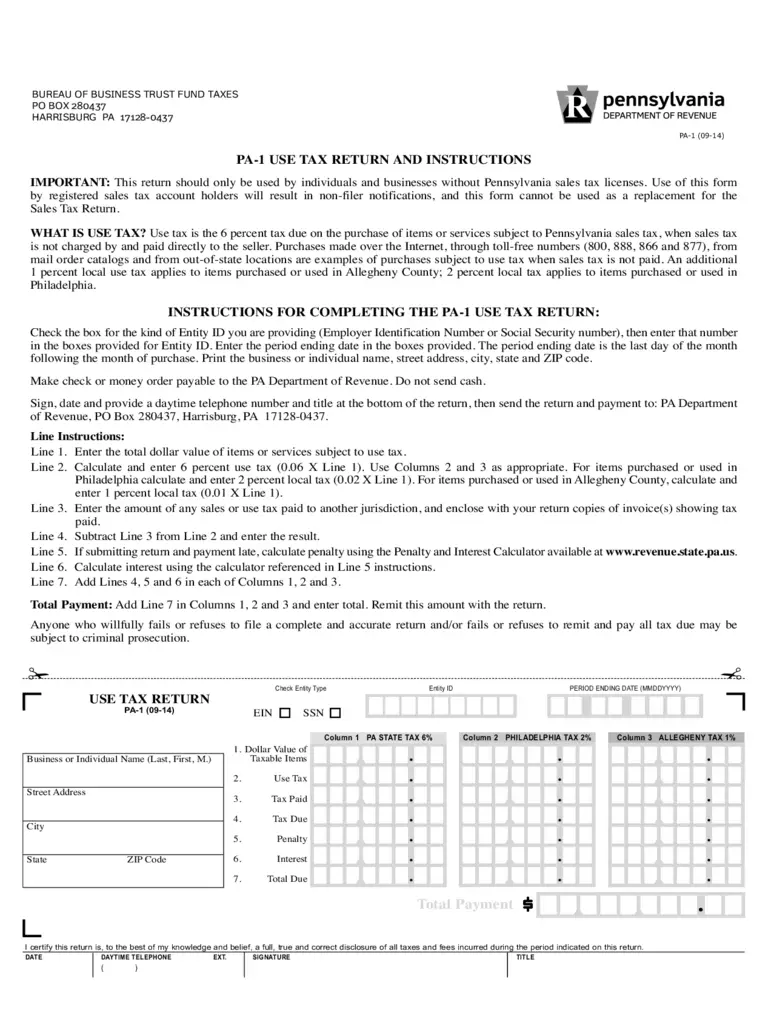

Filing Your Pennsylvania Sales Tax Returns Online

Pennsylvania supports electronic filing of sales tax returns, which is often much faster than filing via mail.

Pennsylvania allows businesses to make sales tax payments electronically via the internet.

You can process your required sales tax filings and payments online using the official Pennsylvania e-TIDES website, which can be found here . You should have received credentials to access your Pennsylvania e-TIDES account when you applied for your Pennsylvania sales tax license.

Simplify Pennsylvania sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Recommended Reading: How Much Does H & R Block Charge For Taxes

Wheres My State Tax Refund Utah

You can check the status of your refund by going to the states Taxpayer Access Point website. On that page you can find the Wheres My Refund? link on the right side.

Due to identity protection measures, the Utah State Tax Commission advises that taxpayers should allow 120 days for a refund to get processed. The earliest you can hope for a refund is March 1.

Tips For Managing Your Taxes

- Your taxes should be accounted for in your long-term financial plan. If you need professional guidance on how to build a financial plan, consider working with a financial advisor. SmartAssets free matching tool can pair you with up to three advisors in your area. Get started now.

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule to give you an idea of when to expect your refund.

Don’t Miss: Where Is My State Refund Ga

Wheres My State Tax Refund Oklahoma

In order to check the status of your state tax refund, visit Oklahoma Tax Commission page and click on the Check on a Refund link. From there you can get to the Oklahoma Taxpayer Access Point. You will need to log in with the last seven digits of your SSN or ITIN, the amount of your refund and your zip code.

If you e-filed, you can generally start to see a status four days after the Oklahoma Tax Commission receives your return. Paper filings will take longer an you should wait about three weeks before you start checking the status of a refund. Once a refund has been processed, allow five business days for your bank to receive the refund. If you elect to get a debit card refund, allow five to seven business days for delivery.

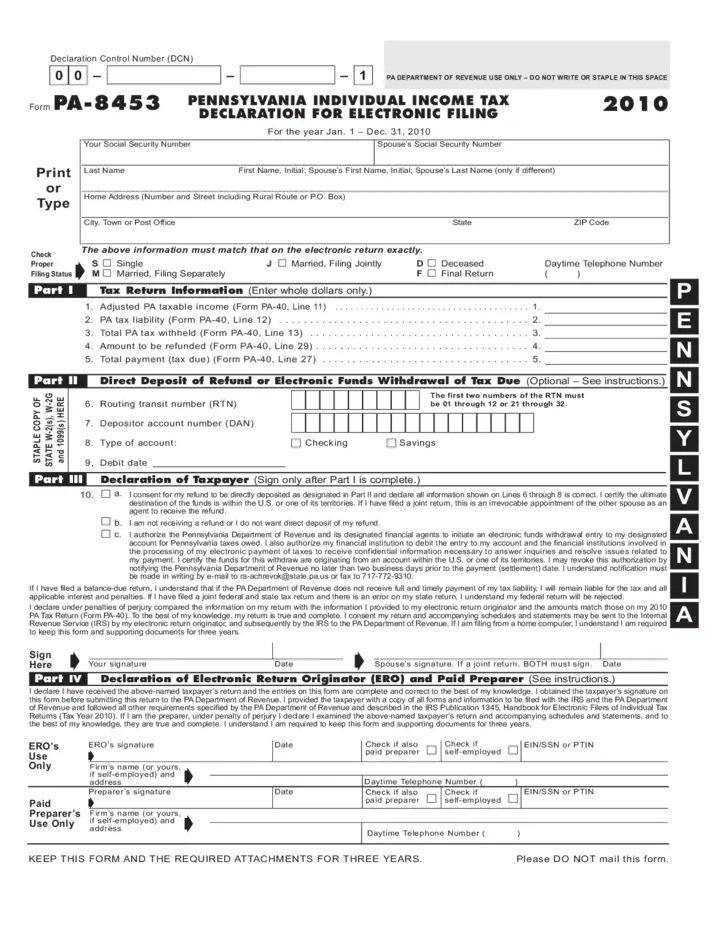

Wheres My Refund Pennsylvania

Check the status of your Pennsylvania state refund online at .

You will be prompted to enter:

- Your Social Security number

- The amount of your requested refund

Services for taxpayers with special hearing and/or speaking needs are available by calling .

Your refund status will be updated daily. If the refund status has not changed or additional information is not being requested, the return still may be awaiting a routine review. You can continue to check your refund status online. Submit a question or contact the states Customer Experience Center for additional information at , between the hours of 7:30 a.m. and 5:00 p.m. .

If you filed electronically it can take one to three business days to post to the system. For paper filed PA-40 returns it can take eight to 10 weeks from the date the return was mailed for it to post to the system. Additionally, it may take approximately four weeks for your return to be reviewed and processed.

You May Like: What Does H& r Block Charge

Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measure to prevent fraudulent returns and this has increased processing times.

Wheres My State Tax Refund New Jersey

New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. You will need to enter your SSN and the amount of your refund.

You can also check the status of a refund using the automated phone inquiry system. The automated system can tell you if and when the state will issue your refund. It cannot give you information on amended returns. The number is 1-800-323-4400 or 609-826-4400. Both options are available 24 hours a day, seven days a week.

In general, electronic tax returns take at least four weeks to process. Paper returns take significantly longer at a minimum of 12 weeks. If you send a paper return via certified mail, it could take 15 weeks or more to process.

Don’t Miss: File Missouri State Taxes Free

Wheres My State Tax Refund North Carolina

Tracking your refund is possible by visiting the website of North Carolinas Department of Revenue and clicking on Wheres My Refund? You can expect processing of your refund to take, on average, six weeks from the date your return is received. If 12 weeks have gone by and you still havent gotten your refund, you should contact the Department of Revenue.

Filing And Payment Deadline

For 2019 state taxes, the state has extended the filing and payment deadline. Pennsylvania residents now have until July 15, 2020 to file their state returns and pay any state tax they owe. As with the federal deadline extension, Pennsylvania wont charge interest or apply penalties to unpaid balances between April 15 and July 15, 2020.

While this year is a little different, generally you must file and pay your Pennsylvania state income tax each year by April 15. If that falls on a holiday or a weekend, youll get a brief reprieve since taxes will then be due the next business day.

You May Like: Www.1040paytax.com

Can I File And Pay My Taxes Online

Yes. For your convenience we have online filing and payment available for the current year and some prior years. Please see the online filing link on our web page.

A PIN is required for online filing. If you did not receive a PIN number with your tax return, please contact the tax office at 590-7997. Once your identity has been verified, a unique PIN number will be assigned to you.

How To Pay Pennsylvania Sales Tax

Step 1: To get started, select the payment type you would like to use to pay your sales tax.

Step 2: enter the amount of payment and your bank information. If you have filed and paid a return with Pennsylvania before, your bank account information may already be saved.

Always make sure to save or print the submission confirmation.

You May Like: How To Get Tax Preparer License

Pennsylvania Provides Guidance On Deductibility Of Federal Employee Retention Credit

The Employee Retention Credit under the CARES Act encourages businesses to keep employees on their payroll. According to the IRS, the refundable tax credit is 50% of up to $10,000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19. Any reduction to the wage expense for federal tax purposes that is a result of a credit against taxes withheld from the employee would be deductible for Pennsylvania Personal Income Tax purposes. Any reduction to the wage expense for federal tax purposes that is a result of a credit against the employers own FICA liability would not be deductible for Pennsylvania Personal Income Tax purposes.

Get Daily News Weather And Breaking News Alerts Straight To Your Inbox Sign Up For Abc27 Newsletters Here

The letters are being sent to Pennsylvanians who the department believes may be eligible for refunds through the commonwealths Tax Forgiveness program. The recipients of the letter will be encouraged to file a Pennsylvania Personal Income Tax Return to claim their refunds.

Refunds available through the Tax Forgiveness program can be up to $1000, depending on a residents income and the number of dependent children.

We want to reach as many Pennsylvanians as possible who are eligible for this program to let them know that their refunds are waiting for them, Revenue Secretary Dan Hassell said. If you have a neighbor, friend, or family member whom you think may be eligible for this program, please encourage them to check their eligibility and file a tax return with our department.

According to the most recent data, the Department of Revenue estimates there are tens of thousands of Pennsylvania taxpayers who would qualify for Tax Forgiveness but do not file an income tax return with the commonwealth to claim the benefit.

How to File a PA-40 and Claim Tax Forgiveness

One easy way to file your Pennsylvania Personal Income Tax Return and the required additional form, Schedule SP, is by using myPATH, the Department of Revenues free, online tax filing system.

Recommended Reading: Can Home Improvement Be Tax Deductible

Cell Phone & Electronic Device Policy

Effective April 24, 2017, the Board of Directors enacted a policy prohibiting the use of cell phones or other electronic recording devices by visitors in the lobby of either of the Tax Bureau offices. The purpose of this policy is to protect confidential taxpayer information which may be discussed or open to view in the office. Telephone calls and cell phone usage must be continued outside.

What Is State Tax

State income tax is a tax assessed by a state on income earned during the tax year either while living or working within the state. State income taxes, which vary by state, are a percentage of money that you pay to the state government based on the income you make at your job.

Similar to federal taxes, it is self-assessed and often based on a percentage you pay the state government on your income. Some states have a flat tax rate or no tax at all, even.

Also Check: How Can I Make Payments For My Taxes

Wheres My State Tax Refund Kentucky

Check the status of your Kentucky tax refund by visiting the revenue departments Wheres My Refund? page.

If you e-filed and opted for direct deposit, you can expect your refund in two to three weeks. Getting a refund as a paper check will take three to four weeks. If you filed a paper return, youre refund will take significantly longer to arrive. The state says it could take eight to 12 weeks.

The Wheres My Refund Page only allows you to check the current years tax return. The status of previous tax returns are available if you call 502-564-4581 and speak to an examiner. It may take more than 20 weeks to process prior year tax returns.

What Can Cause A Delay In My Pennsylvania Refund

There are a number of reasons why your Pennsylvania state refund may be delayed, including the following:

- If the department needs to verify information reported on your return or request. additional information, the process will take longer.

- If you have math errors on your tax return or have other adjustments.

- If you used more than one form type to complete your tax return.

- If your tax return was missing information or incomplete.

Also Check: Buying Tax Liens California

How Do You Pay Pa Income Tax

To pay PA income tax, the Pennsylvania Department of Revenue says, you can pay the following ways:

+ Via electronic funds transfer from your bank account or by using a credit or debit card.

+ Via Electronic Funds Transfer : Pay Pennsylvania taxes directly through your personal savings or checking account through the departments e-Services Center.

+ Credit or Debit Card Payments: Visit www.officialpayments.com or call, toll-free, at .

When I Completed My Local Tax Return I Found That My Employer Did Not Withhold Any Local Income Tax If I Cannot Pay In Full Before April 15th Can I Be Put On A Payment Plan For The Unpaid Balance

It is recommended that an effort is made to pay the tax due in full prior to April 15th. Any amount outstanding after that date will accrue penalties and interest until paid in full. Payments can be made by cash, check or credit card. A third party processor is used for all credit card transactions . Transactions processed through www.OfficialPayments.com are subject to a convenience fee equal to 3% of the payment total. There is a $1.00 minimum convenience fee that will remain with the third party.

To be approved for a 4 month payment plan, you must first show that your current years taxes are paid up to date either through employer withholding or by direct payment of your tax liability, as calculated based on your most current pay stub. Taxes paid after April 15th, even if paid through an installment plan, will accrue penalties and interest until paid full.

If you find that your employer is not withholding the local income tax, you should start making estimated quarterly payments during the current tax year so that the same situation does not repeat itself when you file next years local tax return.

Read Also: How To Buy Tax Liens In California

Need More Tax Guidance

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you get the support you need when it comes to filing taxes.

Need to check the status of your federal refund? Visit our Wheres My Refund page to find out how soon youll receive your federal refund.

Related Topics

Whether you have to file state taxes depends on a few factors. In some cases, you may not be required to file state taxes if you only lived in the state a short time or if your income is below a certain level.

Learn whether you can deduct closing cost after a home refinance with advice from the tax experts at H& R Block.

Who Pays The Tax

The Earnings Tax is a tax on salaries, wages, commissions, and other compensation paid to a person who works or lives in Philadelphia.

You must pay the Earnings Tax if you are a:

- Philadelphia resident with taxable income who doesnt have the City Wage Tax withheld from your paycheck.

- A non-resident who works in Philadelphia and doesnt have the City Wage Tax withheld from your paycheck.

The most common situation for filing and paying the Earnings Tax is when a Philadelphia resident works for an out-of-state employer. Out-of-state employers are not required to withhold Philadelphias Wage Tax if they dont have a physical location within Pennsylvania or arent subject to the Business Income and Receipts Tax. When no Wage Tax is withheld, Philadelphia residents must file and pay the Earnings Tax themselves.

The City of Philadelphia is not a party to any reciprocal tax agreements with any other municipality. Residents of Philadelphia who are employed out-of-state may be required to file and pay a local income tax in that jurisdiction in addition to the Philadelphia Earnings Tax. Non-residents of Pennsylvania cant claim a tax credit against Philadelphia Earnings Tax for income taxes paid to any other state or political subdivision.

If you are self-employed, you pay the following taxes instead of the Earnings Tax:

Also Check: How Much Does H& r Block Charge To Do Taxes