How To Track Your Refund Using The Irs’ Where’s My Refund Tool

To use the IRS tracker tools, you’ll need to provide your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure it’s been at least 24 hours before you start tracking your refund, or up to four weeks if you mailed your return.

Go to the Get Refund Status page on the IRS website and enter your personal data, then press Submit. You should be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

Tax Season Opens Soon

The IRS has announced that tax season will open Monday, January 24, 2022.

Some folks have suggested that a January start date is earlybut Im guessing they have a short memory. Its true that tax season opened a little later in 2021on February 12, 2021but thats an outlier due to the pandemic. The January 24, 2022, tax season open is on par with the open dates for the past few yearsJan. 27 in 2020, Jan. 28 in 2019, and Jan. 29 in 2018. In fact, other than last year, the agency has opened tax season in late January for more than a decade.

File Your Tax Return Electronically

Combining both direct deposit and electronic filing can greatly speed up your tax refund. Since filing electronically requires the use of a tax software program, it can flag errors that may cause processing delays by the IRS. These errors may include incorrect Social Security numbers, dependents dates of birth, and misspelling of names.

You can electronically file your tax return for free using the IRS Free File Program if your adjusted gross income is less than $72,000. Most simple tax returns can also generally be filed for free, although you may be charged to file your state taxes.

If your tax situation is more complicated if you sold property, paid business expenses or earned investment or business income, for exampleyou should consider hiring a tax professional. Having a knowledgeable tax professional, such as an enrolled agent, certified public accountant or other tax professional can help review your tax return and identify any mistakes that may slow down the processing of your tax refund.

Also Check: How To Calculate Mileage For Doordash

Why Might A Tax Extension Request Be Rejected

Nine times out of ten, if you file on time and fill out the form correctly, you should have no issue getting an extension.

In most cases, applications are rejected for minor discrepancies that can easily be rectified. If it comes down to a misspelling or providing information that doesn’t corroborate with IRS records, the tax authority will usually give you a few days to sort out those errors and get the form filed againthis time accurately.

The IRS tends to take less kindly to unrealistic tax liability estimates. If it disagrees with your figures, your application for an extension may be denied and you could even be hit with a penalty.

Tax Filing Season Begins Feb 12 Irs Outlines Steps To Speed Refunds During Pandemic

IR-2021-16, January 15, 2021

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Friday, February 12, 2021, when the tax agency will begin accepting and processing 2020 tax year returns.

The February 12 start date for individual tax return filers allows the IRS time to do additional programming and testing of IRS systems following the December 27 tax law changes that provided a second round of Economic Impact Payments and other benefits.

This programming work is critical to ensuring IRS systems run smoothly. If filing season were opened without the correct programming in place, then there could be a delay in issuing refunds to taxpayers. These changes ensure that eligible people will receive any remaining stimulus money as a Recovery Rebate Credit when they file their 2020 tax return.

To speed refunds during the pandemic, the IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need. People can begin filing their tax returns immediately with tax software companies, including IRS Free File partners. These groups are starting to accept tax returns now, and the returns will be transmitted to the IRS starting February 12.

Last year’s average tax refund was more than $2,500. More than 150 million tax returns are expected to be filed this year, with the vast majority before the Thursday, April 15 deadline.

Also Check: Wheres My Refund Ga State

Double Check Your Tax Return Before You File

Double checking your tax return prior to submission can ensure your tax refund is processed quickly. Failure to do so may cause the IRS to delay the processing of your tax refund.

Here is a list of questions to review prior to filing your tax return to ensure the IRS processes your tax refund as quickly as possible.

- Did I review my identifying numbers for myself, spouse and dependents?

- Did I ensure the names on my tax return are spelled correctly?

- Did I review my dependents information?

- Have I reviewed my banks routing and account numbers for accuracy?

- Did I include the correct date of birth for myself and dependents

- Did I electronically sign my tax return ?

Are Michigan State Taxes Delayed This Year

What if I receive another tax form after Ive filed my return? If youve already e-filed or mailed your return to the IRS or state taxing authority, youll need to complete an amended return. If youve already e-filed or mailed your return to the IRS or state taxing authority, youll need to complete an amended return.

You May Like: Door Dash Tax Form

When Does The Irs Start Accepting Tax Returns

The IRS has announced that the 2020 tax season will begin on January 27th. The beginning of tax season marks the first day that the IRS will accept individual electronic returns and start processing traditional paper returns.

Soon, you and more than 150 million of your fellow Americans will be sifting through tax information and preparing returns or have them prepared for you. In 2018, tax preparers filed nearly 79.5 million electronic returns. In 2019, the industry employed 314,413 tax practitioners in 134,475 businesses and created $11 billion in revenue. Expect tax preparers to be even busier in 2020 due to the tax laws in effect.

You may have an alternative to paying for tax services. About 70% of American taxpayers are eligible to save money by using IRS Free File. The IRS and their commercial partners supply free software to families or individuals making less than $69,000. This software can help you file your taxes without the need of outside assistance.

Regardless of who prepares your taxes, you have until April 15 to file a return or an extension.

Tax Brackets and Tax Rates for 2019 Returns

How much tax revenue does the IRS take in?

During the last fiscal year, the federal government raked in $3.56 trillion in revenue. That works out to almost $11,000 for every man, woman and child in the U.S. Individual income taxes accounted for $1.95 trillion of that total.

Expecting a Tax Refund?

What To Do Once Your Refund Arrives

For many people, their IRS tax refund is the biggest check they receive all year, the IRS says. In anticipation of your windfall, its wise to have a plan for how youre going to use your windfall. Deciding how to spend, save or invest the money in advance can help stop the shopping impulse from getting the best of you.

Your refund is yours to use how you see fit and can be used to help pay for day-to-day expenses or invested for long-term financial stability.

If youre expecting a refund, put it to good use. Looking for inspiration? Bankrate offers five smart ways to invest your tax refund.

Also Check: Taxes For Door Dash

What About My State Tax Refund

What weve covered so far applies to federal tax refunds. As you might expect, every state does things a little differently when it comes to issuing tax refund.

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive or longer, if your state has been or still is under social distancing restrictions. To find out the status of your refund, youll need to contact your state tax agency or visit your states Department of Revenue website.

Tax Filing Season Begins Feb 12 Irs Outlines Steps To Speed Refunds During Pandemic

IR-2021-16, January 15, 2021

WASHINGTON The Internal Revenue Service announced that the nations tax season will start on Friday, February 12, 2021, when the tax agency will begin accepting and processing 2020 tax year returns.

The February 12 start date for individual tax return filers allows the IRS time to do additional programming and testing of IRS systems following the December 27 tax law changes that provided a second round of Economic Impact Payments and other benefits.

This programming work is critical to ensuring IRS systems run smoothly. If filing season were opened without the correct programming in place, then there could be a delay in issuing refunds to taxpayers. These changes ensure that eligible people will receive any remaining stimulus money as a Recovery Rebate Credit when they file their 2020 tax return.

To speed refunds during the pandemic, the IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need. People can begin filing their tax returns immediately with tax software companies, including IRS Free File partners. These groups are starting to accept tax returns now, and the returns will be transmitted to the IRS starting February 12.

Last years average tax refund was more than $2,500. More than 150 million tax returns are expected to be filed this year, with the vast majority before the Thursday, April 15 deadline.

Don’t Miss: Sales Tax In Philadelphia

Do I Qualify For Irs Free File

If your adjusted gross income was $73,000 or less in 2021, you can use free tax software to prepare and electronically file your tax return, according to IRS instructions online for the 2021 tax season.

Taxpayers who earned more can use Free File Fillable Forms, the electronic version of the federal tax forms, to file their tax returns online. Go to IRS.gov to learn more.

Is It Easy To File A Tax Extension

Yes, securing an extension is a fairly straightforward process. All you need to do is get Form 4868, fill it out, and then send it off to the IRS, either electronically or by post, before the deadline. The form itself isn’t very long, although coming up with an estimate of your total tax liability in the tax year can sometimes be tricky.

Don’t Miss: Does Doordash Send A 1099

How Can You Get A Head Start On Filing Your Tax Return In 2022

Although the IRS isnt ready to begin accepting 2021 tax returns just yet, that doesnt mean that you cant get a head start on preparing your tax paperwork. While employers are required to issue W-2s by January 31, 2022, some of them might have already started sending them out.

If you received your W-2s, put them aside until you have gathered all the tax forms you will need to file. Youll also want to be sure that you document any cryptocurrency you earned through digital sales since the IRS will be asking for this.

If youre ready to start filling out your return, companies like TurboTax are already allowing you to input your information into their system so that once the IRS opens its doors for 2021 tax returns, your return is ready to submit.

Before you submit your return for processing, remember to check your figures and information to ensure that it’s correct. This year, the IRS is urging anyone who received CTCs in 2021 to input the exact amounts they received when filing their 2021 tax return. If the figures dont match with the IRSs database, this will delay the processing of your return and the issuance of your refund.

As you #GetReady for tax season, #IRS suggests you check on your advance #ChildTaxCredit payments using an online account. Families will need to compare the payments they received in 2021 with the credit amount they can claim on their 2021 tax return.

When Will I Get My Tax Refund

The Wheres My Refund? tool lets you check the status of your refund through the IRS website or the IRS2Go mobile app. If you submit your tax return electronically, you can check the status of your refund within 24 hours. But if you mail your tax return, youll need to wait at least four weeks before you can receive any information about your tax refund. Keep in mind that usually you can file your taxes in January.

In order to find out the status of your tax refund, youll need to provide your Social Security number , filing status and the exact dollar amount of your expected refund. If you accidentally enter the wrong SSN, it could trigger an IRS Error Code 9001. That may require further identity verification and delay your tax refund.

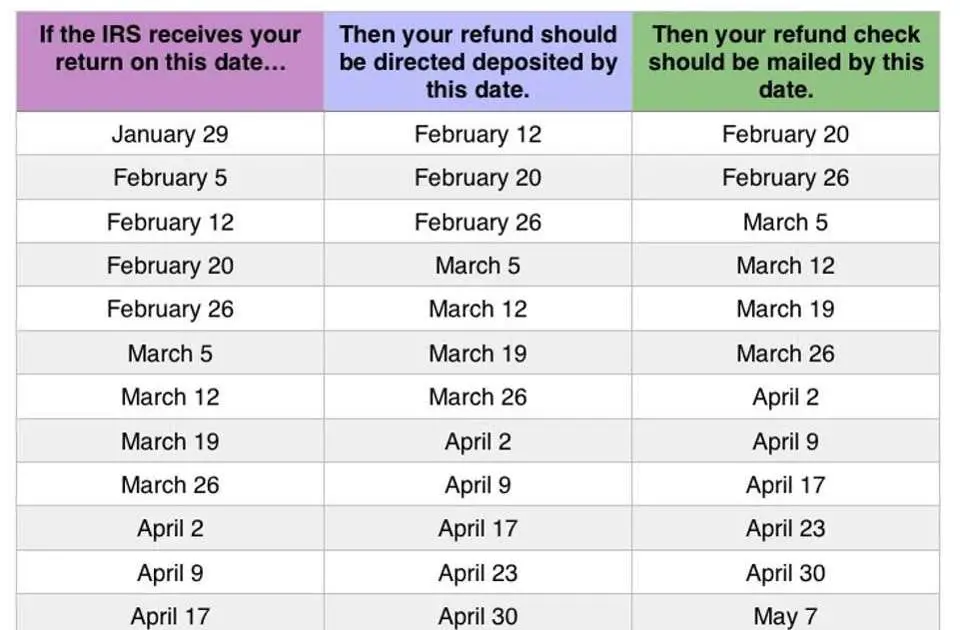

Most taxpayers receive their refunds within 21 days. If you choose to have your refund deposited directly into your account, you may have to wait five days before you can gain access to it. If you request a refund check, you might have to wait a few weeks for it to arrive. The table below will give you an idea of how long youll wait, from the time you file, until you get your refund.

| Federal Tax Refund Schedule | |||

| Paper File, Check in Mail | |||

| Time from the day you file until you receive your refund | 1-3 weeks | 1 month | 2 months |

Note that these are just guidelines. Based on how you file, most filers can generally expect to receive a refund within these time frames.

| 2021 IRS Refund Schedule |

Recommended Reading: Doordash Tax Form

Can I Track My Refund With The ‘where’s My Refund’ Tool Like In The Past

The IRS says using “Wheres My Refund?” on IRS.gov/refunds and the IRS2Go mobile app are the best ways to check the status of a refund. You can check the status within 24 hours after weve received your e-file return or four weeks after youve mailed a paper return.

However, the agency said the website and app “will be updated with projected deposit dates for most early refund filers by February 22.”

When Do I Get My Tax Refund

The answer to when will I get my tax refund depends from year to year.

Generally, the IRS has said that about 90% of refunds are issued within 21 days of when the return was received.

You can check on the status of your refund on the IRS website or at our Wheres My Refund page. Live updates will appear the same day e-file opens. Using this tool, you can easily track the progress of your return as it is processed.

Don’t Miss: Do Doordash Take Out Taxes

Important Filing Season Dates

- Friday, February 12. IRS begins 2021 tax season. Individual tax returns start being accepted and processing begins.

- Thursday, April 15. Due date for filing 2020 tax returns or requesting extension of time to file.

- Thursday, April 15. Due date for paying 2020 tax owed to avoid owing interest and penalties.

- Friday, October 15. Due date to file for those requesting an extension on their 2020 tax returns.

What To Know About The 2022 Tax

Even in 2022, the unprecedented nature of this years tax-filing season all comes down to the COVID pandemic. The federal government tasked the IRS with delivering most of the direct aid approved for 2021 in President Joe Bidens American Rescue Plan, whether that was the child tax credit or stimulus checks.

We urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year, Rettig said. People should make sure they report the correct amount on their tax return to avoid delays.

Those features can cause delays because they leave more room for error either because the IRS didnt tally Americans stimulus totals correctly or because taxpayers made a math error.

Taxpayers are not submitting their tax returns as normal this year, says Garrett Watson, senior policy analyst at the Tax Foundation. Theres going to be wide variations in peoples experiences during this years tax season some are going to see disruptions.

When a tax return doesnt match up with IRS records, its placed in the agencys paper processing backlog, a logjam thats been increasingly harder to work through amid hiring and training challenges.

That means taxpayers are likely to encounter delays if they make a mistake when they file or even if they submit an error-free paper return. Taxpayers who also wait up until the last minute risk accumulating a significant wait time, experts say.

Dont Miss: How Much Is Taxes For Doordash

Also Check: How To Report Plasma Donation On Taxes

Will There Be Tax Delays Due To Covid

The IRS is warning that a resurgence of COVID-19 infections on top of less funding authorization from Congress than the Biden administration had requested could make this filing season particularly challenging.

The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays, IRS Commissioner Chuck Rettig said.

Avoiding a paper tax return will be more important than ever this year to avert processing delays, he said.

STOLE SOMETHING?:IRS says stolen property and bribes must be reported as income