Save With Wise When Invoicing Clients Abroad

If you’re invoicing clients abroad, you could get a better deal on your international business transfers with a Wise Business account. We give you the same exchange rate you see on Google, no hidden markup fees.

Link your Wise account to PayPal to receive and withdraw funds in different currencies to save on fees and set up direct debits for all your recurring payment needs.

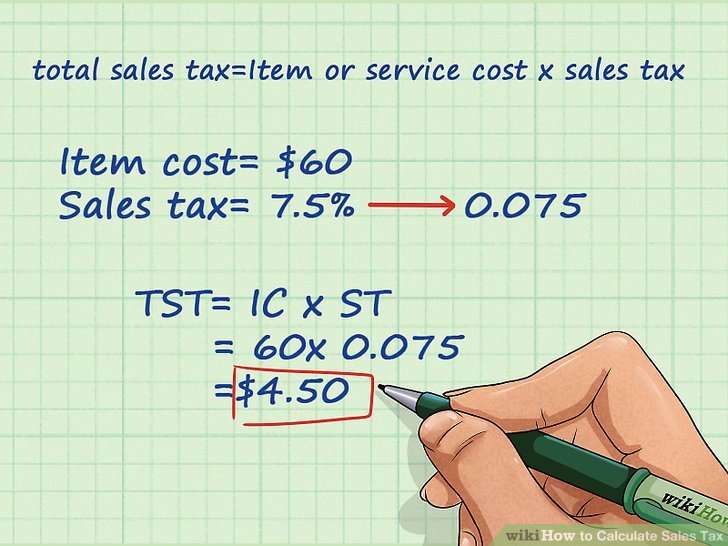

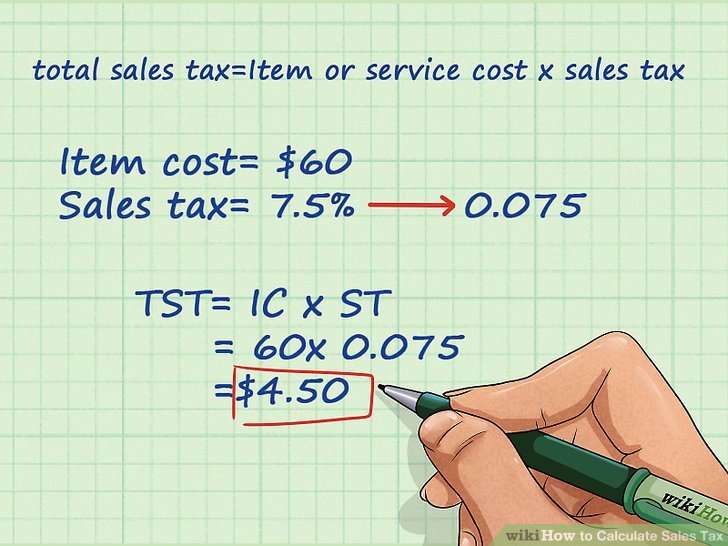

Multiply Retail Price By Tax Rate

Nailing down the rates is much more complicated than the actual math used to determine how much sales tax you’ll be paying that’s just a simple percentage.

Let’s say you’re buying a $100 item with a sales tax of 5%.

Your math would be simply: x = .

That’s $100 x .05 =$5.

Since you’ve figured out the sales tax is $5, that means the total you’ll pay is $105.

New York City Taxes On Certain Services

New York City imposes local sales tax on certain services performed or delivered in New York City, including:

- beautician, barbering, and hair restoring

- tanning

You must file Schedule N with your sales tax return to report sales and remit the sales tax due on the above services that fall within the special rules for New York City sales. Note: Interior decorating and design services performed within New York City are subject to the state portion of the sales tax only and are not subject to the New York City local sales tax. For more information see Tax Bulletin Interior Decorating and Design Services .

Also Check: Is Plasma Donation Money Taxable

Tips For Better Address Searches

- Check the spelling of the street name

- Use “Springwood St” instead of “Spring Wood St”,

- Use “Manor Rd” instead of “Maynor Rd”,

- Use “Belmont Dr” instead of “Bellmont Dr”,

- Use “Lemmon Ave” instead of “Lemon Ave”

What Are The Capital Gains Tax Rates For 2020

In 2020, the capital gains tax rates for most assets held for more than a year are 0%, 15% or 20%. The capital gains tax rates for most assets held for less than a year are common tax categories . What is the short-term capital gains tax?

Stocks and taxesHow do you calculate taxes on stocks? The tax or expense basis for your stock investment is the price you paid for the stock, plus commissions and brokerage fees. To determine your profit from the sale of stock, subtract the sales commissions and expenses from the sales proceeds. Then deduct the tax base. The result is your added value.How much tax do I have to pay on stocks if I Sell?In addition, when y

Also Check: When Does Doordash Send 1099

Federal Revenues From Sales Taxes

Sales taxes also contribute to the Canadian governments budget. The 5% Goods and Services Tax is expected to bring $40.8 billion in tax revenue during the 2019 fiscal year. This amounts to 14.2% of total tax revenue on the federal level. This is almost double the amount Canada spends on national defence every year.

How Does The 0% Tax Rate Work On Capital Gains

The 0% long-term capital gains tax rate has been in effect since 2008 and allows you to generate tax-free income from your investments in just a few steps. 1 Realization of capital gains is the deliberate sale of an investment in a year in which the capital gains are not taxed. This happens in those years that you are in the 0% capital gains tax bracket.

Don’t Miss: Is Freetaxusa Legitimate

Sales Tax By States In 2021

To demonstrate the diversity of sales taxes in the United States, you can find more details about the applied sales taxes in U.S. states in the following table. Besides, you can check when the different states introduced the sales tax and if there is an exemption or reduced rate on sales of food.

| State |

|---|

Bc Rebates And Exemptions To The Gst

There are two types of exemptions for GST: direct exemptions and zero-rated goods and services. The difference is related to how businesses handle costs related to the exemptions, but as a consumer, you would not have to pay GST on items from either category.

Goods and services that are zero-rated from GST include:

- Basic groceries, including meats, fish, cereals, dairy products, eggs, vegetables, coffee, tea. Some foods including snack foods, liquor, and carbonated beverages are charged HST.

- Prescription drugs, but not any drugs available over-the-counter .

- Medical devices

Goods and services that are directly exempt from GST include:

- Residential resales of property that has been previously owned and used

- Rental accommodations of longer than a month

- Educational services that lead to a certificate or diploma or are required for a certain practice

- Medical and dental services

- Financial services such as bank fees

- Legal aid services

- Day-care services

You May Like: Claiming Home Improvement On Taxes

How Do You Calculate Stock Gain Tax Percentage

The math is simple. First, calculate your earnings by subtracting the purchase price from the price at which you sold your stock. Keep in mind that if you have incurred a loss, this number could be negative. Now divide the profit by the original purchase price. Multiply by 100 to get the percentage that reflects the change in your investment.

How Businesses Calculate Sales Tax

The cost a customer pays when purchasing goods or services from a business includes both the company’s sales price and the cost of applicable sales taxes. Businesses and their employees need to know what sales tax is, why they must collect it and how to calculate the correct sales tax amount on each purchase.

Thoroughly understanding this information helps ensure they comply with their state and local sales tax rules and regulations. In this article, we discuss how sales tax is calculated, what it is and answer other frequently asked questions employees have about sales tax.

Don’t Miss: Employer Tax Identification Number Lookup

What State Has The Lowest Capital Gains Tax Biden

Biden’s tax plan will have a significant impact on long-term capital gains as it will nearly double the rate for high-income investors. Individuals currently pay 20% tax on long-term realized income over $445,850. The following table shows the long-term tax rates and income classes for tax year 2021:.

How Do You Calculate Stock Gain Tax Long Term

The first step in calculating long-term capital gains taxes is usually to determine the difference between the price you paid for your property and the price you sold it for, including any commissions or fees. Depending on your income, your capital gains are taxed at the federal level at a rate of 0%, 15% or 20%.

Recommended Reading: Square Dashboard 1099

Do You Need To Collect Sales Tax

You must collect sales tax if your business has a presence in a state that imposes sales tax. The majority of states enforce sales tax.

If your business has nexus in several locations, you might need to collect and remit sales tax for other states, too. What is nexus? Nexus occurs when your business has a presence in a state.

You have nexus if you store inventory, have employees, use a third-party provider to ship orders to customers, or attend a trade show in a state with sales tax. Understand origin vs. destination sales tax laws to determine whether you collect sales tax using your primary or secondary states tax rate.

You might not need to collect sales tax on every transaction, or even at all. Here are some instances where you might not need to collect sales tax:

1. You do business in a state that does not impose sales tax. Alaska, Delaware, Montana, New Hampshire, and Oregon do not enforce sales tax. Although there is no state-mandated sales tax in these five states, keep in mind that there might be local sales tax laws that require you to collect.

2. There is a sales tax holiday. Many states provide a day or weekend where consumers can shop without paying sales tax. Generally, your state will designate certain items that are tax free. Do not collect tax on tax-free items during a sales tax holiday.

Entertainment And Information Services Provided By Telecommunications Service

An additional 5% sales tax is imposed on entertainment and information services provided by telecommunications service that are received by the customer in an exclusively aural manner . See N-93-20, Increase in Tax Rate Applicable to Entertainment and Information Services Provided by Means of Telephony and Telegraphy.

Recommended Reading: Tsc-ind Ct

How To Calculate Sales Tax: A Simple Guide

Sales tax is a tax consumers pay when buying anything . In the U.S., sales tax is a small percentage of a sales transaction. Sales tax rates are set by states and local areas like counties and cities. Governments use sales tax to pay for budget items like fire stations or street sweeping.

If the products and services you sell are subject to sales tax, then youâre required to:

- Calculate how much sales tax to charge on each transaction

- Collect the sales tax from buyers

- Pass it on to your stateâs taxing authority by filing a sales tax return

Your stateâs taxing authority is generally called the â Department of Revenue,â but it may go by another name.

Paper Carryout Bag Reduction Fee

The New York State Bag Waste Reduction Act authorizes counties and cities to impose a five-cent paper carryout bag reduction fee on paper carryout bags that sales tax vendors of tangible personal property provide to customers. Sales tax vendors that sell tangible personal property in a locality that imposes the paper bag fee must charge the fee for each paper carryout bag provided to a customer, even if the vendor does not sell any tangible personal property or a service to the customer. For a current listing of the localities that enacted the fee, see Publication 718-B, Paper Carryout Bag Reduction Fee. The fee is reported on Schedule E, Paper Carryout Bag Reduction Fee.

You May Like: How To File Uber Taxes On Taxact

Registering And Reporting Texas Sales And Use Tax

For yearly filers, reports of sales for the previous year are due on Jan. 20.

Taxpayers required to pay electronically via TEXNET must initiate their payment above $100,000 by 8 p.m. CT on the banking business day prior to the due date in order for the payment to be considered timely. For payments of $100,000 or less, a payor has until 10:00 a.m. on the due date to initiate the transaction in the TEXNET System.

Taxpayers will be notified by letter when their business meets the threshold to be required to pay electronically via TEXNET.

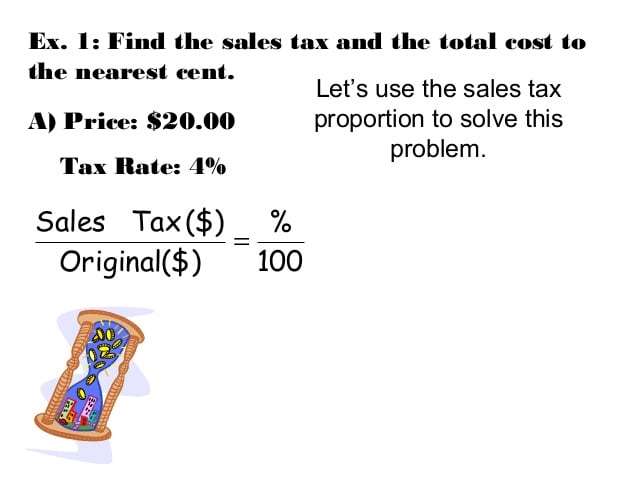

Calculating Sales Tax At Time Of Purchase:

In order to calculate the sales tax of an item, we need to first multiply the pre-tax cost of the item by the sales tax percentage after it has been converted into a decimal. Once the sales tax has been calculated it needs to be added to the pre-tax value in order to find the total cost of the item. Let’s start by working with an example. If a magazine costs $2.35 and has a 6% sales tax, then what is the total cost of the item. First, we need to convert the sales tax percentage into a decimal by moving the point two spaces to the left.

Now, we need to multiply the pre-tax cost of this item by this value in order to calculate the sales tax cost.

Round to two decimal places since our total is in dollars and cents.

Last, add this value to the pre-tax value of the item to find the total cost.

Recommended Reading: Csl Plasma Taxes

Calculating Sales Tax During A Tax Holiday

This example shows how to calculate the sales tax amount and the total amount a customer owes for purchases made during a sales tax holiday. Some of the customer’s items are taxable because they do not qualify for the sales tax exception, while other items are non-taxable because of the exception. The customer is purchasing new clothes, shoes, a backpack and school supplies, tissues and cleaning wipes, a laptop and makeup. The following list shows the store’s total sales amount for each of these categories:

-

Clothes: $155.95

-

Tissues and cleaning wipes: $12.26

-

Laptop: $400.00

-

Makeup: $35.00

The store is in Nashville, Tennessee. The cashier knows the state sales tax rate is 7% and Davidson County’s sale tax rate is 2.25%. They also know that clothing, shoes and school supplies that cost $100 or less per item and computers that cost less than $1,500 are tax-free during the sales tax holiday. The cashier uses this information to make the following calculations:

-

*Sales price for tax-exempt goods: $735.95 *

-

*Sales price for taxable good: $47.26 *

-

*Sales tax amount: $4.37 *

-

*Total amount the customer owes: $787.58 *

Use The Sales Tax Formula To Find The Sales Tax Amount And The Final Sales Amount The Customer Owes

Once you know the combined sales tax rate for the area your business is in and the total taxable sales price for the customer’s purchase, you can calculate the amount of sales tax the customer owes. The sales tax formula is:

x = Sales tax amount

After you find the sales tax amount, add it to the total taxable and non-taxable sales price to calculate the final sales amount. Be sure to add the total non-taxable sales price back in at this point. The final sales amount formula is:

+ + = Final sales amount

The resulting sum is the total amount the customer owes your business for their purchase.

Recommended Reading: Do You Pay Taxes On Plasma Donations

Is Capital Gains Tax An Excise Tax Or An Income Tax

This is because the capital gains tax is an income tax, as the IRS explains, Are you asking whether the capital gains tax counts as tax, excise or income tax? This is the income tax. More specifically, capital gains are treated as income under the tax law and as such charge.

Avoid capital gains taxIs there way to avoid paying capital gains? Send your assets to a charity. For those who have high-quality valuable assets , charities are a great way to avoid capital gains from real estate sales.How to avoid or lower capital gains tax owed?Find out how you can reduce the risk of capital gains. Compare the gains with the losses. Tax loss generation describes the pro

Sales Tax Percentage Calculator

This converter requires the use of Javascript enabled and capable browsers. This script calculates the sales tax percentage of a given purchase amount and a given sales tax amount. It then displays the sales tax percentage and the total sales price, including tax. You may change the default values if you desire. Enter the total amount that you wish to have calculated as the sales amount, in dollars and cents. In our example, that is $50.00 as the sales price. Then, enter in dollars and cents, the sales tax amount. In our example, that is $2.00 for the tax amount. For instance, if a shopping cart does a sales tax calculation for you based on your city, state and zip code, enter the tax amount that it displays. That entry might be something like $2.50 or something similar with dollars and cents. Then click on Calculate and the result should be YOUR local sales tax percentage and the total of the sales price and the sales tax amount. An example of the sales tax percentage might be something like this… If your sales tax has been designated as as 7.75% , it can be written as .0775 we would show it as 7.75 in the Sales Tax Percentage field. If you need to calculate the sales tax amount and you know the sales amount and the sales tax rate or percentage, use our Sales Tax Calculator And De-Calculator. You can use the same page to calculate the appropriate sales tax in a transaction that includes tax. CALCULATE SALES TAX PERCENTAGE

Read Also: When Do You Do Tax Returns

How To Calculate Capital Gains Tax On House Sale

How to Calculate the Long-Term Capital Gains Tax Determine your tax base. This is usually the purchase price plus any commissions or fees paid. Determine your realized amount. Subtract your basis from the amount sold to find the difference. Use the list below to find out what tax rate applies to your investment income.

Violation Of Sales Tax Rules

Taxes can sometimes be complicated and an individual might not necessarily realise when he/she violates any provisions of the laws. Here are some of the most common violations when it comes to sales tax.

- Providing false and misleading information in the forms.

- Failing to obtain registration according to the CST Act.

- Not following the security provisions mentioned in the CST Act.

- Misappropriation of goods purchased at discounted rates.

- Falsely impersonating a dealer or projection oneself as a dealer.

- Unregistered dealers collecting sales tax from consumers is a violation.

- Providing incorrect statements about purchased goods.

Don’t Miss: How Much Do You Pay In Taxes Doordash