How Do I Get Started Paying And Reporting Unemployment Taxes

When you start a new business, you must designate an expected number of employees on your employer ID application. This provides information to the IRS and your state that you have an obligation to pay and report unemployment taxes, and they will probably contact you.

If you are not contacted, or if you decide at some later point to hire your first employee, you can get the process started by yourself. Register with your state and contact the IRS to start paying unemployment insurance.

How Tax Brackets Work

As mentioned earlier, the United States follows a progressive income tax system. In that scheme, not all income is treated equally.

Which, as long as we lack an appetite for a flat tax plan, makes a certain amount of sense as we shall attempt to demonstrate.

When someone talks about being in the 24% bracket, then, that doesnt mean all of their taxable income endures the same 24% bite, but instead only their taxable income above a certain amount .

This is the headache-inducing beauty of the American system of marginal rates.

How To Prepare For Income Taxes

Knowing that you may have to pay income taxes on your unemployment benefits, you can choose from several options to help make the payments more manageable.

- Request tax withholdings. When you were working, your company may have withheld money for taxes and made those payments on your behalf. You can also ask your state to do the same with your weekly unemployment benefits. It will withhold 10% of your unemployment pay, which it will send to the IRS. You may also request state or local tax withholdings if they apply to you.

- Pay estimated taxes. Another option is to make estimated tax payments to the IRS and your state tax agency every quarter. Depending on how much unemployment you collect, and what other sources of income you have throughout the year, you may want to do this even if you have money withheld from your benefits. If you wind up owing more than $1,000 in income taxes, you may have to pay an additional underpayment penalty.

- Set money aside. You could choose to keep all your unemployment benefits if you don’t expect to owe any taxes. Or, even if you expect to owe a little, you could still keep the money and set a portion aside in a savings account in case there’s an emergency in the interim. An income tax calculator could help you estimate how much you’ll want to set aside.

Recommended Reading: 1040paytax.com Official Site

New Exclusion Of Up To $10200 Of Unemployment Compensation

If your modified adjusted gross income is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you dont have to pay tax on unemployment compensation of up to $10,200. If you are married, each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you file Form 1040-NR, you cant exclude any unemployment compensation for your spouse.

The exclusion should be reported separately from your unemployment compensation. See the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure your exclusion and the amount to enter on Schedule 1, line 8.

When figuring the following deductions or exclusions from income, if you are asked to enter an amount from Schedule 1, line 7 enter the total amount of unemployment compensation reported on line 7 and if you are asked to enter an amount from Schedule 1, line 8, enter the amount from line 3 of the Unemployment Compensation Exclusion Worksheet. See the specific form or instructions for more information. If you file Form 1040-NR, you arent eligible for all of these deductions. See the Instructions for Form 1040-NR for details.

Calculate State Disability Insurance Tax

The SDI tax is calculated up to the SDI taxable wage limit of each employees wages and is withheld from the employees wages. Calculated amounts are for computing the contribution amounts to be paid or withheld for reporting to the EDD.

Rates used are for demonstration purposes only, SDI rates are set by law each year. Current SDI rates are available online at Rates and Withholding. Refer to How to Determine Taxable Wages for additional information on determining the taxable wages to be used in the calculation.

You May Like: Buying Tax Liens In California

Current 2021 Employer Contribution Rate

NOTE:On January 14, 2021, pursuant to authority granted by Governor Andrew M. Cuomo, New York State Department of Labor Commissioner Roberta Reardon ordered that employers UI accounts will not be charged for unemployment insurance benefits paid during the COVID-19 pandemic. Subsequently, Governor Cuomo signed legislation that further ensures the relief to employers of UI experience rating charges related to the COVID-19 pandemic. These actions will ease the burden on both contributory and non-contributory employers. For more information, please see the UI Experience Rating Charges fact sheet.

General information about contribution rates:

The Department of Labor mails employers UI rate notices in March of every year.

For 2021, the range of New York State Unemployment Insurance UI contribution rates is as follows:

Should I Wait To File My Taxes To Claim The Waver

Many out-of-work Americans rushed to complete their taxes to get a possible refund to help make ends meet. The tax break is becoming law after 55.7 million tax returns were already filed by Americans with the IRS, as of March 5.

Some filers may consider waiting to file their taxes until the IRS issues new guidance to claim the new $10,200 waiver, experts say.

To be sure, the stimulus package also offers $1,400 stimulus checks to individuals who earned up to $75,000, and married couples with incomes up to $150,000. Payments would decline for incomes above those thresholds, phasing out above $80,000 for individuals and $160,000 for married couples.

Some taxpayers may opt to file their taxes sooner to get the latest stimulus check, particularly if their 2020 income was lower than in 2019.

Don’t Miss: Louisiana Paycheck Tax Calculator

Overview: What Is The Federal Unemployment Tax Act

The Federal Unemployment Tax Act came into law after the worst recession the U.S. had ever seen, where unemployment spiked to unprecedented levels. FUTA funded a program that compensates those who lose their jobs due to layoffs, and sometimes firings.

FUTA joined the Social Security Act of 1935 to create a suite of economic security programs that buoy individuals and the U.S. economy during hard times. The Social Security Act of 1935 had administered unemployment benefits until FUTA was enacted in 1939.

Since then, the government has added several national programs, including Medicare and Medicaid, and business taxes partially fund many of them.

If youve ever applied for unemployment benefits, you know its managed at the state and territory level. Though the federal government collects tax for unemployment, the money gets distributed to each state and participating territory, which is then disbursed to residents in need.

Employers fund federal unemployment through a FUTA payroll tax. The amount owed, or liability, depends on the number of employees and their wages. Businesses dont pay FUTA tax on contractors since theyre not considered employees.

FUTA is an employer tax, so employees do not pay into it.

How To Calculate Futa Tax

Before we calculate FUTA tax, lets identify the organizations and people whose wages are subject to it.

Your small business owes FUTA tax if:

- Youve paid employees $1,500 or more in any quarter of the year

- Youve had one or more employees working at least 20 weeks during the year, even if theyre part-time or temporary employees and worked part of a day

The exceptions to FUTA tax are:

- 5013 organizations

- The wages of your children under 21 if youre their employer

Today, employers must pay federal unemployment tax on 6% of each employees eligible wages, up to $7,000 per employee.

Usually, your business receives a tax credit of up to 5.4% from the federal government when it pays its state unemployment tax, effectively reducing the FUTA rate to 0.6%. Check with your state unemployment tax rules to make sure your business qualifies for the credit.

The 5.4% tax credit is reduced if the businesss state or territory fails to repay the federal government for money borrowed to pay unemployment benefits. In 2019, the Virgin Islands received the only reduction of this kind.

If you classify as an employee to your S-Corporation, your business must pay FUTA tax on your wages. Most other business types do not subject owners pay to FUTA tax, making owners ineligible to receive unemployment benefits.

Since the tax is limited to the first $7,000 of employee wages, these taxes usually go away in the first few months of the year for full-time employees.

| Employee No. |

|---|

Also Check: Irs Federal Returns

If You Get The $600 Expanded Unemployment Benefit You May Also Have A Tax Issue

Weve known that the N.J. Department of Labor hasnt been giving workers the opportunity to have federal taxes withheld from their $600 expanded federal unemployment payments.

Workers can have taxes withheld from their regular unemployment benefits. Just not from the $600.

New Jersey does not tax unemployment benefits, but the federal government does. Without the option to withhold taxes from the $600 payments, workers could be are looking at a federal tax bill of potentially hundreds or thousands of dollars, depending on how long they collect benefits and their overall tax situation. They could even be assessed underpayment penalties when they file their 2020 returns.

Labor Commissioner Robert Asaro-Angelo was asked why workers cant withhold taxes from the payments last week during one of the governors briefings, and he gave a surprising answer.

The reason why is we didnt want to wait longer to get the money out, he said.

We asked the Labor Department to expand on his answer.

A spokeswoman said adding the tax withholding option would have delayed “by several weeks the distribution of the much-needed $600 supplement. “

Pandemic Unemployment Compensation is a new federal program for which the states had to build the infrastructure, while maintaining security, to distribute these benefits in as timely manner as possible, spokeswoman Angela Delli-Santi said in an emailed statement.

Delli-Santi said workers should “prepare accordingly when filing their taxes.

Unemployment Compensation Subject To Income Tax And Withholding

The Tax Withholding Estimator on IRS.gov can help determine if taxpayers need to adjust their withholding, consider additional tax payments, or submit a new Form W-4 to their employer. For more information about estimated tax payments or additional tax payments, visit payment options at IRS.gov/payments.

The Federal Unemployment Tax Act , with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax. For a list of state unemployment tax agencies, visit the U.S. Department of Labor’s Contacts for State UI Tax Information and Assistance. Only the employer pays FUTA tax it is not deducted from the employee’s wages. For more information, refer to the Instructions for Form 940.

Read Also: Buying Tax Liens California

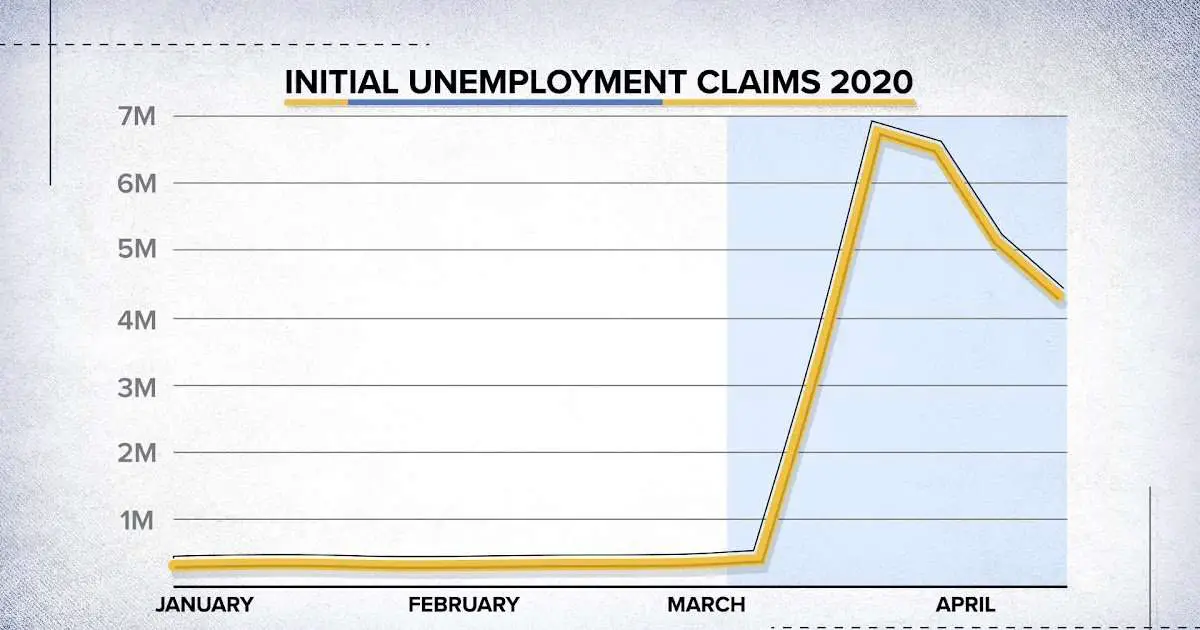

How The Unemployment Landscape Changed

With the U.S. experiencing unemployment rates last year that have not been seen since the Great Depression, Congress had to act quickly to mitigate the effects. To help Americans cope, lawmakers passed the CARES Act, a $2 trillion coronavirus relief package, that boosted unemployment benefits by $600 a week.

The CARES Act also created the Pandemic Unemployment Assistance program, which expanded the eligibility for benefits to include gig workers, independent contractors, self-employed Americans and those who would not traditionally qualify for assistance.

After the initial $600 enhanced unemployment benefits ended in July, an additional $300 boost was granted in August and later extended by lawmakers in December. The $900 billion relief package passed in December extended the program through March 14, as well as the Pandemic Emergency Unemployment Compensation and PUA programs, both of which were set to expire at the end of 2020.

Unemployment benefits replaced about 45% of a worker’s pay nationally in 2019, according the Department of Labor. In terms of dollars, the Brookings Institution estimates that the national average weekly payment was $387 prior to the coronavirus pandemic. But that varies widely by state. Mississippi, for example, paid an average of $215 per week, while those in Massachusetts received $550 per week, on average.

State Payroll Taxes: What You Need To Know

Plus, if you have employees working in multiple states, you have to make sure you are on top of regulations in all of those states. The good thing is that there arent too many different state PayrollTaxes to understand. Also, if you use an online Payroll provider, they should be able to handle state PayrollTaxes for you.

You May Like: Do I Have To Claim Plasma Donation On Taxes

If You Haven’t Filed Your Taxes: Wait

“Hold on and wait” is also the IRS’ message to taxpayers who have yet to file.

The IRS said it “will provide a worksheet for paper filers and work with software industry to update current tax software” to make it easier for people to report unemployment benefits. Tax pros say it will take at least a few days, if not longer, for tax software to reflect recent changes in the law.

“I have two stacks of returns that I can’t file right now,” said Rob Seltzer, a CPA based in Los Angeles. “I have one client that got $15,000 in unemployment. If I filed her return, it wouldn’t work,” he said.

Sui Tax Rate By State

Here is a list of the non-construction new employer tax rates for each state and Washington D.C. . Note that some states require employees to contribute state unemployment tax.

** Some states are still finalizing their SUI tax information for 2021 . For example, Texas will not release 2021 information until June due to COVID-19. We will update this information as the states do.

| State |

|---|

Recommended Reading: Protesting Property Taxes In Harris County

State Unemployment Taxes Vs Futa

Many states collect an additional unemployment tax from employers, known as state unemployment taxes . These range from 2% to 5% of an employee’s wages.

Paying SUTA taxes can lessen the burden of FUTA taxes. Employers can take a tax credit of up to 5.4% of taxable income if they pay state unemployment taxes in full and on time. This amount is deducted from the amount of employee federal unemployment taxes owed.

An employer that qualifies for the highest credit will have a net tax rate of 0.6% . Thus, the minimum amount an employer can pay in FUTA tax is $42 per employee. However, companies that are exempt from state unemployment taxes do not qualify for the FUTA credit.

The Unemployment Figures In Detail

The total number of unemployed is 6.9 million, down 542,000 from October. The number of long-term unemployed dropped to 2.19 million. A smaller number, 1.9 million, lost jobs within the last five weeks. This number declined from October’s 2.1 million.

The real unemployment rate was 7.8% in November, 0.5 percentage points lower than in October. This alternate measure of unemployment, known as U-6, gives a broader definition of unemployment. It includes people who would like a job but haven’t looked for one in the past month. It also includes those who are underemployed and marginally attached.

The real unemployment rate includes 450,000 discouraged workers, down from 455,000 in October and down from 657,000 back in Nov. 2020. Discouraged workers are people who have given up looking for work but would take a job if offered. They are not counted in the unemployment rate because they haven’t looked for a job in the past four weeks.

The labor force participation rate in November was 61.8%, up 0.2 percentage points from October. The labor force doesn’t include those who haven’t looked for a job in the past month. Some would like a job, but others dropped out of the labor force for different reasons. They may have retired, gone back to school, or had a baby.

Recommended Reading: 1099 Nec Doordash

How Much Are Unemployment Benefits Taxed

At the federal level, unemployment benefits are treated the same as other types of ordinary income. The federal income tax brackets, which range from 10% to 37%, will determine how much you pay.

Which bracket you fall into depends on your total income minus deductions and credits, with the rate you’ll pay being determined on a per-dollar basisyou won’t pay the same rate for every dollar you made during the year.

It works something like this: If you file as single in 2020, you can automatically receive a $12,400 standard deduction, which reduces your taxable income. As a result, you won’t have to pay any federal income taxes on the first $12,400 you makeyou might not even have to file a federal tax return. The next $9,875 you make falls into the 10% tax bracket, with the 12% bracket after that covering income from $9,876 to $40,125, and so on .

As the amount you earn climbs, new earnings are pushed into new brackets, but the rate that applies on lower-dollar earnings stays the same. Even if you make $1 million in a year, you still receive the standard deduction, pay 10% on the first $9,875, 12% on the next portion, on up to the top tax rate of 37% for income above $518,400.

As a result, your unemployment benefits may be taxed federally anywhere from 0% to 37%.

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

Recommended Reading: Efstatus Taxact Online