How Far Back Can You Go To File Taxes In Canada

According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Whether you are late by one year, five years, or even ten years, it is crucial that you file immediately. You may think that since you dont have the money to pay your taxes, its best to not file, but this isnt the right move.

The CRA does not forget about you over time. Every day that goes can cost you more money in late-filing penalties, interest, and other potential fees when you delay filing your taxes.

If The Total Amount Owing Is Too High

If you really cant pay your bill, dont hurry to rack up your credit cards or declare bankruptcy. A better route would be to try to get a consumer proposal. A consumer proposal is an agreement wherein you pay less than the entire tax bill, and the rest is forgiven.

Consumer proposals should be managed by a trustee in bankruptcy. A trustee in bankruptcy is legally allowed to negotiate with CRA directly. He/she attest to CRA how much you can afford to pay without going bankrupt , and between them they will come up with a reduced amount and a payment plan.

Note that trustees are paid by a commission that is folded into the regular payments they negotiate for you. You never have to pay them up front and in fact wont feel the payment at all, since theyll have negotiated a lower total payment on your behalf.

Another advantage of working with a trustee in bankruptcy is that their involvement immediately halts any actions against you with regards to your tax bill. In other words, they keep the wolves from your door by protecting you from additional penalties or frozen accounts while the agreement is being hammered out.

How Many Years Can You Go Back To File A Tax Return In Canada

10 yearsHow far back can you go to file taxes in Canada? According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Can I view my tax return online Canada?

My Account is a secure portal that lets you view your personal income tax and benefit information and manage your tax affairs online.

Is T1 General same as tax return summary?

Think of the T1 as a kind of summary of all the other forms you complete for your income taxes, as well as all the information required to file. You need the T1 form to apply for various services like the Canada Child benefit, GST/HST refundable tax credits, and other benefits.

Read Also: How Much Do Llc Pay In Taxes

Filing Back Taxes In Canada

You should file your taxes on time. This is the best way to avoid interest charges, penalties, and additional hassle from the Canada Revenue Agency . However, for many reasons, people sometimes do not file their taxes when they should. Maybe you forgot or maybe you didnt realize that you needed to file. Maybe you did not file on purpose. Sometimes, people believe that its in their best interest to not file their taxes if they dont have the money to pay their tax debt. This isnt true, but its a common belief and it happens.

For whatever reason, if you didnt file your taxes when you should have, and now youre wondering how far back you can file taxes in Canada, the good news is that it is possible to file prior year returns.

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

Recommended Reading: How Do I Do My Taxes Online

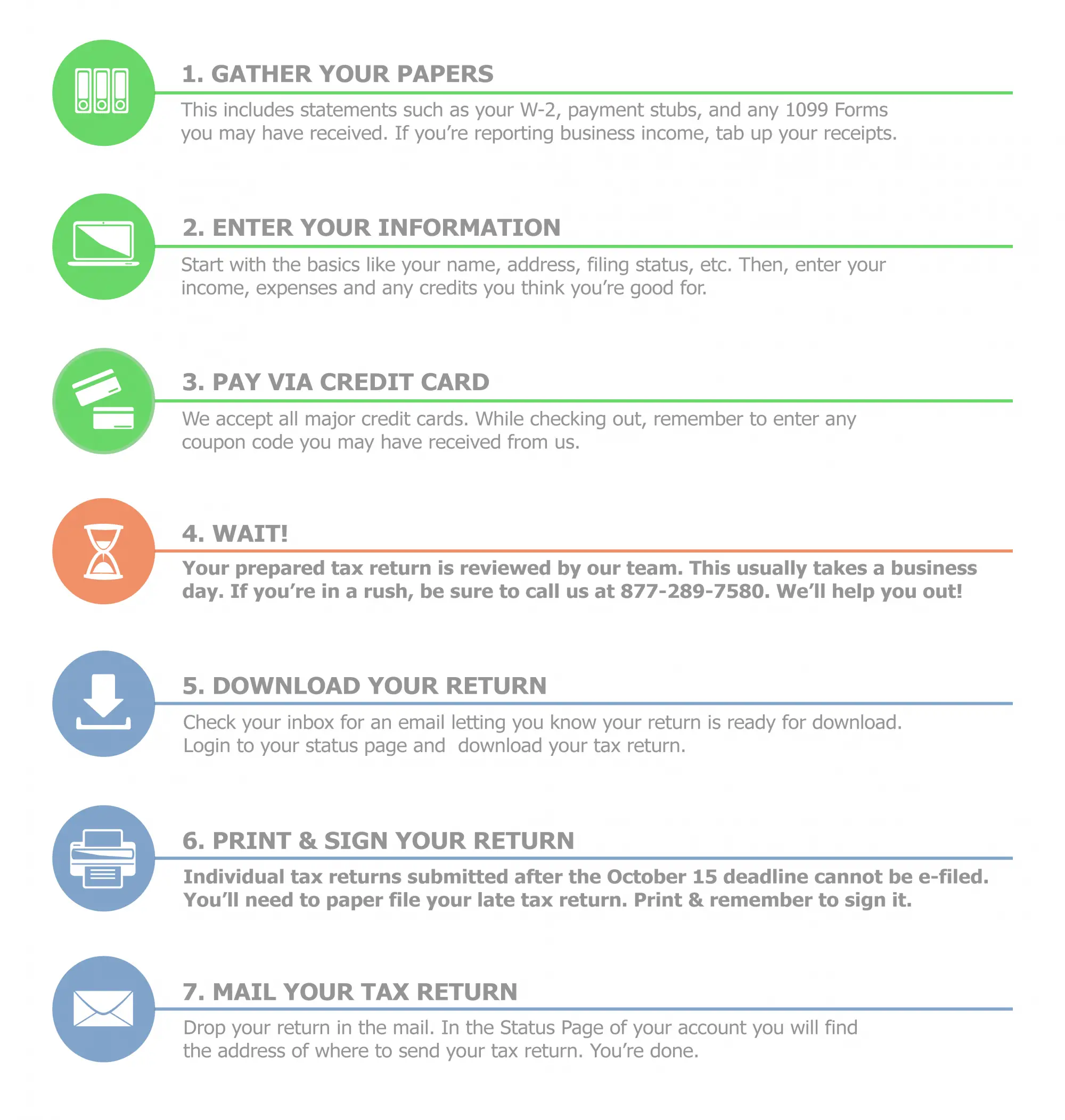

B Hire And Work With A Tax Preparer

While it’s never been easier to do your own taxes using software, as your financial life gets more complex you might wonder if you’re missing something and should get someone to prepare and help file your taxes. If you have a business or a healthy side gig, or you just want help understanding all of the forms, you might seek out a professional’s guidance.

If you don’t want to meet in person with a tax preparer, theres a way to file taxes without leaving the house. A secure portal lets you share documents electronically with a tax preparer. Typically, the preparer will email you a link to the portal, youll set up a password and then you can upload pictures or PDFs of your tax documents.

» Find a local tax preparer for free:See who’s available to help with your taxes in your area

Advantages Of Filing Previous Years Itr

- Loans: If you settle prior tax returns, your loan application will be approved more quickly.

- Investments: Making investments or trading in the stock market will be quite simple once you have finished filing your tax returns for past years. If your tax returns are accurate, it demonstrates your commitment to upholding your civic duties.

- Income proof: People who fulfil their obligations to file tax returns from prior years may submit their documentation as needed, such as when buying products on credit.

- Refund: People who owe more in taxes than they can pay for the previous years maybe eligible for a refund of the extra money.

- Travel: People who pay their past-due income taxes can benefit from expedited processing of their visas for foreign travel. A persons obligations to the government and the economy are confirmed after they have paid off all of their tax debt.

Recommended Reading: Can I File My Llc And Personal Taxes Together

Determine Whether The Deceaseds Tax Records Are Current

Before filing taxes for a deceased person, check to see how many outstanding tax returns they might owe. If that information is not in their personal records, the IRS has a guide to help you through the process of requesting previous-year tax information for a deceased person, including sending the IRS a death certificate and proof of your relationship to the deceased.

Its worth noting that you may be responsible for filing two years worth of tax returns on behalf of the deceased person even if their taxes were previously up to date. If the deceased passed away in the first part of the year, for example, they might owe taxes on the previous year as well as the portion of the current year in which they were alive.

Before Filing Your Income Tax And Benefit Return

You can easily change your address using My Account or the MyCRA mobile web app.

You can also change your address:

- through certified tax software when filing your return, if you are registered for My Account

If you have moved, you need to inform the CRA as soon as possible to avoid interrupting your benefit and credits payments. If you are a paper filer, you need to update your mailing information in order to receive the 2021 Income Tax Package. We encourage you to change your address online and sign up for email notifications. These notifications act as an early warning about important changes made on your account.

If youre not registered for My Account, your representative can send an authorization request through Represent a Client or, if they are filing tour tax return for you, through EFILE.

For more information on how to authorize a representative, go to Representative authorization.

The CRA offers small-business owners and self employed individuals free help by phone or videoconference virtually through the Liaison Officer Service. This service helps you understand your tax obligations and makes you aware of possible business deductions. The Liaison Officer will answer tax-related questions , discuss business deductions and explain common tax errors.

You can sign up for direct deposit:

- by registering for My Account

- by using the MyCRA mobile web application

- through many financial institutions like banks, credit unions and trust companies

Read Also: How To Track My State Taxes

How Bench Can Help

One of the main reasons small business owners fall behind on filing and paying their taxes is because their bookkeeping isnât up to date. If thatâs you, then bookkeeping is also the first place you should start in getting back on track with the IRS.

Thatâs where Bench comes in. Our team of bookkeeping specialists helps you get caught up on your accounting and generate the financial statements you need to file back tax returns. If you need help filing, our tax team can also provide tax preparation and filing from start to finish.

Plus, as a Bench client, you get access to a network of partners who can help you set up a payment plan or negotiate your balance with the IRS.

Drawbacks Of Filing Belated Returns

- Interest may be applicable under section 234A, 234B and 234C.

- A fee under Section 234F would be levied upto Rs 5000, if the return is filed on or before 31 March of the relevant AY. After that, the fine can go upto Rs 10,000.

Example:

For the FY 2018-19 , if the return is filed after 31 August 2019 but before 31 December 2019, a fee of Rs 5000 applies. Post 31 December 2019, the late fee would be Rs 10,000.

Note: For FY 2019-20 the last date to file the income tax return was 10th January 2021 so late fee of Rs. 10,000 shall be payable if the return is filed after 10th January 2021.

- Delayed returns cannot be revised. However, from FY 2016-17, a belated return can also be revised.

- You cannot carry forward some losses that belong to the years for which you did not file returns. However, an exception is available for losses from house property that can be carried forward even if you file your returns late.

Recommended Reading: How Do I Find Out Property Taxes

Dont Despair If Youve Fallen Years Behind On Your Tax Filing

It starts with missing one year. Tax time rolls around and youre going through some things so you put it off or it slips your mind. Second year it happens again. It starts to bother you, but life is hectic. Third year: now its becoming a habit not to file. Every now and then, randomly, you remember and it bothers you, but its never quite the right time to tackle whats starting to look like a huge job.

Gradually, not filing becomes a habit, the unfiled years are piling up and getting more intimidating, and the feeling of pressure and guilt is something you avoid thinking about. But it never quite goes away.

Falling a few years behind happens to plenty of Canadians, most of whom sincerely want to do the right thing. If youre in this position youve got some work ahead of you, but I promise its going to be all right. But youll have to do some work.

Use A Tax Return To Validate Identity

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

Also Check: Do You Have To Pay Federal Taxes On Social Security

Having Your Return Filed By An Accredited Person

You can have a person accredited by Revenu Québec file your return. Note that accredited persons who file more than 10 income tax returns are required to file them online.

Before having an accredited person file your return online, you must complete and sign two copies of the authorization form .You and the accredited person must each keep a copy of the form for a period of six years from the date on which the tax return was filed. Do not send us a copy unless we ask for it.

Filing Your Income Tax Return Online

You can file your own return online or have a person accredited by Revenu Québec file your return for you.

Note Access code

You no longer need an access code to file an income tax return using authorized software. You now have to provide your social insurance number and date of birth and may have to provide the number of the most recent notice of assessment you received. If you are filing an income tax return for someone else, you have to provide their information.

End of noteNoteannonceIncome tax filing deadline extended

Since the regular filing deadline falls on a Saturday this year, you have until May 2, 2022, to file your 2021 income tax return and pay any income tax you may owe. No interest or penalty will be charged.

End of note

Read Also: When Will My Tax Return Come

What Happens If You Dont File

If youre tempted to just let a missed tax return slide, you should know that doing so can cause a host of issues. Although potentially significant, the most minor issue a missed filing can cause is trouble getting a loan. Getting a mortgage, refinancing your home, obtaining a business loan or requesting student financial aid all require you to submit a copy of your filed tax return. You wont get far if you dont have one.

Possibly more problematic is the possibility of a substitute return. If you dont file a return on your own, the IRS may gather the tax information they have and prepare one for you. Simply letting the IRS do the work for you may sound like an easy solution, but they may not be aware of or overly concerned about any deductions or credits you could take. Theyll simply prepare a basic return and send you a copy. If you dont take any action in 90 days, that return and any tax you owe on it becomes binding.

Once the IRS files a return for you, youll need to pay any tax due. If you dont, the IRS will take collection action. This may include taking extra payments from your paycheck or filing a federal tax lien against you. Note that if you fail to file your taxes several times, the IRS may take criminal action against you as well as collection action.

What This Notice Is About

We didn’t receive your tax return. We have calculated your tax, penalty and interest based on wages and other income reported to us by employers, financial institutions and others.

The CP3219N is a Notice of Deficiency . Once you receive your notice, you have 90 days from the date of the notice to file a petition with the Tax Court, if you want to challenge the tax we proposed.

You May Like: How Much To Do Taxes

What If Cra Has Already Billed Me For A Return I Never Filed

If CRA requests that you file a return and you dont respond, sometimes they get impatient and just file something on your behalf. This is called an arbitrary or notional return, and it usually generates a tax bill. However, that doesnt mean you cant still file!

Usually notional returns arent very favourable youd get a better outcome with a return you filed yourself. The good news is, you can override a notional return by filing your own version. If you have already paid an inflated tax bill, fear not: the overpayment will either be credited to your taxes, or refunded to you.

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

Don’t Miss: How Much Of Your Paycheck Goes To Taxes

How To Plan Ahead To Pay Back Taxes

The best way to avoid paying back taxes is filing your annual tax return during tax season. Take time to review your overall tax situation to come up with strategies for reducing your tax bill and achieving your financial goals.

If you think you owe back taxes, consider working with a tax professional who can help you gather past tax returns and file any that you may have missed.

If you think you might owe the IRS when you file your tax return this year or next, consider making estimated tax payments in advance. These payments are generally required for sole proprietors who arent subject to withholding from their paychecks by an employer. Making quarterly estimated tax payments can help you to avoid penalties on your upcoming tax return.

What Is The Deadline To File Taxes In Canada

Typically, individuals are expected to file their income tax returns by April 30, according to the Canada Revenue Agency. The CRA extends the deadline to a previous business day if the May 31 falls on a weekend. will tax deadline be extended in 2021? when can i file my taxes 2021 canada? is tax filing deadline extended for 2021?

What is the deadline for filing taxes in 2020?

Filing due dates for your 2020 tax return Filing due date is April 30 for most taxpayers, June 15 for self-employed, may vary for a deceased persons return Payment deadline for 2020 taxes Pay your balance owing on or before April 30 to avoid interest and penalties, find payment options to pay your taxes

What are the key dates for filing a tax return?

Find key dates including filing due dates, payment deadlines, and dates for receiving credits and benefit payments from the CRA. Filing due date is April 30 for most taxpayers, June 15 for self-employed, may vary for a deceased persons return

What is the penalty for filing your taxes late in Canada?

However, recognizing the difficult circumstances faced by Canadians, the CRA will not charge late-filing penalties where a 2019 individual return or a 2019 or 2020 corporation, or trust return is filed late as long as it is filed by September 30, 2020.

You May Like: How Much Does It Cost To File Taxes With Taxslayer