When Can I File My Taxes

Each year, the IRS issues a statement in early January with the first day to file taxes.

Typically, the official date when you can file taxes falls in mid to late January.

The IRS announced it will start processing tax returns Feb. 12. Worried about waiting weeks for your refund? We can do your taxes now and when you file at Block, you could get a Refund Advance up to $3,500 today. No waiting on the IRS. No loan fees and 0% interest.

Tax Refunds 2022 Dates: What Is Irs Calendar And Deadlines

All you need to know

The coronavirus pandemic has changed the world as we knew it, and it’s not likely to go back to the pre-COVID world any time soon. When it comes to filing for 2022 taxes, that’s almost definitely the case.

COVID-19 will still be a concern in Spring 2022, and a number of stimulus laws will still present challenges, as may new tax laws that could well be created by then.

This year, though, the process of filing tax is likely to be closer to the pre-pandemic ‘normal’ than either 2020 or 2021 were, as both had extended deadlines due to IRS office closures and other reasons.

Pay Nothing Out Of Pocket Use Your Federal Refund To Pay For Turbotax Learn More

TurboTax CD/download also available

- Earned Income Tax Credit

- Child tax credits

- Student Loan Interest deduction

Read Also: H& r Block Early Access W2

When Will I Receive My Tax Return

A number of factors contribute to when your tax return will come through, either by check or direct deposit, being:

- How early you file

- If you are claiming certain credits

- Whether it’s e-filed or sent by mail

- Whether you have existing federal government debts

- The COVID stimulus payments will not affect your income tax refund, though some taxpayers who didn’t receive one may be determined to have been owed one, which may see it added to their 2022 refund

It is important to note that the IRS will delay processing by at least two weeks if an income tax return has EITC or CTC in order to have them verified.

Annual Irs Maintenance Blackout For Mef Returns Begins Soon Halting E

The Modernized e-File is a web-based system that allows electronic filing of corporate, individual, partnership, exempt organization, and excise tax returns through the Internet. The IRS has an annual maintenance period during which certain types of returns are not accepted electronically. This blackout period is set to begin later this month.

It is critical that tax professionals and taxpayers interested in e-filing individual returns that are eligible for e-file– the current and two prior years: 2021 filing season 2018 and 2019 –complete the e-file process before the blackout. Failure to do so will result in the IRS refusing to accept the return until MeF reopens for the next tax season.

Also Check: Tsc-ind

Irs Tax Filing Deadline In 2022 Isnt April 15 Filers Get A Few More Days

The IRS will delay the traditional April 15 tax filing due date.AP Photo/Patrick Sison, File

The IRS has set the deadline for filing 2021 tax returns for April 18, pushed back a few days because of a holiday observed in the nations capital.

The April 18 deadline is because the usual Tax Day, April 15, will fall on the day Washington, D.C., observes Emancipation Day. The local holiday marks the day President Abraham Lincoln signed the Compensated Emancipation Act in 1862, freeing enslaved people in the District of Columbia.

While Emancipation Day is usually celebrated on April 16, it would fall on a Saturday this year. Observing it on Friday means the tax deadline moves to Monday.

Although the holiday isnt widely observed outside the nations capital, its bumped back Tax Days before, including in 2007 and 2016.

The IRS delayed the personal tax filing deadline in 2020 and 2021 as a pandemic relief measure. Last year, though, it didnt announce a one-month delay until mid-March.

The agency has already acted to delay this years filing deadlines for people impacted by localized disasters, including the victims of a wildfire in Colorado and tornadoes in Illinois and Tennessee.

The IRS hasnt said when it will start processing tax returns. Last year, processing was delayed until mid-February as the agency was busy sending out stimulus payments.

Businesses, however, must mail tax forms to their employees by Jan. 31.

— The Oregonian/OregonLive

How Can I Track A California Tax Refund

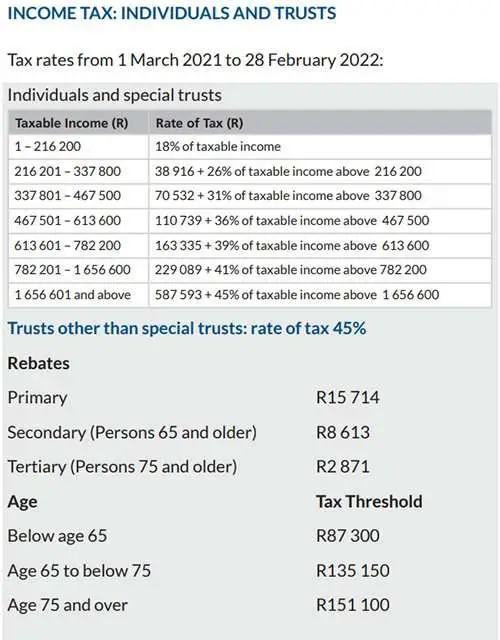

Paying taxes is a fact of life for many who live or work in the most-populous U.S. state. The amount of state income tax you owe will depend on a number of factors, including your filing status, how much money you earn in a year, and what credits or deductions youre eligible to take.

If you overpay your state taxes during the tax year, you may be owed a refund when Tax Day comes around. If youve filed your state tax return and are expecting a California state refund, you can probably track its status through the State of California Franchise Tax Board. It offers a Wheres my refund tool thats similar to the IRS tool for tracking your federal income tax return. The tool will allow you to track the status of your most recent refund. If you want to check on refunds from prior tax years, youll have to contact the FTB.

To track your current tax refund, youll need several important pieces of information.

- Social Security number

- Numbers in your mailing address

- ZIP code

- Refund amount

When you click the Check Your Refund button on the website, youll first enter your Social Security number. Then youll enter the numbers in your mailing address. This refers to the digits before the street name so if you live at 104 Main Street, the numbers would be 104. Next, youll enter your ZIP code. Finally, youll enter the anticipated refund amount in whole dollars, which can be found on your most recent California tax return.

Also Check: Doordash Payable Account

Health Care Coverage Penalties

Californians who did not have qualifying health insurance throughout the year are subject to a penalty of $800 or more when they file their state tax returns. The penalty for a dependent child is half that of an adult a family of four could face a penalty of $2,400 or more. If you had health coverage in 2021, check the Full-year health care coverage, box 92, on your state tax return to avoid penalties.

You can get health coverage and financial help at CoveredCA.com. It is crucial to get health coverage to avoid penalties when filing your tax return next year. For information, visit ftb.ca.gov/healthmandate.

Where To Send Your California Tax Return

| Income Tax Returns Franchise Tax Board |

You can save time and money by electronically filing your California income tax directly with the . Benefits of e-Filing your California tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

California’s free eFile program allows all California taxpayers to instantly file their income tax return over the internet. California provides several free resources for eFile users, including ReadyReturn , and CalFile, a free software program offered by the Franchise Tax Board. In addition, California supports e-filing your return through a variety of third-party software packages.

The benefits of e-filing your California tax return include speedy refund delivery , scheduling tax payments, and instant filing confirmation. If you have questions about the eFile program, contact the California Franchise Tax Board toll-free at 1-800-852-5711.

To e-file your California and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

Read Also: Reverse Tax Id Lookup

How Long Might It Take To Get My California Tax Refund

Processing times vary depending on multiple factors. Here are a few.

- How you file your California tax return If you choose to e-file, normal processing times can take up to two weeks. If you decide to paper file, processing can take up to four weeks.

- Potential delays Your return could be delayed if the FTB decides it needs extra review for accuracy, is incomplete, or shows signs of fraud or identity theft. In those situations, it could take a month for you to receive your refund or a notice from the FTB requesting more information if you e-filed your return and two months if you filed a paper return.

- Amendments to your return If you amend your California state tax return, that could delay your refund up to three months.

Generally, choosing to e-file your return and have your refund deposited directly into your bank account will help you get your refund faster.

Tax Forms For Federal And State Taxes

OVERVIEW

TurboTax software programs include the tax forms you’re likely to need to file your federal and state taxes. And the great thing is they guide you through your tax return so you don’t need to know which tax forms to file. You can also find all federal forms and state tax forms at the links below.

Recommended Reading: Appeal Cook County Property Taxes

What Could Cause A Refund Delay

There are countless reasons your tax refund could be delayed. Weve outlined some common instances where a delay could occur:

- If you file a paper return, the IRS says you should allow about six weeks to receive your refund.

- If the IRS mails you a physical check, you will receive a check through the mail.

- If you file Form 8379, Injured Spouse Allocation, it could take up to 14 weeks to process your tax return.

- If your identity has been stolen and another return was filed with your social security number, it could take longer for the IRS to sort out the situation.

- If you owe a debt, like unpaid child support, your refund could be offset to pay part or all of it.

Each of the possibilities above could cause a delay or prevent receiving the refund altogether. Its important to note that each individuals tax scenario is unique and no two filings are handled exactly the same.

Child Tax Credit : American Parents Could Owe Money After Monthly Payments Conclude

Receive a child tax credit? Look out for an IRS letter

monthly child tax credit paymentsLETTERS ARE ON THE WAY TO UPDATE PARENTS ON THEIR CHILD TAX CREDITIF YOU RECEIVED A CHILD TAX CREDIT PAYMENT, IT’S POSSIBLE YOU OWE SOME OF IT BACK2022 BRINGS AN END TO MONTHLY CHILD TAX CREDIT PAYMENTSNick Natario has covered all the ways families and individuals can get help during the pandemic. Get updates by follow him Natario on , and .

Don’t Miss: How To Report Plasma Donation On Taxes

California Increases Fee Collection Requirements For Marketplace Facilitators

California legislation AB-1402 extends the registration and filing requirements related to marketplace facilitators that goes beyond the Departments existing laws requiring marketplace facilitators to register, collect, and remit sales and use taxes with the department. Effective January 1, 2022, marketplace facilitators are required to register, collect, and remit lead-acid battery recycling fees, lumber products assessment, electronic waste recycling fee, and tire fees with the California Department of Tax and Fee Administration. Excluded from this requirement are local prepaid mobile telephony surcharges.

When To Expect Your 2022 Irs Income Tax Refund

Will the 2022 tax filing season be normal? According to tax attorney Ken Berry, it’s not likely that when Spring 2022 comes around that everything will be like it was in 2019 or before. Covid-19 will still be a concern, several stimulus tax laws will still be challenging for some filers, and new tax laws may very well be created between now and then that add more complexity.

But the income tax filing process will likely be closer to normal than either 2020 or 2021 were, which both had extended filing deadlines due to closures of IRS offices, the tax courts, and IRS and tax firm staff being new to remote working.

In other words… be ready to have your taxes filed The good news is that the federal and state income tax returns filing process should be closer to normal, as well. Depending on when a taxpayer files, they can often receive their tax refund payments within only 2-3 weeks.

Traditionally , the IRS starts accepting tax returns during the last week of January. If major new tax legislation is passed at the end of the year, however, this could push the start of tax season back by a week or two. So, early tax filers who are a due a refund can often see them as early as mid or late February. However, taxpayers with the Earned Income Tax Credit or Child Tax Credit generally have their refunds delayed by about one month while the IRS confirms eligibility for these credits.

Several factors can determine when a taxpayer may receive their tax return, including:

| May 23 |

Recommended Reading: Do I Have To File Taxes For Doordash If I Made Less Than $600

Will Stimulus Checks Be Taxed

For those who received stimulus checks, the income is not taxable at the federal level. You might recall that the first check was for up to $1,200 for eligible adults and $500 per dependent, and the second check was up to $600. Although some states are taxing the income, these payments are not subject to California income tax.

Irs Refunds: When Is The Irs Accepting 2022 Tax Returns

Useful information to get your refunds faster

We are now into 2022 and this means that taxpayers in the USA can start filing their taxes for the 2021 tax year. For those who are due a tax refund from the Internal Revenue Service , filing earlier could see the tax rebate paid quicker.

Read Also: Can Home Improvement Be Tax Deductible

When Is California Accepting State Tax Returns

CA is not going to get your state return until your federal return can be accepted by the IRS. The IRS is not going to start accepting/rejecting returns until January 28. Until then, your return is in pending.

The IRS will not begin to accept/reject returns until January 28. Until then, e-filed returns will just be sitting on a server, waiting. You will receive an email after that date letting you know if your return was accepted or rejected. It will probably take several days after January 28 for them to work through the backlog of returns on the server.

Federal Individual Tax Returns And Income Tax Payments Are Due By May 17

If you typically file Form 1040, an individual federal tax return, you now have until May 17, 2021, to file your tax return and pay outstanding income taxes. Typically, this includes individual tax filers and self-employed people who report income and expenses on a Schedule C form.

As in normal tax years, you still have to file an extension if you need to file after May 17. You can request more time by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, with the IRS on or before May 17.

Youll have until October 15, 2021 to file your return but you still need to pay any taxes owed by May 17.

Also Check: Appeal Property Tax Cook County

California Franchise Tax Board To Hold Sixth Interested Parties Meeting Regarding Market

The California Franchise Tax Board will hold a sixth interested parties meeting to solicit public input regarding additional proposed amendments to Californias market-based rules regulation . The sixth IPM will be held telephonically on Friday, June 4, 2021, at 10:00 a.m. To attend, interested parties need to RSVP to the FTB by May 28, 2021, at the email address set forth in the notice. Instructions on how to participate in the sixth IPM are set forth in the notice as well. The proposed amendments to be discussed include: added definitions of asset management services and of professional services examples to be included in the regulation addition of a special rule for certain professional services and a change to the applicability date .

May 13, 2021